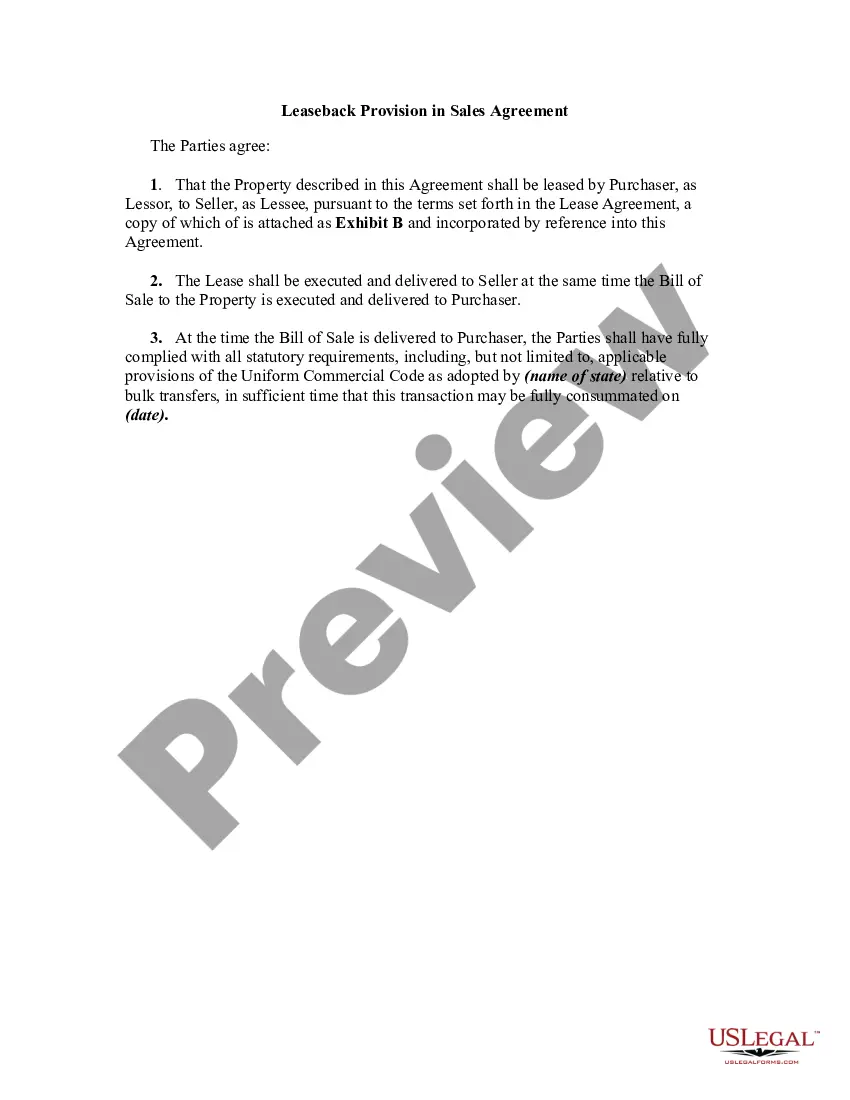

Indiana Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

Finding the appropriate official document format can be quite a challenge.

Of course, there are numerous templates accessible online, but how do you find the official form you require.

Utilize the US Legal Forms website.

First, ensure that you have chosen the correct form for your location/region. You can preview the document using the Preview option and review the form details to confirm it is suitable for you. If the form does not meet your needs, use the Search field to locate the correct form. Once you are certain that the form is appropriate, click the Buy Now option to acquire the form. Select the pricing plan you wish and provide the necessary information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Choose the document format and download the official document to your device. Finally, complete, edit, print, and sign the downloaded Indiana Leaseback Provision in Sales Agreement. US Legal Forms is the largest compilation of legal documents where you can access a variety of template files. Use this service to obtain professionally crafted papers that comply with state requirements.

- The platform provides thousands of templates, including the Indiana Leaseback Provision in Sales Agreement, suitable for both business and personal needs.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and select the Download option to obtain the Indiana Leaseback Provision in Sales Agreement.

- Use your account to browse through the legal forms you have acquired previously.

- Go to the My documents tab in your account and download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are some basic steps you should follow.

Form popularity

FAQ

The primary difference between a lease and a sale is ownership. In a lease, one party retains ownership while the other pays to use the asset. In contrast, a sale transfers ownership entirely. The Indiana Leaseback Provision in Sales Agreement serves to protect the interests of both parties in these transactions.

One disadvantage of leasebacks is that they can reduce asset ownership over time, leading to a loss of equity. Additionally, lease payments may be higher than mortgage payments over time. It's essential to carefully review the Indiana Leaseback Provision in Sales Agreement to fully understand any potential drawbacks before proceeding.

The cap rate for sale and leaseback transactions usually depends on various factors, including the specific asset, the lease term, and market conditions. Typically, cap rates can range from 4% to 8%. The Indiana Leaseback Provision in Sales Agreement enables both buyers and sellers to frame these financial expectations clearly.

The cap rate for a lease typically indicates how much return an investor expects from that lease. This rate can fluctuate based on asset type, location, and market demand. When considering the Indiana Leaseback Provision in Sales Agreement, understanding the cap rate helps both parties align their expectations and financial goals.

An entity assesses whether the transfer qualifies as a sale by evaluating factors such as the completion of the transaction and the transfer of risks and rewards. Proper documentation and adherence to accounting standards are essential. Utilizing the Indiana Leaseback Provision in Sales Agreement can simplify this process by providing a clear framework for such assessments.

A good cap rate for a seller in a sale and leaseback can vary depending on market conditions, but it generally ranges between 5% to 10%. This rate indicates the potential return on investment. When negotiating under the Indiana Leaseback Provision in Sales Agreement, both parties should consider the cap rate to ensure a fair deal.

The leaseback condition refers to the terms under which the seller of an asset is allowed to lease it back from the buyer. These terms typically include the lease duration, payment structure, and any maintenance responsibilities. Understanding the Indiana Leaseback Provision in Sales Agreement is crucial, as it dictates these conditions and protects both parties' interests.

Typical sale-leaseback terms often include the length of the lease, payment structure, and maintenance responsibilities. The Indiana Leaseback Provision in Sales Agreement usually stipulates lease periods ranging from 5 to 20 years, with periodic rent adjustments. These terms need to be carefully negotiated to reflect the interests of both the seller and the buyer. Engaging with a platform like uslegalforms can simplify the process and provide necessary documentation.

The IFRS 16 amendment for sale and leaseback enhances clarity around accounting for these transactions. Under the Indiana Leaseback Provision in Sales Agreement, this amendment specifies how to recognize the sale and leaseback arrangements on financial statements. It aims to ensure that companies disclose their lease liabilities and associated rights properly. Staying informed about these amendments helps businesses align their accounting practices with global standards.

The limitation on sale and leaseback primarily relates to how the arrangement impacts the financial statements of a business. Generally, the Indiana Leaseback Provision in Sales Agreement requires specific disclosures to ensure transparency. Businesses must not overstate their financial flexibility, as improper handling of sale and leaseback agreements may lead to legal implications or audits. Understanding these limitations ensures compliance and aligns with best financial practices.