A trustor is the person who created a trust. The trustee is the person who manages a trust. The trustee has a duty to manage the trust's assets in the best interests of the beneficiary or beneficiaries. In this form the trustor is acknowledging receipt from the trustee of all property in the trust following revocation of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust

Description

How to fill out Receipt By Trustor For Trust Property Upon Revocation Of Trust?

Selecting the appropriate legal document template can be challenging.

Certainly, there is a multitude of templates available online, but how do you locate the specific legal form you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust, suitable for both business and personal needs.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form is correct, click the Get now button to acquire the form. Select your preferred pricing plan and enter the required information. Create your account and process the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust. US Legal Forms is the largest repository of legal forms where you can find various document templates. Leverage the service to obtain professionally crafted documents that adhere to state requirements.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust.

- Use your account to access the legal forms you have previously ordered.

- Navigate to the My documents section of your account and download another copy of the required document.

- If you are a new user of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have chosen the correct form for your city/state. You can browse the form using the Review button and read the form description to confirm it's suitable for you.

Form popularity

FAQ

A revocable living trust can be a great option for protecting your assets while maintaining flexibility during your lifetime. This type of trust allows you to retain control and make changes as needed while providing protection from probate after your passing. When preparing an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust, consider the benefits of a revocable living trust as a strategic approach to asset protection.

Indiana Code 30-5-5-15 deals with the powers and responsibilities of the trustee regarding the management of trust property. This code ensures that a trustee acts in the best interest of the beneficiaries and upholds fiduciary duties. Understanding this regulation is crucial when preparing an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust, as it outlines key legal obligations.

Certain assets cannot be included in a trust, such as a primary residence that you occupy or certain types of retirement accounts. Additionally, some assets may have specific restrictions based on tax implications or creditor protections. When completing an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust, it is vital to understand these limitations so you can structure your trust effectively.

One of the most significant mistakes parents make is failing to fund the trust properly. Establishing a trust fund is just the first step; transferring assets into the trust is essential for it to be functional. Without these assets, the trust becomes ineffective, leaving parents and beneficiaries unprotected. To avoid this error, it's crucial to follow through with all necessary documentation, like creating an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust, ensuring a comprehensive estate plan.

Certain assets, like retirement accounts and health savings accounts, should be kept outside a revocable trust due to tax implications and beneficiary designations. Furthermore, it's not advisable to place assets with joint ownership in a revocable trust, as they might bypass probate anyway. Retaining these assets outside a trust can simplify the estate settlement process. Therefore, understanding what belongs in an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust matters greatly for effective estate planning.

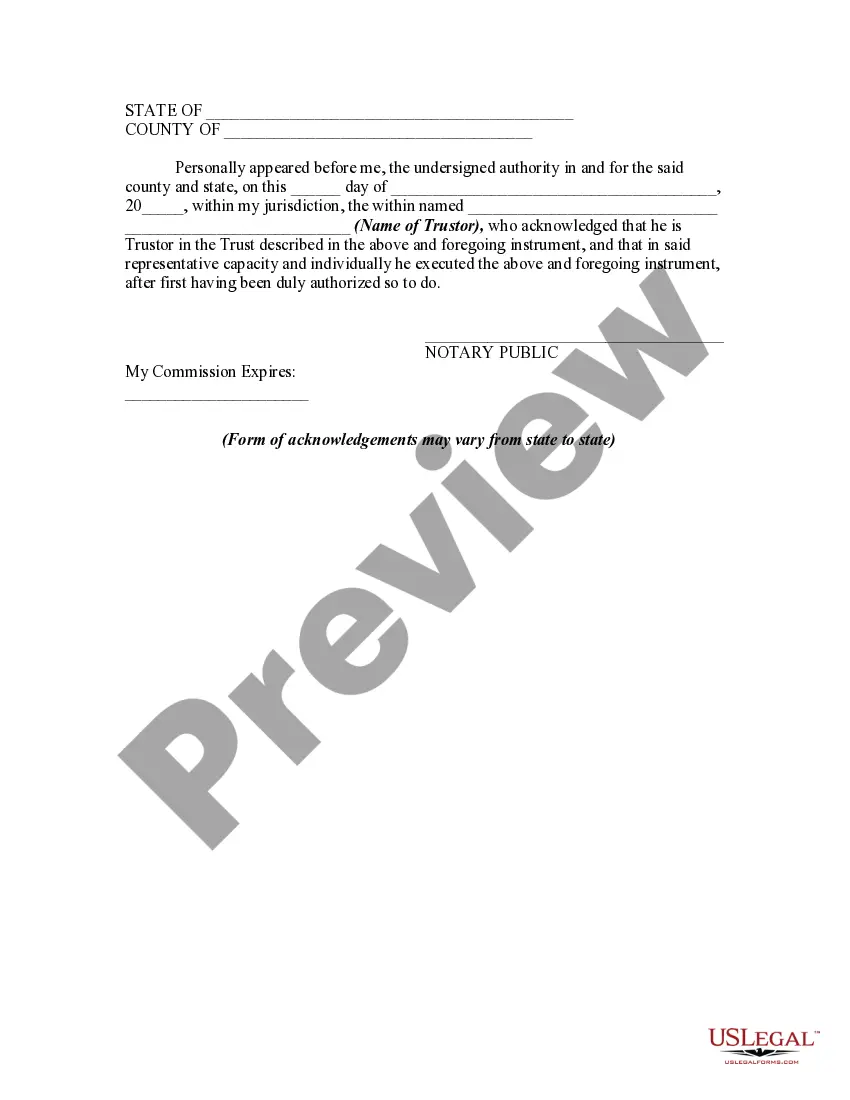

A trust becomes revoked when the trustor takes formal steps to cancel it, often by signing a written document that indicates their intent. This document should state their decision clearly, often resulting in an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust, which serves as proof of the revocation. It is advisable to follow specific legal requirements to ensure the revocation stands up in court. Consulting legal resources can empower trustors to make informed decisions.

An example of revocation occurs when a trustor decides to dismantle their living trust and reclaim the assets placed within it. For instance, if the trustor becomes dissatisfied with the trust’s terms or changes their estate planning goals, they might issue an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust to revoke it officially. This action allows the trustor to regain control over their assets and make necessary adjustments. Understanding revocation is key to maintaining a flexible estate plan.

A trust can be terminated through revocation by the trustor, by operation of law, or through court intervention. When the trustor revokes a trust, they often provide an Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust to document the process. Additionally, if the trust's purpose has been fulfilled or deemed impossible, it may also be dissolved legally. Recognizing these methods can help you manage your trust effectively.

A trust can be deemed null and void for several reasons, such as lack of proper execution or if it violates state laws. If the trust creator, known as the trustor, does not meet legal requirements, the trust may not hold up in court. Additionally, a trust may become invalid if the trustor lacks the mental capacity to create the trust or if it was established under fraudulent terms. Understanding these factors is crucial, especially during the Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust.

When a trust is dissolved, the assets are typically distributed according to the terms set out in the trust document or returned to you as the trustor. Utilizing the Indiana Receipt by Trustor for Trust Property Upon Revocation of Trust aids in creating a legal record of this distribution. This ensures clear ownership and avoids future conflicts. If you need guidance on the dissolution process, uslegalforms can provide useful templates and resources.