If you need to comprehensive, obtain, or printing legal file layouts, use US Legal Forms, the largest collection of legal forms, that can be found on the Internet. Take advantage of the site`s easy and practical lookup to get the papers you need. Numerous layouts for business and person uses are categorized by types and claims, or search phrases. Use US Legal Forms to get the Indiana Satisfaction of Mortgage by a Corporation within a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in to your profile and then click the Download button to find the Indiana Satisfaction of Mortgage by a Corporation. Also you can gain access to forms you earlier downloaded inside the My Forms tab of the profile.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the form to the right city/nation.

- Step 2. Use the Review method to examine the form`s content. Do not forget to read through the explanation.

- Step 3. Should you be not happy with the form, utilize the Research industry on top of the display screen to locate other types from the legal form template.

- Step 4. Upon having located the form you need, click the Buy now button. Select the pricing plan you choose and add your references to register on an profile.

- Step 5. Process the purchase. You should use your bank card or PayPal profile to perform the purchase.

- Step 6. Select the format from the legal form and obtain it on the device.

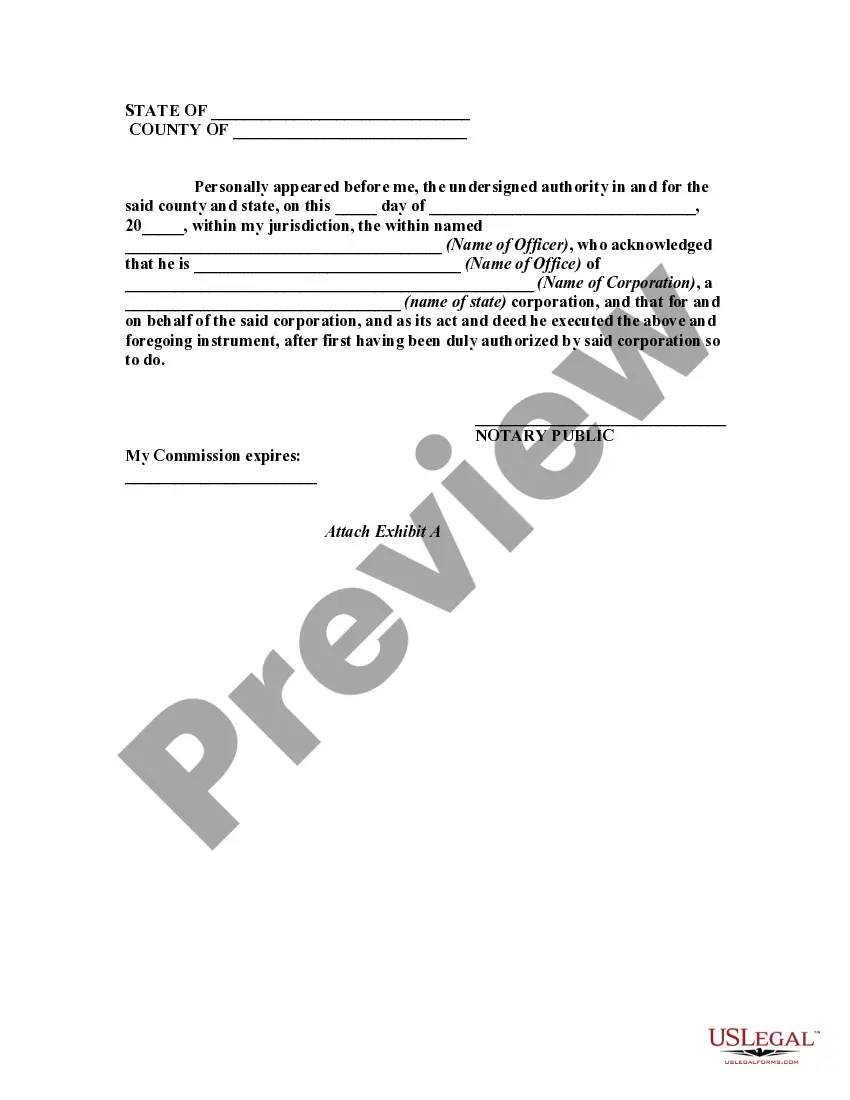

- Step 7. Comprehensive, edit and printing or indicator the Indiana Satisfaction of Mortgage by a Corporation.

Each legal file template you buy is your own for a long time. You may have acces to every single form you downloaded inside your acccount. Select the My Forms area and pick a form to printing or obtain once more.

Compete and obtain, and printing the Indiana Satisfaction of Mortgage by a Corporation with US Legal Forms. There are many skilled and state-certain forms you may use for your business or person needs.