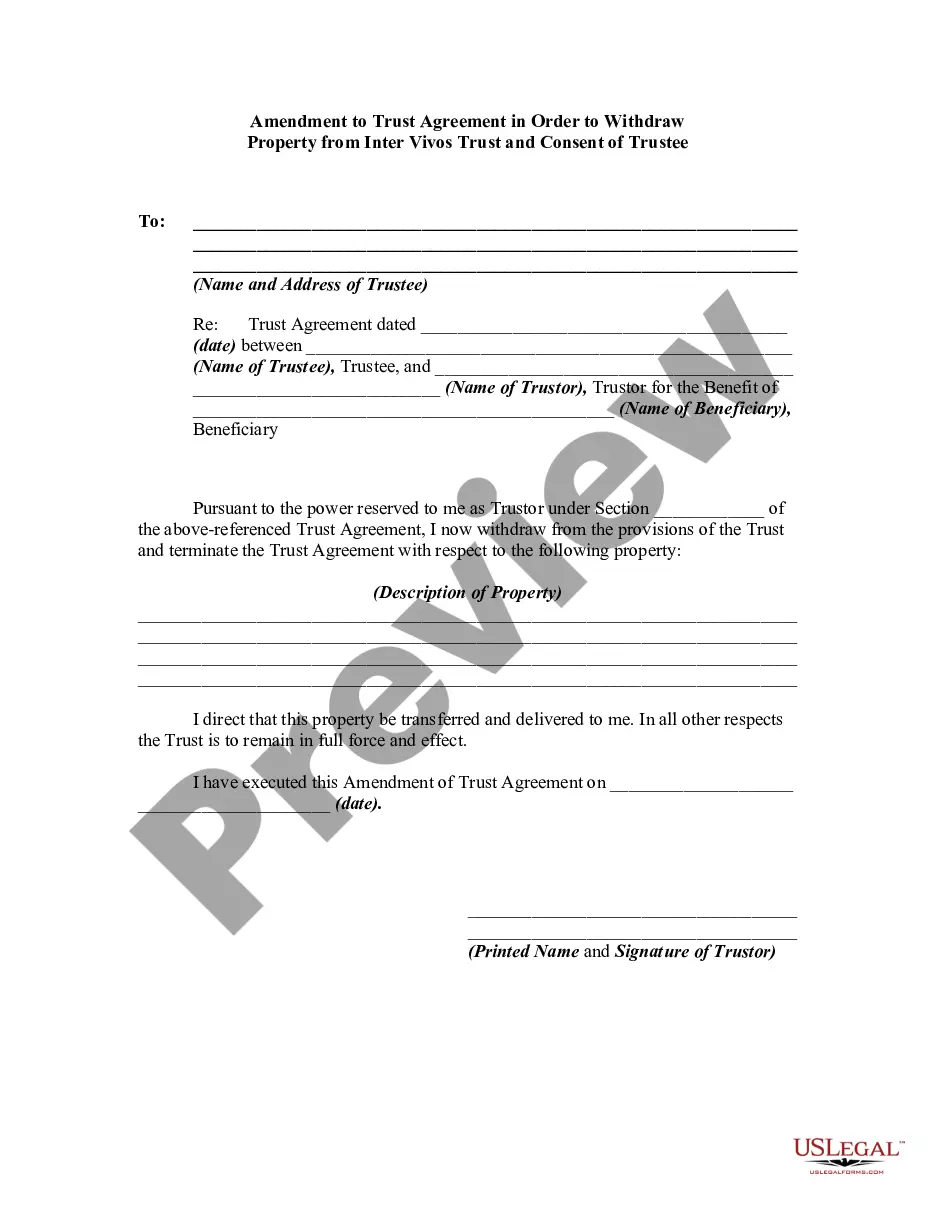

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

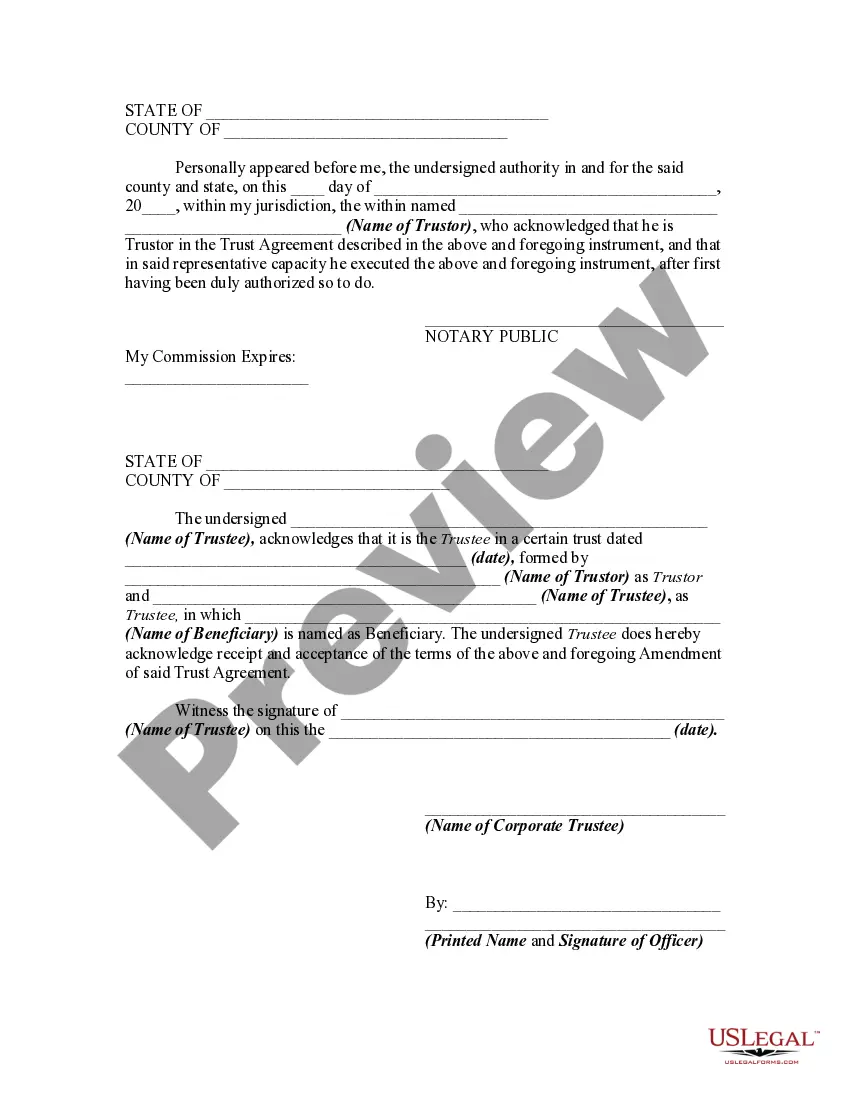

Indiana Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee In the state of Indiana, an Amendment to Trust Agreement is a legal document that allows for the withdrawal of property from an Inter Vivos Trust, which is a trust that is created during the granter's lifetime. This amendment is crucial when the granter wishes to make changes or remove specific assets from the trust. With this amendment, the granter can modify the terms of the trust agreement to reflect their intentions accurately. The process of amending a trust agreement in Indiana involves obtaining the consent of the trustee, who is typically responsible for managing the trust assets. The trustee's consent signifies their agreement to the proposed changes. Keywords: Indiana Amendment to Trust Agreement, Withdraw Property, Inter Vivos Trust, Consent of Trustee, Granter, Amendment, Trust Agreement Types of Indiana Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee: 1. Partial Withdrawal Amendment: This type of amendment allows the granter to withdraw specific assets or a portion of the property from the Inter Vivos Trust. The granter can specify the assets to be withdrawn and ensure that the trust's remaining assets continue to be managed by the trustee. 2. Full Withdrawal Amendment: In cases where the granter wishes to completely dissolve the Inter Vivos Trust and withdraw all the assets, a full withdrawal amendment is required. This amendment terminates the trust agreement and transfers all the assets back to the granter. 3. Beneficiary Modification Amendment: An amendment may also be required if the granter wishes to modify the beneficiaries designated under the trust agreement. This amendment allows the granter to add or remove beneficiaries or change the distribution of assets among the existing beneficiaries. By utilizing an Indiana Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and securing the consent of the trustee, the granter can ensure that their intentions regarding the trust assets are accurately reflected and legally binding. Please note that while this content provides a general overview of the topic, it is important to consult with a qualified attorney in Indiana to obtain precise legal advice tailored to your specific situation. Laws and regulations surrounding trusts can vary, and professional guidance is necessary to ensure compliance and meet your individual needs.Indiana Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee In the state of Indiana, an Amendment to Trust Agreement is a legal document that allows for the withdrawal of property from an Inter Vivos Trust, which is a trust that is created during the granter's lifetime. This amendment is crucial when the granter wishes to make changes or remove specific assets from the trust. With this amendment, the granter can modify the terms of the trust agreement to reflect their intentions accurately. The process of amending a trust agreement in Indiana involves obtaining the consent of the trustee, who is typically responsible for managing the trust assets. The trustee's consent signifies their agreement to the proposed changes. Keywords: Indiana Amendment to Trust Agreement, Withdraw Property, Inter Vivos Trust, Consent of Trustee, Granter, Amendment, Trust Agreement Types of Indiana Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee: 1. Partial Withdrawal Amendment: This type of amendment allows the granter to withdraw specific assets or a portion of the property from the Inter Vivos Trust. The granter can specify the assets to be withdrawn and ensure that the trust's remaining assets continue to be managed by the trustee. 2. Full Withdrawal Amendment: In cases where the granter wishes to completely dissolve the Inter Vivos Trust and withdraw all the assets, a full withdrawal amendment is required. This amendment terminates the trust agreement and transfers all the assets back to the granter. 3. Beneficiary Modification Amendment: An amendment may also be required if the granter wishes to modify the beneficiaries designated under the trust agreement. This amendment allows the granter to add or remove beneficiaries or change the distribution of assets among the existing beneficiaries. By utilizing an Indiana Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and securing the consent of the trustee, the granter can ensure that their intentions regarding the trust assets are accurately reflected and legally binding. Please note that while this content provides a general overview of the topic, it is important to consult with a qualified attorney in Indiana to obtain precise legal advice tailored to your specific situation. Laws and regulations surrounding trusts can vary, and professional guidance is necessary to ensure compliance and meet your individual needs.