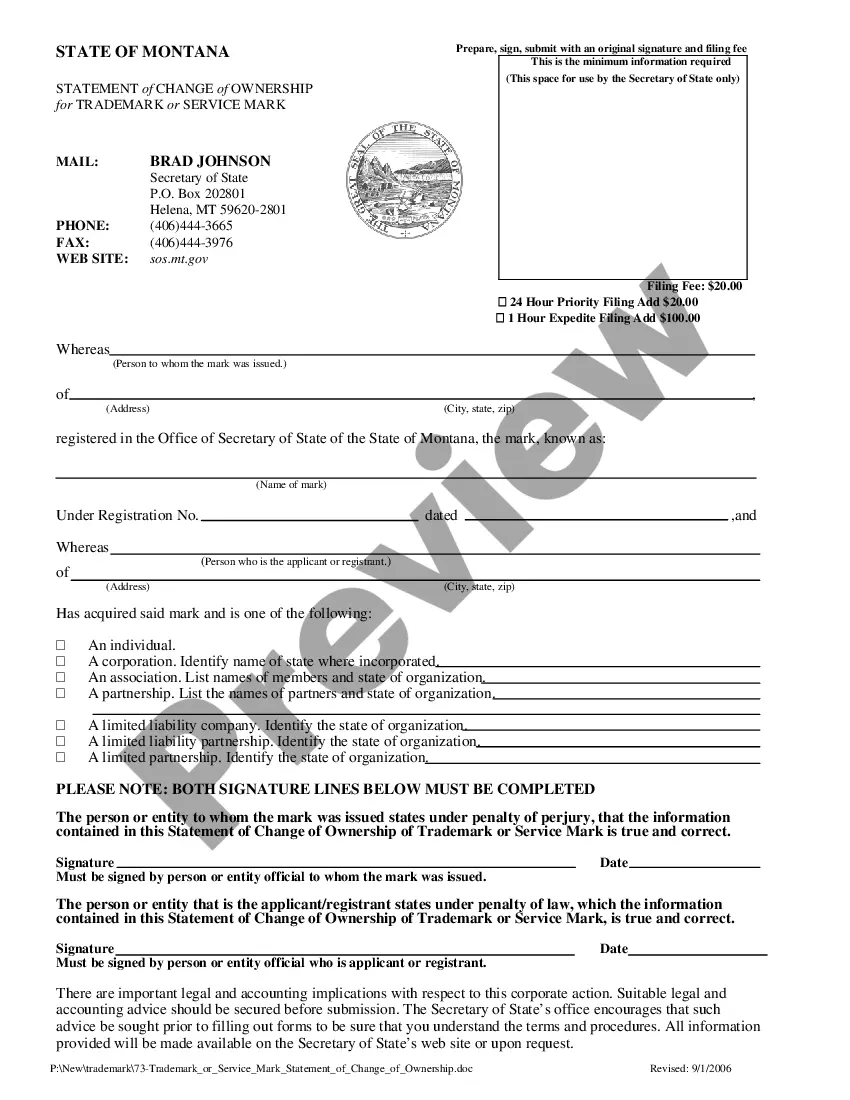

There are primarily four types of intellectual property in the U.S.: (1) patents, (2) trademarks, (3) copyrights and (4) trade secrets. A copyright exists automatically once the creator of a "work" fixes the work in a tangible medium. A work is "fixed in a tangible medium" when it is written, photographed, recorded or otherwise documented. Copyrights can include everything from books and works of literature, as well as non-literary written documents, including compilations of data, references, price lists and computer software. Although a copyright will generally exist under the common law automatically, the rights of the creator are best protected when the creator files for copyright protection under the Copyright Act (17 U.S.C. 201) through the U.S. Patent and Trademark Office.

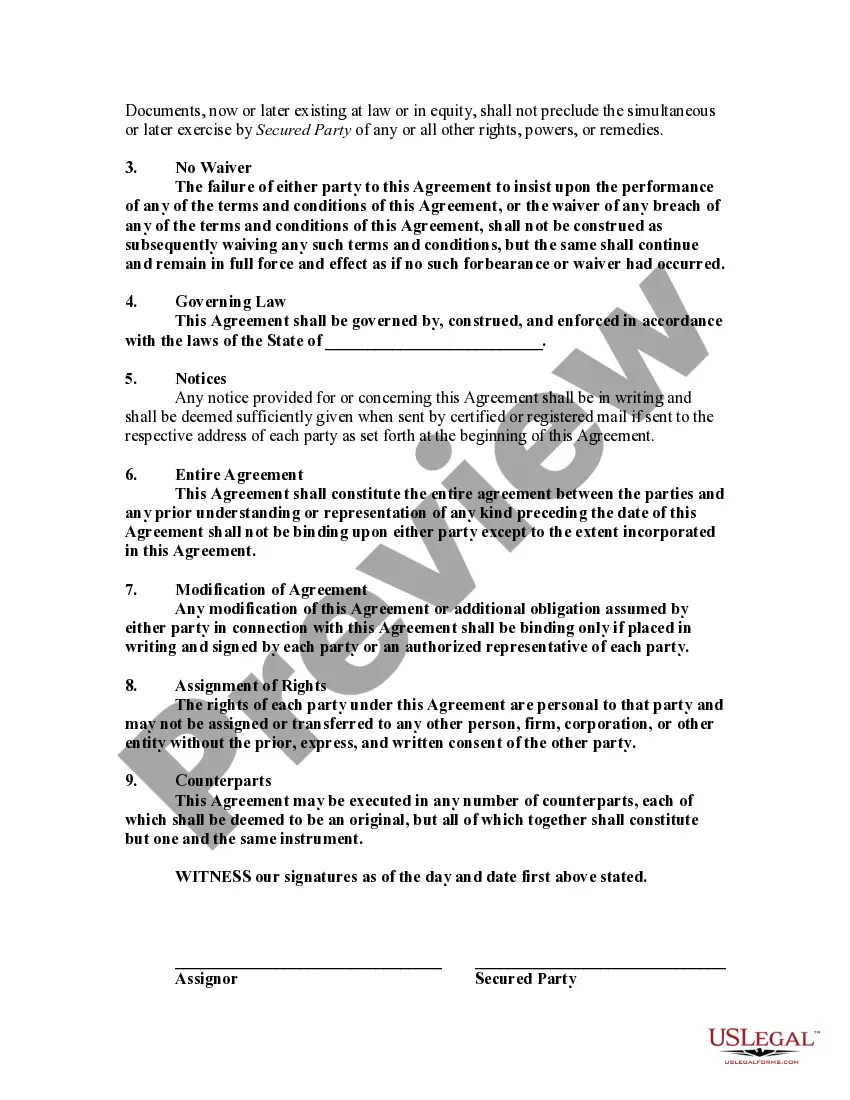

Title: Indiana Copyright Security Agreement Executed in Connection with Loan Agreement: A Comprehensive Overview Keywords: Indiana, copyright security agreement, loan agreement, types, execution Introduction: In the context of loan agreements, the Indiana Copyright Security Agreement serves as a crucial legal document meant to protect the interests of lenders. This detailed description dives into the various aspects of the Indiana Copyright Security Agreement executed in connection with a loan agreement. It also sheds light on different types of security agreements commonly encountered in Indiana. 1. Understanding the Indiana Copyright Security Agreement: The Indiana Copyright Security Agreement is a legally binding contract created to ensure that the loan provided by a lender is backed by the borrower's intellectual property rights, particularly copyrights. This agreement establishes the lender's rights and priorities concerning the borrower's copyright assets in case of default or breach of the loan agreement. 2. Key Components: a. Identification of the Parties: The Indiana Copyright Security Agreement begins by identifying the lender (secured party) and the borrower (granter) involved in the loan arrangement. b. Description of the Intellectual Property: The agreement specifies the copyrights and associated intellectual property assets being offered as security by the borrower. It includes a detailed description of the copyrighted works, registration information, and any related rights or revenues. c. Grant of Security Interest: The borrower grants the lender a security interest in the copyrighted works, allowing the lender to assume legal control over the borrower's intellectual property assets until the loan is repaid. d. Representations and Warranties: The borrower affirms ownership of the copyrighted works, their validity, and the absence of any encumbrances or third-party claims. e. Default and Remedies: The agreement outlines the specific events that would constitute default, such as payment default or insolvency. It also delineates the remedies available to the lender in case of default, including the ability to take possession of and sell the copyrighted works to recover outstanding amounts. 3. Different Types of Indiana Copyright Security Agreement Executed in Connection with Loan Agreement: a. General Copyright Security Agreement: This is the most common type of agreement, involving all copyrights owned by the borrower as security for the loan. b. Specific Copyright Security Agreement: In some cases, the agreement focuses on specific copyrighted works that are of substantial value or uniqueness. It provides targeted security for those particular works. c. Collateral Assignment of Copyrights: Rather than providing a security interest, this type involves the outright transfer of copyrights to the lender as collateral until the loan is paid off. d. Intellectual Property Pledge Agreement: This agreement goes beyond copyrights and may include other intellectual property assets such as trademarks or patents as security for the loan. Conclusion: The Indiana Copyright Security Agreement serves as a vital tool in protecting the interests of lenders within loan agreements. By ensuring the borrower's copyrights serve as collateral, lenders can mitigate risk and secure their investment. This comprehensive overview covered the key components of the agreement while highlighting the different types that borrowers and lenders may encounter in Indiana. It emphasizes the importance of executing such agreements to maintain a secure financial relationship between both parties involved.