Indiana Agreement to Assign Lease to Incorporators Forming Corporation

Description

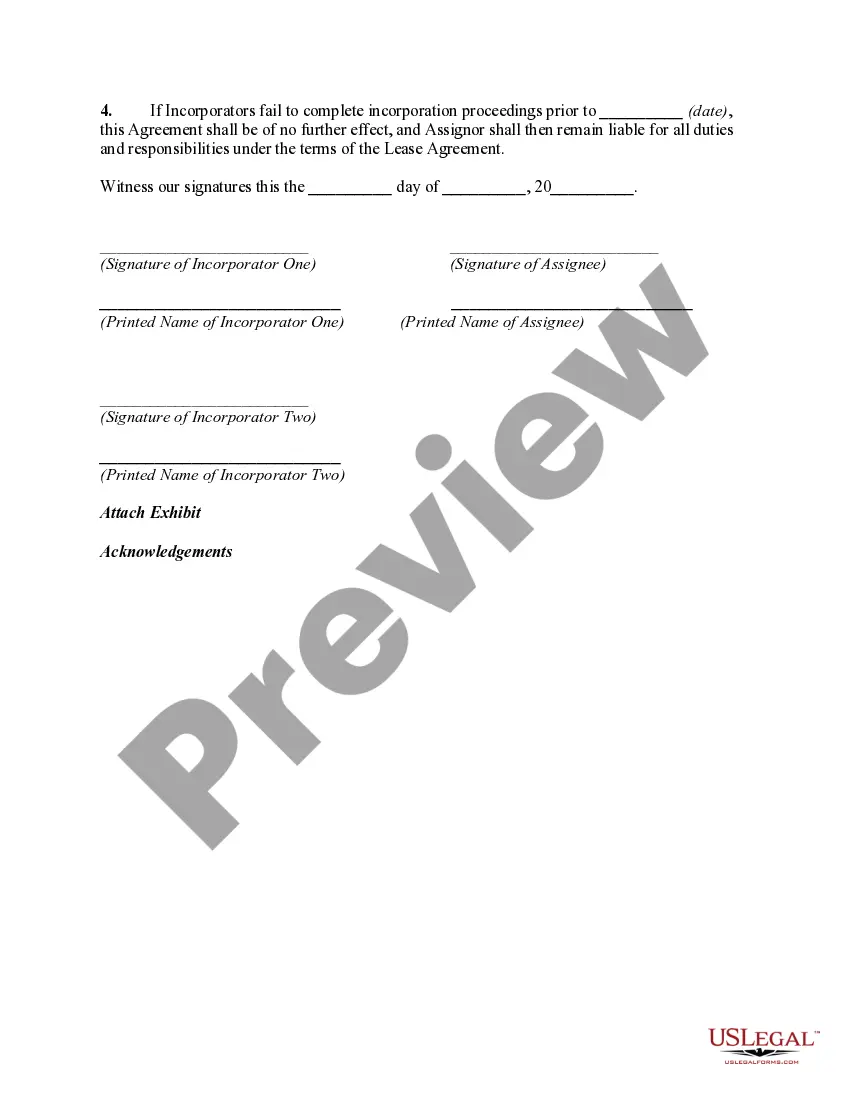

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

If you need to finalize, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Employ the site’s straightforward and convenient search feature to locate the documents required. Numerous templates for business and personal purposes are organized by categories and states, or by keywords. Use US Legal Forms to find the Indiana Agreement to Assign Lease to Incorporators Forming Corporation in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Indiana Agreement to Assign Lease to Incorporators Forming Corporation. You can also access forms you previously downloaded in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the steps below.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Complete, download, and print the Indiana Agreement to Assign Lease to Incorporators Forming Corporation with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to inspect the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Indiana Agreement to Assign Lease to Incorporators Forming Corporation.

Form popularity

FAQ

Yes, you can assign a lease that has already been assigned, but this may depend on the original lease terms. Some leases require landlord consent for any further assignments, while others might explicitly permit such actions. It is essential to review your lease agreement and, if necessary, consult legal guidance to ensure compliance. The Indiana Agreement to Assign Lease to Incorporators Forming Corporation can provide useful templates for these situations.

To legally terminate a lease in Indiana, tenants must adhere to the lease's terms or local laws. Situations such as unsafe living conditions, landlord non-compliance, or military deployment may allow for early termination without penalty. It is advisable to document all issues and communicate with the landlord prior to taking action. Consider referencing the Indiana Agreement to Assign Lease to Incorporators Forming Corporation for further clarity in your lease agreements.

Landlords in Indiana have a responsibility to maintain their properties in safe and habitable condition. They must ensure that basic utilities are functional, perform necessary repairs promptly, and respect tenants' rights to privacy. Violations of these obligations can lead to legal actions by tenants. For landlords looking to streamline their processes, utilizing tools like the Indiana Agreement to Assign Lease to Incorporators Forming Corporation can be beneficial.

Tenants in Indiana without a written lease still hold certain rights under the law. They retain the right to a habitable living space, protection from discrimination, and the ability to seek repairs. Importantly, these tenants often operate under a month-to-month agreement, which allows for more flexibility. Understanding these rights can be crucial for those concerned about their lease situations, especially when considering the Indiana Agreement to Assign Lease to Incorporators Forming Corporation.

In Indiana, landlords typically cannot enter rental properties without notice and tenant consent. The law requires landlords to provide reasonable notice before entering, generally 24 hours. This protects tenant privacy and ensures respect for their living space. However, in emergencies, immediate access is allowed without prior notice.

Indiana is often regarded as moderate in terms of tenant-friendliness. While it has specific laws to protect tenants, such as habitability requirements, its regulations are less comprehensive than in other states. If you are considering leasing or assigning a lease, utilizing the Indiana Agreement to Assign Lease to Incorporators Forming Corporation can help ensure fairness and clarity within the rental relationship.

Generally, leases do not need to be notarized in Indiana, as verbal agreements can be valid. However, it is advisable to have a written lease to avoid disputes. Incorporating the Indiana Agreement to Assign Lease to Incorporators Forming Corporation can provide the necessary documentation and clarity for all involved parties, thus protecting your interests.

Assigning a lease in Indiana involves obtaining the landlord's consent, drafting an assignment agreement, and notifying the tenant about the change. The Indiana Agreement to Assign Lease to Incorporators Forming Corporation can serve as a structured solution for this process. This ensures clear communication and legally binds the parties involved, making the assignment smoother.

To create a lease agreement in Indiana, start by outlining the terms, including rental amount, duration, and responsibilities of both parties. It’s essential to ensure compliance with Indiana rental laws. Templates are available online, and using the Indiana Agreement to Assign Lease to Incorporators Forming Corporation can help streamline the leasing process for new incorporators.

The most common commercial lease agreement in Indiana is the triple net lease. In this type of lease, the tenant is responsible for property taxes, insurance, and maintenance costs, in addition to the rent. This arrangement allows landlords to have fixed costs, making it a preferred choice for many property owners. If you plan to assign a lease, the Indiana Agreement to Assign Lease to Incorporators Forming Corporation can simplify the transition.