A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

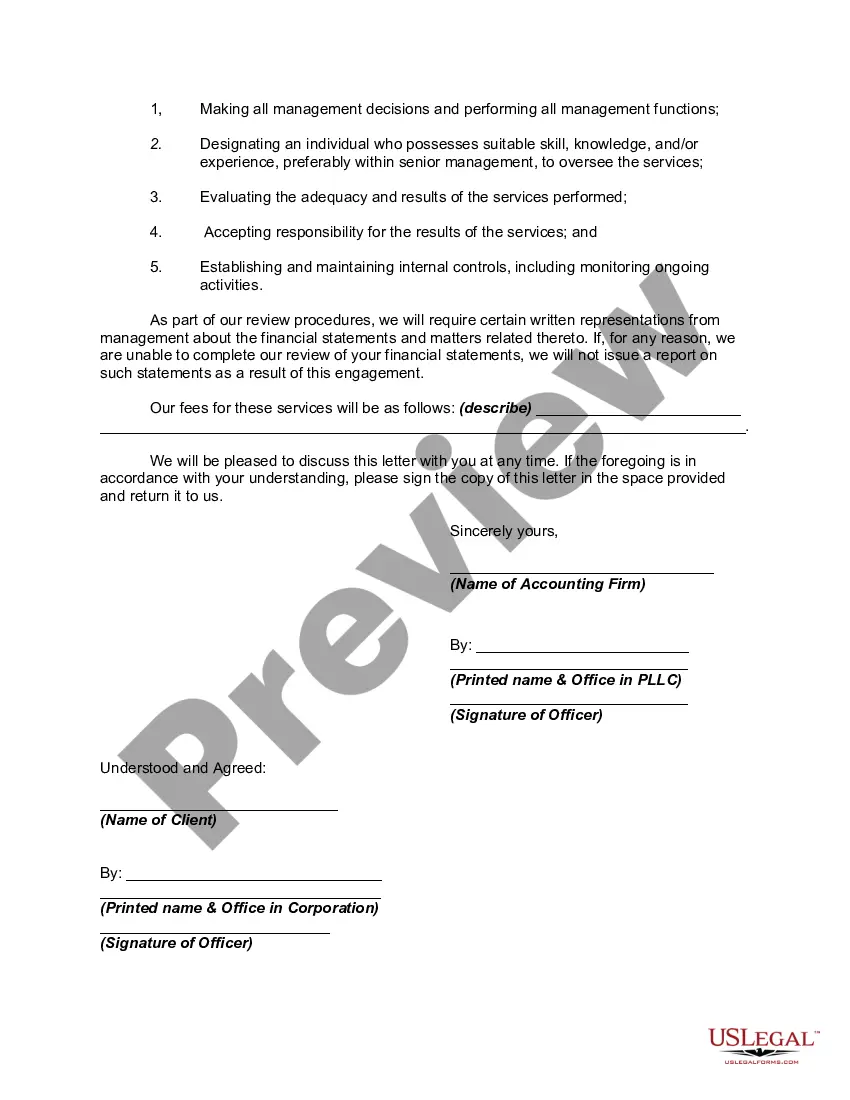

An Indiana Engagement Letter for Review of Financial Statements by an Accounting Firm is a legal document that outlines the terms and conditions under which an accounting firm will perform a review of an entity's financial statements in accordance with Generally Accepted Accounting Principles (GAAP). This letter serves as a contract between the accounting firm and the client, defining the scope and nature of the engagement. The Indiana Engagement Letter for Review of Financial Statements typically includes the following key details: 1. Parties Involved: The letter identifies the accounting firm and the client, including their legal names, addresses, and contact information. 2. Objectives and Scope of Engagement: The letter specifies that the engagement is for the review of financial statements. It outlines that the review will consist of performing analytical procedures and making inquiries to provide limited assurance on the financial statements' conformity with GAAP. It may also clarify that a review is less in-depth than an audit but provides some level of assurance to the readers of the financial statements. 3. Responsibilities of the Accounting Firm: The engagement letter outlines the responsibilities of the accounting firm, including conducting the review in accordance with professional standards, gathering sufficient evidence, and assessing the reasonableness of the financial statements. 4. Responsibilities of the Client: The letter highlights the client's responsibilities in providing accurate and complete financial records, making all necessary disclosures, and granting the accounting firm access to relevant documents and information. 5. Reporting: The letter describes that the outcome of the review will be reported in a formal letter to management containing the accounting firm's findings and conclusions. It may also specify that the accounting firm is not expressing an opinion on the financial statements but is providing limited assurance. In Indiana, there may be variations of the Engagement Letter for Review of Financial Statements based on the specific circumstances of the engagement. Some potential types may include: 1. General Engagement Letter for Review of Financial Statements: This is the standard engagement letter used for most clients requiring a review of their financial statements. 2. Engagement Letter for Review of Financial Statements in Compliance with Industry Regulations: This type of engagement letter is tailored to clients operating in specific industries that have additional reporting requirements or regulatory guidelines. 3. Engagement Letter for Review of Group Financial Statements: This variation is used when reviewing the financial statements of a group of companies, necessitating additional considerations such as consolidation and intercompany transactions. 4. Engagement Letter for Review of Financial Statements for Nonprofit Organizations: Designed specifically for nonprofit organizations, this engagement letter may include references to applicable accounting standards and regulatory requirements unique to the nonprofit sector. It is important to note that the types and variations of engagement letters may vary across accounting firms based on their specific templates and customization options.An Indiana Engagement Letter for Review of Financial Statements by an Accounting Firm is a legal document that outlines the terms and conditions under which an accounting firm will perform a review of an entity's financial statements in accordance with Generally Accepted Accounting Principles (GAAP). This letter serves as a contract between the accounting firm and the client, defining the scope and nature of the engagement. The Indiana Engagement Letter for Review of Financial Statements typically includes the following key details: 1. Parties Involved: The letter identifies the accounting firm and the client, including their legal names, addresses, and contact information. 2. Objectives and Scope of Engagement: The letter specifies that the engagement is for the review of financial statements. It outlines that the review will consist of performing analytical procedures and making inquiries to provide limited assurance on the financial statements' conformity with GAAP. It may also clarify that a review is less in-depth than an audit but provides some level of assurance to the readers of the financial statements. 3. Responsibilities of the Accounting Firm: The engagement letter outlines the responsibilities of the accounting firm, including conducting the review in accordance with professional standards, gathering sufficient evidence, and assessing the reasonableness of the financial statements. 4. Responsibilities of the Client: The letter highlights the client's responsibilities in providing accurate and complete financial records, making all necessary disclosures, and granting the accounting firm access to relevant documents and information. 5. Reporting: The letter describes that the outcome of the review will be reported in a formal letter to management containing the accounting firm's findings and conclusions. It may also specify that the accounting firm is not expressing an opinion on the financial statements but is providing limited assurance. In Indiana, there may be variations of the Engagement Letter for Review of Financial Statements based on the specific circumstances of the engagement. Some potential types may include: 1. General Engagement Letter for Review of Financial Statements: This is the standard engagement letter used for most clients requiring a review of their financial statements. 2. Engagement Letter for Review of Financial Statements in Compliance with Industry Regulations: This type of engagement letter is tailored to clients operating in specific industries that have additional reporting requirements or regulatory guidelines. 3. Engagement Letter for Review of Group Financial Statements: This variation is used when reviewing the financial statements of a group of companies, necessitating additional considerations such as consolidation and intercompany transactions. 4. Engagement Letter for Review of Financial Statements for Nonprofit Organizations: Designed specifically for nonprofit organizations, this engagement letter may include references to applicable accounting standards and regulatory requirements unique to the nonprofit sector. It is important to note that the types and variations of engagement letters may vary across accounting firms based on their specific templates and customization options.