This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

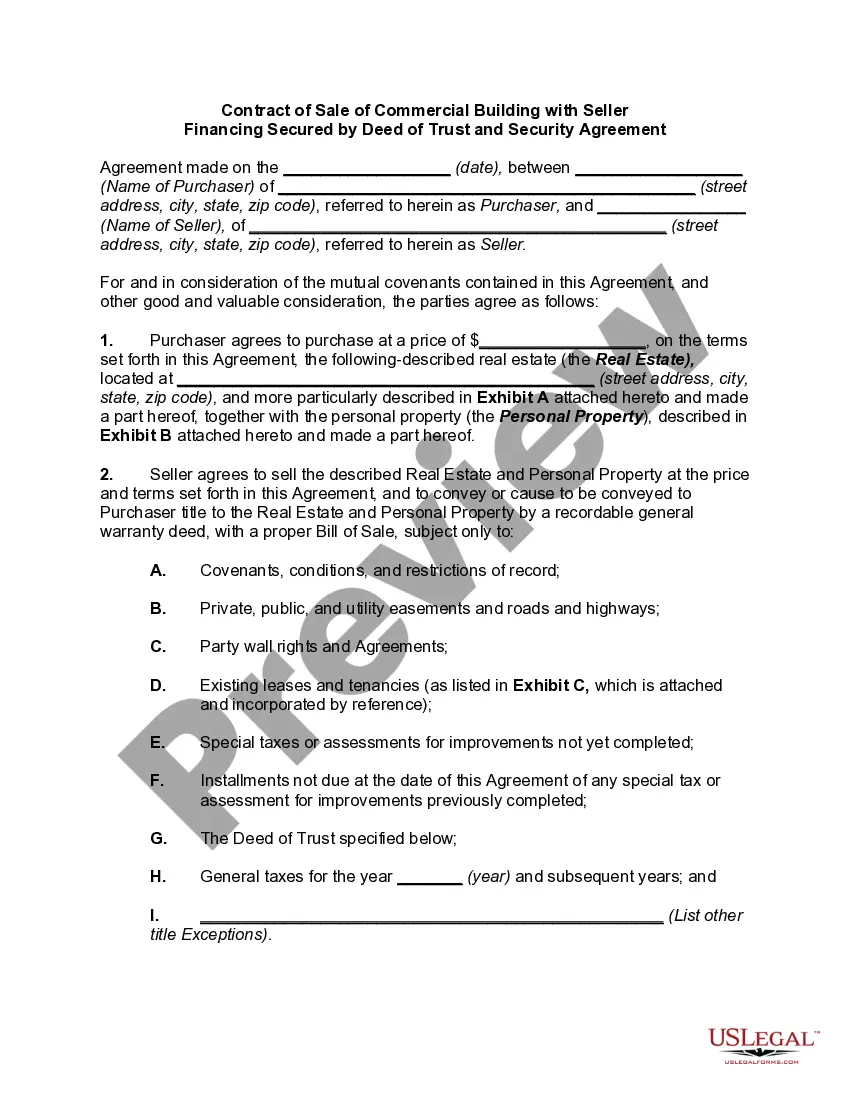

Indiana Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement

Description

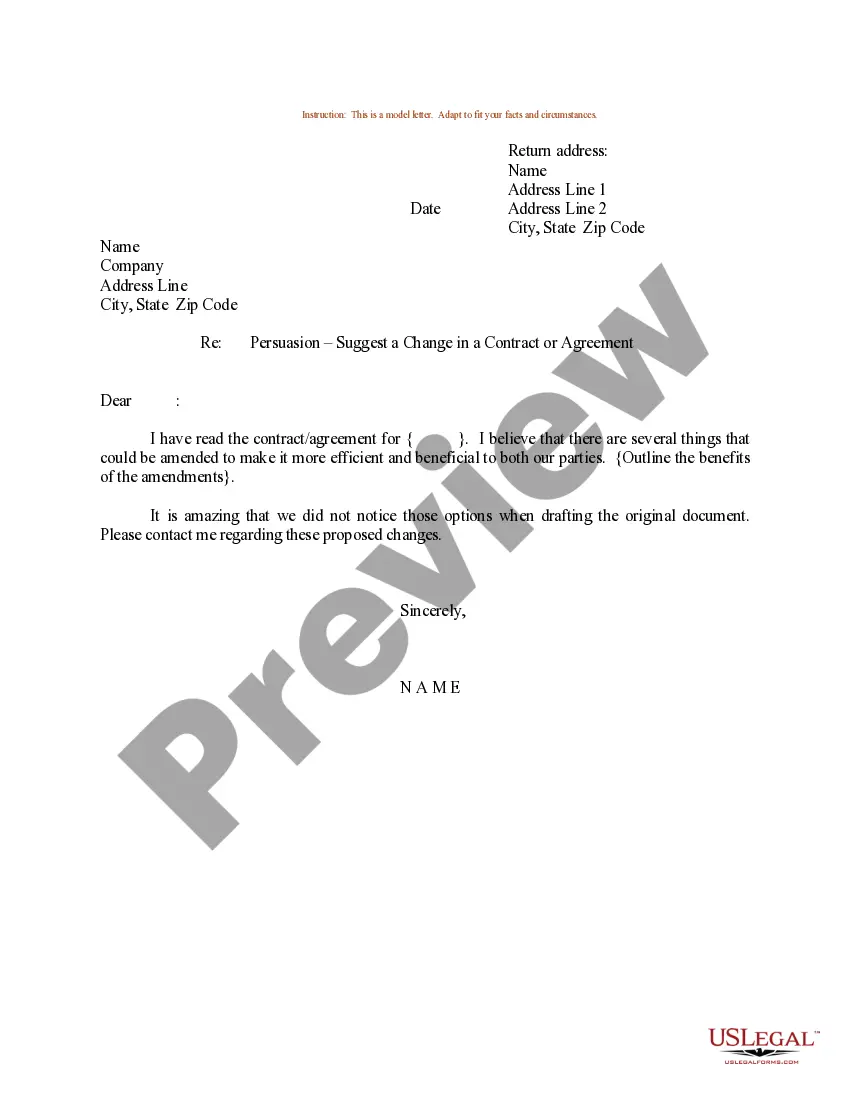

How to fill out Contract To Sell Commercial Property With Commercial Building - Seller Financing Secured By Mortgage And Security Agreement?

Selecting the finest legal document template can be a challenge. Of course, there are numerous designs accessible online, but how will you find the legal form you require? Utilize the US Legal Forms website. The service offers a multitude of templates, including the Indiana Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement, which you can utilize for both business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to locate the Indiana Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement. Use your account to view the legal forms you have previously acquired. Navigate to the My documents section of your account and obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are some simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can review the document using the Review feature and read the form description to confirm it is the right one for your needs. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the document is suitable, click on the Get now button to obtain the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Indiana Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement.

- US Legal Forms is the largest collection of legal documents where you can find various document templates.

- Utilize the service to download professionally crafted documents that meet state requirements.

- The templates are user-friendly and designed for ease of use.

- All documents are verified for accuracy and compliance.

- You can access forms for different legal needs across various states.

- The platform ensures a secure transaction process for your convenience.

Form popularity

FAQ

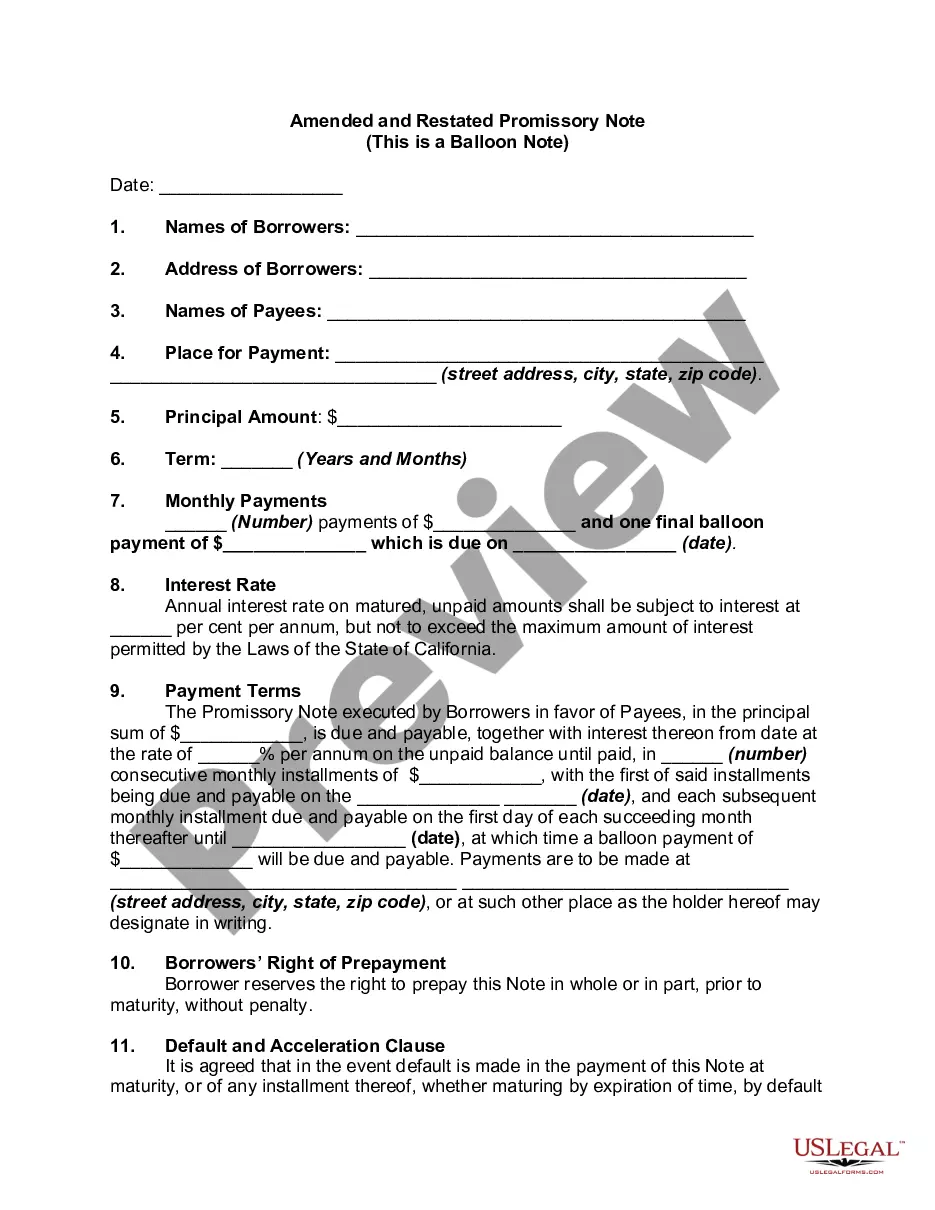

In a land contract, the seller takes the position of the bank. In that position, they are also responsible for collecting payments and taking back the property in the event the buyer breaches the contract.

The Land Contract or Memorandum must be recorded.

Seller retains title A major drawback of a contract for deed for buyers is that the seller retains the legal title to the property until the payment plan is completed. On one hand, this means that they're responsible for things like property taxes.

A buyer who can't get traditional financing may not find a seller offering a land contract on favorable terms. Land contract interest rates may be much higher than conventional mortgage rates. The buyer could lose the home if the seller goes bankrupt, dies, is delinquent on taxes or stops paying the mortgage.

Sec. 9.5. "Land contract" means a contract for the sale of real estate in which the seller of the real estate retains legal title to the real estate until the total contract price is paid by the buyer.

Typically, you must notify the seller of your intent to cancel the transaction in writing, delivered either in person or by mail. Refer to the notice of cancellation rights in your contract for the proper way to cancel.

Articles of agreement are the foundational documents of a business entity. With these documents, a business will outline members' voting rights, limitations of the company, and entity powers.