An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana General Form of Irrevocable Trust Agreement

Description

How to fill out General Form Of Irrevocable Trust Agreement?

It is feasible to spend hours on the internet searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by specialists.

It is easy to obtain or print the Indiana General Form of Irrevocable Trust Agreement from your service.

First, ensure you have chosen the correct document template for the county/city you select. Review the form outline to verify that you have chosen the accurate type. If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Indiana General Form of Irrevocable Trust Agreement.

- Every legal document template you acquire is permanently yours.

- To obtain another copy of the purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

Form popularity

FAQ

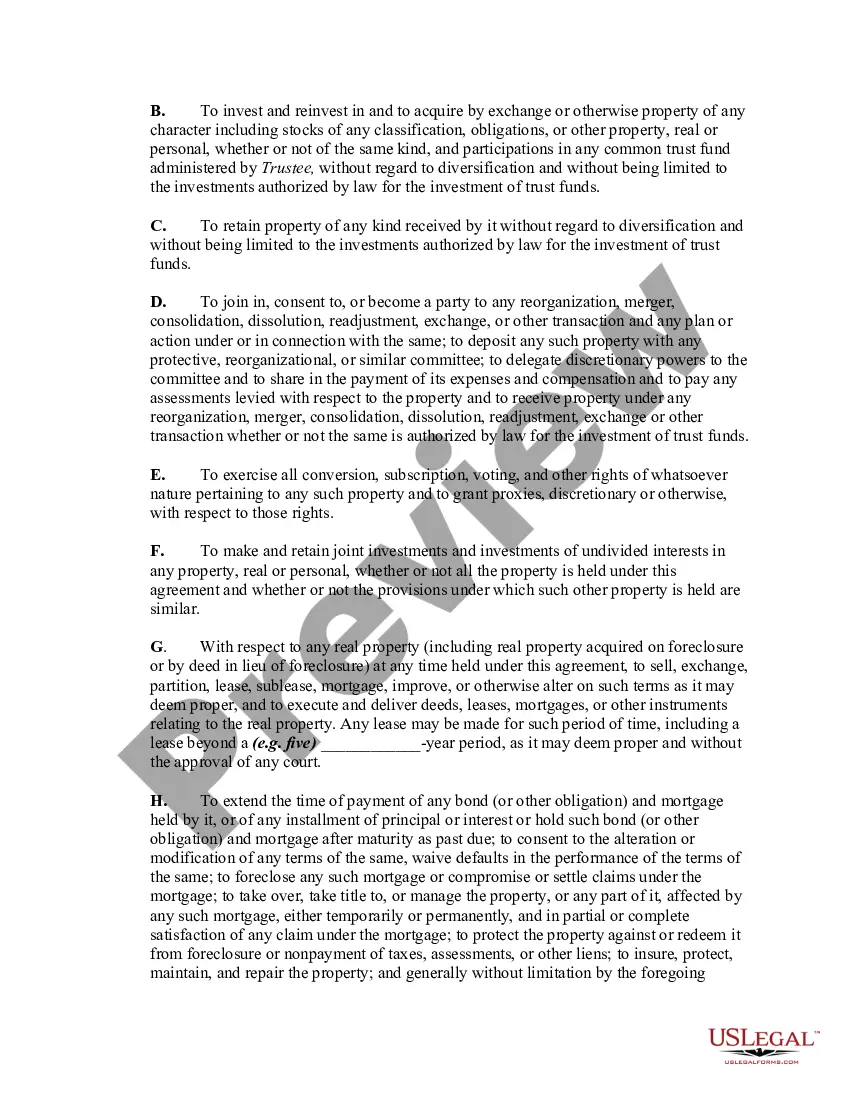

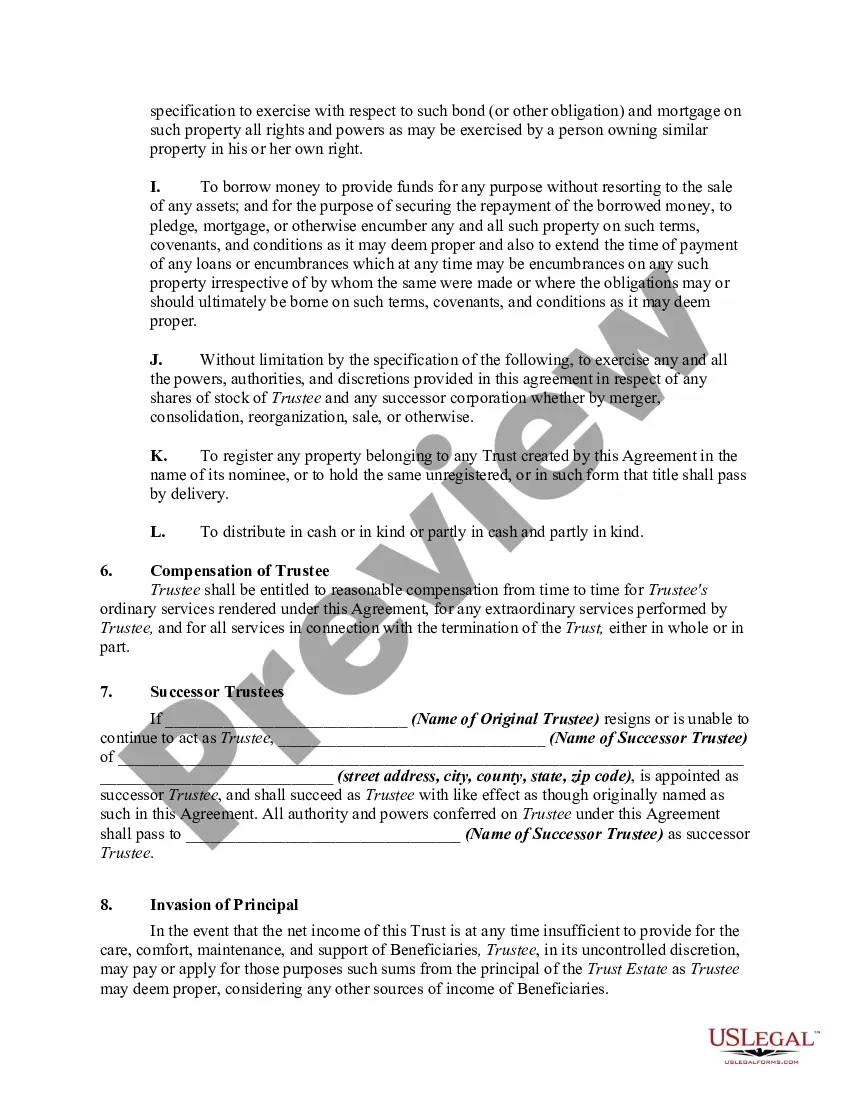

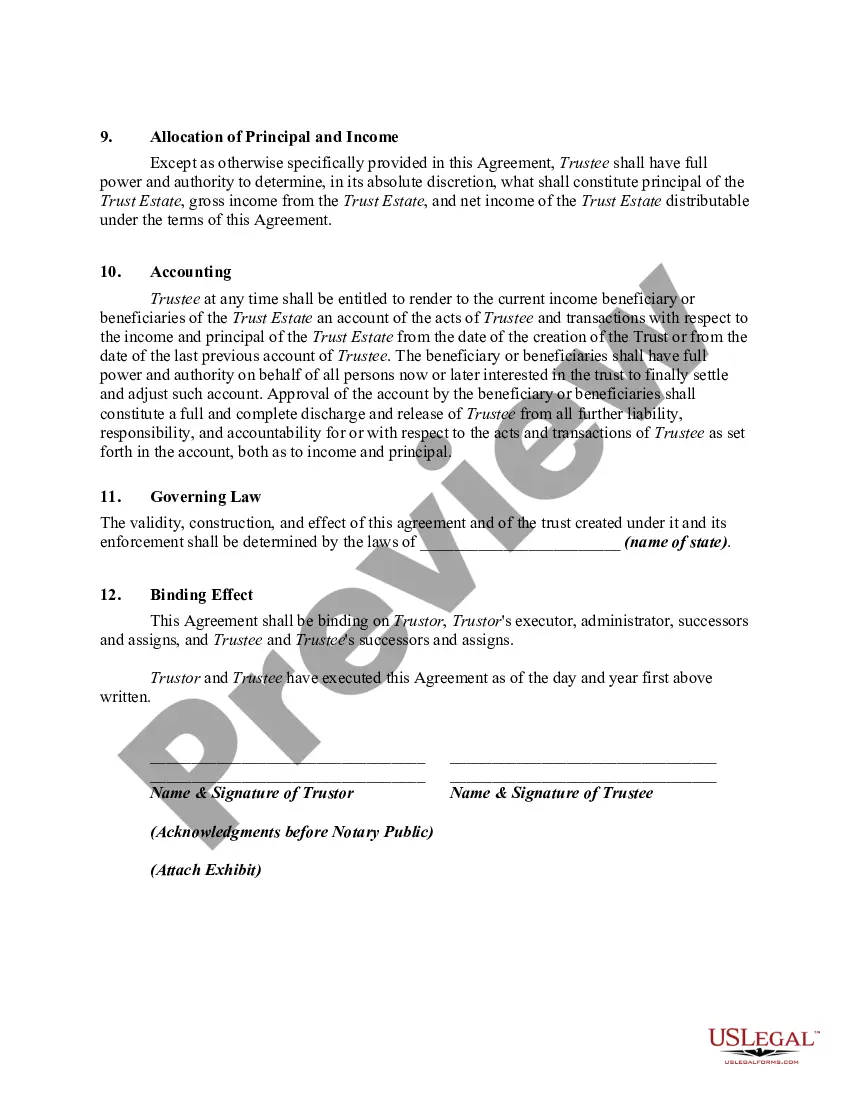

To write an irrevocable trust document, start by clearly defining your intentions regarding asset management and distribution in the Indiana General Form of Irrevocable Trust Agreement. Include necessary details such as the grantor, trustee, and beneficiaries, as well as specific instructions for asset distribution. Use straightforward and clear language to avoid ambiguity, and ensure the document is notarized for legal validity. If you find this process daunting, consider using uslegalforms to access user-friendly templates and legal guidance.

Yes, you can write your own irrevocable trust, but it's essential to ensure that it meets Indiana's legal requirements. Using the Indiana General Form of Irrevocable Trust Agreement as a template can simplify this process and ensure that you include all necessary components. However, it is wise to have your document reviewed by a legal expert to prevent any issues or oversight. A well-structured trust protects your intentions and provides peace of mind.

When creating an irrevocable trust, avoid including personal property that you may want to retain control over, like your primary residence or personal bank accounts. Additionally, do not include assets that could lose value or are not easily transferable. The Indiana General Form of Irrevocable Trust Agreement is designed to protect and manage specific designated assets; ensuring that the contents align with your long-term goals is crucial. Keeping your trust simple and focused can help avoid complications down the road.

The wording in an irrevocable trust must clearly indicate its irrevocable nature and outline the terms and conditions of the trust. A typical statement in the Indiana General Form of Irrevocable Trust Agreement may include a declaration that the trust cannot be changed or terminated by the grantor once established. It is also essential to specify the roles of the trustee, beneficiaries, and any conditions regarding the distribution of assets. Use clear, straightforward language to make your intentions unmistakable.

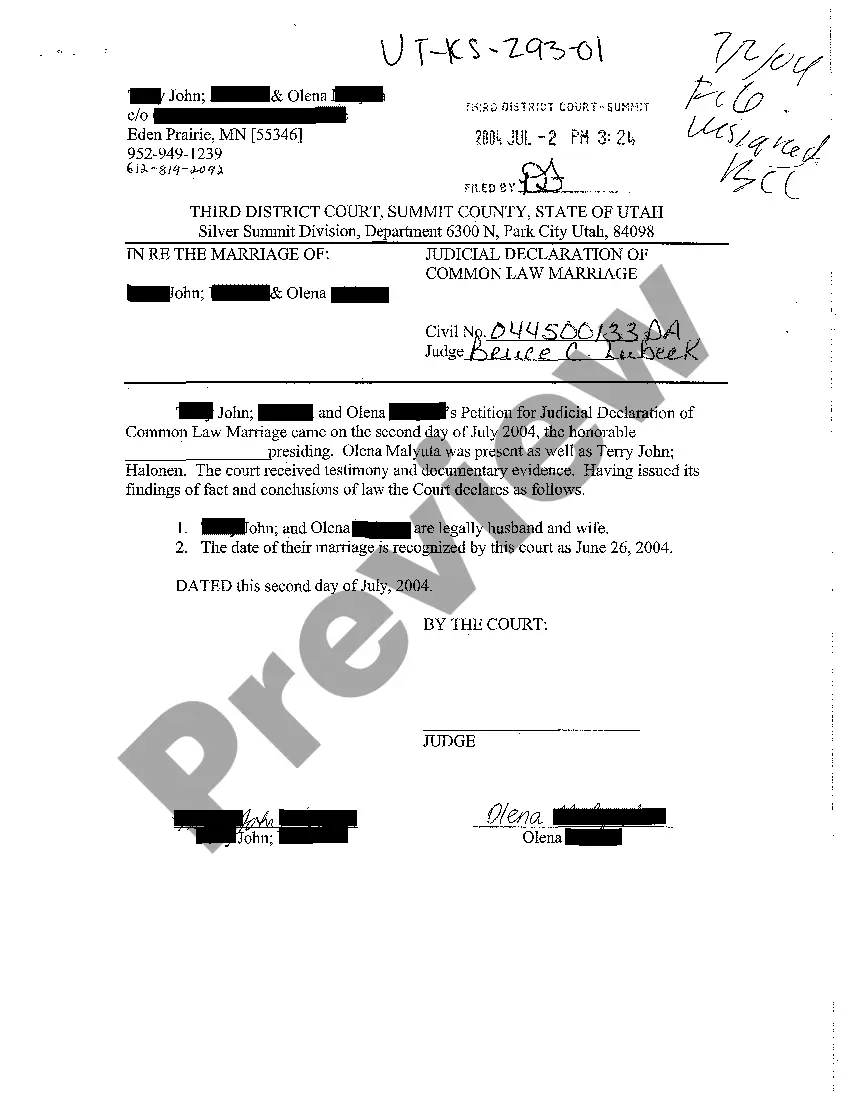

Yes, in Indiana, it is generally required that the Indiana General Form of Irrevocable Trust Agreement be notarized to validate the document. Notarization helps confirm the identity of the signatories and provides a level of assurance that the agreement was created without coercion. While notarization is not the only requirement, it is an important step in making sure the trust is legally recognized. Always consult with a legal professional to ensure all necessary procedures are followed.

In Indiana, irrevocable trusts are governed by specific state laws that determine how they operate and are enforced. An irrevocable trust cannot be modified or revoked without the consent of the beneficiaries and the trustee. This means once you create an Indiana General Form of Irrevocable Trust Agreement, it secures your assets according to your wishes without the possibility of changes. Familiarizing yourself with these laws ensures that you understand your rights and responsibilities in managing and administering the trust.

Filling out an irrevocable trust requires clear understanding and careful attention to detail. You should begin by using the Indiana General Form of Irrevocable Trust Agreement to ensure you include all necessary provisions. Input essential information such as the names of the grantor, trustee, and beneficiaries. Additionally, clearly outline the terms and conditions for the trust to ensure that your wishes are accurately reflected.

Filling out a trust agreement involves several key steps, including selecting the type of trust, identifying the grantor and beneficiaries, and detailing the specific terms of the trust. When using the Indiana General Form of Irrevocable Trust Agreement, it is crucial to provide clear information and ensure all parties understand their roles. Always consider consulting with a professional for guidance to ensure the trust is completed accurately and legally.

While a trust does not have to be notarized in Indiana, doing so is highly beneficial. The Indiana General Form of Irrevocable Trust Agreement is well suited for notarization, which can enhance its respectability and facilitate smoother dealings with banks and other institutions. Notarization can also help prevent potential legal challenges to the trust's validity.

One of the most significant mistakes parents make is failing to clearly outline their intentions within the trust document. The Indiana General Form of Irrevocable Trust Agreement allows parents to specify their wishes but omitting details can lead to misunderstandings among beneficiaries. Additionally, not changing or updating the trust as circumstances change can invalidate its purpose and complicate distributions.