Indiana Sample Letter for Land Deed of Trust

Description

How to fill out Sample Letter For Land Deed Of Trust?

If you wish to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the website's simple and convenient search to find the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the Indiana Sample Letter for Land Deed of Trust with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Indiana Sample Letter for Land Deed of Trust. You can also access forms you have previously downloaded in the My documents tab of your account.

Each legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Indiana Sample Letter for Land Deed of Trust with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

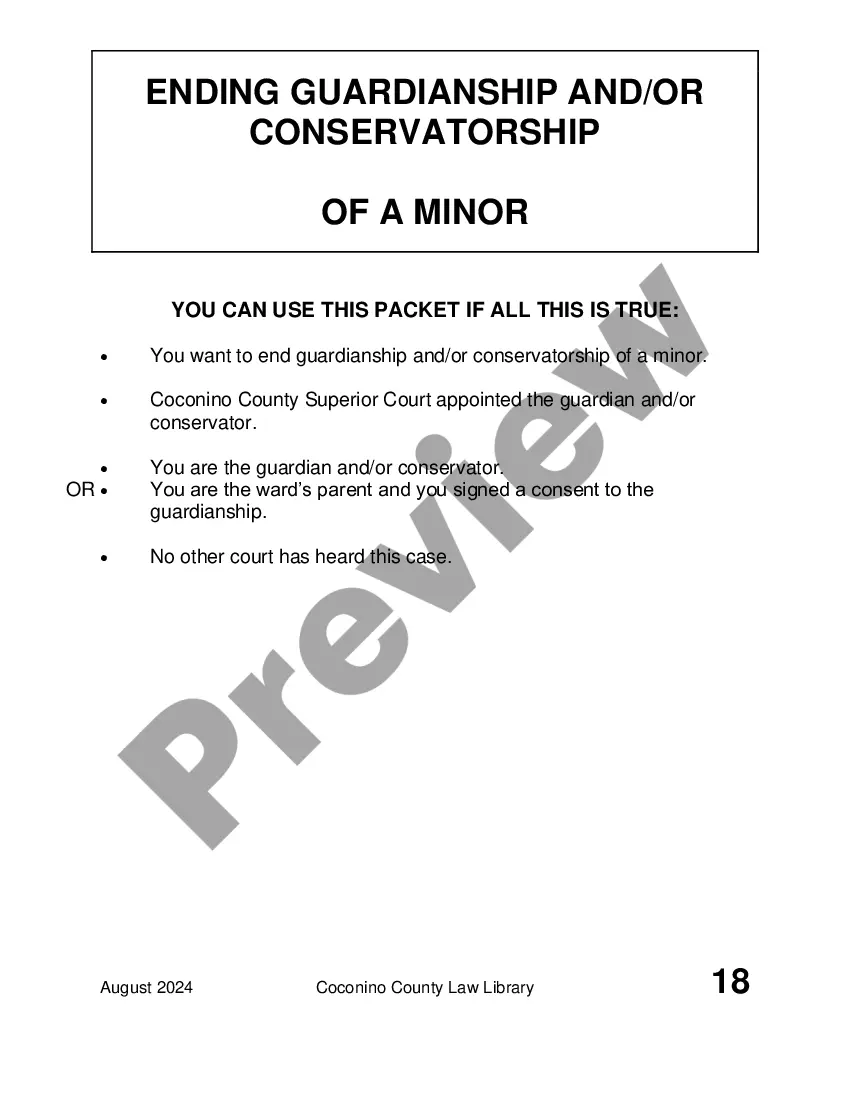

- Step 1. Ensure you have selected the form for the correct city/land.

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, make use of the Lookup field at the top of the screen to find other forms from the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Indiana Sample Letter for Land Deed of Trust.

Form popularity

FAQ

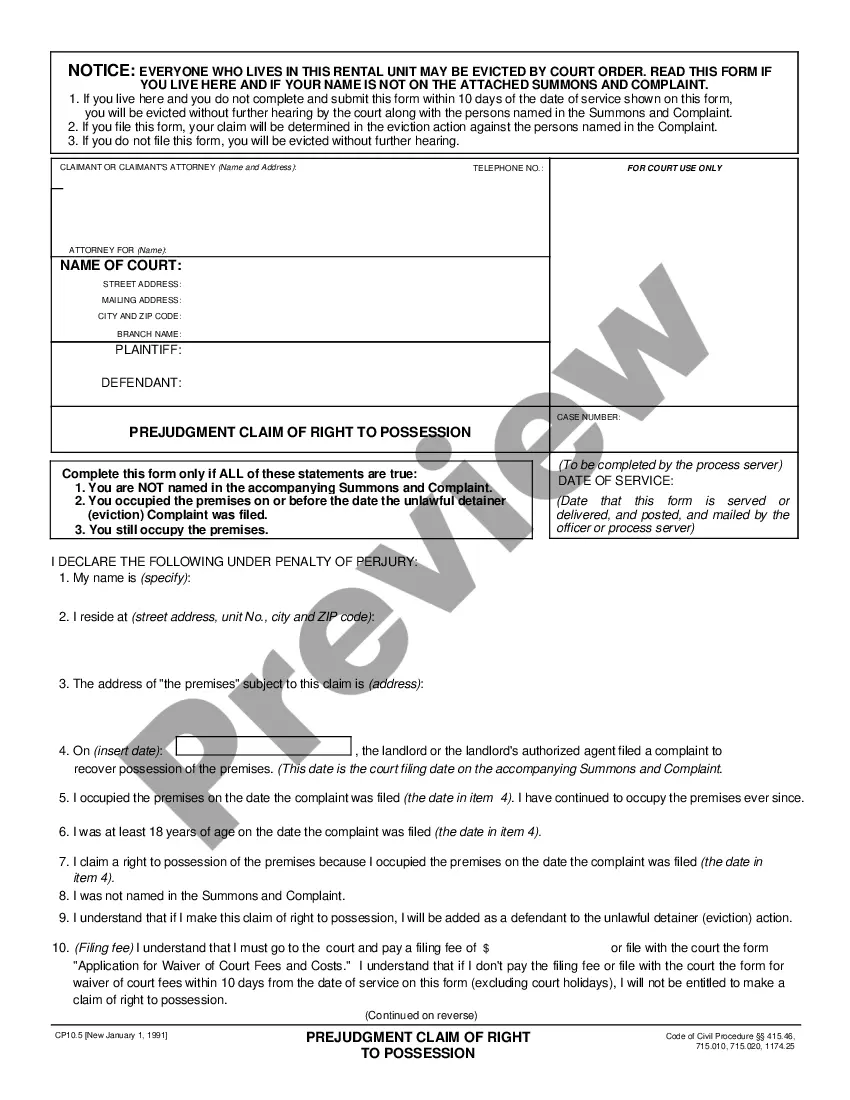

This deed is used by trustees of trusts or administrators of estates to transfer title to property without incurring any liability for warranties on themselves.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Definitions. Trust: A legal document that spells out how a person's assets should be managed during their lifetime or after their death.

Six years after the Trust Deed starts, your credit rating will contain no mention of it. It's important to remember, if you have already missed payments or have been paying reduced amounts to your creditors then your credit rating may already have been adversely affected.

The Trust Agreement must be drafted and executed by all beneficiaries and parties with power of direction. The Trust Agreement, along with a copy of a government issued picture identification for each beneficiary and power of direction holder, should be submitted to Indiana Land Trust Company for acceptance.

A Trust deed is a legal document that comprises and sets out the terms and conditions of creating and managing a trust. It involves the objective of the trust established , the names of the beneficiaries and the amount of lump sum income they will receive and even the method by which they will receive the payment.