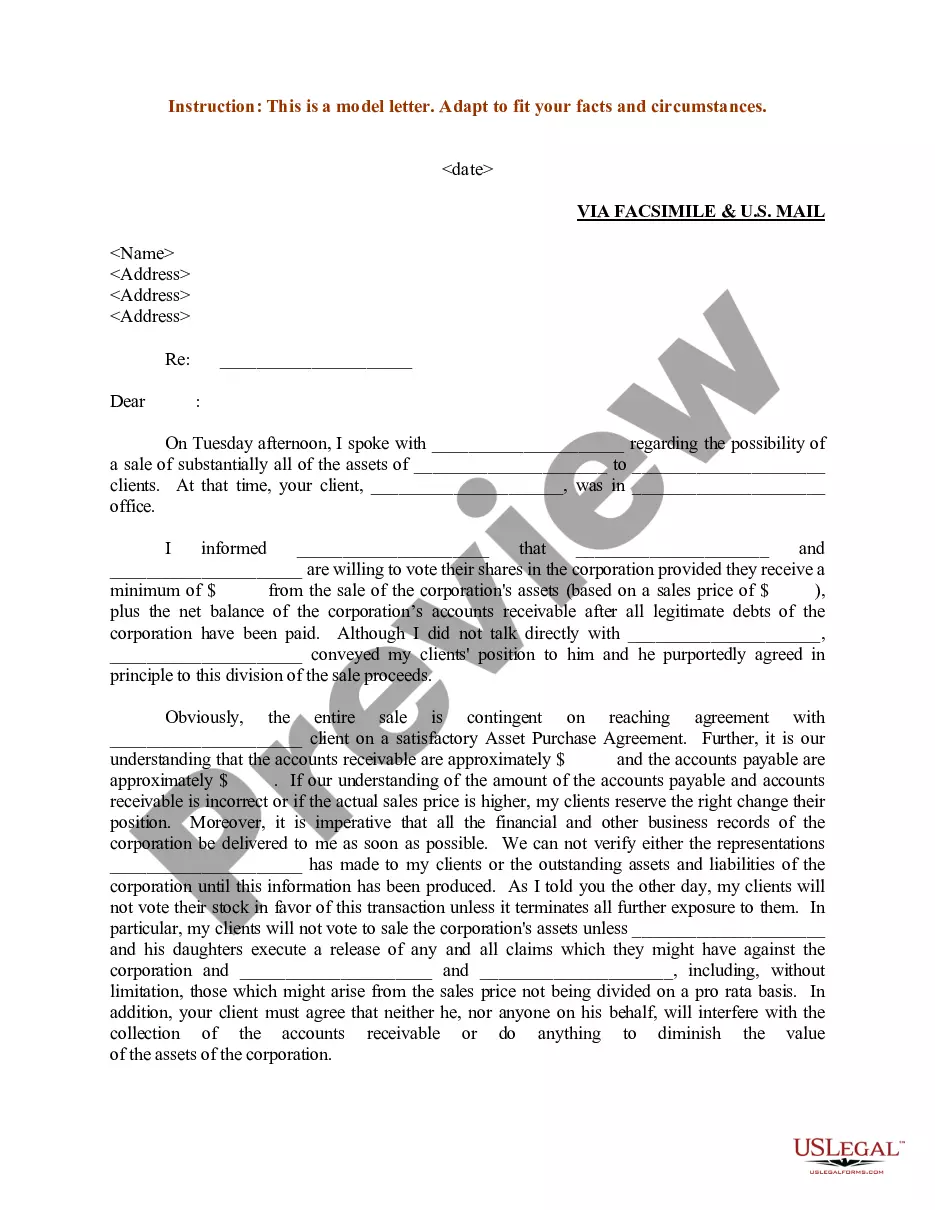

Keyword: Indiana Sample Letter for Sale of Corporate Assets — Introduction: The Indiana Sample Letter for Sale of Corporate Assets is a legally binding document used by businesses in Indiana to initiate and formalize the process of selling their corporate assets. This letter provides a comprehensive and detailed framework, outlining the terms and conditions under which the assets will be sold, thus safeguarding the interests of both the seller and potential buyers. — Components of the Indiana Sample Letter for Sale of Corporate Assets: 1. Parties involved: The letter begins by identifying the parties involved, namely the seller (corporation) and potential purchaser(s). It includes their legal names, addresses, and contact information. 2. Asset description: The letter includes a precise and comprehensive description of the assets being sold, clearly defining their scope, nature, and condition. This ensures transparency and helps prospective buyers assess the value and potential of the assets. 3. Purchase price: The letter outlines the sale price agreed upon by the parties, including any deposit, payment schedule, and method of payment (e.g., cash, check, electronic payment). 4. Representations and warranties: The letter may include representations and warranties made by the seller regarding the condition, title, and legal standing of the assets being sold. This offers protection to the buyer and assures them of the accuracy of provided information. 5. Due diligence: It is essential to mention that the buyer has the right to conduct due diligence within a specified timeframe to evaluate the assets thoroughly. This allows them to investigate all relevant aspects, such as financial records, contracts, liabilities, and encumbrances. 6. Closing and transfer of assets: The letter specifies the closing date, at which point the assets will be officially transferred to the buyer. It also outlines the necessary documentation, including bills of sale, assignments, and any additional paperwork required for the transfer to be legally binding. 7. Governing law and dispute resolution: This section identifies the governing law of the agreement, ensuring it complies with Indiana state regulations. It may include provisions for dispute resolution, such as negotiation, mediation, or litigation, to address any potential conflicts arising from the sale. — Types of Indiana Sample Letter for Sale of Corporate Assets: 1. Simple Sale of Corporate Assets Letter: Used for straightforward asset sales with minimal complexity. 2. Asset Sale with Assumed Liabilities Letter: Appropriate when the buyer assumes certain liabilities associated with the assets being sold. 3. Asset Sale with Retained Assets Letter: Used when the seller intends to retain certain assets while selling others. 4. Asset Sale as a Going Concern Letter: Suitable for transactions where the business is sold as a whole, including all related assets and liabilities. In conclusion, the Indiana Sample Letter for Sale of Corporate Assets is a crucial document enabling businesses to navigate the sale of their corporate assets with legal precision and clarity. Depending on the specific circumstances of the transaction, different types of sample letters can be used to suit the seller's and buyer's requirements.

Indiana Sample Letter for Sale of Corporate Assets

Description

How to fill out Indiana Sample Letter For Sale Of Corporate Assets?

You may devote time on the web searching for the authorized file web template that fits the state and federal needs you want. US Legal Forms provides a huge number of authorized varieties that happen to be analyzed by pros. You can actually download or print out the Indiana Sample Letter for Sale of Corporate Assets from our assistance.

If you already have a US Legal Forms accounts, you may log in and click the Down load key. Following that, you may comprehensive, edit, print out, or signal the Indiana Sample Letter for Sale of Corporate Assets. Each and every authorized file web template you acquire is yours forever. To obtain yet another backup of any purchased form, visit the My Forms tab and click the related key.

If you use the US Legal Forms site the first time, adhere to the basic instructions beneath:

- Very first, be sure that you have chosen the best file web template to the state/city of your choosing. Browse the form explanation to make sure you have selected the right form. If available, use the Review key to search throughout the file web template at the same time.

- If you wish to discover yet another version from the form, use the Search discipline to get the web template that meets your requirements and needs.

- Once you have found the web template you want, click on Acquire now to move forward.

- Find the rates prepare you want, key in your accreditations, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal accounts to pay for the authorized form.

- Find the formatting from the file and download it to your system.

- Make changes to your file if necessary. You may comprehensive, edit and signal and print out Indiana Sample Letter for Sale of Corporate Assets.

Down load and print out a huge number of file themes making use of the US Legal Forms web site, which offers the most important variety of authorized varieties. Use skilled and condition-particular themes to deal with your small business or specific requires.