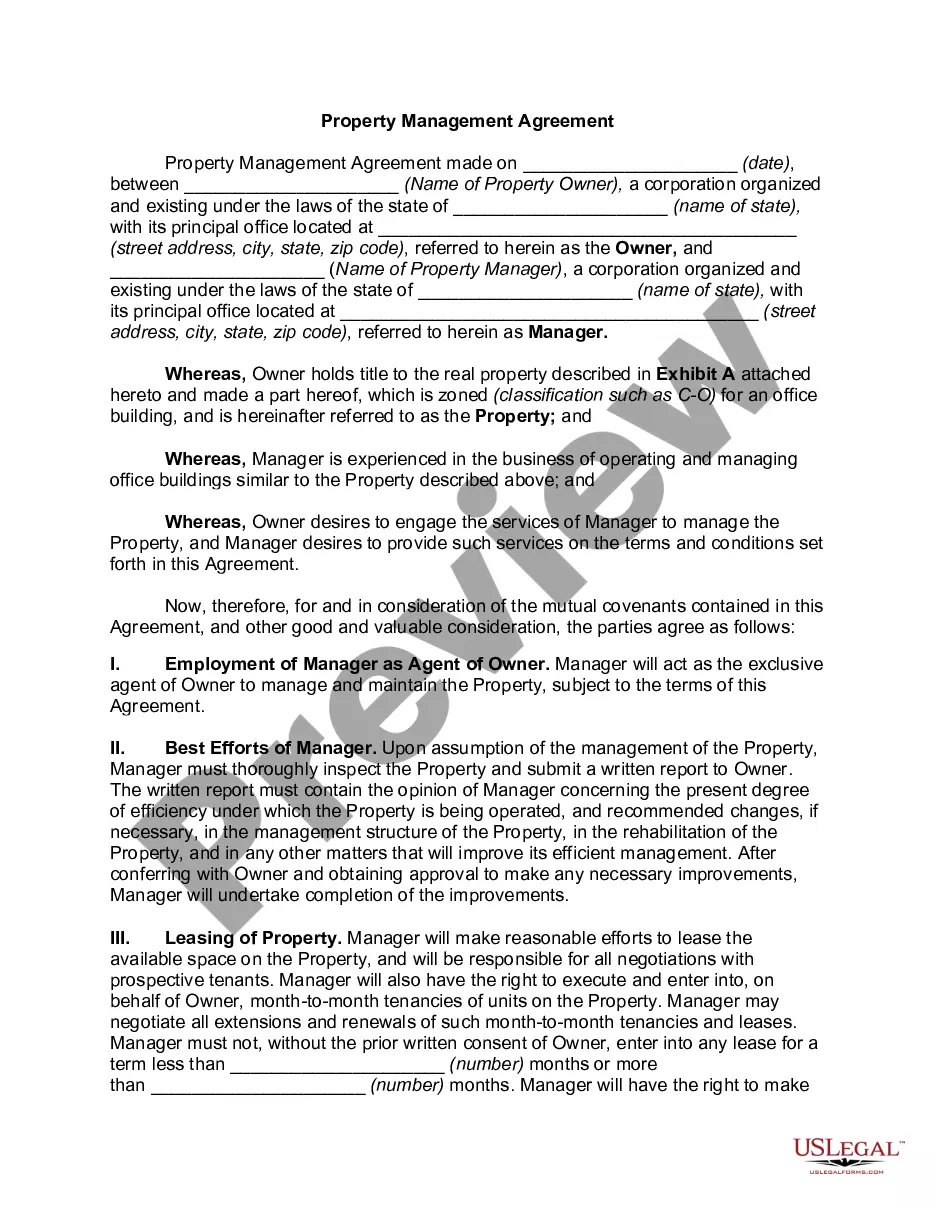

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Privacy and Confidentiality Policy for Credit Counseling Services

Description

How to fill out Privacy And Confidentiality Policy For Credit Counseling Services?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad selection of legal document formats that you can download or print.

By utilizing the website, you will find countless templates for business and personal purposes, categorized by types, states, or keywords. You can retrieve the latest versions of documents like the Indiana Privacy and Confidentiality Policy for Credit Counseling Services within moments.

If you hold a membership, Log In and obtain the Indiana Privacy and Confidentiality Policy for Credit Counseling Services from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously acquired templates in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Retrieve the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Indiana Privacy and Confidentiality Policy for Credit Counseling Services. Every template added to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, just go to the My documents section and click on the document you need. Access the Indiana Privacy and Confidentiality Policy for Credit Counseling Services with US Legal Forms, the most extensive library of legal document formats. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- Ensure you have selected the correct document for your location/state.

- Click the Preview button to examine the content of the form.

- Review the document details to confirm you have chosen the right template.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the document, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

A HIPAA violation occurs when protected health information is accessed or disclosed without proper authorization. This includes failing to implement safeguards to keep your information secure, or sharing your data inappropriately. Familiarizing yourself with these rules helps ensure compliance with the Indiana Privacy and Confidentiality Policy for Credit Counseling Services.

Counselors in Indiana are bound by strict confidentiality laws that protect client information. These laws require counselors to keep your personal details private, with specific exceptions that focus on safety and legal requirements. Following these laws is integral to the Indiana Privacy and Confidentiality Policy for Credit Counseling Services.

There are several exceptions to confidentiality in counseling, including cases of harm to oneself or others, instances of child abuse, and court orders. These exceptions allow counselors to disclose necessary information while balancing the need for client confidentiality. Understanding these exceptions is essential under the Indiana Privacy and Confidentiality Policy for Credit Counseling Services.

The HIPAA privacy rule establishes standards for protecting sensitive patient information. In simple terms, it governs who can access your health records and ensures that your information is only shared with necessary parties. This rule plays a crucial role in reinforcing the Indiana Privacy and Confidentiality Policy for Credit Counseling Services.

The HIPAA law in Indiana ensures that individuals' health information is protected. Specifically, it regulates how healthcare providers, including credit counseling services, handle patient data. This means your privacy is safeguarded under the Indiana Privacy and Confidentiality Policy for Credit Counseling Services.

The Indiana data privacy law governs how personal information is collected, stored, and shared by organizations operating in the state. This law is designed to enhance consumer protections and ensure that individuals have rights regarding their personal data. By aligning with the Indiana Privacy and Confidentiality Policy for Credit Counseling Services, organizations can ensure compliance while gaining clients' trust in handling their private information.

Yes, counselors are held accountable for protecting confidential information through various ethical and legal standards. They must adhere to state laws and professional guidelines, ensuring that clients' data is securely stored and only shared with consent. Following the Indiana Privacy and Confidentiality Policy for Credit Counseling Services provides a framework that emphasizes the significance of safeguarding client information.

In Indiana, therapists are required to report specific information regarding threats to health or safety, such as suspected child abuse or imminent danger to oneself or others. This mandatory reporting helps protect vulnerable individuals while ensuring that client confidentiality is still respected whenever possible. Understanding these requirements is vital for both therapists and clients, making it essential to follow the Indiana Privacy and Confidentiality Policy for Credit Counseling Services.

The HIPAA privacy rule in Indiana establishes standards for protecting health information, ensuring that personal health records remain confidential. Under this rule, healthcare providers, including credit counseling services that may offer health-related financial advice, must safeguard any sensitive patient information they handle. Compliance with the Indiana Privacy and Confidentiality Policy for Credit Counseling Services reinforces the need for diligence in maintaining client confidentiality.

The privacy policy in information security focuses on safeguarding sensitive information from unauthorized access and breaches. It includes measures such as encryption, access controls, and regular audits to ensure that data remains secure. Adhering to the Indiana Privacy and Confidentiality Policy for Credit Counseling Services helps organizations create effective strategies that protect client data while delivering exceptional service.