Title: Exploring Indiana Limited Partnership Agreements Between Limited Liability Companies and Limited Partners Introduction: In the state of Indiana, limited partnerships serve as effective business structures combining the advantages of limited liability protection with flexible management structures. This article aims to provide a detailed description of Indiana Limited Partnership Agreements (Pas) between Limited Liability Companies (LCS) and Limited Partners, outlining their key components, benefits, and potential variations. 1. Understanding Indiana Limited Partnership Agreement: An Indiana Limited Partnership Agreement is a legally binding contract that establishes the rights, obligations, and responsibilities of the parties involved in a limited partnership. It governs the relationship between a Limited Liability Company acting as the general partner and one or more Limited Partners. 2. Key Components of Indiana Limited Partnership Agreement: a) Identification of Parties: The PA should clearly identify the LLC as the general partner and the limited partner(s) involved. b) Name and Purpose: The agreement must state the limited partnership's official name and outline its primary objectives. c) Contributions: Each partner's capital contributions, whether in cash, property, or services, should be detailed. d) Profits and Losses: The agreement should define how profits and losses are allocated among the partners. e) Management and Control: The PA should outline the LLC's role in managing the partnership and specify any decision-making rights granted to limited partners. f) Withdrawal and Dissolution: Procedures for withdrawing or dissolving the partnership should be clearly defined. g) Liability and Indemnification: The agreement should address the extent of limited partners' liability and provisions for indemnification. h) Dispute Resolution: The PA may outline methods for resolving disputes, such as mediation or arbitration. i) Term and Amendments: The length of the partnership and provisions for making amendments to the agreement should be stated. 3. Benefits of Indiana Limited Partnership Agreement for LCS and Limited Partners: a) Limited Liability Protection: Limited partners enjoy limited liability, protecting their personal assets from business-related obligations. b) Tax Advantages: Partnerships are not subject to double taxation, as profits and losses pass through to individual partners' tax returns. c) Flexibility in Management: Limited partners can participate in the partnership's profits without being actively involved in daily operations. d) Capital Investment: Pas allow LCS to raise capital by bringing in limited partners who contribute financially. e) Learning Opportunity: For limited partners, investing in a limited partnership can be a valuable learning experience alongside financial gains. 4. Types of Indiana Limited Partnership Agreements: a) General Partnership: In a general partnership PA, all partners assume unlimited liability for the partnership's obligations, including debts. b) Limited Liability Partnership (LLP): Laps offer limited liability protection to all partners, including the general partner(s) involved. c) Limited Liability Limited Partnership (LL LP): Helps combine the characteristics of a limited partnership and a limited liability partnership, providing liability protection to all partners while maintaining the partnership structure. Conclusion: Indiana Limited Partnership Agreements between Limited Liability Companies and Limited Partners provide a flexible and effective business structure. These agreements safeguard the interests of both parties, outlining their rights, responsibilities, and ownership stakes. By understanding the key components and benefits, businesses and investors can structure their partnerships appropriately to achieve their objectives while mitigating potential risks.

Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

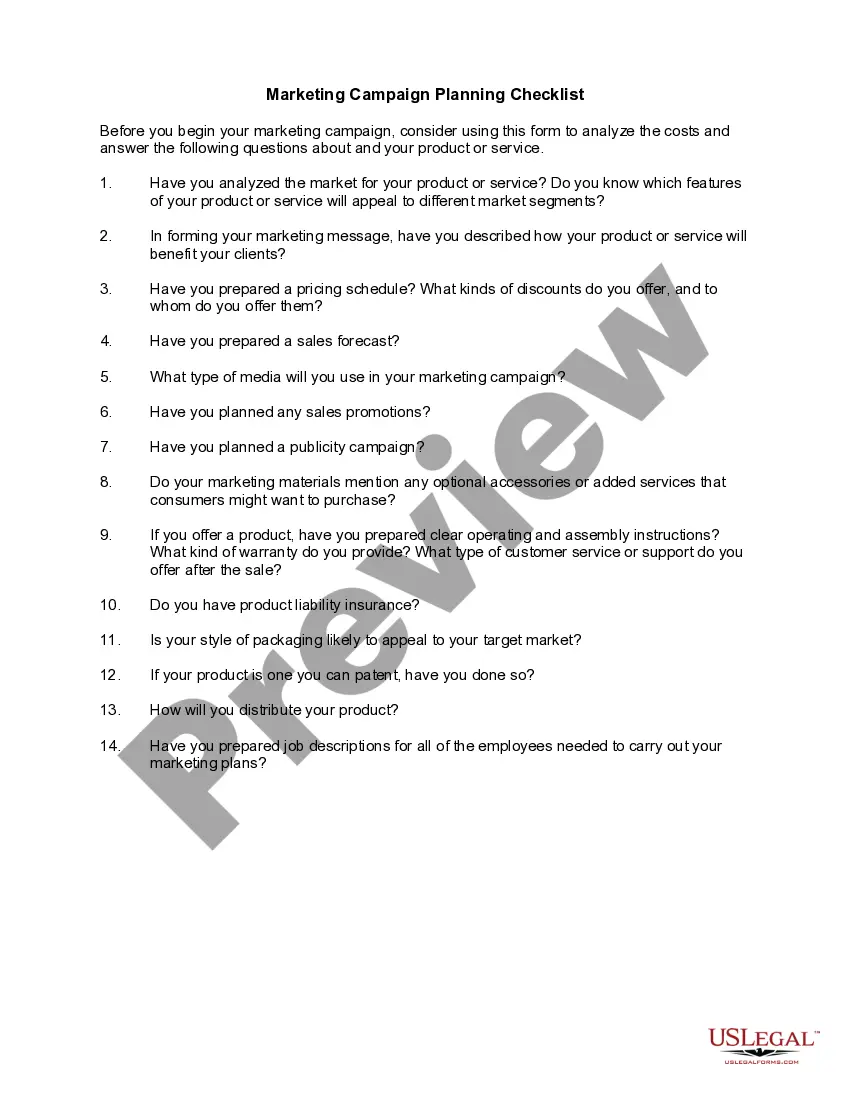

How to fill out Indiana Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

You may invest numerous hours online looking for the legal document format that satisfies the federal and state standards you require.

US Legal Forms provides thousands of legal templates that can be reviewed by professionals.

You can download or print the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner from your service.

First, ensure that you have chosen the correct document format for the region/area of your choice. Review the form description to confirm you have selected the right form. If available, use the Preview button to look through the document format as well. To find another version of the form, use the Search field to locate the format that suits your needs and requirements. Once you have identified the format you want, click Buy now to proceed. Choose the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Select the file format of the document and download it to your device. Make adjustments to the document if possible. You can complete, edit, and sign and print the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Every legal document format you obtain is yours permanently.

- To acquire another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

Form popularity

FAQ

In general, both partners in a limited liability company partnership cannot be limited partners. At least one partner must be a general partner to manage the business and assume liability. Understanding the structure is vital when creating an Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. Consulting with resources like US Legal Forms can provide you with the necessary templates and guidance to ensure compliance with state laws.

Yes, an LP can have two general partners. This setup can allow for more flexibility in management and decision-making within the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. However, it is crucial to clearly outline the roles and responsibilities of each general partner in the partnership agreement to avoid potential conflicts. Utilizing a professional platform like US Legal Forms can help you create a comprehensive agreement tailored to your specific needs.

While being a limited partner has its benefits, there are also disadvantages such as limited control over the business. Limited partners typically cannot participate in management without risking their liability protection. Moreover, their returns are often contingent on the general partner's performance, as described in the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

Absolutely, a partnership can have two or more limited partners. Each partner can contribute capital while enjoying limited liability regarding debts and obligations, as outlined in the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. However, it’s important to define each partner’s role to maintain compliance and structure.

One significant difference is that limited partners in a limited partnership are not involved in managing the business, while partners in a limited liability partnership can participate without losing their liability protection. The Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner lays out these distinctions clearly. Understanding these differences helps you choose the right structure for your business needs.

Yes, you can have both a limited company and a partnership operating in conjunction. This structure allows for additional flexibility and potential tax benefits, depending on how the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner is structured. Consulting with legal professionals can help you navigate the complexities of such arrangements.

A limited partner primarily provides capital to the partnership but does not engage in daily management. Their role is to invest in the business while enjoying limited liability for its debts, as specified in the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. This allows them to benefit from the profits while minimizing risk.

If a limited partner wants to exit a limited partnership, they must review the terms outlined in the Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. This agreement typically specifies the procedures for withdrawal and any potential financial implications. It is vital to follow these guidelines to maintain a good standing with remaining partners.

If a limited partner participates in the management of a limited partnership, they may risk losing their limited liability protection. In an Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it’s essential to clearly define roles to ensure limited partners do not actively manage the business. This distinction protects their assets from liabilities incurred by the partnership.

The Indiana Code 23 1 49 1 outlines the statutory framework for limited partnerships in the state. This code defines the rights and obligations of limited partners and general partners within an Indiana Limited Partnership Agreement Between Limited Liability Company and Limited Partner. Understanding this code can help you navigate the complexities of forming and managing a limited partnership.

Interesting Questions

More info

Ural System Legal Information Institute View Privacy Policy Legal Information Institute Search Site Search Support Legal Information Institute.