Indiana Lease of Business Premises — Real Estate Rental is a legally binding agreement that outlines the terms and conditions between a landlord and a tenant for the leasing of commercial property in Indiana. This lease agreement is specific to businesses seeking to rent property for their operations, such as offices, retail spaces, warehouses, or any other commercial premises. Keywords: Indiana, lease, business premises, real estate rental, landlord, tenant, commercial property, offices, retail spaces, warehouses, lease agreement. There are several types of Indiana Lease of Business Premises — Real Estate Rental agreements available, depending on the specific needs of the tenant and the nature of the business. Here are some common types: 1. Full-Service Lease: This type of lease includes all expenses related to the property, including utilities, maintenance, repairs, and property taxes. The tenant pays a base rent, which covers these expenses. 2. Triple Net Lease: In this type of lease, the tenant is responsible for additional costs such as property taxes, insurance, and maintenance. The base rent is typically lower, but the tenant bears a larger portion of the property expenses. 3. Gross Lease: This lease type includes a fixed monthly or annual rent, and the landlord is responsible for most property expenses, such as property taxes, insurance, and maintenance. This gives the tenant more predictability in terms of expenses. 4. Modified Gross Lease: This type of lease is a combination of a gross lease and a triple net lease. The tenant and the landlord agree on how certain expenses will be divided, such as property taxes or maintenance costs. 5. Graduated Lease: A graduated lease includes a predetermined rent increase at specific intervals, providing the landlord with a gradual increase in rental income over time. 6. Short-term Lease: Sometimes, businesses may require a lease for a limited period. Short-term leases typically last a few months to a year, making them suitable for startups or seasonal businesses. The Indiana Lease of Business Premises — Real Estate Rental agreement typically covers essential details such as the length of the lease, rental cost, security deposit, maintenance responsibilities, permitted use of the premises, renewal options, termination conditions, and any additional terms agreed upon by the landlord and tenant. It's important for both parties to carefully review and understand the terms and conditions outlined in the lease agreement before signing, as it sets the groundwork for the landlord-tenant relationship and protects the rights and obligations of both parties throughout the lease term.

Indiana Lease of Business Premises - Real Estate Rental

Description

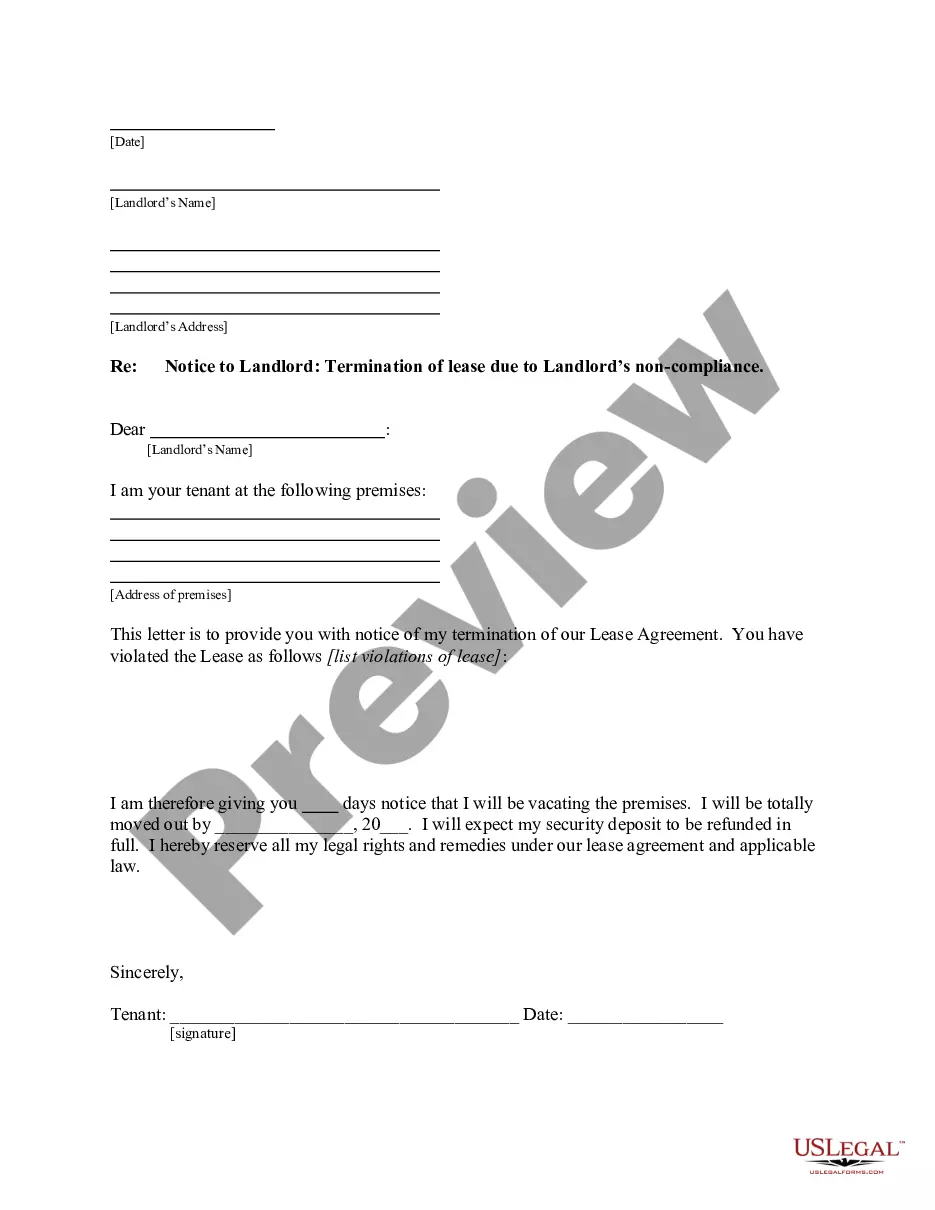

How to fill out Indiana Lease Of Business Premises - Real Estate Rental?

Are you in a situation where you need documents for either professional or personal purposes nearly every time.

There are numerous authentic document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Indiana Lease of Business Premises - Real Estate Rental, designed to meet federal and state requirements.

Once you find the right form, simply click Purchase now.

Select the pricing plan you prefer, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Indiana Lease of Business Premises - Real Estate Rental template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

- Use the Review button to check the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Leasing commercial property for your business starts with identifying the ideal location that meets your operational needs. Once you find a suitable space, gather necessary documents and approach the landlord with an offer. Utilizing resources like uslegalforms can help you navigate the Indiana Lease of Business Premises - Real Estate Rental process by ensuring you include all vital elements and protect your interests.

The minimum term for a commercial lease in Indiana generally starts at one year. However, some landlords may offer shorter terms based on their rental strategies or the nature of the rental property. Always consult an attorney or a rental platform like uslegalforms to better understand how the Indiana Lease of Business Premises - Real Estate Rental can be tailored to fit your situation.

In Indiana, the maximum length of a commercial lease can vary significantly, depending on the agreement between the landlord and tenant. Typically, these leases can last anywhere from one to twenty years. It’s crucial to discuss your specific needs with a legal expert to ensure that the terms of the Indiana Lease of Business Premises - Real Estate Rental align with your business goals.

Yes, you can rent your property to your business, but there are specific legal and tax considerations to keep in mind. By using an Indiana Lease of Business Premises - Real Estate Rental, you formalize the arrangement, making it a legitimate business expense. It is advisable to consult with a legal or financial professional to ensure compliance with all regulations and maintain proper documentation. This approach can provide liquidity and potential tax benefits.

To rent commercial space for your business, start by determining your needs regarding size, location, and budget. An Indiana Lease of Business Premises - Real Estate Rental is your primary consideration, so be prepared to provide financial statements and business plans. Engage a real estate agent experienced in commercial leases for assistance. Conduct a thorough review of potential spaces, ensuring they meet your business operations.

Leasing a building for your business involves negotiating a lease agreement with the property owner. This Indiana Lease of Business Premises - Real Estate Rental outlines terms such as rent amount, duration, and responsibilities for maintenance. Typically, a security deposit is required, and tenants must adhere to all lease conditions. Once signed, this contract becomes legally binding, so reviewing it carefully is essential.

Living in a commercial property in Indiana is typically restricted due to zoning laws. An Indiana Lease of Business Premises - Real Estate Rental usually focuses on business activities rather than residential use. Before making a decision, consult local regulations and your lease terms. If residential use is desired, look for properties that allow such arrangements.

In most cases, renting a business space to live in is not allowed under zoning regulations. When pursuing an Indiana Lease of Business Premises - Real Estate Rental, it's essential to understand the property’s designated use. Check local laws and the lease agreement to ensure compliance. If you want to live and work in the same space, consider a mixed-use property.

To assign a commercial lease, review the lease agreement to understand any clauses pertaining to assignment. Most leases require the landlord's consent before an assignment can occur. After obtaining approval, draft an assignment agreement that details the parties involved and any conditions of the assignment. Clarifying these steps within the context of an Indiana Lease of Business Premises - Real Estate Rental is essential for a smooth transition.

The Indiana rental form is a standardized document that outlines the terms and conditions of a rental agreement between a landlord and tenant. It typically includes important details such as rental payment amounts, responsibilities for maintenance, and rules regarding property use. Having a clear and comprehensive rental form can help prevent misunderstandings. You can find resources for creating an Indiana Lease of Business Premises - Real Estate Rental form through various online platforms.

Interesting Questions

More info

Renting a small business is a great way to earn extra money while you get started. Renting a small business can save you time and money because you can focus on your strengths and areas of expertise. Renting A Small Business is not for everyone but if you have the time and desire to put in the time, it is definitely worth consideration. What Small Business Owners Need to Know Rental a small business is a great way to start earning extra money while you get started Not everyone can find the time or resources to start a business like a small business. The average small business owner struggles with the day-to-day tasks around running their businesses. Many small business owners don't have the same experience as their colleagues who do have small businesses. To overcome this hurdle, some small business owners choose to rent out their business.