Indiana Owner Financing Contract for Mobile Home: A Comprehensive Guide Introduction: The Indiana Owner Financing Contract for Mobile Home is a legally binding agreement that outlines the terms and conditions of a mobile home sale, where the owner acts as the lender and finances the purchase for the buyer. This contract offers an alternative financing option for individuals who may not qualify for traditional loans or prefer a more flexible payment plan. This article will provide a detailed description of what this contract entails and explore potential variations or types of such contracts in Indiana. Key Elements: 1. Contract Parties: The contract identifies the parties involved, including the buyer (purchaser) and the owner (seller and lender) of the mobile home. 2. Mobile Home Description: A comprehensive description of the mobile home is included, including its make, model, year, identification numbers, and any included furnishings or appliances. 3. Purchase Price and Down Payment: The contract stipulates the agreed-upon purchase price for the mobile home and outlines the down payment required, if applicable. 4. Payment Terms: The contract delineates the payment amount, frequency, and duration of the financing agreement. It may include provisions for interest rates, late payment penalties, and any grace periods. 5. Legal Rights and Responsibilities: The contract includes terms regarding property ownership and responsibilities. It outlines the rights and obligations of both the buyer and the owner during the financing period. 6. Default and Remedies: In case of default by the buyer, the contract defines remedies available to the owner. This may include repossession of the mobile home and potential penalties or fees. 7. Termination Conditions: The contract outlines circumstances that could lead to the termination of the financing agreement, including completion of payments, violation of certain terms, or agreement cancellation with mutual consent. Types of Indiana Owner Financing Contracts for Mobile Homes: 1. Fixed Interest Rate Contract: This contract type maintains a constant interest rate throughout the financing period, ensuring predictable monthly payments. 2. Adjustable Interest Rate Contract: Unlike the fixed-rate contract, this option allows the interest rate to fluctuate over time, usually based on a predetermined index. The buyer's monthly payments may vary accordingly. 3. Lease-to-Own Contract: This contract enables the buyer to occupy the mobile home immediately, paying rent to the owner while working towards eventually owning the property. 4. Land Contract: In cases where the mobile home and land are sold together, a land contract may be utilized. This involves financing the entire property purchase and outlining specific terms for both the mobile home and the land. Conclusion: The Indiana Owner Financing Contract for Mobile Home offers buyers an opportunity to secure homeownership through an alternative financing approach. By customizing the terms to suit individual needs, this contract allows for flexibility and increased accessibility in the mobile home market. Understanding the various types of contracts available ensures that prospective buyers can select the option that best aligns with their financial circumstances and goals.

Indiana Owner Financing Contract for Moblie Home

Description

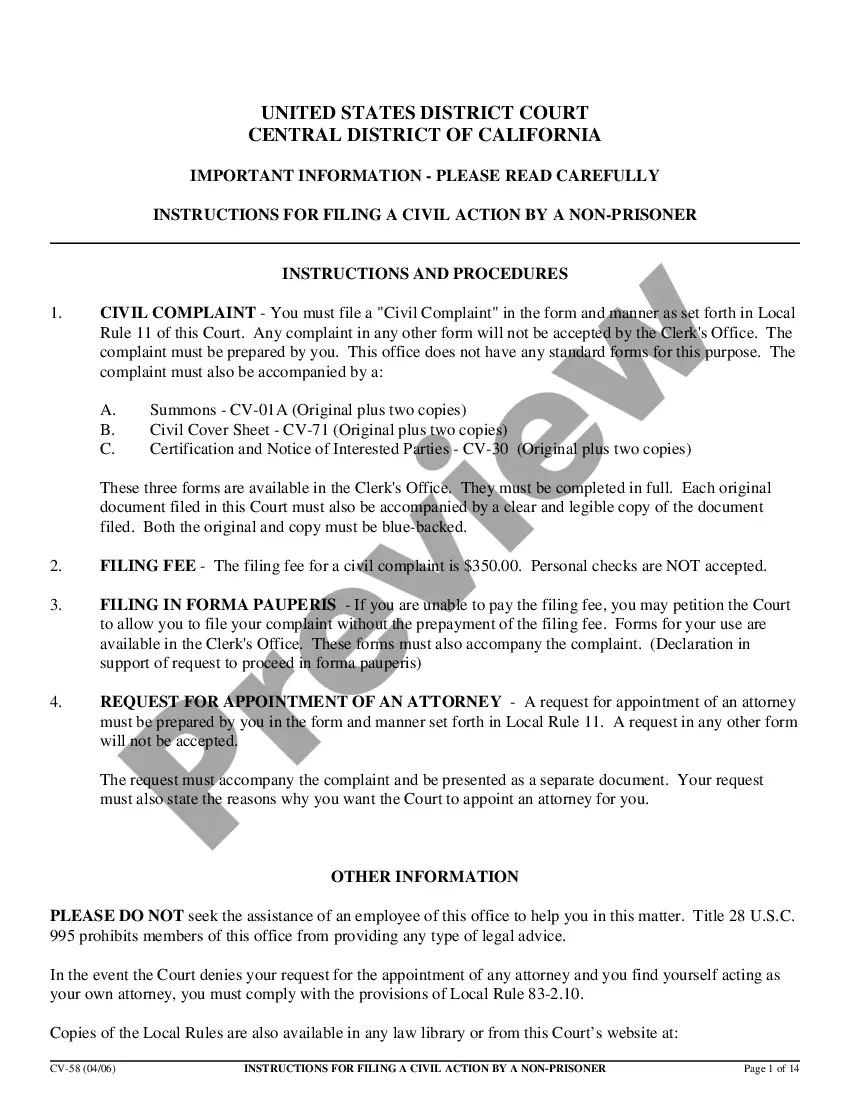

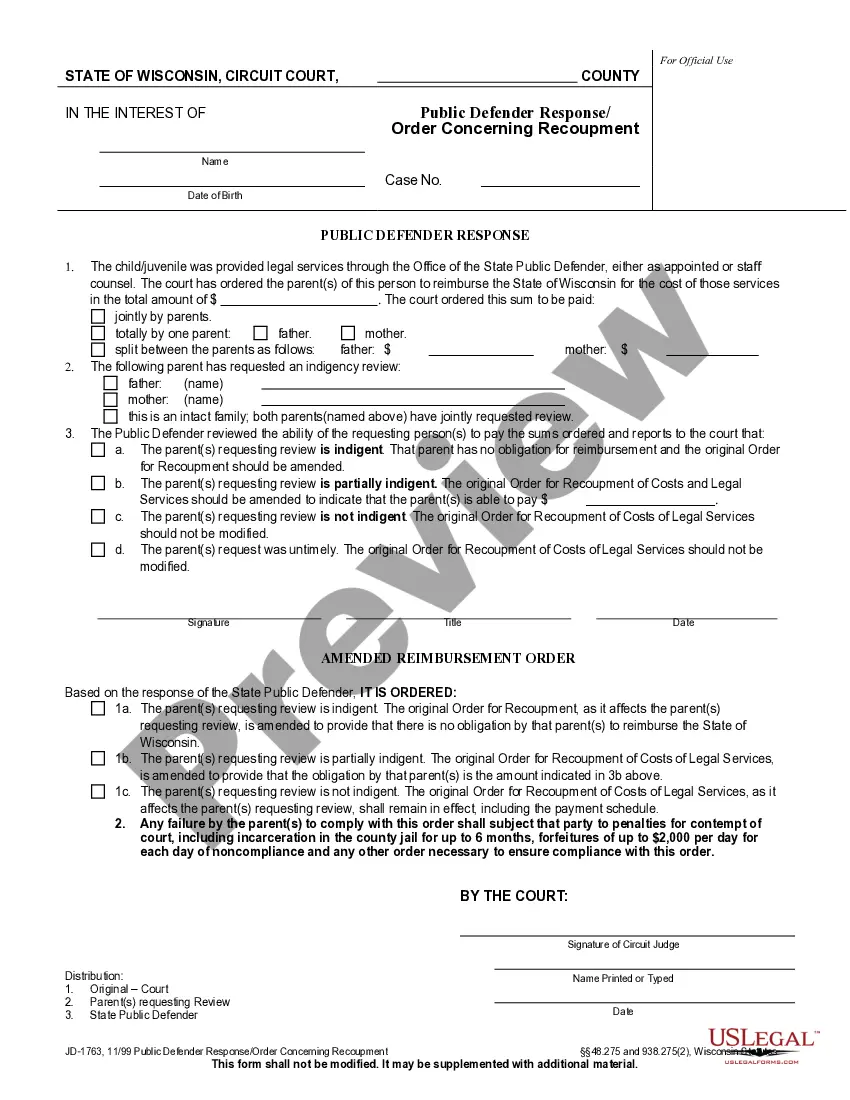

How to fill out Indiana Owner Financing Contract For Moblie Home?

If you wish to comprehensive, down load, or printing authorized papers layouts, use US Legal Forms, the most important collection of authorized varieties, that can be found online. Use the site`s easy and practical research to find the paperwork you need. Different layouts for company and person reasons are sorted by types and says, or keywords and phrases. Use US Legal Forms to find the Indiana Owner Financing Contract for Moblie Home in just a couple of mouse clicks.

Should you be already a US Legal Forms client, log in for your profile and click the Down load button to find the Indiana Owner Financing Contract for Moblie Home. You can even accessibility varieties you previously saved within the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape to the correct metropolis/region.

- Step 2. Make use of the Preview solution to check out the form`s information. Do not overlook to read the explanation.

- Step 3. Should you be unhappy with the type, make use of the Search field towards the top of the display screen to discover other versions in the authorized type format.

- Step 4. When you have found the shape you need, click on the Get now button. Choose the costs strategy you like and add your credentials to sign up to have an profile.

- Step 5. Process the deal. You can use your bank card or PayPal profile to accomplish the deal.

- Step 6. Select the file format in the authorized type and down load it on your device.

- Step 7. Complete, change and printing or indicator the Indiana Owner Financing Contract for Moblie Home.

Each authorized papers format you get is your own permanently. You possess acces to each and every type you saved in your acccount. Click the My Forms area and select a type to printing or down load once again.

Compete and down load, and printing the Indiana Owner Financing Contract for Moblie Home with US Legal Forms. There are thousands of professional and status-distinct varieties you may use for your personal company or person needs.

Form popularity

FAQ

The minimum down payment for a mobile home typically depends on your financing method and the lender's policies. Generally, down payments can range from 5% to 20%, but with an Indiana Owner Financing Contract for Mobile Home, you might find more favorable terms. Owner financing often allows you to negotiate lower down payments, making it accessible for more buyers. Consider discussing your options with knowledgeable professionals to find the best solution.

Financing a manufactured home can pose unique challenges compared to traditional homes. Many lenders view manufactured homes as personal property rather than real estate, which may limit financing options. However, obtaining an Indiana Owner Financing Contract for Mobile Home can simplify this process, giving you more flexibility. Exploring owner financing can provide you with a viable path to secure your dream home.

Typical terms for owner financing include a down payment ranging from 5% to 20%, an interest rate that is often competitive with conventional loans, and a repayment plan that can last from 5 to 30 years. These terms can vary based on negotiations between the buyer and seller. A clearly defined Indiana Owner Financing Contract for Mobile Home can help both parties agree upon terms and conditions smoothly. You can find helpful templates on USLegalForms.

To write up an owner finance contract, begin by outlining the agreement's basic terms, including the property, financing details, and buyer information. It is crucial to specify the payment structure, along with any taxes or insurance obligations. Utilizing a clear Indiana Owner Financing Contract for Mobile Home helps ensure that all necessary legal requirements are met, fostering a smooth transaction. Resources from USLegalForms can assist you.

An example of owner financing is when a seller allows the buyer to make payments directly to them instead of going through a bank. In this scenario, the buyer typically pays a down payment, followed by monthly installments. This method can simplify the buying process, especially for those who may have difficulty obtaining traditional loans. Utilizing an Indiana Owner Financing Contract for Mobile Home can formalize this agreement.

While specific requirements can vary, many sellers may consider applicants with credit scores as low as 580 for owner financing deals. However, a higher credit score often leads to better terms, such as lower interest rates. If you have concerns about credit, discussing options through the Indiana Owner Financing Contract for Mobile Home can help you explore paths to homeownership more easily.

In a typical seller financing agreement, the seller acts as the lender, which means they hold the deed until the buyer fulfills their financial obligations. This is different from traditional mortgages where banks or financial institutions hold the deed. To fully understand this process, reviewing the Indiana Owner Financing Contract for Mobile Home is essential.

One downside of owner financing is the potential for higher interest rates, which may result in increased payments over time. Additionally, sellers assume risks related to foreclosure if the buyer does not fulfill their obligations. To mitigate these issues, a well-drafted Indiana Owner Financing Contract for Mobile Home can help spell out terms clearly and protect both parties.

If the buyer defaults on the owner financing contract, the seller can begin the process of foreclosure, much like a traditional mortgage. This means the seller may take back the property and keep any payments made. It is crucial for both parties to understand the terms outlined in the Indiana Owner Financing Contract for Mobile Home, as they dictate these procedures.

Reporting a seller-financed mortgage is relatively straightforward. As the seller, you need to report the interest income on your tax return. Using an Indiana Owner Financing Contract for Mobile Home can help substantiate your financial records and make it easier to report accurately. Consider consulting a tax professional for guidance on your specific obligations.

Interesting Questions

More info

This is great to know if you can afford what's available. Find the right lender for your situation. There are hundreds of lenders that have mortgages that meet your needs. Find a lender that has a good rating. A good mortgage is a good mortgage. Find a lender that works with financial institutions. Find one that's been in business for several years. Find one that is experienced in making mortgages. Look at all the details of a mortgage. Get a copy of the mortgage. You can get a copy of the mortgage for free from the bank that you're buying from. Some borrowers can find these free copies on their loan application. Ask to visit the home. Get inside the property to get a feel for the community. Ask to speak to current residents to get feedback on the property. If you're still searching for home, let's hear from you. Have you ever purchased real estate and want to ask a question?