Indiana Agreement and Release for Working at a Novelty Store - Self-Employed

Description

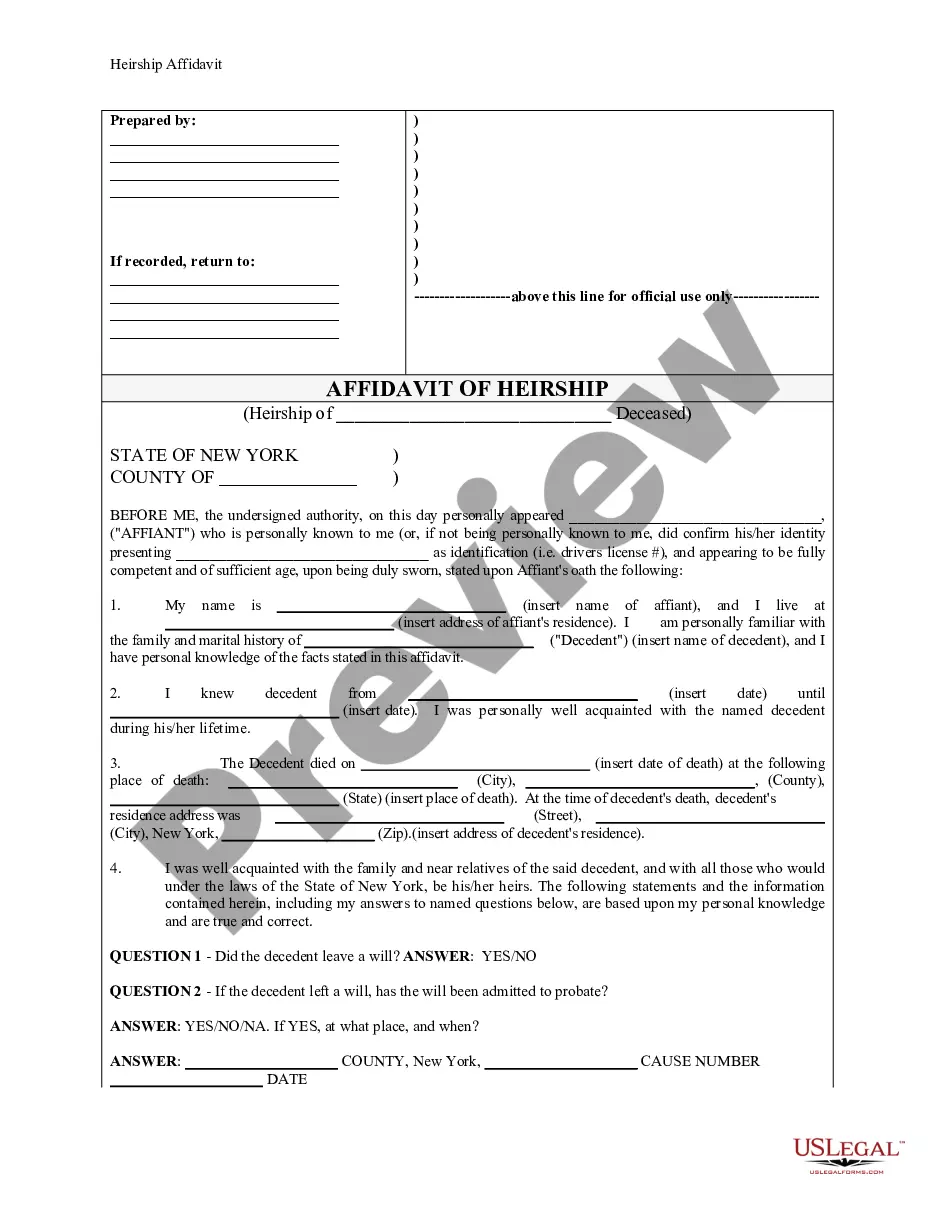

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

If you need extensive, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms that are available online.

Use the site’s straightforward and user-friendly search functionality to find the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Buy Now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to acquire the Indiana Agreement and Release for Working at a Novelty Store - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Indiana Agreement and Release for Working at a Novelty Store - Self-Employed.

- You can also access forms you have previously acquired from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s contents. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

Form popularity

FAQ

The Indiana code regarding independent contractors primarily focuses on the definition of independent contractors and the obligations they hold. Understanding these codes can help clarify your responsibilities, especially related to taxes and liability. It is essential to comply with these regulations to operate legally. Incorporating the Indiana Agreement and Release for Working at a Novelty Store - Self-Employed can enhance your understanding of these laws while providing essential legal safeguards.

Starting a retail business in Indiana involves several steps, including obtaining a business license, choosing a business structure, and registering your business name. It is essential to create a solid business plan that outlines your goals, target market, and marketing strategies. Such preparation will help your business thrive in the competitive retail landscape. The Indiana Agreement and Release for Working at a Novelty Store - Self-Employed can also support your legal framework as you establish your retail operation.

Yes, contractors in Indiana may need specific licenses, depending on their field of work. For example, those involved in construction or certain specialized services often require certification to meet state standards. Before starting any contracting work, always check with the Indiana licensing board to ensure you meet all legal requirements. Having the Indiana Agreement and Release for Working at a Novelty Store - Self-Employed can also help clarify responsibilities and protections under the law.

To become an independent contractor in Indiana, you must register your business and obtain any necessary licenses. You should also familiarize yourself with state tax regulations, as independent contractors are responsible for their own taxes. The Indiana Agreement and Release for Working at a Novelty Store - Self-Employed serves as a valuable document to formalize your working relationship and ensure compliance while protecting your rights.

In Indiana, a business license is not universally required for all businesses. However, specific types of businesses, especially retail stores like those selling novelty items, may need a license or permit based on local regulations. Therefore, it is crucial to consult your local governing authority to understand the exact requirements. Utilizing the Indiana Agreement and Release for Working at a Novelty Store - Self-Employed can provide legal clarity for your business operations.

Yes, independent contractors in Indiana need to obtain a business license depending on their business structure and location. Acquiring a license ensures you operate legally and can provide services without hindrance. This step is essential for anyone entering into an Indiana Agreement and Release for Working at a Novelty Store - Self-Employed.

In Indiana, an inheritance tax waiver form is generally required to release a decedent's assets from tax liability. This applies to beneficiaries who may inherit property. Having clarity on tax obligations helps in planning your estate wisely. If you have complexities that relate to your Indiana Agreement and Release for Working at a Novelty Store - Self-Employed, ensure to address them effectively.

The NP1 form in Indiana is utilized for non-profit organizations seeking to claim a sales tax exemption. This form is essential for qualifying organizations to acquire goods without incurring sales tax charges. If you are involved in transactions with non-profits, understanding the NP1 form is vital for your business. Make sure it complements your Indiana Agreement and Release for Working at a Novelty Store - Self-Employed.

The ST 105 form in Indiana functions as a certificate of exemption for sales tax. It allows buyers to forgo paying sales tax on qualified purchases. When selling items in your novelty store, utilizing this form can enhance your operations. Always relate its use to your Indiana Agreement and Release for Working at a Novelty Store - Self-Employed for better compliance.

To obtain farm tax exemption in Indiana, you must apply for an agricultural exemption through the Indiana Department of Revenue. Gather necessary documentation that proves your farming activities. This exemption can significantly reduce your tax burden as a self-employed individual. Relating it to your Indiana Agreement and Release for Working at a Novelty Store - Self-Employed may bring additional benefits.