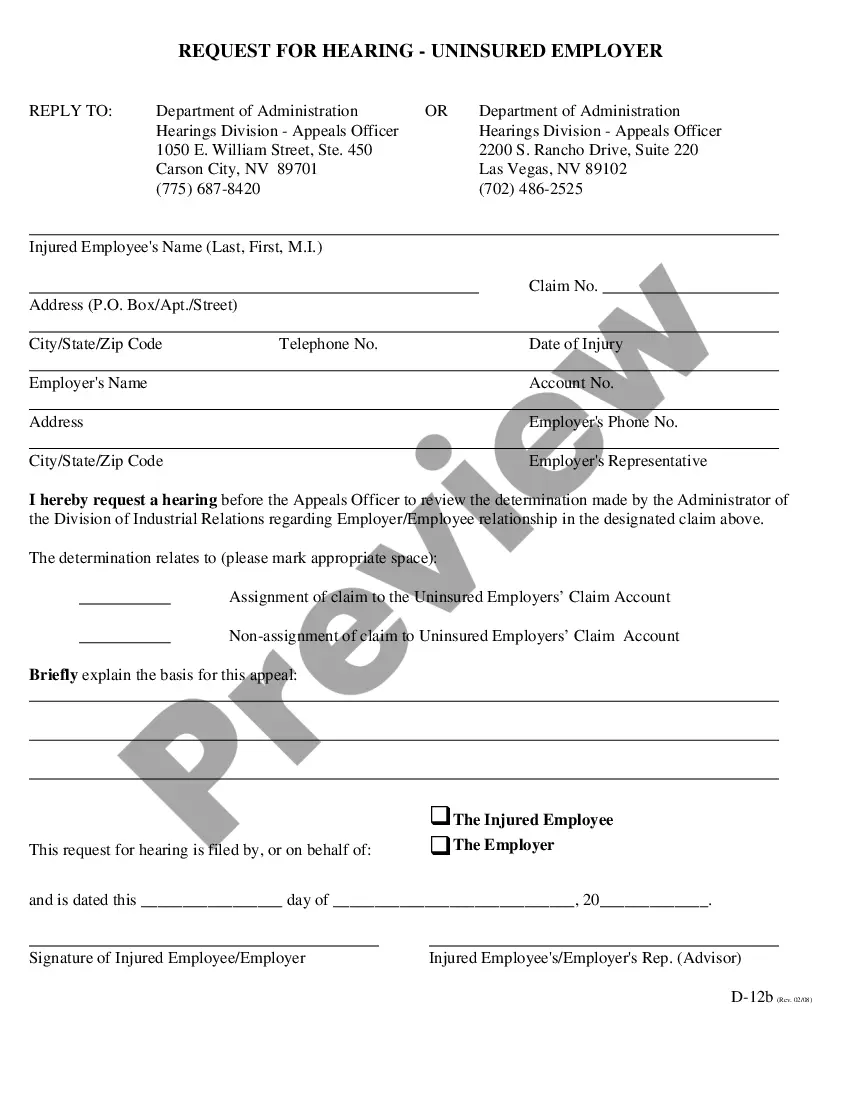

Title: Indiana Sample Letter Concerning Stop Payment Notice — Important Details and Types Description: If you reside in Indiana and need to issue a stop payment notice for a particular transaction, it is crucial to understand the nuances involved in this process. This detailed description will provide valuable insights and includes various types of Indiana Sample Letters concerning Stop Payment Notice, ensuring you are well-equipped to handle such situations effectively. 1. Understanding Stop Payment Notices in Indiana: A stop payment notice is a legal document that allows you, as a payee, to inform your financial institution to halt the payment process for a particular transaction. This can be due to various reasons, such as a dispute with a vendor, lost check, unauthorized payment, or incorrect payment details. Stop payment notices are governed by specific laws and regulations in Indiana, ensuring your rights as a payer are protected. 2. Elements of an Indiana Sample Letter concerning Stop Payment Notice: When drafting an Indiana Sample Letter concerning Stop Payment Notice, ensure it contains the following crucial components: a) Your name, address, and contact information. b) Date of the notice issuance. c) The name and address of the financial institution. d) A clear statement of the intent to place a stop payment on a specific transaction. e) Details of the transaction, including invoice or payment number, payee name, and the exact amount. f) Supporting documents or evidence justifying the stop payment request, if necessary. g) A clear and concise deadline for the financial institution to acknowledge and process the request. h) Request for a written confirmation from the financial institution once the stop payment order is executed. 3. Types of Indiana Sample Letters concerning Stop Payment Notice: a) Vendor Dispute Stop Payment Notice: Used when a vendor fails to deliver goods or services as promised, resulting in a dispute over the payment. b) Lost Check Stop Payment Notice: Used when a physical check has been misplaced, lost, or stolen, ensuring its payment is halted while a replacement check is issued. c) Unauthorized Payment Stop Payment Notice: Used when a payment is made without the payee's authorization or consent, requiring immediate action to halt further transactions. d) Incorrect Payment Details Stop Payment Notice: Used when the payee discovers erroneous payment details, such as incorrect account numbers or payment amounts, preventing any payment discrepancies. By familiarizing yourself with the essential elements and different types of Indiana Sample Letters concerning Stop Payment Notice, you can effectively communicate your concerns to your financial institution and safeguard your financial interests. Remember, it is crucial to consult with legal professionals or financial advisors to ensure compliance with Indiana's specific regulations while dealing with such matters.

Indiana Sample Letter concerning Stop Payment Notice

Description

How to fill out Indiana Sample Letter Concerning Stop Payment Notice?

Discovering the right authorized file web template can be quite a have difficulties. Obviously, there are tons of layouts accessible on the Internet, but how will you discover the authorized develop you require? Take advantage of the US Legal Forms internet site. The assistance offers a huge number of layouts, including the Indiana Sample Letter concerning Stop Payment Notice, that can be used for enterprise and private requires. Each of the forms are checked out by experts and fulfill federal and state requirements.

When you are currently listed, log in to the bank account and then click the Down load switch to obtain the Indiana Sample Letter concerning Stop Payment Notice. Utilize your bank account to appear through the authorized forms you may have acquired formerly. Visit the My Forms tab of the bank account and obtain one more copy in the file you require.

When you are a new user of US Legal Forms, listed below are easy instructions for you to follow:

- First, be sure you have selected the right develop to your city/region. You may look through the form utilizing the Preview switch and study the form description to make sure it is the right one for you.

- In case the develop does not fulfill your preferences, make use of the Seach area to get the correct develop.

- When you are certain that the form is suitable, select the Buy now switch to obtain the develop.

- Opt for the rates plan you would like and type in the essential information and facts. Create your bank account and purchase the order utilizing your PayPal bank account or charge card.

- Pick the document file format and acquire the authorized file web template to the gadget.

- Comprehensive, change and produce and sign the acquired Indiana Sample Letter concerning Stop Payment Notice.

US Legal Forms may be the largest collection of authorized forms in which you can find a variety of file layouts. Take advantage of the service to acquire appropriately-manufactured documents that follow state requirements.