Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and individual purposes, categorized by type, state, or keywords. You can find the latest iterations of forms such as the Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping in mere seconds.

If you are already a member, Log In to retrieve the Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping from the US Legal Forms library. The Download option will be available on every form you view. You will have access to all previously downloaded forms from the My documents section of your account.

Complete the purchase. Utilize your credit card or PayPal account to finalize the transaction.

Download the format and save the form to your device. Make edits. Complete, modify, print, and sign the downloaded Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. Each template you add to your account does not expire and belongs to you permanently. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping through US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or individual requirements.

- If you are using US Legal Forms for the first time, follow these simple instructions to get started.

- Ensure you have selected the correct form for your location/county.

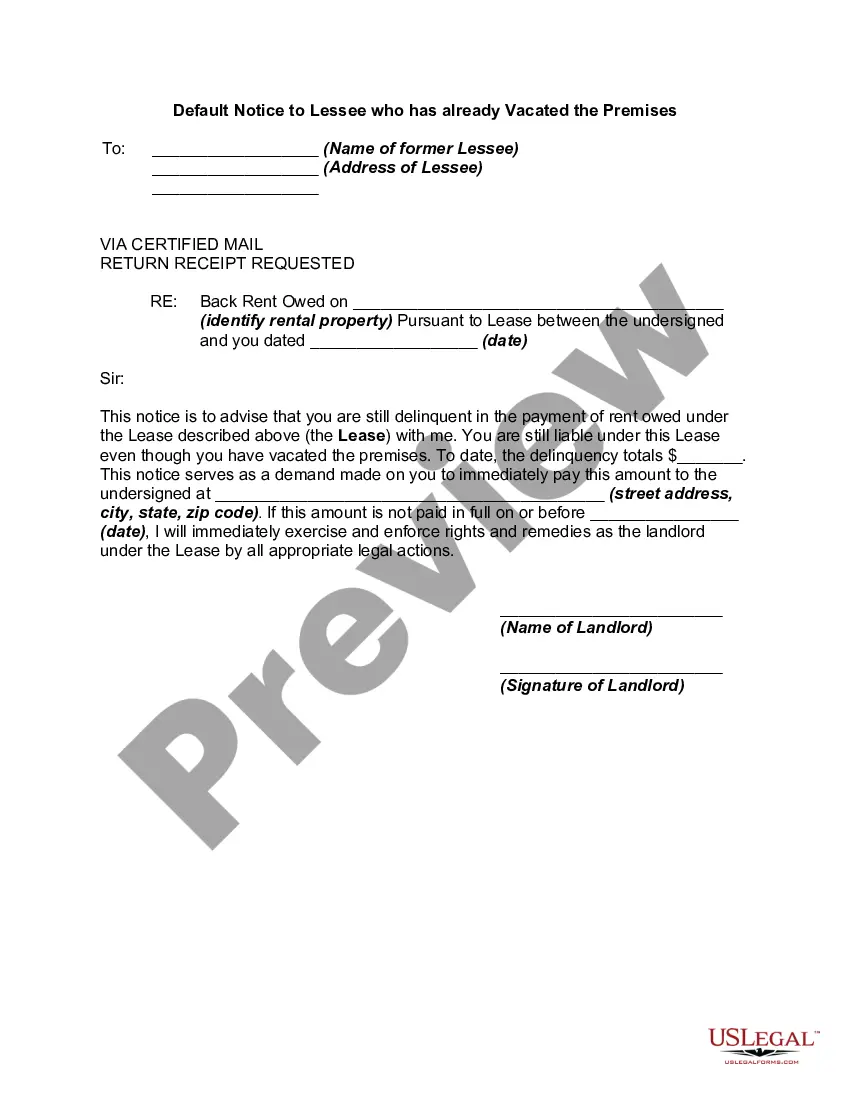

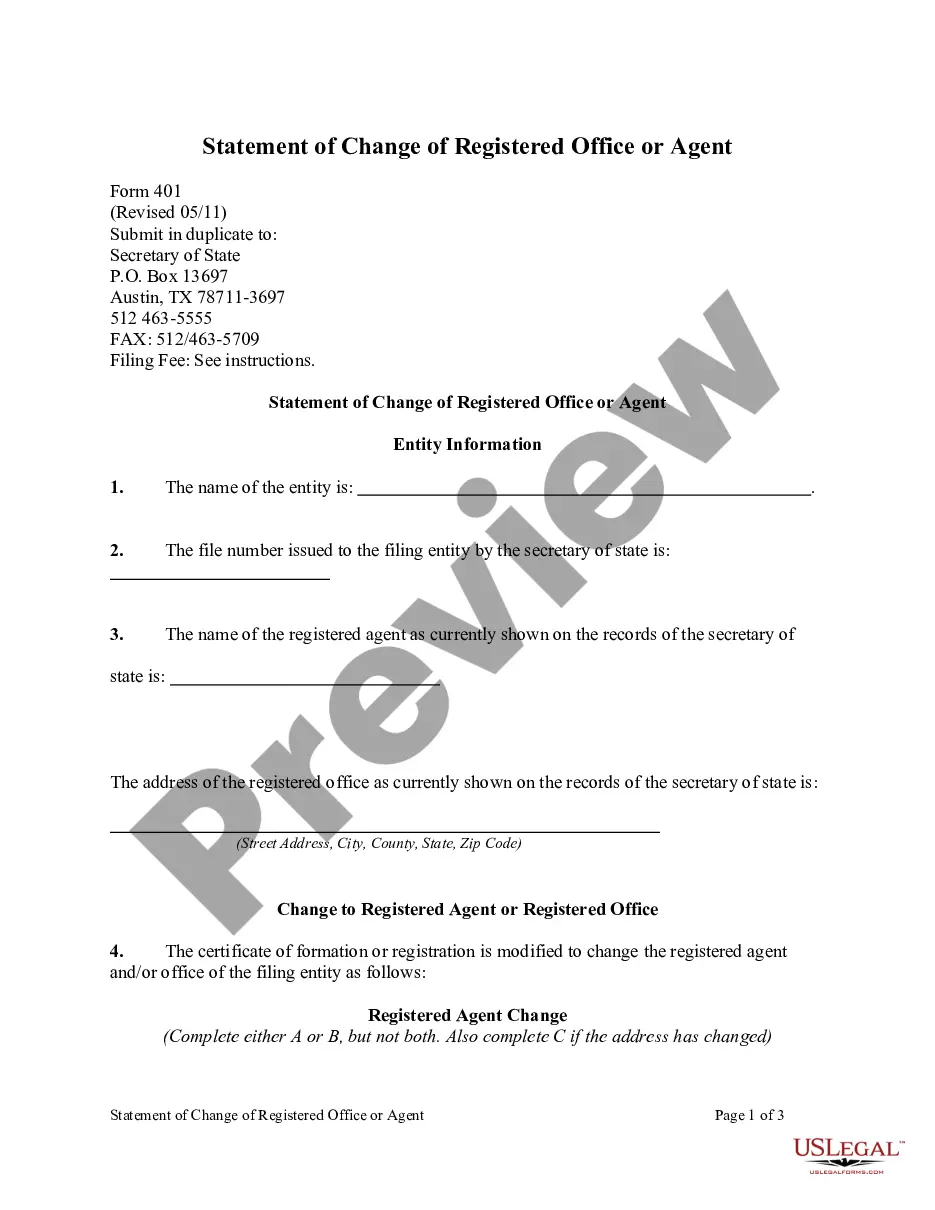

- Click the Preview option to review the content of the form.

- Examine the form details to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your choice by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

A consultancy agreement typically includes sections that outline the services provided, payment arrangements, and confidentiality clauses. It often features a clear timeline for deliverables and responsibilities of both the consultant and client. You can find samples of an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping that demonstrate best practices and effective structures.

Consultants should ideally have a consulting agreement that lays out the specifics of their relationship with the client. This agreement should encompass the services offered, confidentiality obligations, payment details, and termination conditions. An Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping serves as a comprehensive model that addresses these elements effectively.

Creating a consulting agreement involves identifying both parties and clearly defining the consulting services required. You should also determine payment rates, deadlines, and any necessary terms for confidentiality or indemnification. To ensure compliance and thoroughness, consider utilizing an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping for guidance and structure.

A consulting agreement is a contract between a consultant and a client that details the services to be provided, payment structures, and the responsibilities of each party. This document helps to protect both parties by clarifying expectations and limits. Specifically, an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping defines essential terms that pertain to consulting services in these specialized areas.

To write a simple consulting agreement, begin by outlining the key components, such as the scope of work, payment terms, and duration of the agreement. You should also include confidentiality clauses and specify any deliverables expected from the consultant. Using an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can streamline this process, ensuring that all crucial elements are included.

A contract for provision of accounting services is a formal agreement that outlines the relationship between an accountant and their client, focusing on the financial services to be rendered. This includes specific commitments, such as bookkeeping, audits, and tax advising, while also detailing payment terms and project milestones. Engaging in an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can streamline this relationship and clarify expectations on both ends.

Yes, there are government contracts available specifically for accounting services. Many local, state, and federal agencies require accounting expertise to maintain compliance and manage budgets. Tapping into these opportunities as an accounting consultant can diversify your services and enhance your firm’s presence within the market, especially when guided by an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping.

A contract for the provision of services serves as a formal agreement between a service provider and a client. This document clarifies what services will be provided, how they will be delivered, and the items required to fulfill those duties. Utilizing an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can help ensure all legal aspects are handled appropriately, providing peace of mind for both parties.

To structure a consulting agreement effectively, begin by defining the scope of work, including specific services and deliverables. Next, address the terms of payment, project timelines, and confidentiality clauses. Be sure to incorporate an Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping that clearly states all responsibilities to prevent misunderstandings and ensure clarity.

The contract for provision of accounting services outlines the terms and expectations between the accountant and the client. This document typically includes details about the specific services offered, fees, timelines, confidentiality, and any responsibilities. Having a well-designed Indiana General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping protects both parties and ensures accountability.