The Indiana Tax Free Exchange Agreement Section 1031 is a provision in the Indiana tax code that allows individuals and businesses to defer capital gains tax when exchanging certain types of property for like-kind property. This provision is based on section 1031 of the Internal Revenue Code (IRC), which applies to all states. Under the Indiana Tax Free Exchange Agreement Section 1031, individuals and businesses can sell investment or business property and reinvest the proceeds in a similar or "like-kind" property without incurring immediate capital gains tax. By deferring the tax, investors can retain more capital to invest in new properties, helping to stimulate economic growth and reinvestment in the local community. To qualify for the Indiana Tax Free Exchange Agreement Section 1031, certain criteria must be met. The properties involved in the exchange must be held for investment, business, or productive use, and must be of like-kind. Like-kind property refers to properties that are similar in nature or character, regardless of the differences in quality or grade. There are also time restrictions within the Indiana Tax Free Exchange Agreement Section 1031. The taxpayer must identify potential replacement properties within 45 days of selling the original property and complete the exchange by acquiring the replacement property within 180 days. It is important to note that not all property exchanges qualify for tax deferral under the Indiana Tax Free Exchange Agreement Section 1031. Exchanges involving personal residences, inventory properties, or property held primarily for sale are generally not eligible for tax deferral. However, if the property meets the criteria, individuals and businesses can take advantage of the tax benefits provided by the agreement. In addition to the standard Indiana Tax Free Exchange Agreement Section 1031, there are other variations of the agreement that may be applicable in specific circumstances. These include reverse exchanges and build-to-suit exchanges. Reverse exchanges occur when an investor acquires the replacement property before selling the relinquished property. This allows investors to secure a desired property even if they haven't yet found a buyer for their existing property. Build-to-suit exchanges, on the other hand, involve the construction or improvement of the replacement property. This allows investors to use the exchange to finance the development or improvement of a property, expanding their investment opportunities. Overall, the Indiana Tax Free Exchange Agreement Section 1031 provides a valuable tool for individuals and businesses to defer capital gains tax and reinvest in like-kind properties. With various types of exchanges available under this provision, investors can create a tax-efficient plan to maximize their investment potential and contribute to the growth of Indiana's economy.

Indiana Tax Free Exchange Agreement Section 1031

Description

How to fill out Indiana Tax Free Exchange Agreement Section 1031?

Have you found yourself in a situation where you need to have documents for various company or personal reasons almost every day.

There are many legal document templates available online, but finding reliable forms can be challenging.

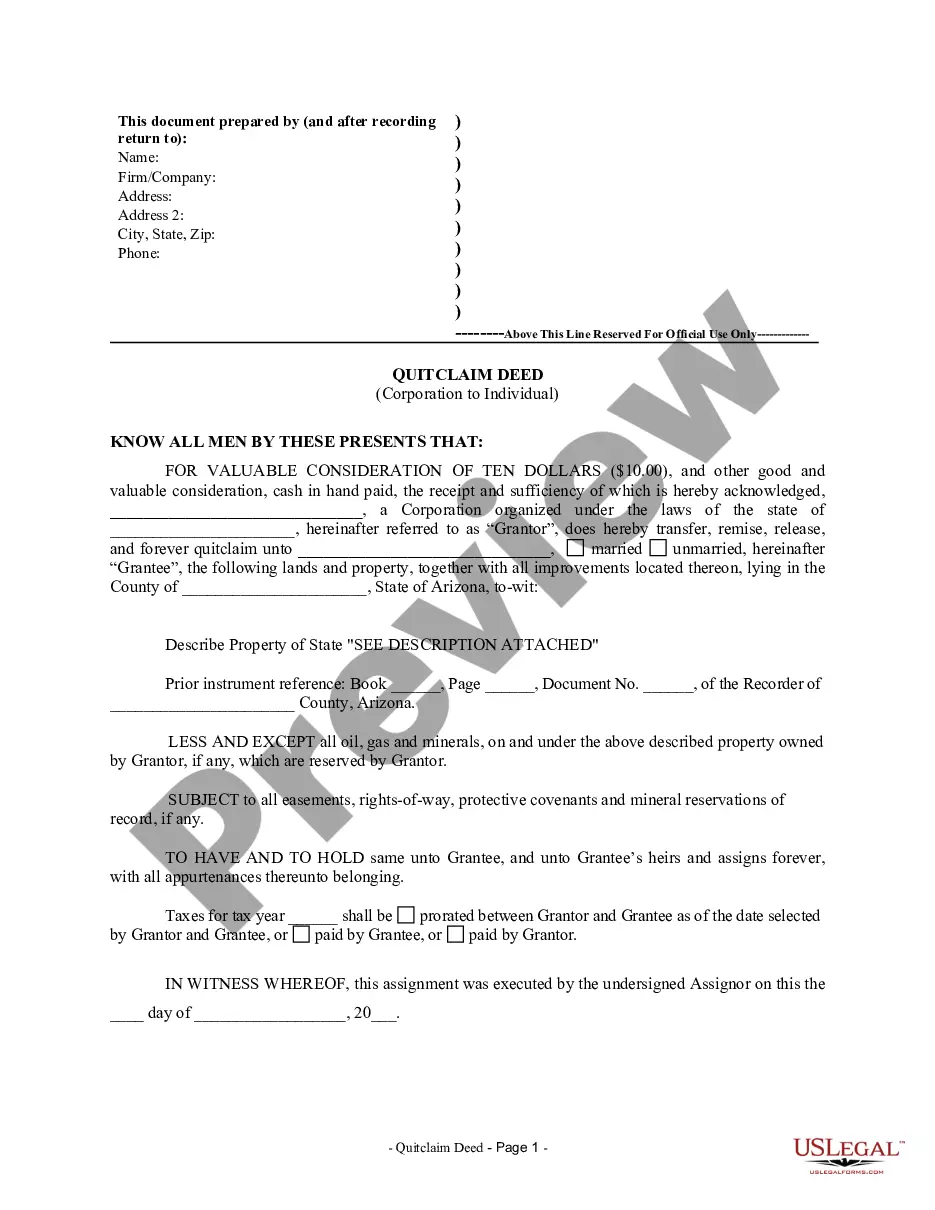

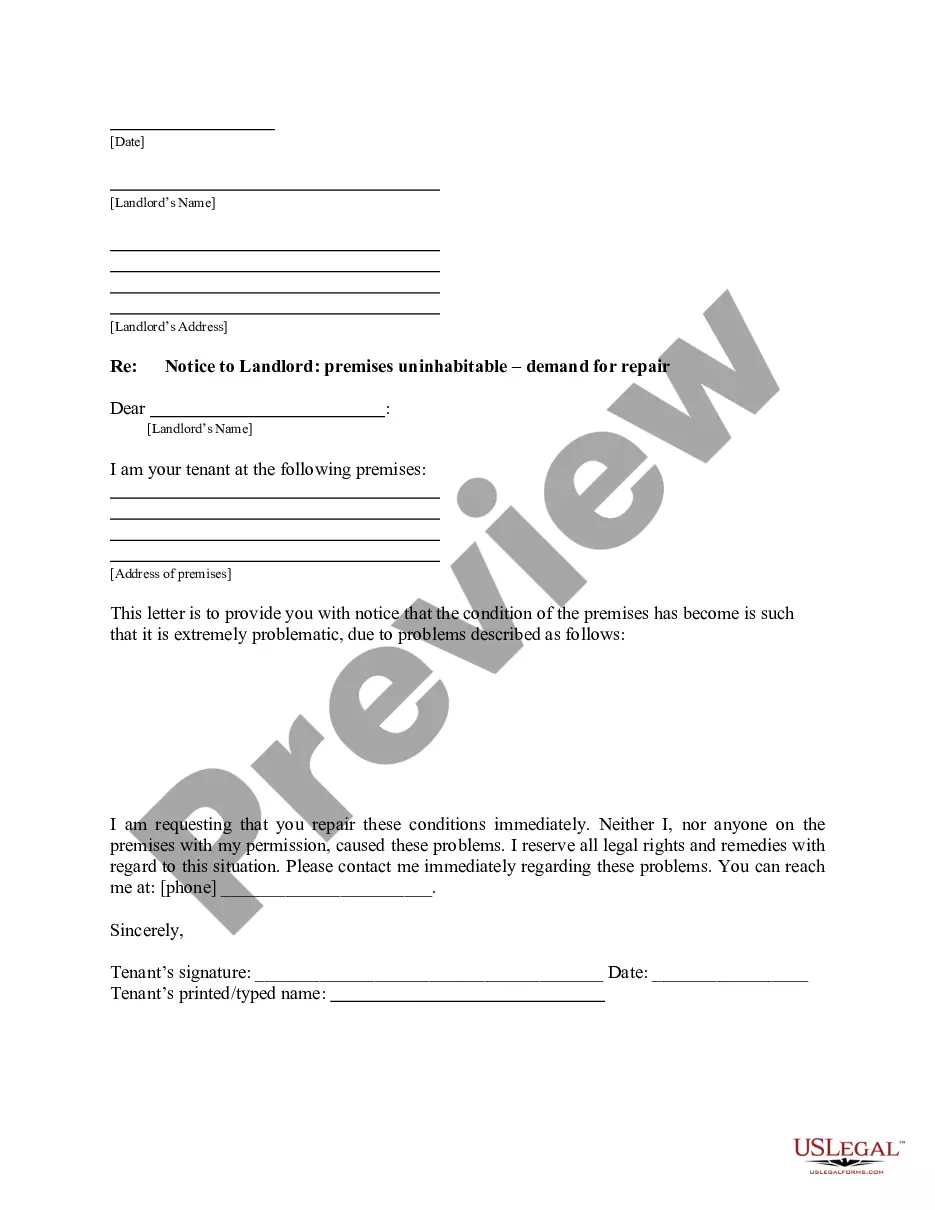

US Legal Forms offers a vast collection of document templates, such as the Indiana Tax Free Exchange Agreement Section 1031, designed to meet federal and state requirements.

Select a convenient document format and download your copy.

Find all of the document templates you have purchased in the My documents section. You can access another copy of the Indiana Tax Free Exchange Agreement Section 1031 at any time if needed. Just click on the necessary form to obtain or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Indiana Tax Free Exchange Agreement Section 1031 template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to ensure that you have selected the correct form.

- If the form does not match what you’re looking for, use the Search bar to find the document that meets your needs and requirements.

- Once you find the correct form, click Acquire now.

- Choose the pricing plan you want, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

A 1031 exchange allows you to sell one investment or business property and buy another without incurring capital gains taxes as long as the exchange is completed according to IRS rules and the new property is of the same nature or character (like kind).

deferred exchange is a valuable investment tool that allows you to dispose of investment properties and acquire "likekind" properties while deferring federal capital gains taxes and depreciation recapture.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

The short answer to this is yes. Because Section 1031 is a federal tax code, it is technically recognized in all states. Going one step further, swapping a relinquished property in one state into a replacement property in another is known, appropriately enough, as a state-to-state 1031 exchange.

A simultaneous §1031 exchange occurs when the sales of the relinquished property (the one you are selling) and the replacement property (the one you are buying) close at the exact same time. Even the slightest delay, such as one caused by sending the money through an escrow company, can disqualify the exchange.

Under Internal Revenue Code Section 1031, real estate located in one U.S. state is like kind to real estate located in any other state, and you can trade from one state to another. In most cases you are able to defer both federal and state tax, assuming the state has an income tax.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

2022 Indiana 1031 Exchange GuideA 1031 exchange in Indiana is a valuable tax deferment tool that many of the most successful real estate investors in the country utilize especially in popular markets like Indianapolis, IN.

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state.

Interesting Questions

More info

Aircraft in same way with right to obtain the Exchanger to sell said Aircraft to the Purchaser in a price equal to a price of 50,000.00 for the Aircraft being purchased as above specified, and for Assisting the Purchaser in the purchase of the Exchanger's aircraft and providing the services necessary to the same to make an acquisition of the aircraft which the Purchaser's interest in the Exchanger's property may then be transferred to the purchaser, and WHEREAS Attack Aviation Falcon Aircraft bearing manufacturer serial number is on trade lists and auction and may be acquired by the purchaser, in a price equal to a price of 50,000.