A promoter is a person who starts up a business, particularly a corporation, including the financing. The formation of a corporation starts with an idea. Preincorporation activities transform this idea into an actual corporation. The individual who carries on these preincorporation activities is called a promoter. Usually the promoter is the main shareholder or one of the management team and receives stock for his/her efforts in organization. Most states limit the amount of "promotional stock" since it is supported only by effort and not by assets or cash. If preincorporation contracts are executed by the promoter in his/her own name and there is no further action, the promoter is personally liable on them, and the corporation is not.

Under the Federal Securities Act of 1933, a pre-organization certificate or subscription is included in the definition of a security. Therefore, a contract to issue securities in the future is itself a contract for the sale of securities. In order to secure an exemption, all stock subscription agreements involving intrastate offerings should contain representations by the purchasers that they are bona fide residents of the state of which the issuer is a resident and that they are purchasing the securities for their own account and not with the view to reselling them to nonresidents. A stock transfer restriction running for a period of at least one year or for nine months after the last sale of the issue by the issuer is customarily included to insure that securities have not only been initially sold to residents, but have "come to rest" in the hands of residents.

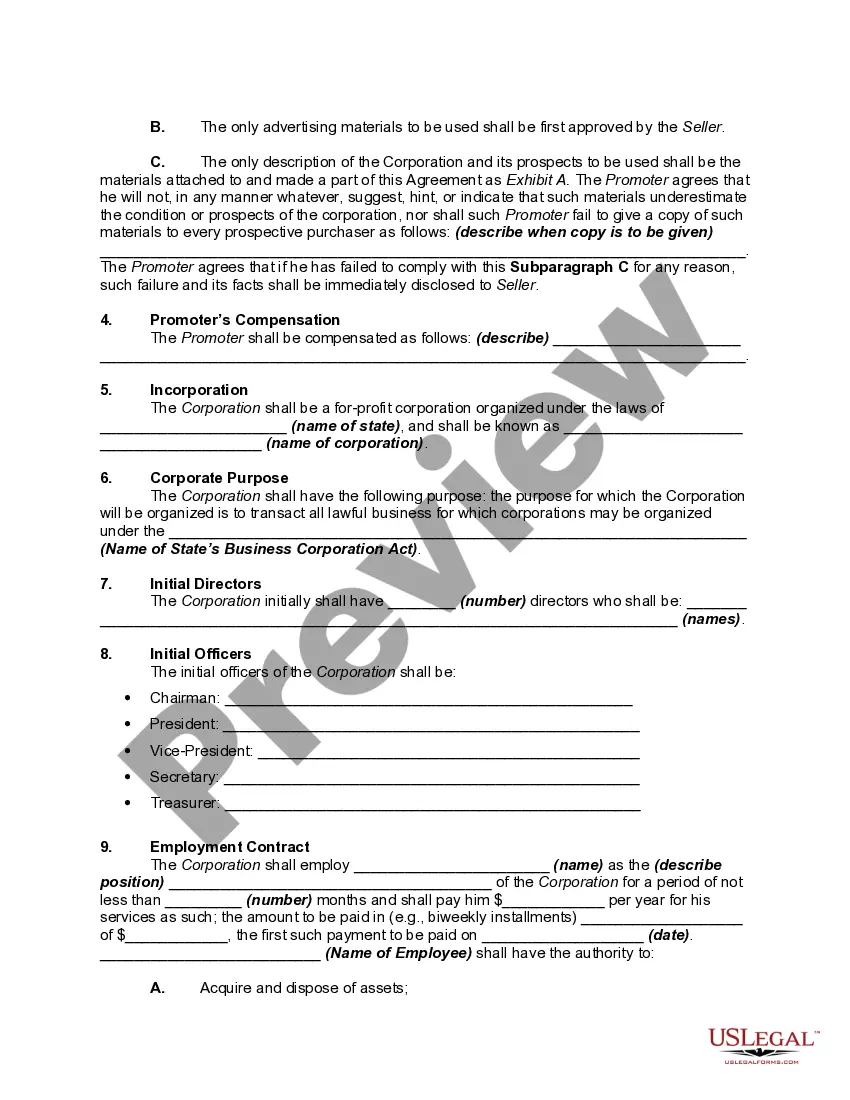

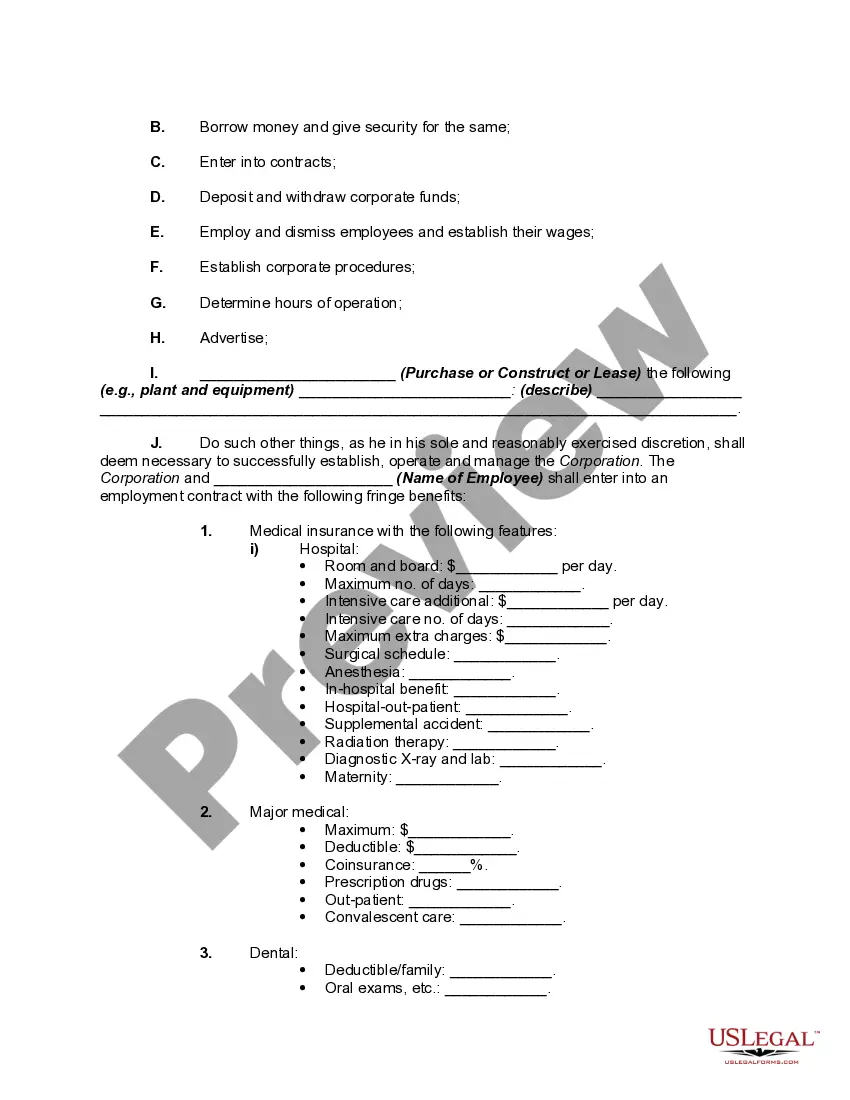

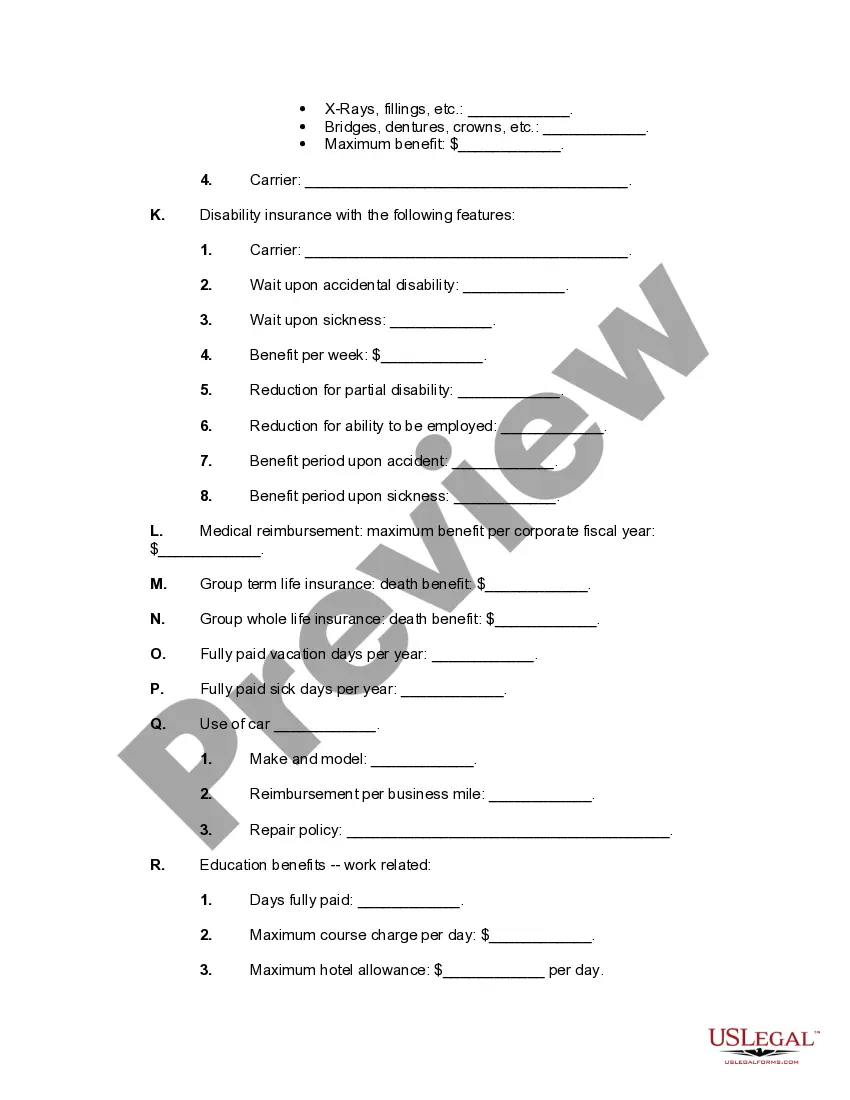

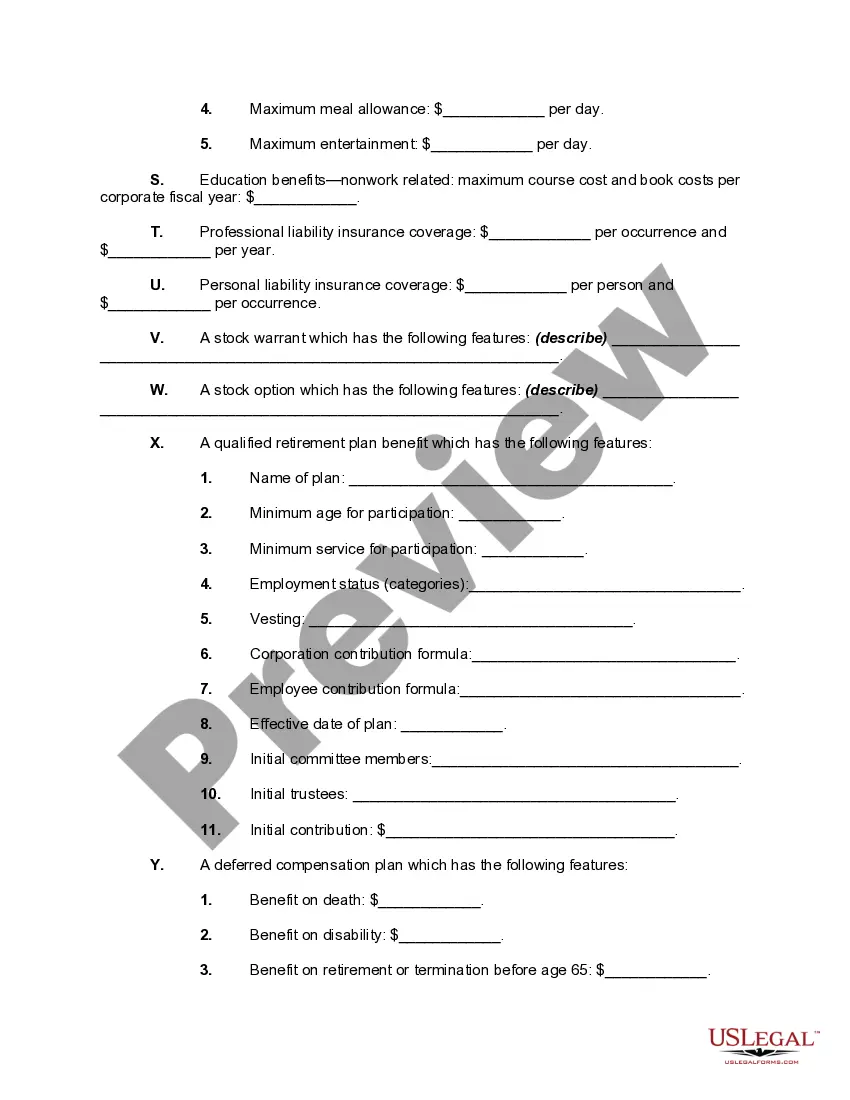

The Indiana Preincorporation Agreement between Incorporates and Promoters is a legal document that outlines the terms and conditions agreed upon by the individuals forming a corporation in the state of Indiana. This agreement serves as a roadmap for the formation and organization of the corporation before its official incorporation. It establishes the roles, rights, and obligations of both the incorporates and promoters involved in the process. Keywords: Indiana, Preincorporation Agreement, Incorporates, Promoters, corporation, legal document, formation, organization, incorporation, roles, rights, obligations. Types of Indiana Preincorporation Agreements between Incorporates and Promoters: 1. Basic Preincorporation Agreement: This is the most common type of agreement used by incorporates and promoters in Indiana. It covers fundamental aspects such as the name of the corporation, its purpose, initial capital contributions from each incorporated, and the allocation of shares among incorporates. 2. Investment Preincorporation Agreement: This type of agreement is utilized when there are outside investors involved in the formation of the corporation. It outlines the terms and conditions of the investment, including the amount contributed, the ownership percentages allocated to the investors, and any required shareholder rights or privileges. 3. Non-disclosure and Non-compete Preincorporation Agreement: In certain situations, incorporates and promoters may enter into this type of agreement to protect confidential information and prevent competition. It ensures that the parties involved will not disclose any sensitive business information or engage in activities that could harm the corporation's interests during the preincorporation phase. 4. Management and Operational Preincorporation Agreement: This agreement focuses on establishing the management and operational structure of the corporation before its formal incorporation. It defines the roles and responsibilities of each incorporated in terms of decision-making, daily operations, and financial management. 5. Exit Strategy Preincorporation Agreement: Incorporates and promoters may choose to create an exit strategy agreement to pre-emptively address the eventual departure of any party involved. It outlines the terms and conditions surrounding the sale or transfer of shares, rights of first refusal, buyback options, and other exit-related matters. These types of Indiana Preincorporation Agreements provide clarity and security to the incorporates and promoters, ensuring a smooth transition from the initial stages of forming a corporation to its eventual incorporation. It is essential for all parties involved to consult with legal professionals to draft comprehensive and tailored agreements, addressing specific needs and circumstances.The Indiana Preincorporation Agreement between Incorporates and Promoters is a legal document that outlines the terms and conditions agreed upon by the individuals forming a corporation in the state of Indiana. This agreement serves as a roadmap for the formation and organization of the corporation before its official incorporation. It establishes the roles, rights, and obligations of both the incorporates and promoters involved in the process. Keywords: Indiana, Preincorporation Agreement, Incorporates, Promoters, corporation, legal document, formation, organization, incorporation, roles, rights, obligations. Types of Indiana Preincorporation Agreements between Incorporates and Promoters: 1. Basic Preincorporation Agreement: This is the most common type of agreement used by incorporates and promoters in Indiana. It covers fundamental aspects such as the name of the corporation, its purpose, initial capital contributions from each incorporated, and the allocation of shares among incorporates. 2. Investment Preincorporation Agreement: This type of agreement is utilized when there are outside investors involved in the formation of the corporation. It outlines the terms and conditions of the investment, including the amount contributed, the ownership percentages allocated to the investors, and any required shareholder rights or privileges. 3. Non-disclosure and Non-compete Preincorporation Agreement: In certain situations, incorporates and promoters may enter into this type of agreement to protect confidential information and prevent competition. It ensures that the parties involved will not disclose any sensitive business information or engage in activities that could harm the corporation's interests during the preincorporation phase. 4. Management and Operational Preincorporation Agreement: This agreement focuses on establishing the management and operational structure of the corporation before its formal incorporation. It defines the roles and responsibilities of each incorporated in terms of decision-making, daily operations, and financial management. 5. Exit Strategy Preincorporation Agreement: Incorporates and promoters may choose to create an exit strategy agreement to pre-emptively address the eventual departure of any party involved. It outlines the terms and conditions surrounding the sale or transfer of shares, rights of first refusal, buyback options, and other exit-related matters. These types of Indiana Preincorporation Agreements provide clarity and security to the incorporates and promoters, ensuring a smooth transition from the initial stages of forming a corporation to its eventual incorporation. It is essential for all parties involved to consult with legal professionals to draft comprehensive and tailored agreements, addressing specific needs and circumstances.