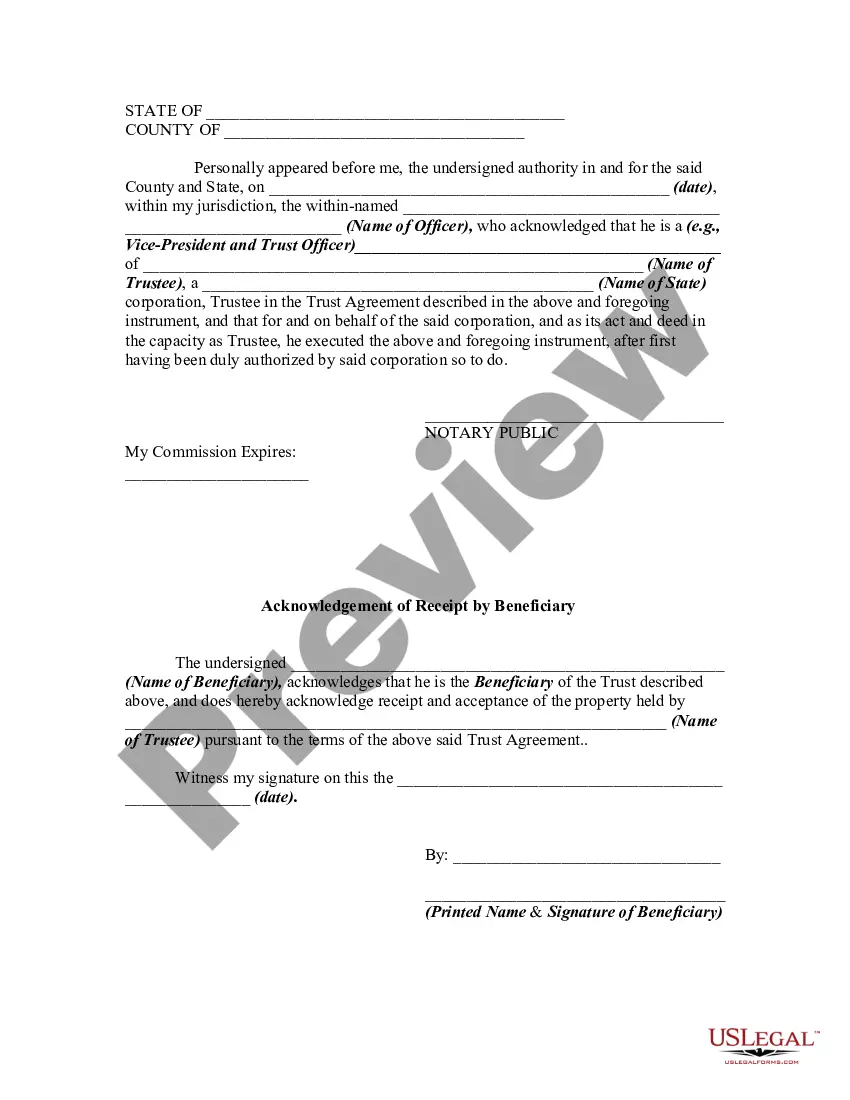

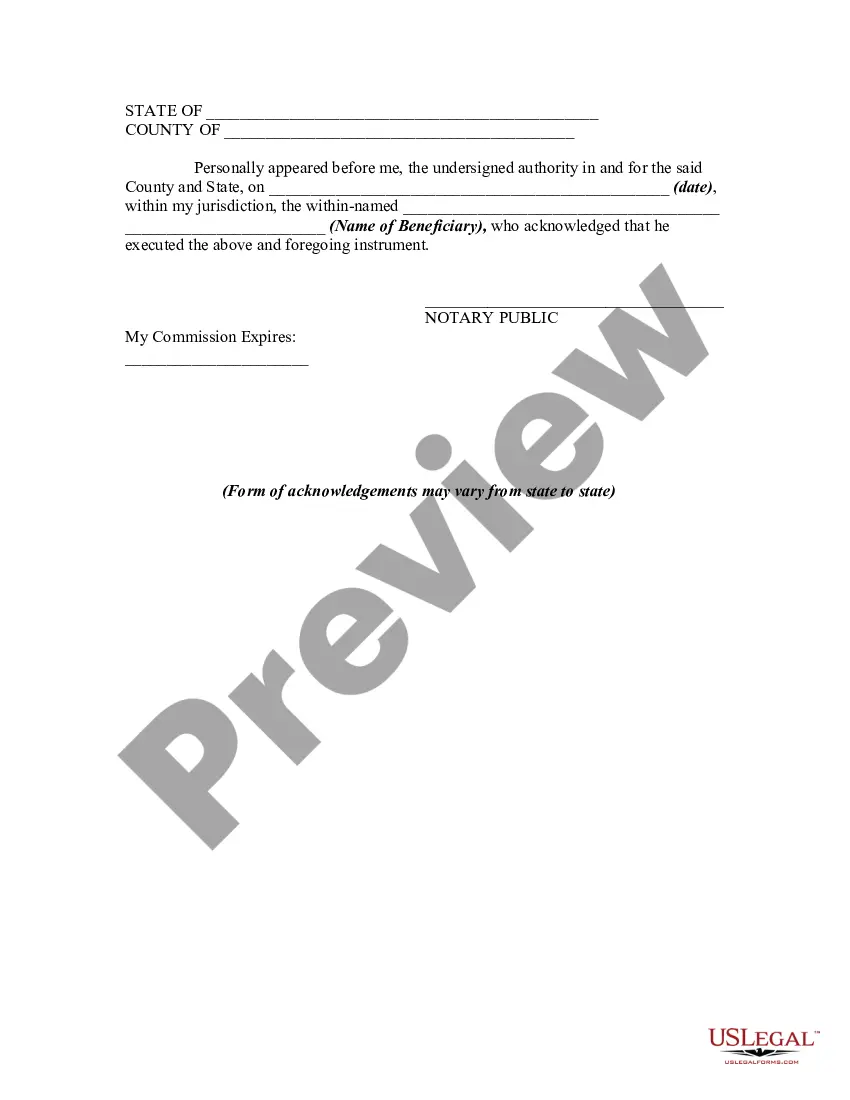

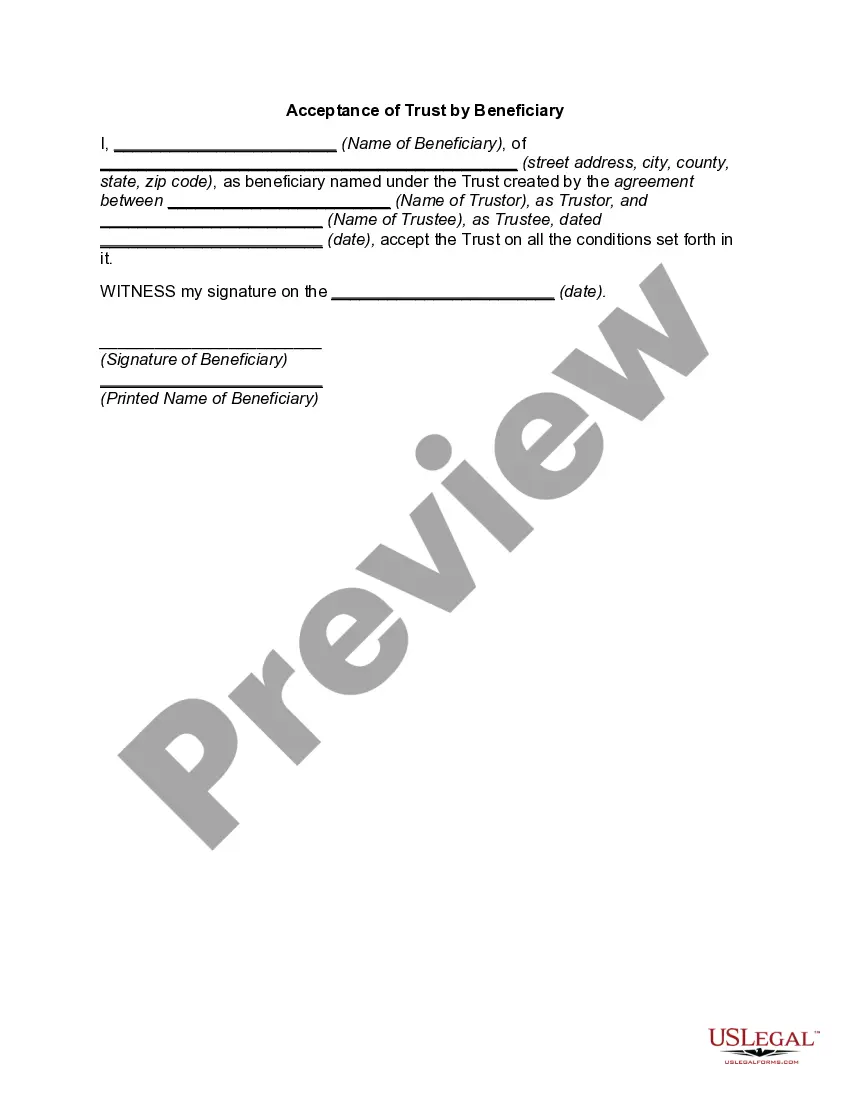

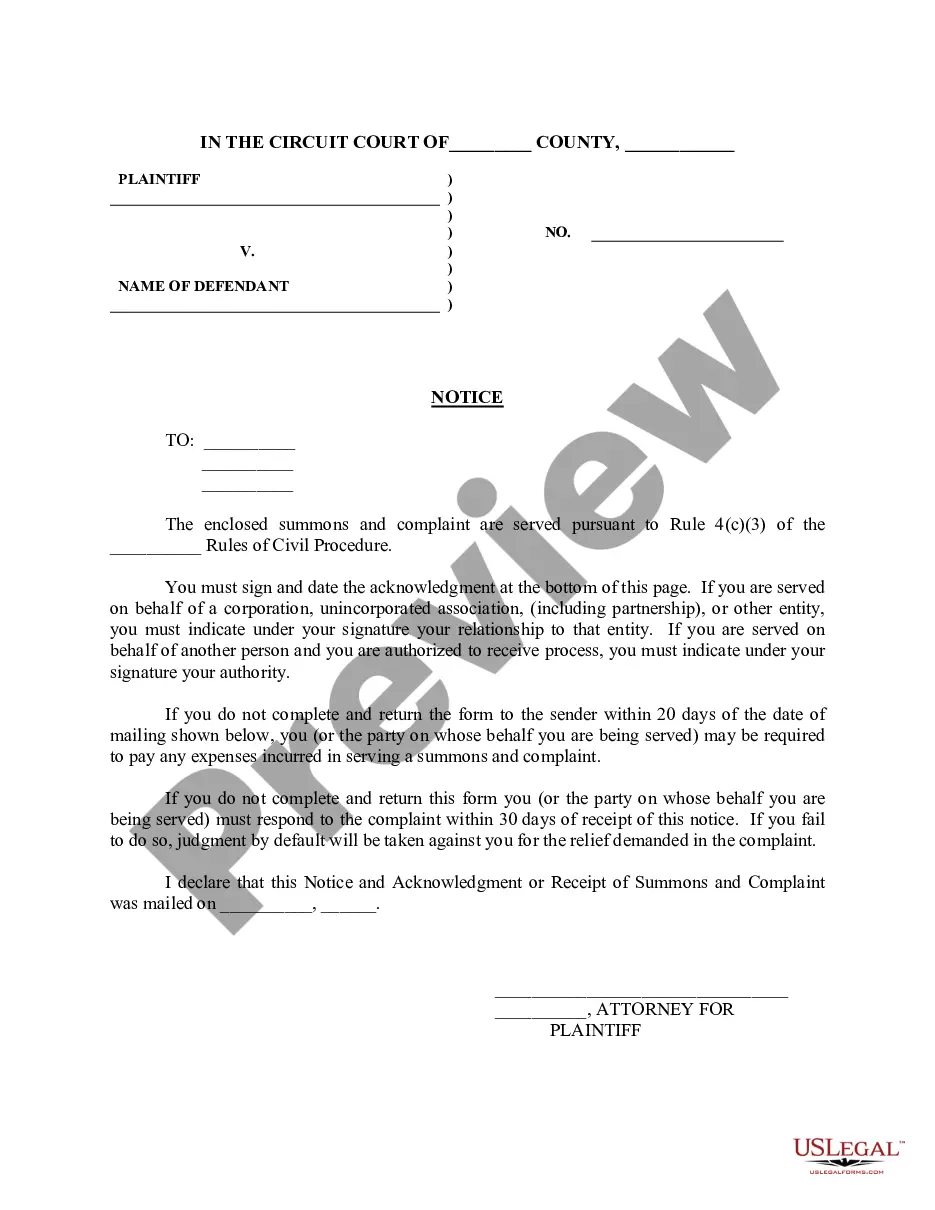

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Are you currently in the location where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary, which are designed to meet federal and state requirements.

Select a convenient file format and download your copy.

Retrieve all the document templates you have purchased in the My documents list. You can get another copy of the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary anytime, if necessary. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to locate the form that fits your needs and specifications.

- If you find the right form, click Purchase now.

- Choose the pricing plan you want, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

To write a trust distribution letter, start by clearly stating the purpose of the letter, which is to inform the beneficiary about the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary. Include the details of the trust, such as the trust name and relevant dates, to ensure clarity. Next, outline the specific distribution amounts and any conditions attached to the distribution. Finally, provide your contact information for any questions, ensuring the letter is professional and easy to understand.

Trustee disclosure obligations include providing beneficiaries with information about trust activities, financial statements, and any changes that may impact their interests. This transparency is essential for fostering a positive relationship and ensuring that beneficiaries feel secure in their rights. Utilizing resources like uslegalforms can streamline the process of complying with the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary requirements.

The duty to keep beneficiaries informed is a crucial responsibility of the trustee. It ensures beneficiaries understand their rights and the status of the trust. By following the guidelines of the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary, trustees can maintain transparency and build trust with beneficiaries.

The purpose of a receipt and release is to document the transfer of assets and verify that beneficiaries have received them. This process helps prevent future disputes by clarifying that the trustee has fulfilled their duties. Incorporating the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary simplifies this process, ensuring everyone is on the same page.

Trustees are obligated to act in the best interest of the beneficiaries, manage trust assets prudently, and maintain transparency. They must provide regular reports and updates, ensuring that beneficiaries understand how their interests are being managed. The Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary framework provides guidelines for these responsibilities.

Trustees are not legally bound to comply with all beneficiary requests, but they should consider their opinions seriously. Maintaining an open line of communication can lead to better trust management and satisfaction among beneficiaries. Adhering to the principles of Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary emphasizes the importance of cooperation.

A receipt from the beneficiary of a trust is a written acknowledgment that the beneficiary has received assets or property from the trustee. This document serves as proof of receipt and protects both parties by documenting the transaction. It is a critical part of the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary to ensure clarity on asset distribution.

A trustee release is a formal document that allows a trustee to distribute assets to beneficiaries. This release signifies that the beneficiaries accept the assets and acknowledge the trustee's fulfillment of duties. By following proper procedures, such as those outlined in the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary, parties can minimize potential disputes.

The trustee has a legal obligation to notify beneficiaries about relevant trust activities. This includes updating them on the trust's financial standing and any actions that may affect their interests. In ensuring an Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary process, clear communication fosters trust and transparency.

A release form for inheritance is a legal document that beneficiaries sign to acknowledge receipt and acceptance of their inheritance. In the context of the Indiana Release by Trustee to Beneficiary and Receipt from Beneficiary, this form helps complete the legal transaction while protecting both the trustee and the beneficiary. Signing this document ensures no further claims will arise regarding the inherited assets.