The Indiana HIPAA Release Form for Insurance is a crucial document that ensures the privacy and protection of an individual's medical information. HIPAA, or the Health Insurance Portability and Accountability Act, mandates the safeguarding and confidentiality of personal health records. This release form specifically caters to insurance-related matters in the state of Indiana. It grants permission to insurance companies and associated healthcare providers to access and disclose medical information for the purpose of claims processing, coverage determinations, and other insurance-related functions. By completing this form, individuals authorize the release of their health information to insurance companies, including but not limited to, health, life, long-term care, and disability insurance providers. The Indiana HIPAA Release Form for Insurance helps expedite the insurance claims process, making it easier for policyholders to receive the coverage and benefits they are entitled to in times of need. There are several types of Indiana HIPAA Release Forms for Insurance, depending on the type of insurance coverage involved: 1. Health Insurance Release Form: This form enables the release of medical information relevant to health insurance coverage, such as medical diagnoses, treatments, prescriptions, and laboratory results. It is commonly utilized in health insurance claims and coverage disputes. 2. Life Insurance Release Form: Specifically designed for life insurance policies, this form allows the disclosure of medical records and information that may impact coverage eligibility, premium rates, or the processing of death benefit claims. 3. Long-Term Care Insurance Release Form: Long-term care insurance release forms authorize the release of personal medical information for evaluating an individual's eligibility for long-term care insurance and processing claims related to home care, assisted living, or nursing home services. 4. Disability Insurance Release Form: Disability insurance release forms facilitate the disclosure of medical information necessary to assess an individual's eligibility for disability insurance coverage and claims processing. This includes details regarding medical conditions, disabilities, treatments, and functional limitations affecting the ability to work. These various types of Indiana HIPAA Release Forms for Insurance are essential tools in streamlining the insurance process while maintaining the patient's privacy rights. They serve as a legal consent ensuring that insurance companies have access to relevant medical information needed for accurate coverage decisions and claims settlements.

Indiana Hippa Release Form for Insurance

Description

How to fill out Indiana Hippa Release Form For Insurance?

US Legal Forms - one of the most significant libraries of lawful kinds in the States - offers a wide array of lawful document web templates you can obtain or print. Utilizing the web site, you can get 1000s of kinds for organization and individual uses, sorted by categories, suggests, or keywords.You can get the latest models of kinds just like the Indiana Hippa Release Form for Insurance within minutes.

If you currently have a subscription, log in and obtain Indiana Hippa Release Form for Insurance from the US Legal Forms catalogue. The Acquire switch will appear on each and every type you look at. You have access to all earlier acquired kinds within the My Forms tab of your own bank account.

If you would like use US Legal Forms for the first time, here are easy guidelines to help you get began:

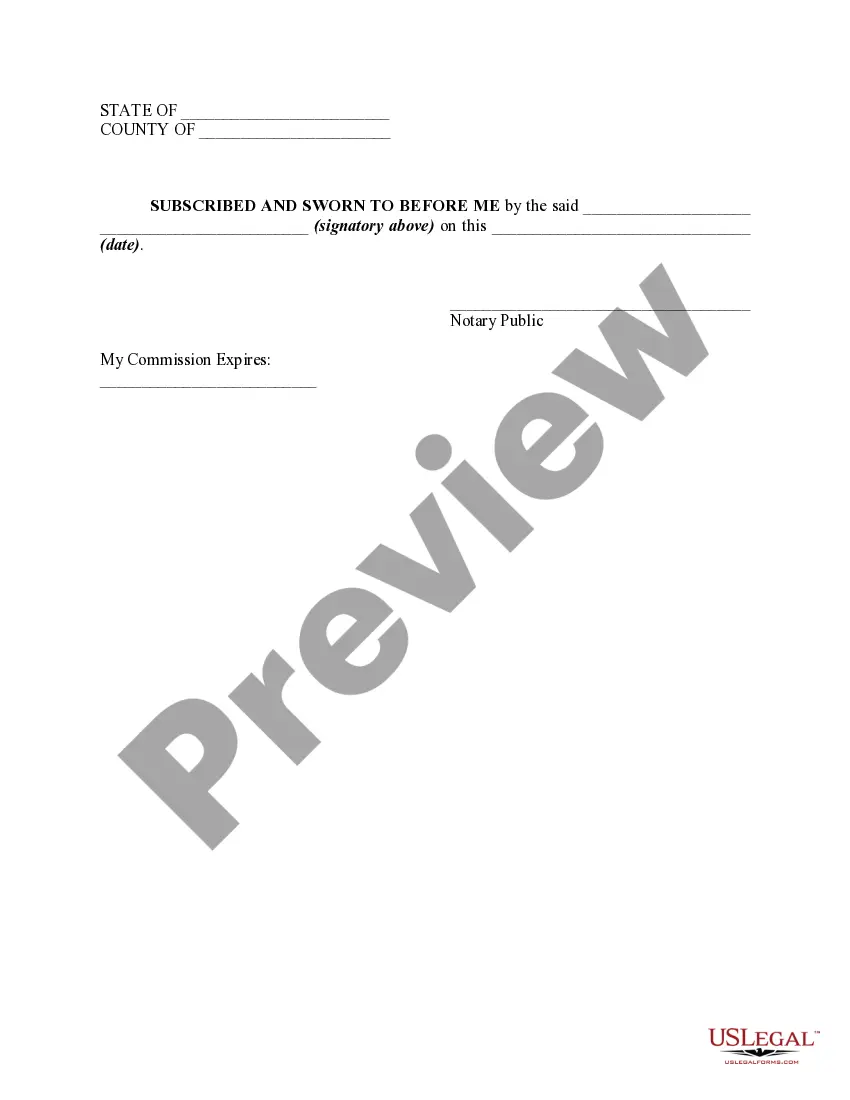

- Make sure you have picked out the correct type for your area/region. Click the Preview switch to examine the form`s content. Look at the type description to actually have selected the appropriate type.

- In the event the type doesn`t match your specifications, use the Search industry near the top of the display to get the one who does.

- When you are happy with the form, confirm your choice by visiting the Get now switch. Then, pick the pricing prepare you favor and provide your references to sign up for the bank account.

- Procedure the deal. Utilize your bank card or PayPal bank account to complete the deal.

- Select the structure and obtain the form in your device.

- Make alterations. Load, revise and print and indication the acquired Indiana Hippa Release Form for Insurance.

Each web template you included with your bank account lacks an expiry time and is your own permanently. So, if you want to obtain or print yet another version, just go to the My Forms portion and then click about the type you require.

Gain access to the Indiana Hippa Release Form for Insurance with US Legal Forms, the most extensive catalogue of lawful document web templates. Use 1000s of specialist and condition-distinct web templates that meet your small business or individual requirements and specifications.