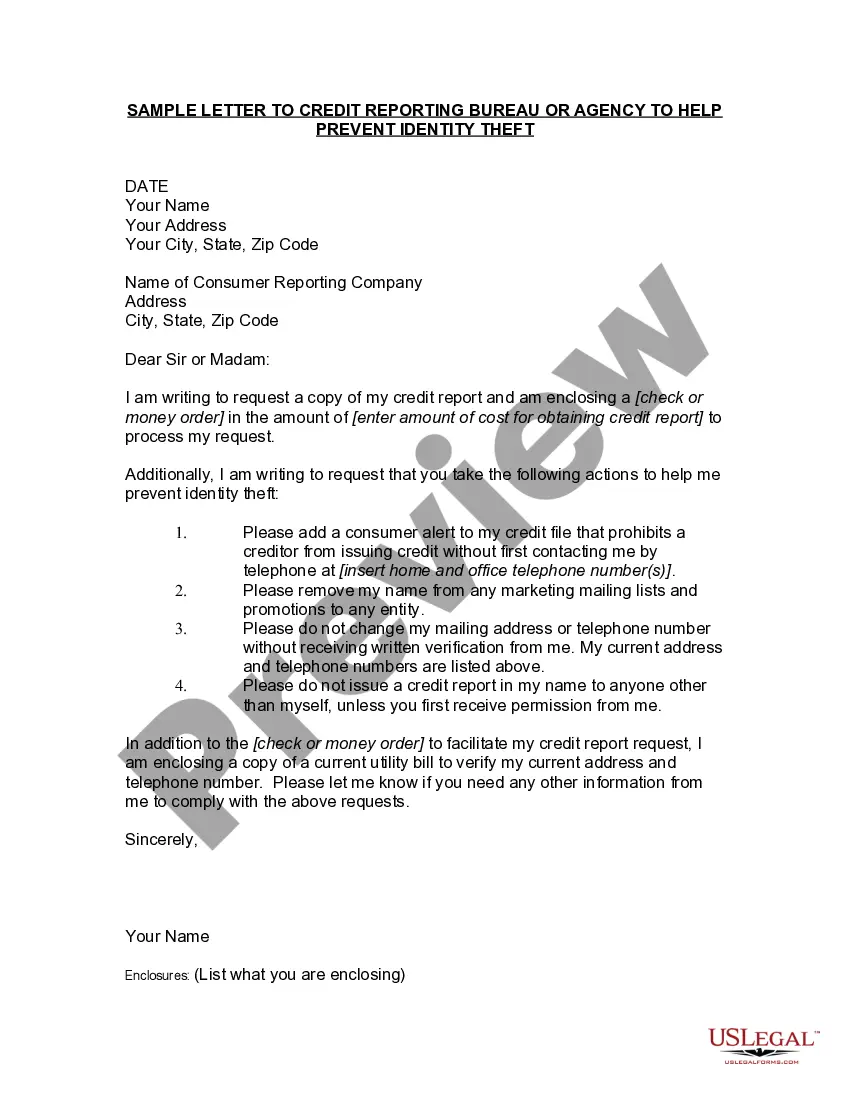

Title: Indiana Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft Introduction: Protecting one's identity is crucial in today's digital age. In the state of Indiana, residents can take proactive measures to prevent identity theft by writing a detailed letter to credit reporting bureaus or agencies. This article will provide a comprehensive guide on how to craft an Indiana sample letter to credit reporting bureaus, highlighting essential keywords and variations applicable to different scenarios. 1. Basic Indiana Sample Letter to Credit Reporting Bureau: Informative keywords: Indiana, sample letter, credit reporting bureau, prevent, identity theft. [Begin your letter with necessary personal details] — Full Nam— - Address - City, State, ZIP Code — ContacNumberbe— - Email Address - Date Dear [Credit Reporting Bureau/Agency's Name], Paragraph 1: Begin by stating your purpose and concern for writing to the credit reporting bureau. Mention that you are an Indiana resident who wants to prevent identity theft. Paragraph 2: Explain the specific steps you have taken to protect your personal information, such as regularly monitoring bank statements and credit reports, and using secure online practices. Paragraph 3: Consider including any instances where you suspect your personal information might be compromised, like unauthorized accounts, suspicious transactions, or phishing attempts. Paragraph 4: Request the bureau to place an extended fraud alert on your credit file or take appropriate measures to safeguard your account information. Offer any additional information or documentation to support your request if necessary. Paragraph 5: Express gratitude for their attention to your matter and provide contact information for further communication. Sincerely, [Your Full Name] 2. Indiana Sample Letter requesting Credit Freeze: Informative keywords: Indiana, sample letter, credit reporting bureau, request, credit freeze, prevent, identity theft. Following the same format as the basic Indiana sample letter, you can modify the content to request a credit freeze. A credit freeze restricts unauthorized access to your credit report, making it difficult for identity thieves to open accounts in your name. 3. Indiana Sample Letter reporting Identity Theft: Informative keywords: Indiana, sample letter, credit reporting bureau, report, identity theft. In case you've already become a victim of identity theft, you can use this letter to report the incident to credit reporting bureaus or agencies. Adjust the content accordingly to describe the fraudulent accounts, transactions, or any other relevant information. Conclusion: When it comes to preventing identity theft, addressing credit reporting bureaus or agencies with a well-crafted letter plays a vital role. By tailoring the provided Indiana sample letters to your specific needs, you can take proactive steps to protect your identity and take back control over your finances. Remember to keep copies of all correspondence for your records.

Indiana Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft

Description

How to fill out Sample Letter To Credit Reporting Bureau Or Agency To Help Prevent Identity Theft?

Choosing the right authorized document web template could be a battle. Obviously, there are plenty of templates available on the net, but how would you discover the authorized type you require? Take advantage of the US Legal Forms web site. The assistance delivers a large number of templates, for example the Indiana Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft, which can be used for business and personal requires. Every one of the forms are checked out by specialists and satisfy state and federal demands.

Should you be already signed up, log in for your account and then click the Download key to have the Indiana Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft. Utilize your account to search throughout the authorized forms you have bought in the past. Go to the My Forms tab of your respective account and have yet another backup from the document you require.

Should you be a whole new consumer of US Legal Forms, here are basic instructions for you to comply with:

- Initial, be sure you have chosen the right type to your area/region. It is possible to examine the shape using the Preview key and look at the shape outline to make sure it will be the best for you.

- In the event the type will not satisfy your requirements, take advantage of the Seach field to discover the right type.

- Once you are sure that the shape would work, click on the Acquire now key to have the type.

- Select the prices plan you need and type in the required info. Build your account and pay for your order utilizing your PayPal account or Visa or Mastercard.

- Opt for the document file format and acquire the authorized document web template for your gadget.

- Full, modify and produce and signal the obtained Indiana Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft.

US Legal Forms is the largest library of authorized forms that you can see different document templates. Take advantage of the company to acquire skillfully-created paperwork that comply with state demands.

Form popularity

FAQ

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Dispute Credit Fraud With Your Lenders Call any affected companies where fraud has occurred. Contact your credit card company and cancel all affected cards. Place a fraud alert with all three credit bureaus. Dispute incorrect information on your credit report. Close any other new accounts opened in your name.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Asked by: Mr. Jillian Rau | Last update: February 9, 2022 Score: 4.1/5 (71 votes) Section 623 of the FRCA allows you to dispute any inaccurate information on your credit report directly with the original creditor, as long as you've already completed the process with the credit bureau.

Sample dispute letter to credit reporting agencies: [RE: Your Account Number (if known)] Dear Sir or Madam: I am a victim of identity theft and I write to dispute certain information in my file resulting from the crime. I have circled the items I dispute on the attached copy of the report I received.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.