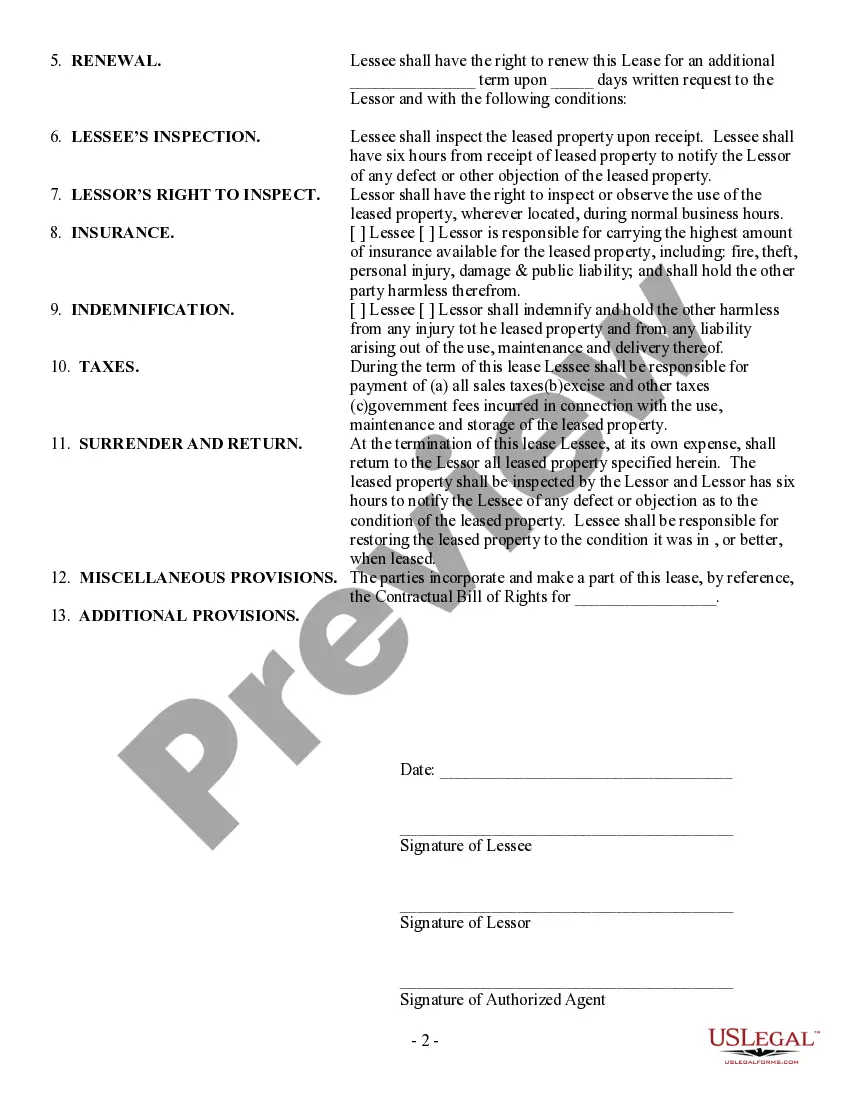

Indiana Simple Equipment Lease is a legally binding agreement that allows businesses in Indiana to lease equipment for their operations. This lease agreement provides a simplified and convenient solution for businesses to acquire the necessary equipment without purchasing it outright. The Indiana Simple Equipment Lease is designed to be straightforward and easy to understand, making it suitable for both small and large businesses. It outlines the terms and conditions for the lease, including the duration, payment terms, and responsibilities of both the lessor (equipment owner) and the lessee (business). One type of Indiana Simple Equipment Lease is the short-term lease. This type of lease is ideal for businesses that only require equipment for a specific project or a limited duration. The short-term lease offers flexibility and allows businesses to avoid the long-term commitment of purchasing equipment outright. Another type of Indiana Simple Equipment Lease is the long-term lease. This lease is more suitable for businesses that require equipment for an extended period. The long-term lease provides businesses with access to necessary equipment without the significant upfront costs associated with purchasing equipment. The Indiana Simple Equipment Lease takes into account the unique business needs and legal requirements of the state. It ensures compliance with Indiana laws and regulations, providing peace of mind to businesses. By utilizing the Indiana Simple Equipment Lease, businesses can save money, improve cash flow, and have access to state-of-the-art equipment necessary for their operations. This lease agreement offers a flexible and cost-effective solution for acquiring equipment, allowing businesses to focus on their core activities and achieve their goals. In summary, the Indiana Simple Equipment Lease is a convenient and straightforward agreement for businesses in Indiana to lease equipment. It includes both short-term and long-term lease options, catering to the specific needs of businesses. This lease agreement facilitates equipment acquisition without the financial burden of purchasing outright, ensuring compliance with Indiana laws.

Indiana Simple Equipment Lease

Description

How to fill out Indiana Simple Equipment Lease?

You can dedicate countless hours online trying to locate the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of authentic documents that have been vetted by professionals.

You can download or print the Indiana Simple Equipment Lease from my platform.

If you are looking to find a different version of the document, use the Search box to locate the template that suits your needs and requirements. Once you find the template you want, click Purchase now to proceed. Select the payment plan you prefer, enter your details, and register for a free account on US Legal Forms. Complete the purchase using your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document as needed. You can complete, edit, sign, and print the Indiana Simple Equipment Lease. Access and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, edit, print, or sign the Indiana Simple Equipment Lease.

- Every legal document template you purchase is yours permanently.

- To get another copy of the purchased document, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the document description to confirm that you've chosen the right form.

- If available, use the Review button to browse through the document template as well.

Form popularity

FAQ

Yes, equipment leases are indeed part of ASC 842, which dictates the accounting treatment for both lessees and lessors. When you engage in an Indiana Simple Equipment Lease, understanding ASC 842 ensures you meet compliance requirements. Knowing these rules enhances transparency in your financial reporting.

Equipment leases can be classified as operating leases, especially when they do not transfer ownership to the lessee. An Indiana Simple Equipment Lease often falls into this category, as it typically allows usage without substantial risks and rewards of ownership. This classification can simplify your accounting processes.

To record a lease of equipment, start by determining the lease term and payment structure. For an Indiana Simple Equipment Lease, you'll need to recognize the lease liability and corresponding right-of-use asset on your balance sheet. Ensure accurate accounting entries by consulting your financial team or using reliable accounting software.

The typical term of an equipment lease can vary widely, often ranging from one to five years; however, it ultimately depends on your specific needs. For an Indiana Simple Equipment Lease, shorter terms often offer flexibility, while longer terms can provide stability. Choose a term that best aligns with your operational goals and budget.

Yes, leased equipment is typically considered an asset under ASC 842 guidelines. When you enter an Indiana Simple Equipment Lease, the leased equipment is recorded as a right-of-use asset. This allows you to acknowledge the benefit you gain from using the equipment during the lease term.

Yes, ASC 842 applies to equipment leases, impacting how you recognize and present lease liabilities and right-of-use assets on your balance sheet. For an Indiana Simple Equipment Lease, understanding these guidelines ensures compliance and proper financial reporting. It's crucial to consult relevant materials or professionals to navigate these regulations effectively.

Yes, you can make a lease yourself. Crafting your own Indiana Simple Equipment Lease gives you complete control over the terms of the agreement. However, to ensure compliance with legal standards and to address any specific needs, consider using templates and legal guidance from uslegalforms, making the process smoother and more reliable.

Certainly, you can write your own lease agreement. This process allows for personalization to fit your needs, particularly for an Indiana Simple Equipment Lease. However, it’s essential to include all critical elements, and utilizing resources from uslegalforms can guide you in crafting a legally sound document that protects your interests.

While you do not need a lawyer to prepare a lease agreement, it is often recommended. This is especially true for an Indiana Simple Equipment Lease, where the terms can significantly impact both lessee and lessor. Using uslegalforms can provide you with pre-prepared agreements, but consulting a lawyer can offer peace of mind and ensure all legalities are thoroughly addressed.

Yes, you can create your own lease agreement. When drafting an Indiana Simple Equipment Lease, ensure that you include all necessary terms such as rental duration, payment details, and responsibilities of both parties. While it's possible to do this independently, using templates from uslegalforms can help you avoid common pitfalls and ensure your lease is compliant with state laws.

Interesting Questions

More info

Only Used With Power of Attorney Last Will Testament Power of Attorney for Estate of Business Owner.