Title: Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: A Comprehensive Overview Introduction: The Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit outlines the key terms, conditions, and contingencies involved in the sale of a business owned by a sole proprietor in the state of Indiana. This agreement allows for a thorough audit of the business's financials before finalizing the purchase price. Key Elements of the Agreement: 1. Parties Involved: This section identifies the parties entering into the agreement, including the seller (sole proprietor) and the buyer(s) who intend to purchase the business. 2. Business Description: The agreement provides a detailed description of the business being sold, including its assets, liabilities, inventory, intellectual property, customer base, and any unique features that distinguish it from competitors. 3. Purchase Price Calculation: The agreement states that the purchase price shall be determined after conducting a comprehensive audit of the business's financials, including its income statements, balance sheets, tax records, and other relevant documents. The formula for calculating the purchase price might be included, specifying any adjustments or contingencies based on the audit's findings. 4. Contingencies: To safeguard the buyer's interests, the agreement may include contingencies that allow the buyer to adjust or renegotiate the purchase price based on the audit results. These contingencies may cover areas such as undisclosed debts, pending legal issues, tax obligations, warranty claims, or other potential liabilities. 5. Terms of Payment: The agreement outlines the agreed-upon terms and timeline for payment of the purchase price. It may include provisions for down payments, installment plans, or obtaining financing to complete the transaction. 6. Closing and Transition: This section defines the closing date when the ownership of the business will transfer to the buyer. It may also outline the responsibilities of both parties during the transition phase, including training, assistance in acquiring necessary licenses and permits, and transferring relevant contracts or leases. Types of Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: While there may not be distinct types, the agreement can be customized to suit the specific needs and requirements of the parties involved. This customization allows for variations such as different contingencies, payment structures, or additional clauses addressing unique circumstances. Conclusion: The Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a crucial document that facilitates the smooth transfer of ownership while ensuring transparency and protection for both the seller and the buyer. Its flexibility allows for customization to meet the specific requirements of the parties involved in the sale of a business in Indiana.

Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

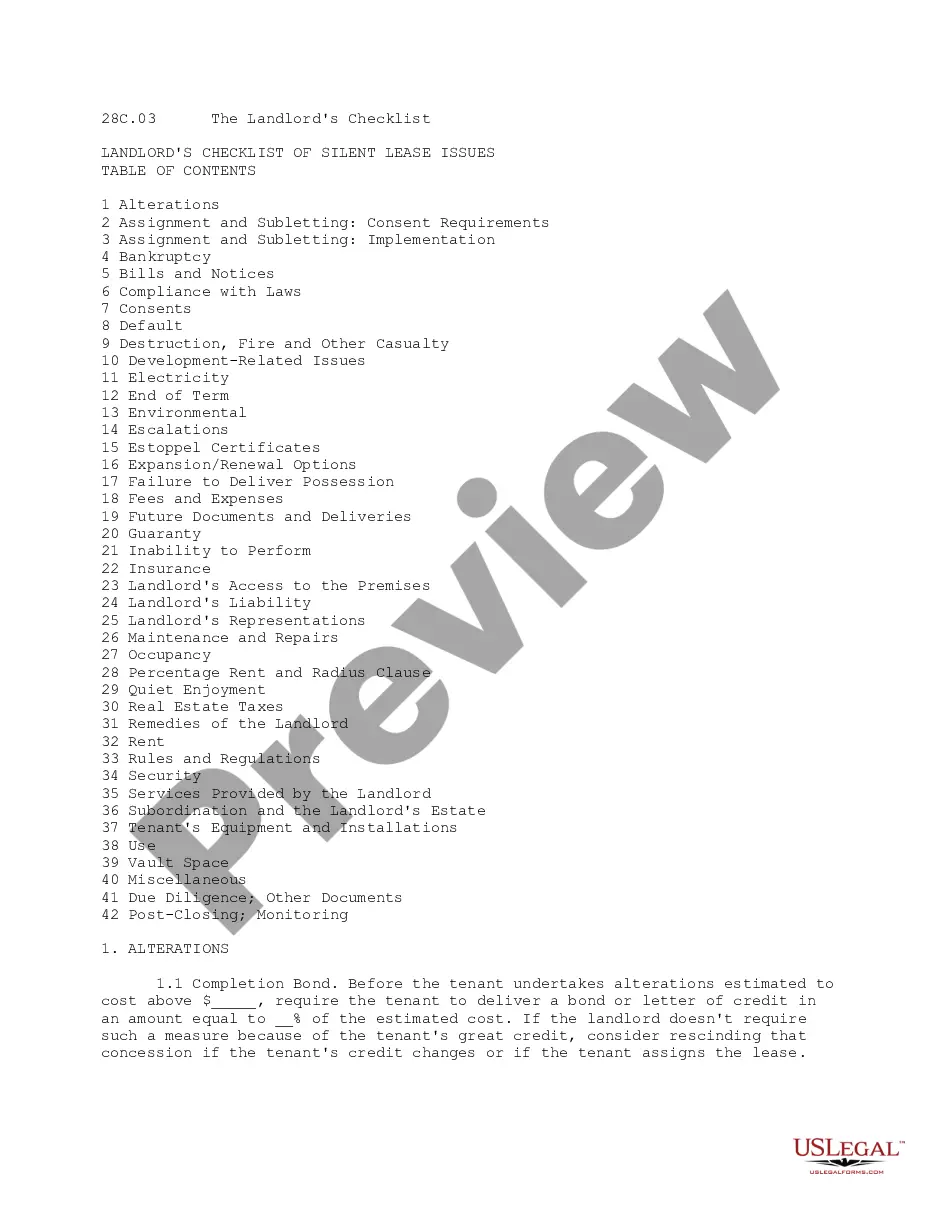

How to fill out Indiana Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

If you aim to compile, acquire, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the website's user-friendly search to find the documents you need.

A multitude of templates for business and personal purposes are organized by categories and claims, or by keywords.

Step 4. Once you have found the form you want, click the Buy now button. Select the pricing plan that you prefer and provide your details to register for the account.

Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Indiana Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/region.

- Step 2. Use the Review option to browse through the content of the form. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other models in the legal form category.

Form popularity

FAQ

However, there are some basic items that should be included in every purchase agreement.Buyer and seller information.Property details.Pricing and financing.Fixtures and appliances included/excluded in the sale.Closing and possession dates.Earnest money deposit amount.Closing costs and who is responsible for paying.More items...?

What Should Be Included in a Sales Agreement?A detailed description of the goods or services for sale.The total payment due, along with the time and manner of payment.The responsible party for delivering the goods, along with the date and time of delivery.More items...

Your sale and purchase agreement should include the following:Your name(s) and the names of the seller(s).The address of the property.The type of title (for example, freehold or leasehold).The price.Any deposit you must pay.Any chattels being sold with the property (for example, whiteware or curtains).More items...

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.