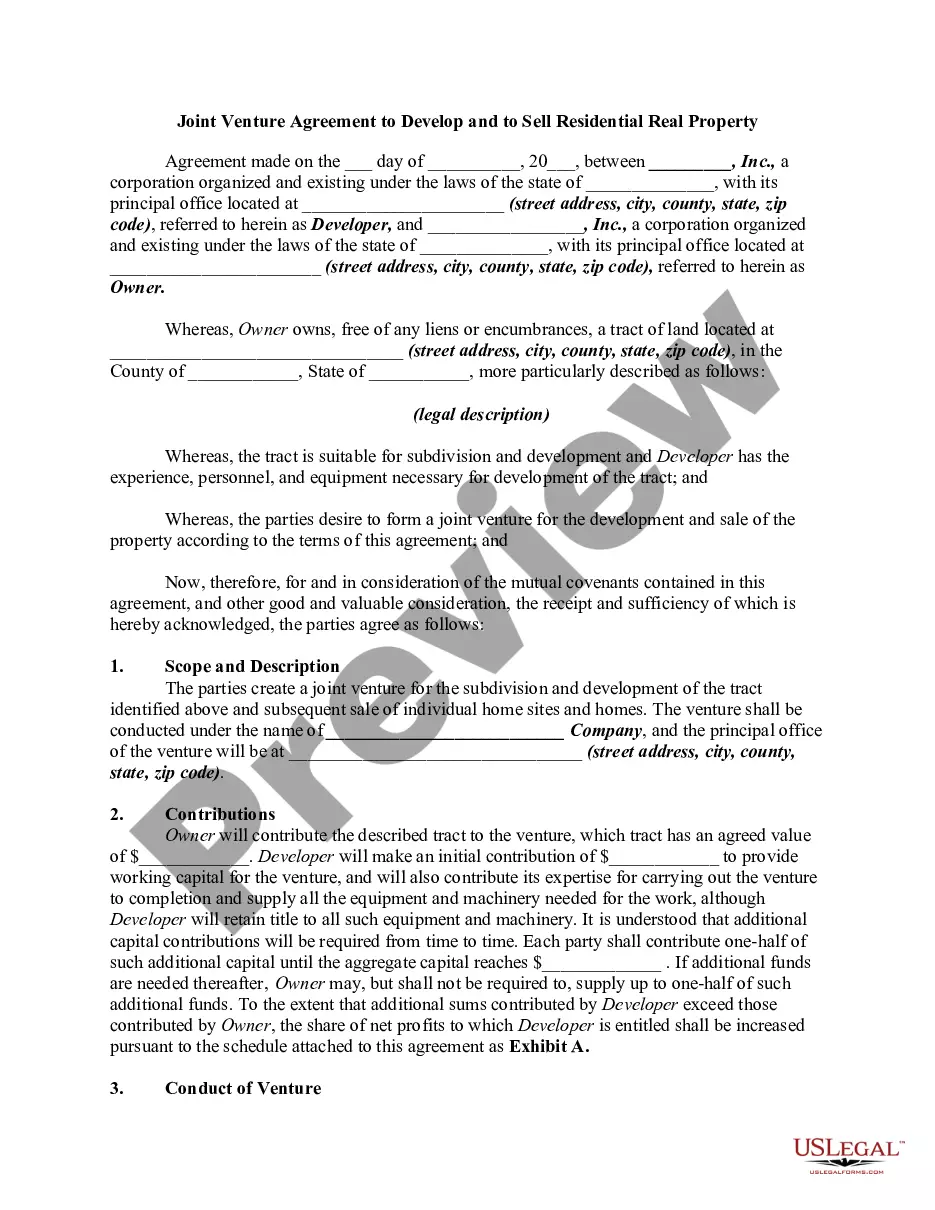

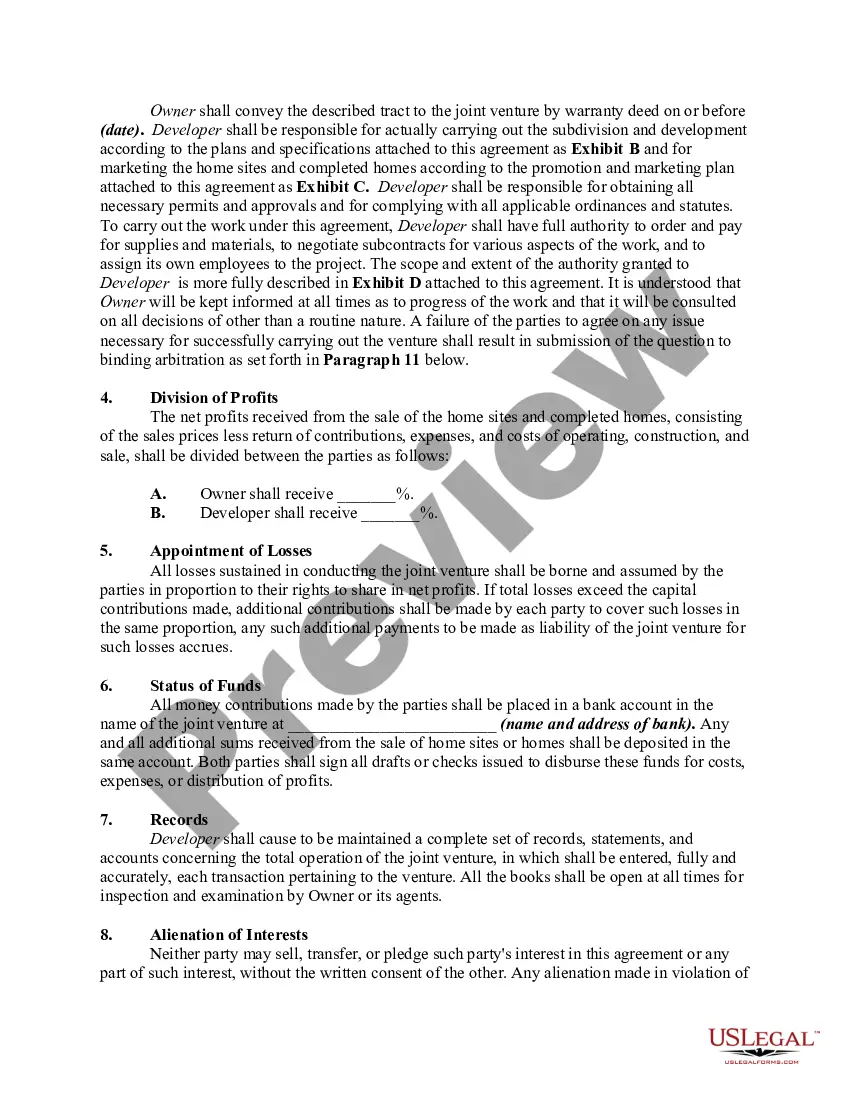

Title: Indiana Joint Venture Agreement to Develop and Sell Residential Real Property — A Comprehensive Guide Keywords: Indiana joint venture agreement, develop and sell residential real property, types of joint venture agreement, real estate development, property investment, legal contract, property development partnership. Introduction: In the realm of real estate development and property investment, an Indiana Joint Venture Agreement plays a vital role in facilitating collaboration between individuals or entities to jointly develop and sell residential real properties. This article will provide a detailed description of what an Indiana Joint Venture Agreement to Develop and Sell Residential Real Property entails, including different types that may exist. Detailed Description: 1. Purpose: The primary objective of an Indiana Joint Venture Agreement to Develop and Sell Residential Real Property is to establish a legally binding contract between multiple parties, such as property developers, investors, and contractors. The agreement outlines the specific terms, responsibilities, and obligations of each party involved in the joint venture project. 2. Key Elements: a. Parties involved: The agreement identifies all parties entering into the joint venture, including their roles and responsibilities. This typically includes the property developer or developer's entity, investors, and other stakeholders. b. Scope of the project: The agreement encompasses a detailed description of the residential real property project to be developed and ultimately sold. It may include the location, size, design plans, and construction timeline. c. Capital contributions: The agreement specifies the capital contributions made by each party involved. This includes financial investments, physical assets, land or properties contributed, or services rendered. d. Profit and loss sharing: The agreement outlines the distribution of profits or losses incurred during the project, typically based on each party's capital contributions or other predetermined factors. e. Decision-making and management: The agreement establishes the decision-making processes, management structure, and authority to ensure smooth operation and efficient progress of the project. f. Exit strategy: Terms for exiting the joint venture before or after completion of the project, including the sale or transfer of interest, are delineated in the agreement. 3. Types of Indiana Joint Venture Agreement to Develop and Sell Residential Real Property: a. Fixed Partnership Agreement: In this type, the joint venture partners maintain a long-term partnership arrangement, pooling resources and sharing profit and loss according to predetermined ratios. b. Specific Property Agreement: This agreement is tailored for a particular residential real property development project. The terms and conditions are project-specific and cease to exist upon successful completion of the project. c. Silent Partnership Agreement: This type involves investors who contribute capital but have limited involvement in the day-to-day management and decision-making process related to the project. d. Equity-Based Agreement: Here, joint venture partners contribute capital in exchange for equity, entitling them to a share in profits and ownership of the developed residential property. Conclusion: An Indiana Joint Venture Agreement to Develop and Sell Residential Real Property is a legally binding contract that facilitates collaboration among various stakeholders in the real estate industry. Understanding the purpose, key elements, and various types of joint venture agreements enables parties to establish clear expectations and responsibilities essential for successful property development and sales projects in Indiana.

Indiana Joint Venture Agreement to Develop and to Sell Residential Real Property

Description

How to fill out Indiana Joint Venture Agreement To Develop And To Sell Residential Real Property?

Have you been inside a placement in which you need to have files for sometimes business or specific reasons just about every time? There are plenty of authorized document web templates available online, but discovering kinds you can trust is not effortless. US Legal Forms offers a huge number of form web templates, just like the Indiana Joint Venture Agreement to Develop and to Sell Residential Real Property, which are written in order to meet federal and state needs.

In case you are already familiar with US Legal Forms site and possess a free account, basically log in. After that, you can download the Indiana Joint Venture Agreement to Develop and to Sell Residential Real Property format.

Unless you offer an profile and would like to begin to use US Legal Forms, adopt these measures:

- Find the form you require and make sure it is to the proper metropolis/county.

- Take advantage of the Preview button to check the form.

- See the outline to actually have selected the appropriate form.

- In the event the form is not what you`re seeking, take advantage of the Research area to discover the form that meets your needs and needs.

- When you discover the proper form, click Acquire now.

- Pick the prices plan you need, fill out the desired info to produce your bank account, and buy the order utilizing your PayPal or credit card.

- Decide on a practical document file format and download your duplicate.

Get each of the document web templates you may have bought in the My Forms menus. You can obtain a more duplicate of Indiana Joint Venture Agreement to Develop and to Sell Residential Real Property whenever, if required. Just go through the needed form to download or produce the document format.

Use US Legal Forms, by far the most comprehensive selection of authorized varieties, to save lots of time as well as prevent faults. The service offers appropriately made authorized document web templates which you can use for a selection of reasons. Make a free account on US Legal Forms and begin generating your way of life easier.