Indiana Owner Financing Contract for Vehicle

Description

How to fill out Owner Financing Contract For Vehicle?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Indiana Owner Financing Agreement for Vehicle, designed to meet state and federal requirements.

Select your preferred pricing plan, fill in the necessary information to create your account, and finalize the purchase using PayPal or credit card.

Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Indiana Owner Financing Agreement for Vehicle at any time, simply click the desired form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Owner Financing Agreement for Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for your specific city/county.

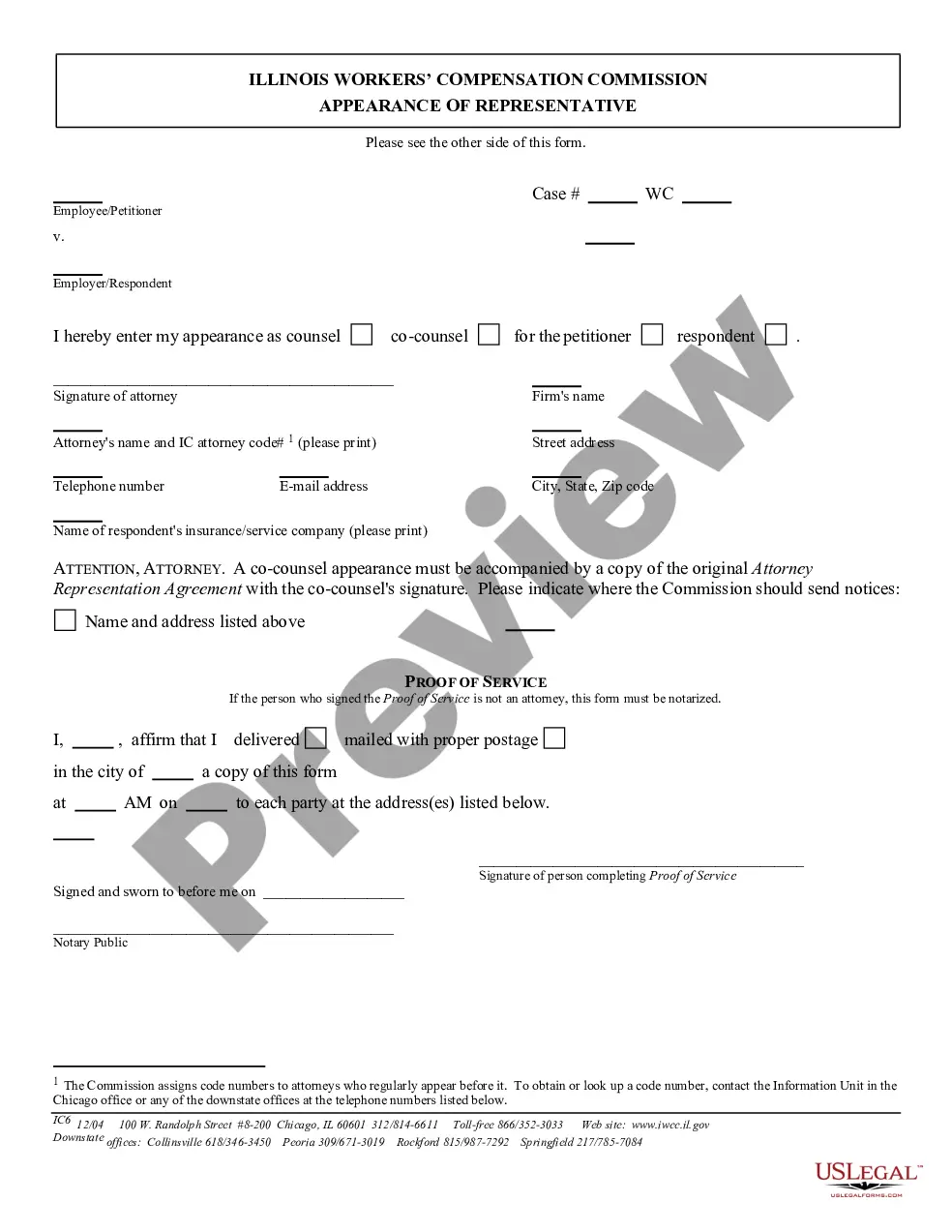

- Utilize the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form does not match your needs, make use of the Search field to find the form that meets your requirements.

- Once you have identified the correct form, click Get now.

Form popularity

FAQ

Yes, you can drive a car you just bought from a private seller in Indiana, but you should follow some important steps. Ensure you have the signed bill of sale and proper identification. Before driving, also check if you have temporary registration or insurance. Always remember to complete the Indiana Owner Financing Contract for Vehicle to secure the financial terms and avoid future complications.

People often choose owner financing as it provides flexibility and easier access to vehicle ownership compared to traditional financing. This arrangement can benefit buyers with poor credit who may struggle to secure loans from banks. Additionally, sellers might favor this option as it can yield higher returns and reduce the time their vehicle stays on the market. Exploring an Indiana Owner Financing Contract for Vehicle can help you navigate this convenient solution.

To write an owner financing contract in Indiana, start by outlining the essential details such as buyer and seller information, vehicle description, and payment terms. Include clauses that cover the down payment, interest rate, repayment schedule, and what happens in case of default. Using a template can simplify the process; consider using the resources available on the US Legal platform for comprehensive and legally sound contract templates.

Good terms for seller financing typically involve a reasonable down payment, competitive interest rates, and flexible repayment schedules. It's important to ensure that the terms are fair for both the seller and the buyer. An Indiana Owner Financing Contract for Vehicle can help frame these terms effectively, allowing both parties to feel secure in their agreement.

To write an owner finance contract, begin by detailing the buyer and seller’s information alongside the vehicle's description. Clearly state the terms of payment, including amounts, due dates, and consequences of default. Utilize an Indiana Owner Financing Contract for Vehicle from USLegalForms to ensure all necessary elements are included and legally sound.

One downside of owner financing is that sellers may face risks if buyers default on payments. Additionally, the seller holds the title until the financing is complete, which can complicate matters if the buyer misuses the vehicle. It’s essential to consider these factors while drafting an Indiana Owner Financing Contract for Vehicle to protect your interests.

The average length of seller financing varies, but it often ranges from three to five years for vehicle sales. However, sellers and buyers can negotiate this duration based on their preferences and financial situations. An Indiana Owner Financing Contract for Vehicle allows for flexibility in payment terms, ensuring a suitable agreement for both parties.

To set up an owner financing contract, start by drafting an Indiana Owner Financing Contract for Vehicle that outlines all agreed-upon terms. It’s essential to include payment schedules, interest rates, and any conditions of sale. After both parties review and agree to the document, have it signed in front of a notary to ensure its legal validity.

Closing costs for an Indiana Owner Financing Contract for Vehicle are generally lower than traditional financing. They can include fees for title transfer, notary services, and possibly an attorney to review the contract. Expect these costs to vary, but budgeting a few hundred dollars should cover most typical expenses.

To buy a car from a private seller in Indiana, you will need an Indiana Owner Financing Contract for Vehicle, the vehicle title, and a bill of sale. Additionally, you'll need to complete a Statement of Vehicle Condition form. Make sure to have valid identification and any financing documents ready to streamline the process.