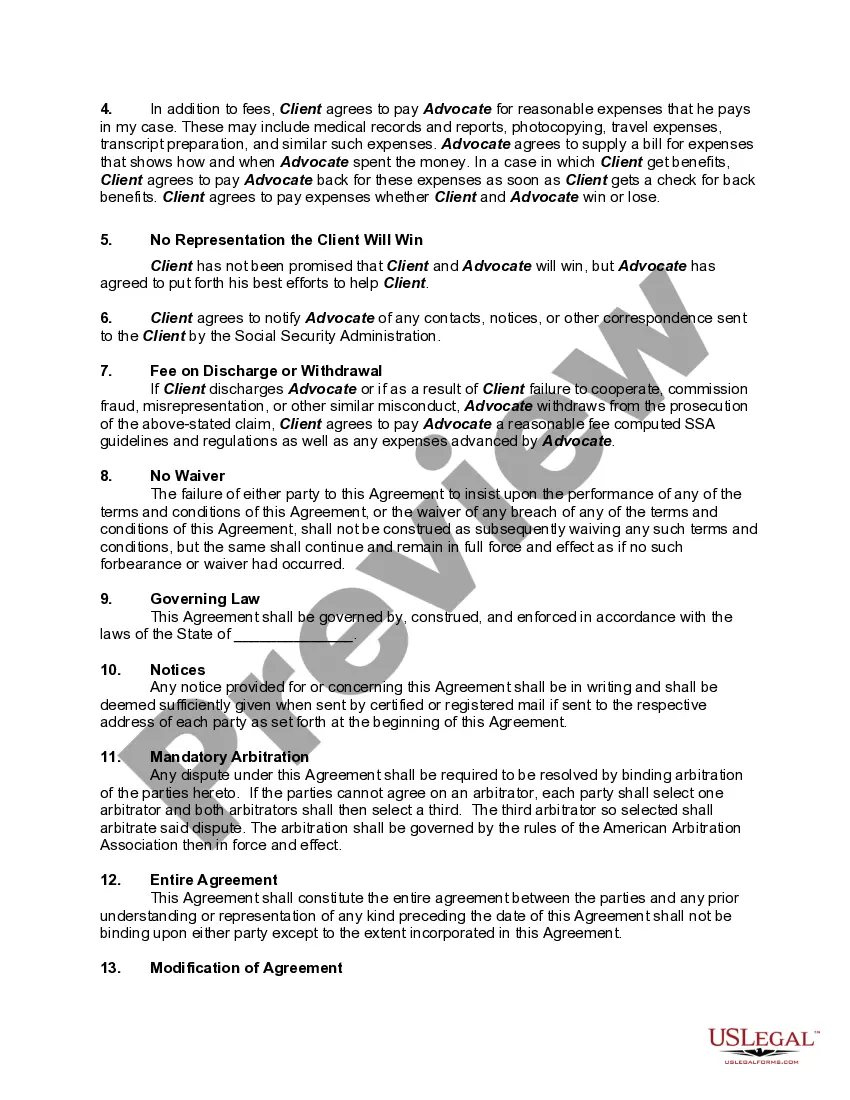

A Disability Advocate, also known as a Disability Consultant or non-attorney Representative, is a specially trained individual who assists others who are applying for Social Security disability benefits.

The duties of a Disability Advocate involve the execution of both formal and informal procedures on behalf of an applicant for Social Security disability benefits. These actions include, but are not limited to, the assessment of a case to determine the approximate percent chance of winning, and the development of a case by requesting copies of the client's medical records. By law, Social Security must consider the advocate's argument before making a final decision. If the advocate's argument is properly structured and supported by the evidence, it can greatly enhance the client's chances of winning benefits.