Indiana Employment Verification Letter for Mortgage

Description

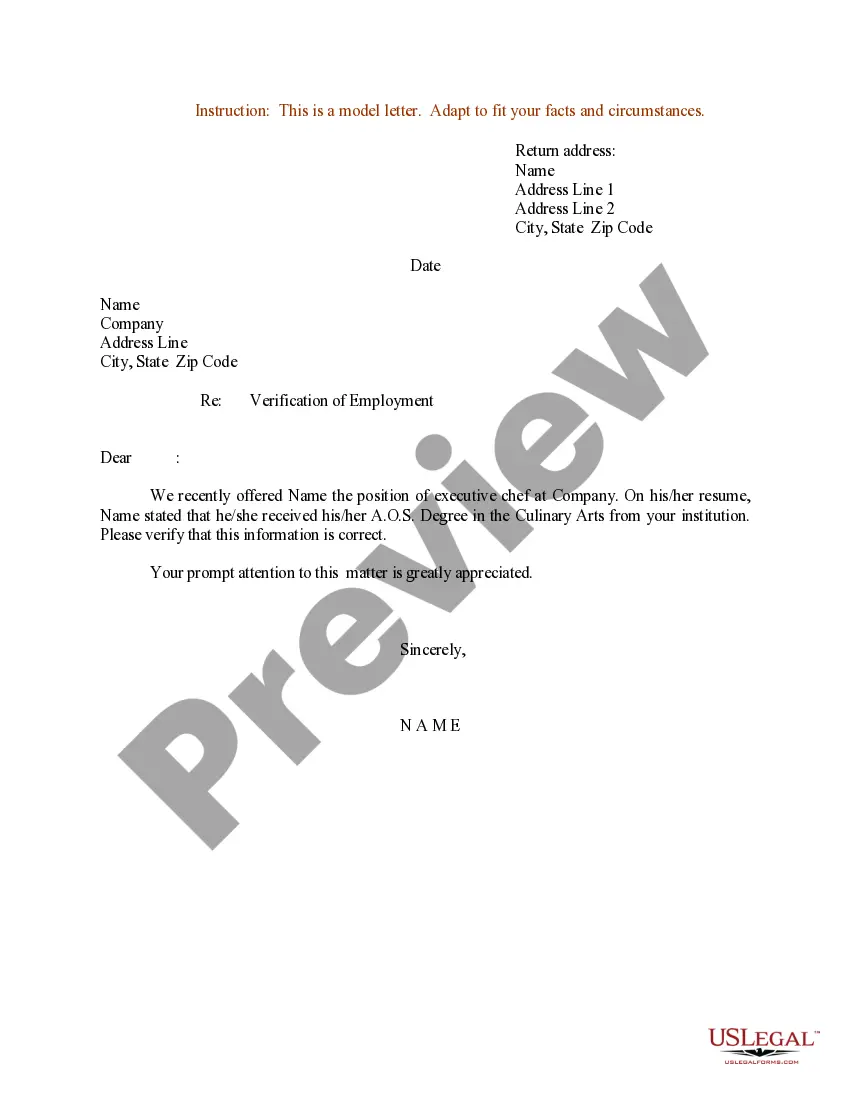

How to fill out Employment Verification Letter For Mortgage?

You can spend time online looking for the appropriate document template that satisfies the state and federal requirements you need. US Legal Forms provides a wide array of valid forms that are vetted by experts. You can obtain or print the Indiana Employment Verification Letter for Mortgage from our service.

If you already have a US Legal Forms account, you may sign in and click the Get button. After that, you can complete, modify, print, or sign the Indiana Employment Verification Letter for Mortgage. Every legal document template you acquire is yours permanently. To get another copy of a purchased form, visit the My documents section and click the corresponding button.

If you are using the US Legal Forms website for the first time, follow the simple steps outlined below: First, make sure you have selected the correct document template for the state/city of your choice. Review the document summary to ensure you have chosen the right form. If available, use the Preview button to review the document template as well. If you wish to find another version of the form, use the Search box to locate the template that meets your needs and requirements. Once you have found the template you want, click Get now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make edits to the document if necessary. You can complete, modify, sign, and print the Indiana Employment Verification Letter for Mortgage. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- You can spend time online looking for the appropriate document template.

- US Legal Forms provides a wide array of valid forms that are vetted by experts.

- You can obtain or print the Indiana Employment Verification Letter for Mortgage from our service.

- If you already have a US Legal Forms account, you may sign in and click the Get button.

- After that, you can complete, modify, print, or sign the Indiana Employment Verification Letter for Mortgage.

- Every legal document template you acquire is yours permanently.

- To get another copy of a purchased form, visit the My documents section.

Form popularity

FAQ

Banks can call your employer to verify employment for personal loans. But most banks will simply verify your income through a tax document or bank statement when evaluating your application for a personal loan.

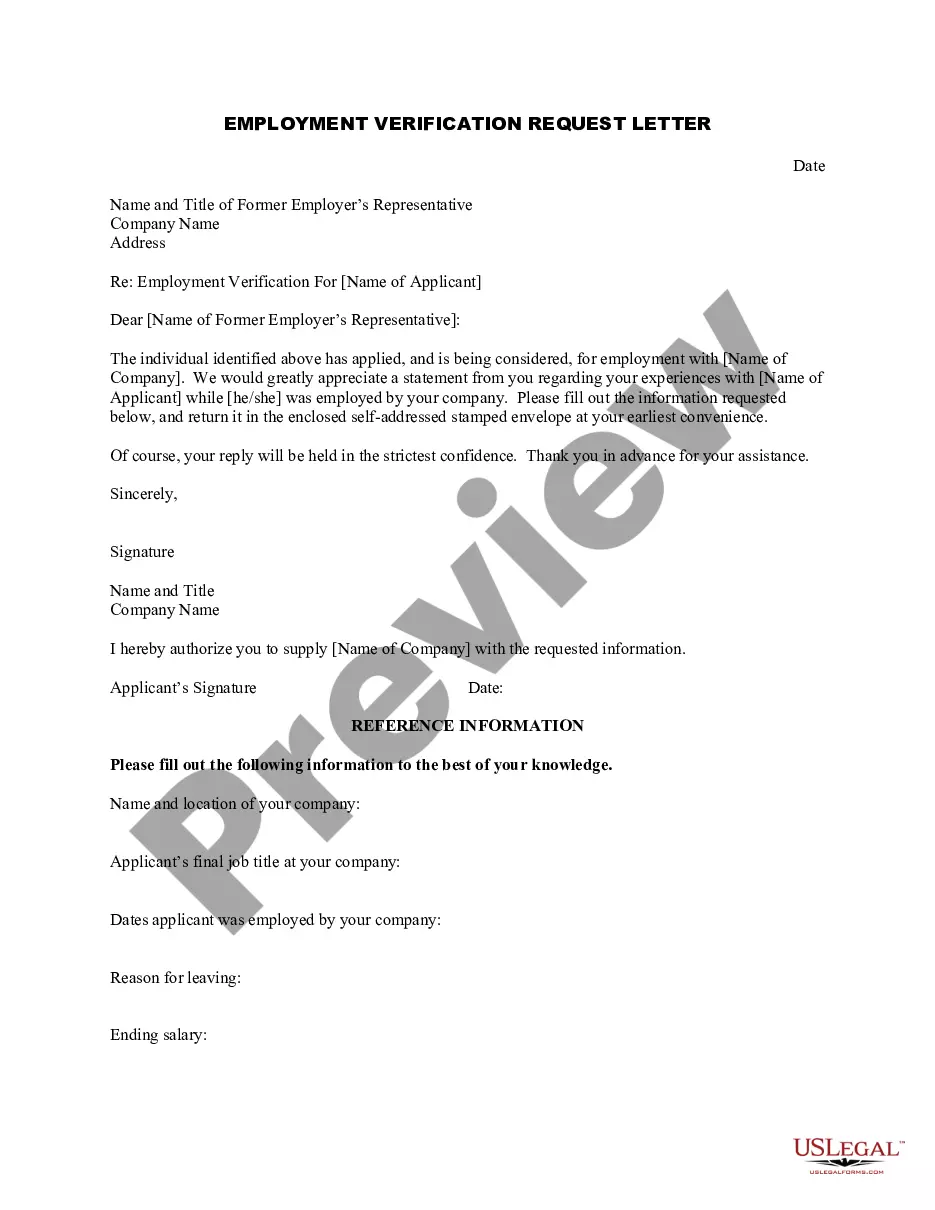

One of the most essential documents to show your lender is a letter of employment. A letter of employment, also sometimes called a job letter or income verification letter, proves your employment status, shows what kind of work you do, and helps the lender confirm that you have reliable income to pay off your mortgage.

Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Most lenders only require verbal confirmation, but some will seek email or fax verification. Lenders can verify self-employment income by obtaining tax return transcripts from the IRS.

A verification of mortgage (VOM) is an official statement that verifies your existing loan terms and provides a rating of the payment history, including if the loan was current or delinquent for each month listed. It reflects only the most recent 12 months of your loan, excluding the current month.

VOE or Verification of Employment is a type of mortgage program where all of the verification is handled directly with the employer. If you're a salaried worker or a wage earner, this program could work for you as an alternate type of financing.

A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and earning a salary. Providing a proof of income letter is common for those needing to prove they have a job to secure a loan or sign a lease.

What You Should Know. Most mortgage lenders require your employer to write details about your employment status. The purpose is for lenders to understand your job stability and verify your application. The letter must include things such as job title, salary, years of employment, and more.

Every lender will perform income and employment verification before a loan goes through the underwriting process.