Indiana Separation and Property Settlement Agreement

Description

How to fill out Separation And Property Settlement Agreement?

If you wish to complete, acquire, or print out authorized document themes, use US Legal Forms, the most important selection of authorized varieties, that can be found on the Internet. Utilize the site`s simple and easy convenient look for to get the paperwork you require. A variety of themes for company and person reasons are sorted by types and states, or keywords. Use US Legal Forms to get the Indiana Separation and Property Settlement Agreement in a number of click throughs.

Should you be presently a US Legal Forms buyer, log in to the accounts and then click the Obtain key to find the Indiana Separation and Property Settlement Agreement. You can even entry varieties you previously saved inside the My Forms tab of the accounts.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your correct city/region.

- Step 2. Use the Preview choice to check out the form`s content. Don`t forget to read through the description.

- Step 3. Should you be not happy together with the develop, utilize the Research area at the top of the display screen to get other models of your authorized develop format.

- Step 4. Upon having discovered the shape you require, select the Buy now key. Select the rates program you prefer and add your references to register for the accounts.

- Step 5. Approach the transaction. You may use your credit card or PayPal accounts to finish the transaction.

- Step 6. Find the formatting of your authorized develop and acquire it on your device.

- Step 7. Total, edit and print out or indicator the Indiana Separation and Property Settlement Agreement.

Every single authorized document format you acquire is the one you have permanently. You might have acces to each develop you saved with your acccount. Go through the My Forms section and select a develop to print out or acquire yet again.

Be competitive and acquire, and print out the Indiana Separation and Property Settlement Agreement with US Legal Forms. There are millions of expert and status-certain varieties you may use for the company or person demands.

Form popularity

FAQ

Divorce Law Does Not Prohibit Anyone From Dating You should know first that, legally speaking, you are permitted to date during a divorce. To be sure, there are no laws in Indiana that prohibit the spouses from dating other people while their divorce case is underway.

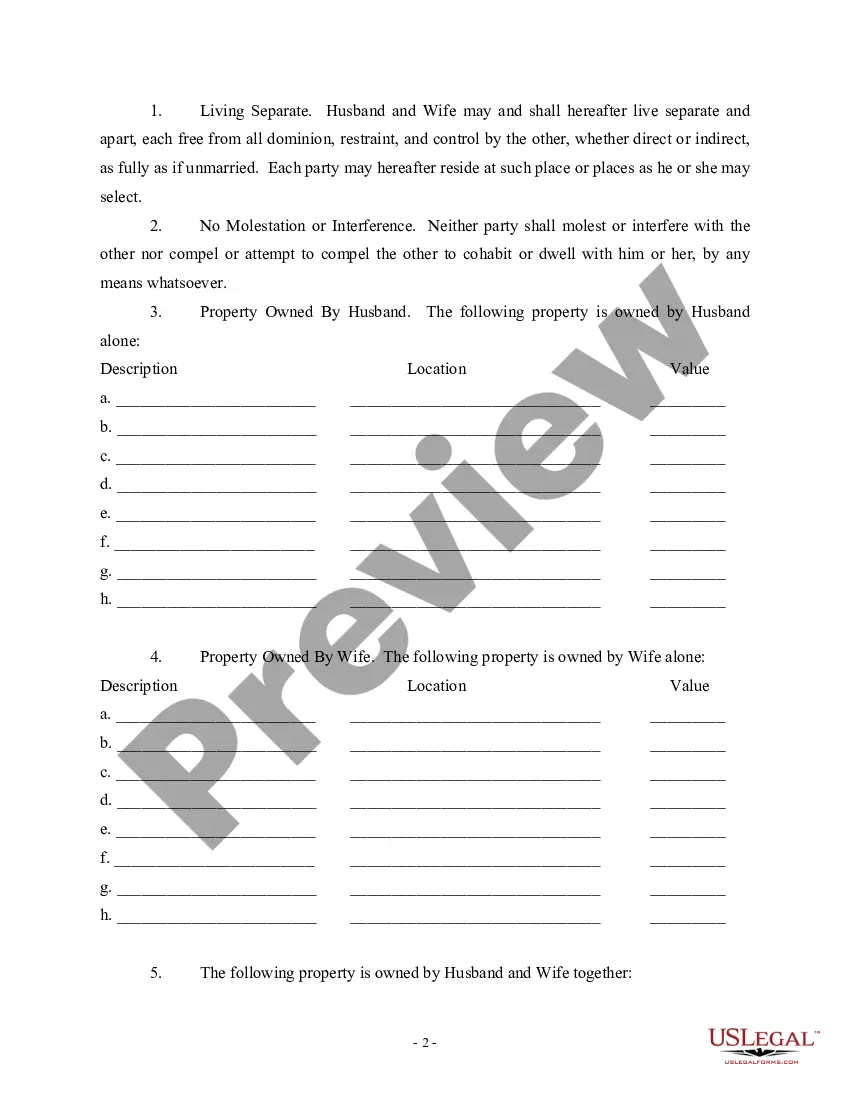

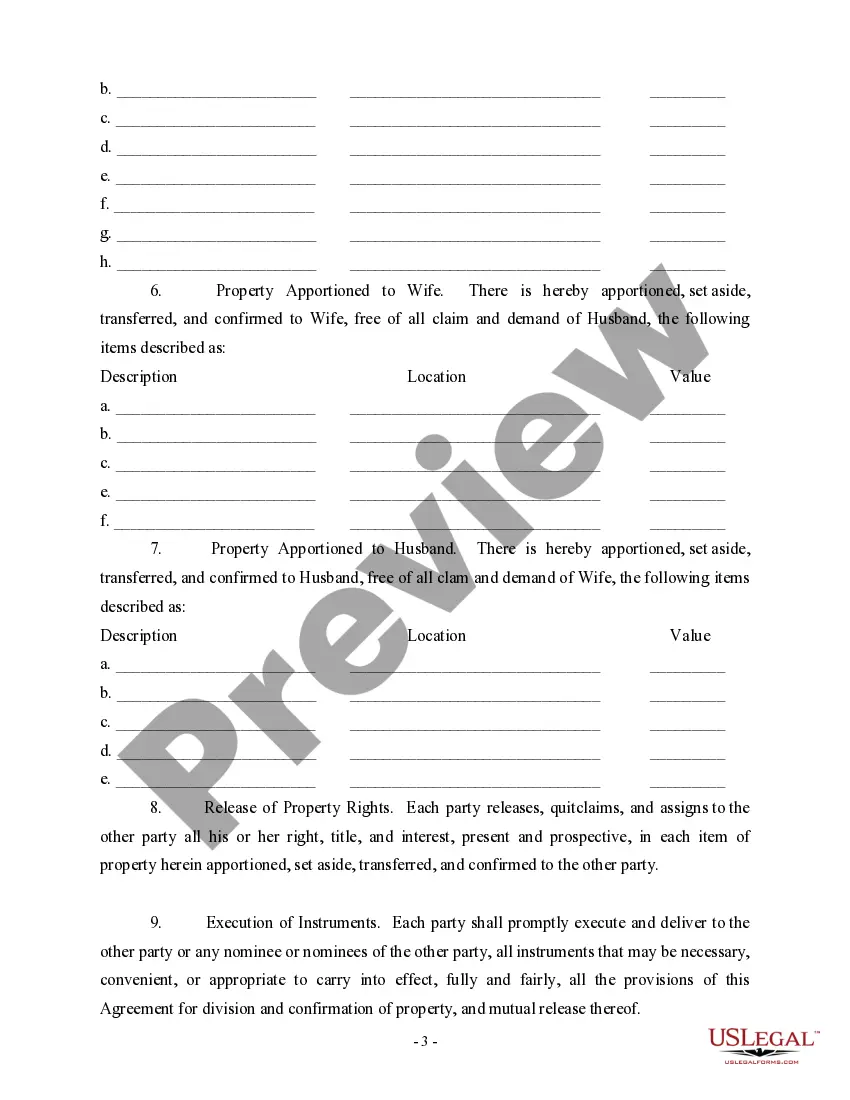

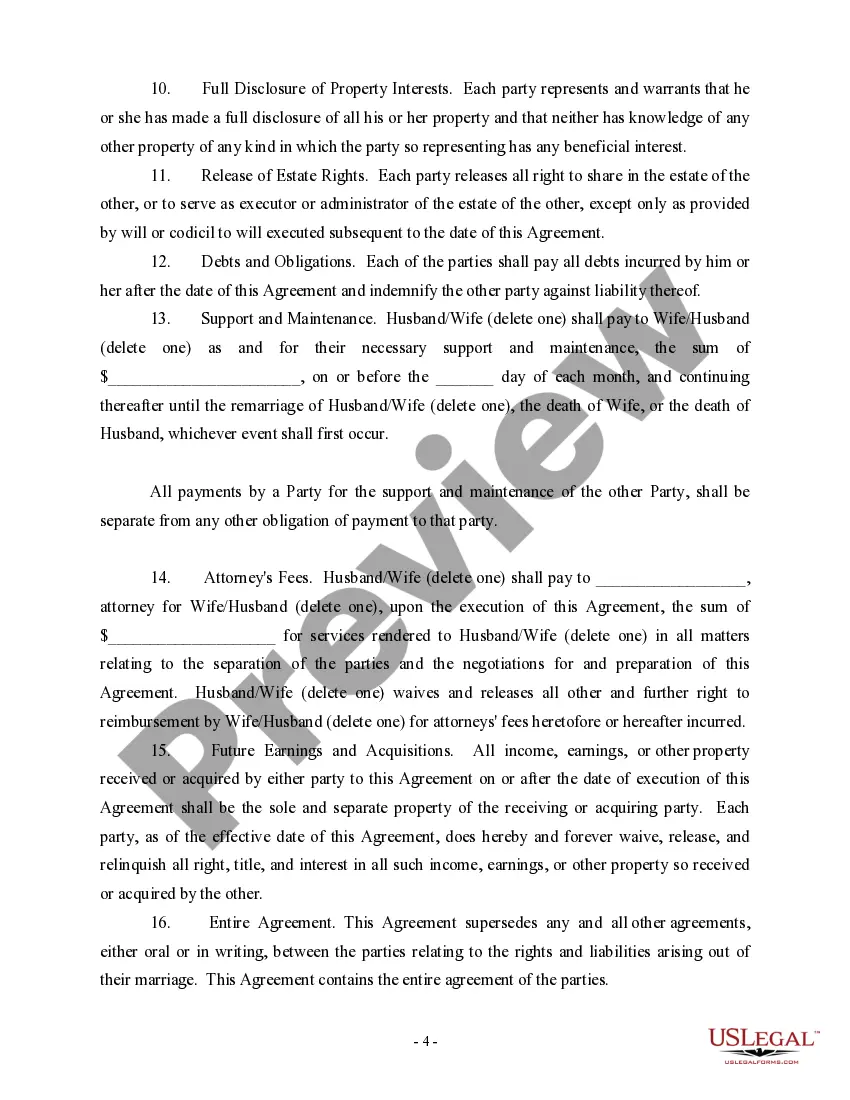

A marital separation agreement, also known as a property settlement agreement, is a written contract dividing your property, spelling out your rights, and settling problems such as alimony and custody.

In some states, couples can stay legally separated indefinitely, but in Indiana, your legal separation can't exceed 12-months, which means that you have one year to decide whether you want to reconcile or file for divorce.

How Long Does a Person Need to Be Married in Indiana to Get a Full Share of Assets in a Divorce? There is no statutory definition for a ?long? marriage in Indiana that would entitle a person to a ?full? share of assets in a divorce.

But the law doesn't say that either spouse must get to keep the family home after divorce. If you and your spouse can't agree on what to do with your house, the judge will make a decision based on the specific circumstances in your case.

A legal separation is more formal than just moving apart though. You would need to get a court to approve your decision and put together a legal separation agreement. This is an agreement that divides property, sets an arrangement for raising your children, and ends the financial connection you have to your spouse.

To proceed with a legal separation, the court must agree that the conditions of the marriage make it intolerable for the parties to continue to cohabitate. The court must also find that the marriage should be maintained.

Property Division in Indiana Even though Indiana law doesn't recognize community property, it does require courts to determine an "equitable property division." More specifically, property is divided in a "just and reasonable" manner. In most cases, this means that each spouse gets about half of everything they own.