Indiana Financial Consulting Agreement

Description

How to fill out Financial Consulting Agreement?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Employ the site’s simple and user-friendly search to locate the documents you need. Various templates for business and personal purposes are categorized by regions and states, or keywords.

Utilize US Legal Forms to locate the Indiana Financial Consulting Agreement with just a few clicks.

Every legal document template you acquire is yours indefinitely. You can access all forms you downloaded through your account. Click the My documents section and select a form to print or download again.

Fill out, download, and print the Indiana Financial Consulting Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Indiana Financial Consulting Agreement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

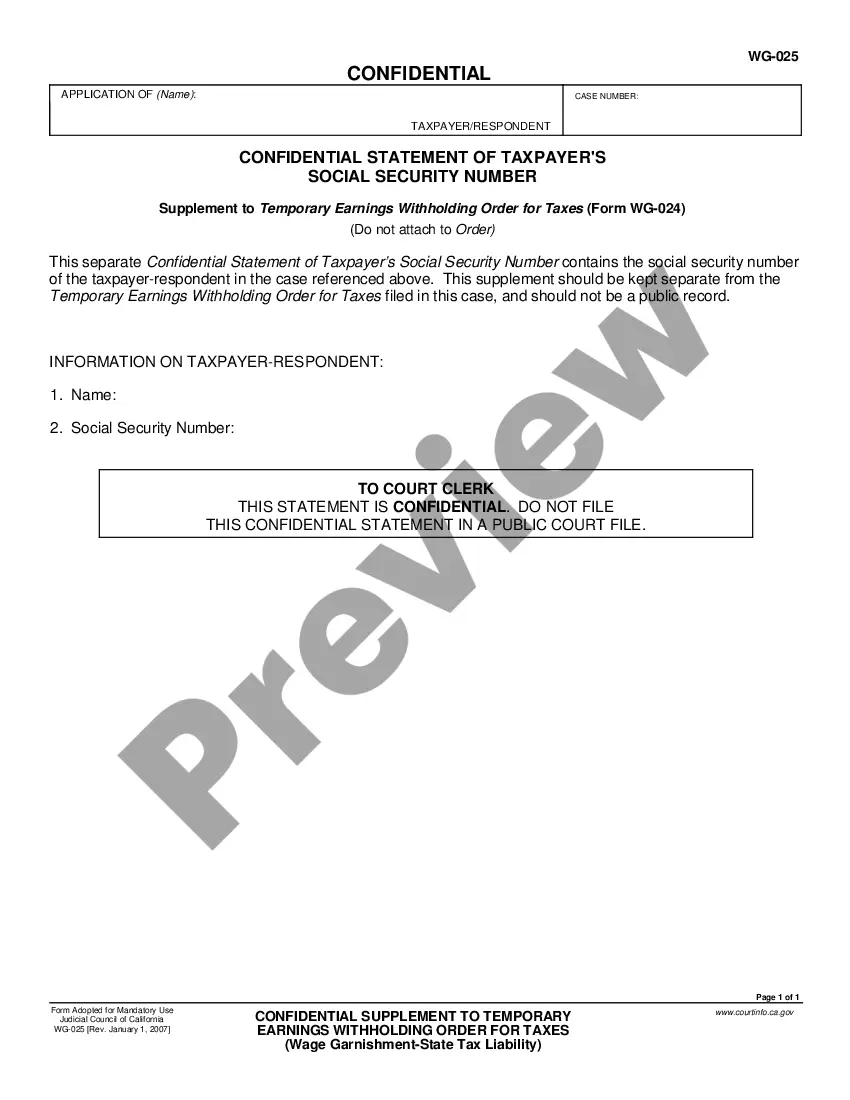

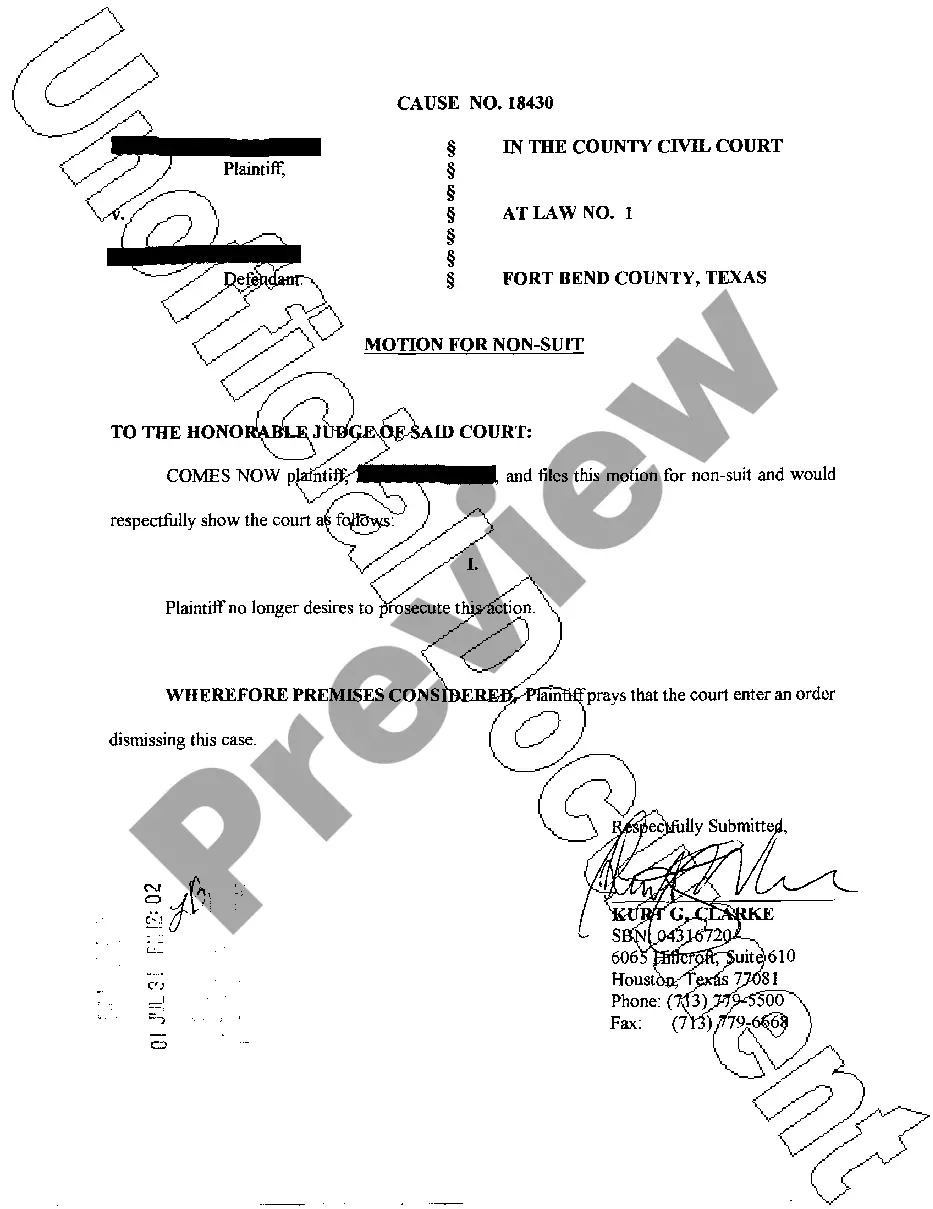

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have found the form you want, click the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the Indiana Financial Consulting Agreement.

Form popularity

FAQ

To set up an Indiana Financial Consulting Agreement, begin by clearly defining the scope of services your consultant will provide. Next, outline the compensation structure, including payment terms and any additional expenses. It's also crucial to specify the duration of the agreement and the procedures for termination. Consider using platforms like US Legal Forms, which offer templates to simplify the process and ensure compliance with Indiana law.

A scope of work (SOW) is a detailed description of the specific tasks to be completed, while a consulting agreement encompasses the overall relationship between the consultant and the client. The SOW often acts as an attachment to the consulting agreement, elaborating on project specifics. In the context of an Indiana Financial Consulting Agreement, integrating both documents can provide a comprehensive framework for the consulting engagement.

A consulting agreement is a legally binding document that outlines the services a consultant will provide to a client. This agreement details the scope of work, compensation, duration, and confidentiality obligations. When creating an Indiana Financial Consulting Agreement, it is essential to specify all these elements to ensure both parties understand their commitments and expectations.

As a consultant, you can protect yourself by clearly outlining your services, payment terms, and liability limitations in a written agreement. Consider using an Indiana Financial Consulting Agreement template from US Legal Forms to ensure your rights and responsibilities are well-defined. Additionally, maintaining open communication with your client can help prevent misunderstandings and disputes.

While all consulting agreements are contracts, not all contracts are consulting agreements. A consulting agreement specifically pertains to services provided by a consultant to a client, often involving expert advice or recommendations. An Indiana Financial Consulting Agreement is a specialized type of consulting contract that includes elements specific to financial consulting services, ensuring clarity and legal protection.

A consulting services agreement is a formal contract that outlines the relationship between a consultant and a client. This document specifies the services to be provided, compensation, and timelines. When drafting an Indiana Financial Consulting Agreement, it is crucial to address these details to protect both parties and ensure smooth collaboration.

Writing a simple consulting agreement involves defining the services offered, setting timelines, and establishing payment details. Begin with a clear introduction of both parties, followed by specific tasks and deadlines. You can enhance your agreement by referencing an Indiana Financial Consulting Agreement template available at US Legal Forms, which simplifies compliance with state regulations.

To set up a consulting agreement, start by identifying the parties involved and their roles. Clearly outline the scope of the services, payment terms, and duration of the agreement. Utilize templates from US Legal Forms to ensure you cover essential elements, specifically tailored for an Indiana Financial Consulting Agreement, which can streamline the process and provide peace of mind.

To write a consulting agreement, begin by stating the parties and purpose of the agreement. Clearly outline services to be provided, compensation, and any deadlines. Incorporating all these elements will ensure your Indiana Financial Consulting Agreement is comprehensive and legally sound.

Writing an agreement involves outlining the intentions and responsibilities of each party in a clear manner. Start by defining the purpose, then systematically detail the terms of the agreement. Utilize resources like US Legal Forms to create a professional Indiana Financial Consulting Agreement that meets legal expectations.