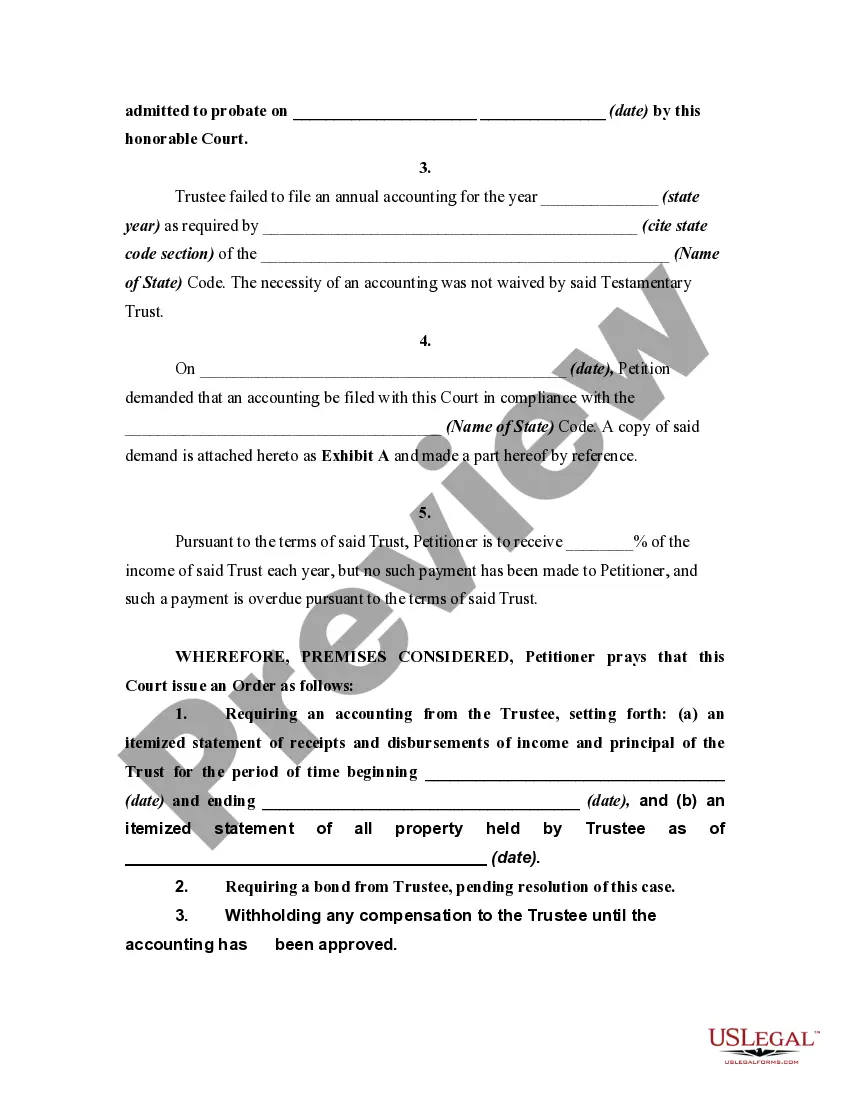

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

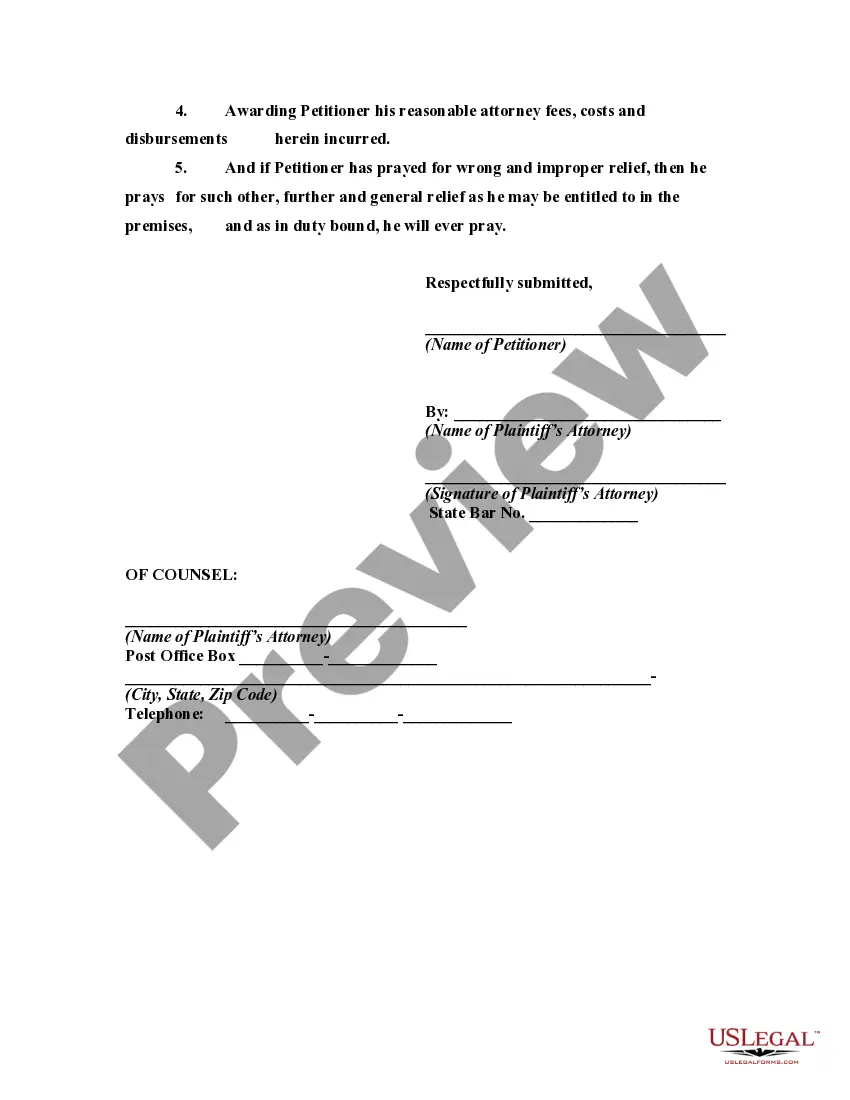

Indiana Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the most recent versions of forms like the Indiana Petition to Require Accounting from Testamentary Trustee in moments.

If you have an account, Log In and download the Indiana Petition to Require Accounting from Testamentary Trustee from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you're using US Legal Forms for the first time, here are some simple tips to get you started: Make sure you have chosen the correct form for your area/region. Click the Preview button to review the form's content. Examine the form summary to confirm that you have selected the right form. If the form doesn't meet your requirements, utilize the Search field at the top of the page to find one that does. Once you are satisfied with the form, confirm your choice by clicking the Buy now button. After that, select your preferred pricing plan and provide your details to create an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Indiana Petition to Require Accounting from Testamentary Trustee. Each template you added to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Indiana Petition to Require Accounting from Testamentary Trustee using US Legal Forms, the largest collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

Form popularity

FAQ

(a) When a person dies, the person's real and personal property passes to persons to whom it is devised by the person's last will or, in the absence of such disposition, to the persons who succeed to the person's estate as the person's heirs; but it shall be subject to the possession of the personal representative and ...

Code § 29-3-6-2. On (date of hearing) at (time of hearing) in (place of hearing) at (city), Indiana, the (name and address of court) will hold a hearing to determine whether a guardian should be appointed or a protective order should be issued for (name of alleged incapacitated person or minor).

Section 29-3-3-1 - Payment of debt owed to minor; delivery of minor's property in possession of another; use of payment or property (a) Any person indebted to a minor or having possession of property belonging to a minor in an amount not exceeding ten thousand dollars ($10,000) may pay the debt or deliver the property ...

(1) If the petition is for the appointment of a successor guardian, notice shall be given unless the court, for good cause shown, orders that notice is not necessary. (2) If the petition is for the appointment of a temporary guardian, notice shall be given as required by IC 29-3-3-4.

(a) A guardian appointed in this state may petition the court to transfer the guardianship to another state. (b) Notice of a petition under subsection (a) must be given to the persons that would be entitled to notice of a petition in this state for the appointment of a guardian.

(1) An action brought by a beneficiary if good cause is found by a court. (2) An action brought by an executor or other fiduciary of a will that incorporates a no contest provision, unless the executor or other fiduciary is a beneficiary against whom the no contest provision is otherwise enforceable.

Sec. 1. (a) The surviving spouse of a decedent who was domiciled in Indiana at the decedent's death is entitled from the estate to an allowance of twenty-five thousand dollars ($25,000).

The trustee of a charitable trust shall annually file a verified written certification with the attorney general stating that a written statement of accounts has been prepared showing at least the items listed in section 13(a) of this chapter.