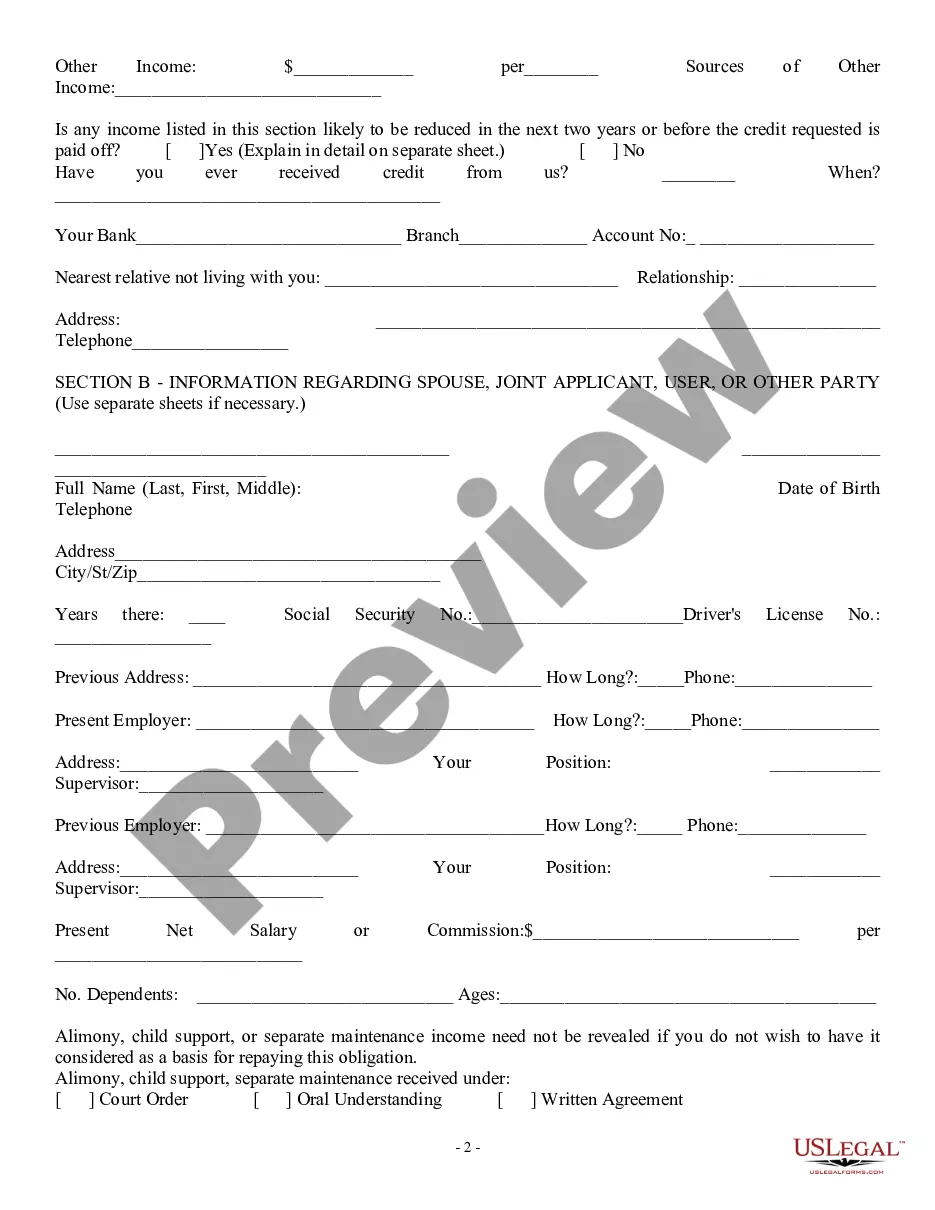

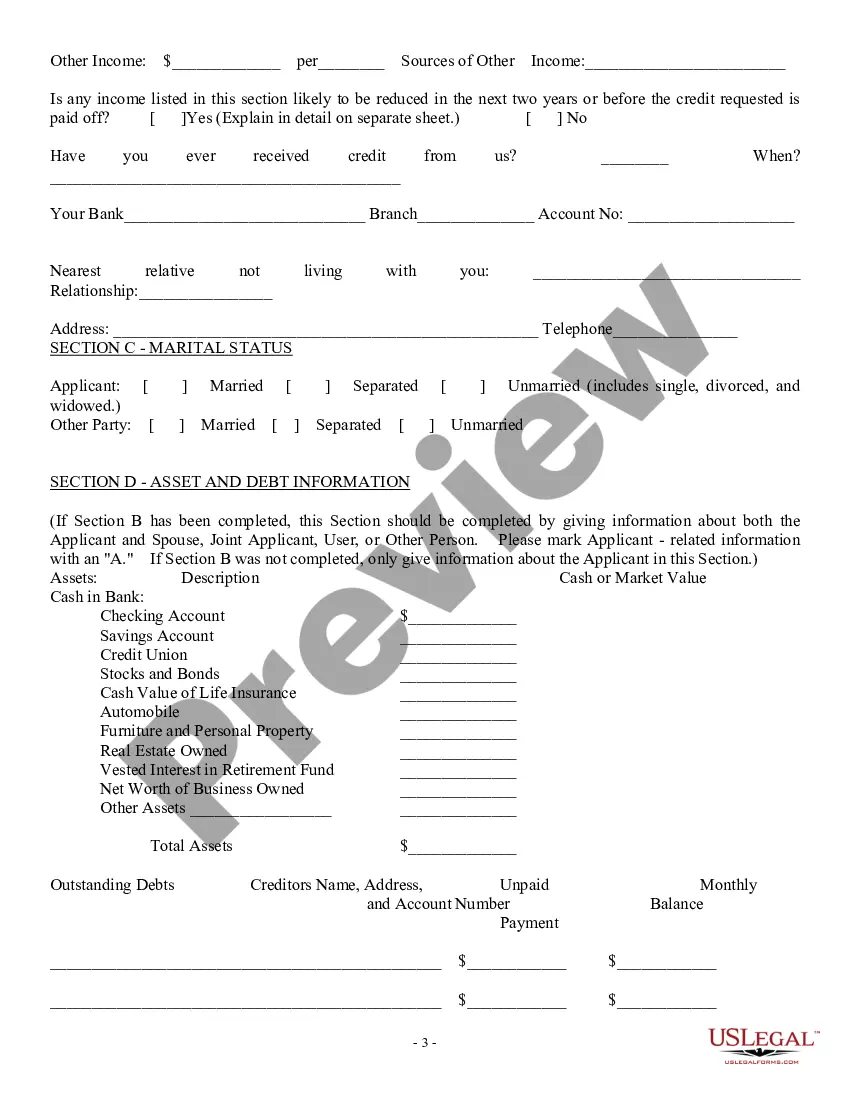

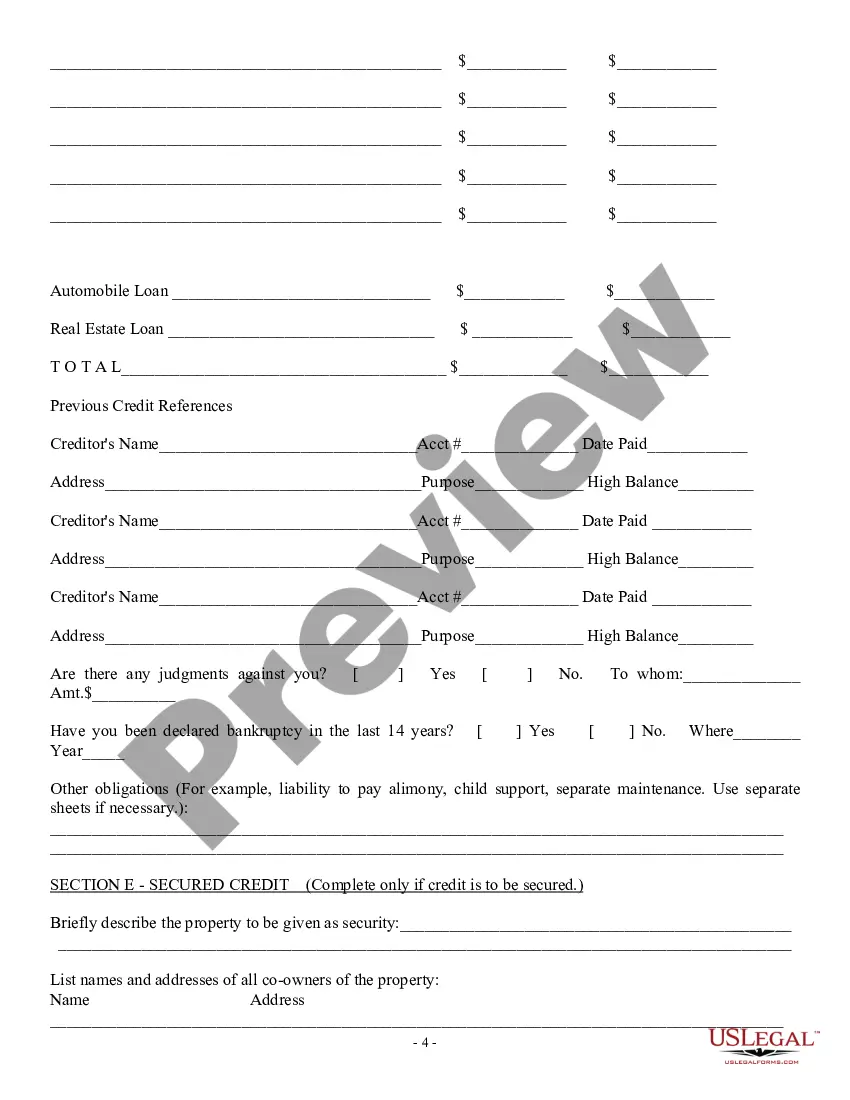

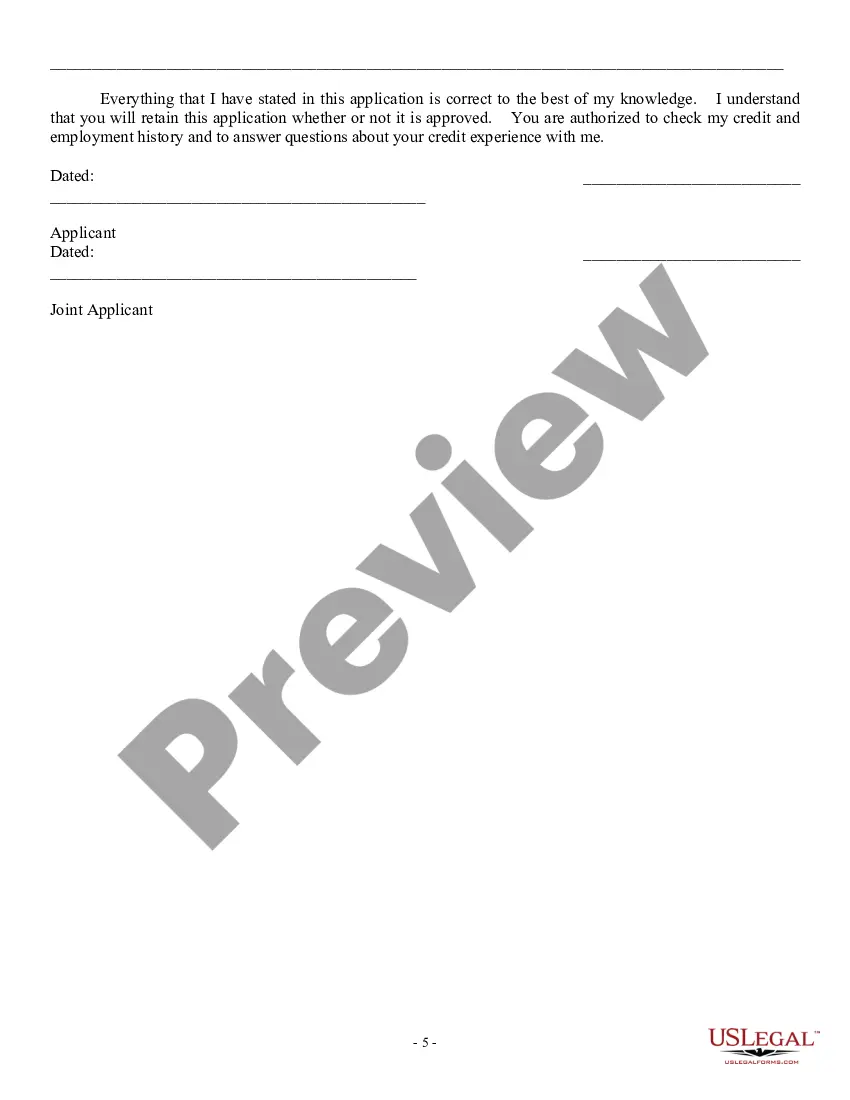

Description: The Indiana Consumer Loan Application — Personal Loan Agreement is a comprehensive document that serves as a legal agreement between a lender and a borrower in Indiana. It outlines the terms and conditions under which a personal loan will be granted and repaid. This loan agreement ensures transparency and protects the rights of both parties involved. Keywords: Indiana Consumer Loan Application, Personal Loan Agreement, lender, borrower, terms and conditions, personal loan, repayment, transparency, rights, legal agreement. Different types of Indiana Consumer Loan Application — Personal Loan Agreement: 1. Secured Personal Loan Agreement: This type of loan agreement requires the borrower to provide collateral, such as property or a vehicle, to secure the loan. By doing so, the borrower reduces the risk for the lender, which often leads to lower interest rates. 2. Unsecured Personal Loan Agreement: Unlike secured loans, unsecured loans do not require collateral. In this type of loan agreement, the borrower is not required to provide any asset as security. However, lenders typically charge higher interest rates to compensate for the increased risk. 3. Fixed-Rate Personal Loan Agreement: This loan agreement specifies a fixed interest rate that remains constant throughout the loan term. It allows borrowers to plan their repayments accurately, as the interest rate will not change regardless of market fluctuations. 4. Variable-Rate Personal Loan Agreement: In contrast to fixed-rate loans, variable-rate loans have an interest rate that can fluctuate over time. The interest rate is usually tied to a benchmark index, such as the prime rate. This type of loan agreement carries the potential for both lower or higher interest rates during the loan term. 5. Installment Personal Loan Agreement: An installment loan agreement requires the borrower to repay the loan amount along with interest in regular, fixed amounts over a predetermined period. This type of loan agreement is ideal for borrowers who prefer predictable monthly payments. 6. Line of Credit Personal Loan Agreement: Unlike traditional personal loans, a line of credit does not provide the borrower with a lump sum of money. Instead, the borrower has access to a predetermined credit limit and can draw funds as needed. This type of loan agreement is more flexible, as interest is only charged on the amount borrowed. The Indiana Consumer Loan Application — Personal Loan Agreement is tailored to accommodate the specific needs and preferences of each borrower, ensuring a fair and transparent lending process.

Indiana Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Indiana Consumer Loan Application - Personal Loan Agreement?

It is possible to invest hours on the web attempting to find the legal record template that suits the state and federal demands you need. US Legal Forms gives a large number of legal forms which are analyzed by specialists. You can easily acquire or produce the Indiana Consumer Loan Application - Personal Loan Agreement from our assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Obtain option. After that, it is possible to full, change, produce, or sign the Indiana Consumer Loan Application - Personal Loan Agreement. Each legal record template you buy is yours eternally. To get one more copy of the bought type, go to the My Forms tab and click the related option.

If you use the US Legal Forms internet site initially, keep to the simple recommendations listed below:

- Initially, make sure that you have chosen the right record template for that area/area of your choosing. Look at the type information to make sure you have picked out the appropriate type. If readily available, utilize the Review option to appear through the record template too.

- If you want to find one more model of the type, utilize the Search industry to find the template that meets your requirements and demands.

- When you have found the template you want, click Get now to carry on.

- Find the rates strategy you want, enter your accreditations, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal accounts to fund the legal type.

- Find the file format of the record and acquire it to your gadget.

- Make modifications to your record if required. It is possible to full, change and sign and produce Indiana Consumer Loan Application - Personal Loan Agreement.

Obtain and produce a large number of record templates utilizing the US Legal Forms site, that provides the most important collection of legal forms. Use specialist and state-distinct templates to take on your company or specific requirements.