A virtual assistant is like a personal secretary. They provide customer support, write, answer calls, transcribe, do research, etc. They basically work at home and communicate with their Employer through the Internet or through phone. One method many companies take to maximize the likelihood of having a positive experience in retaining a virtual assistant is by going through a virtual staffing agency. These virtual staffing agencies operate similarly to conventional staffing agencies.

Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee

Description

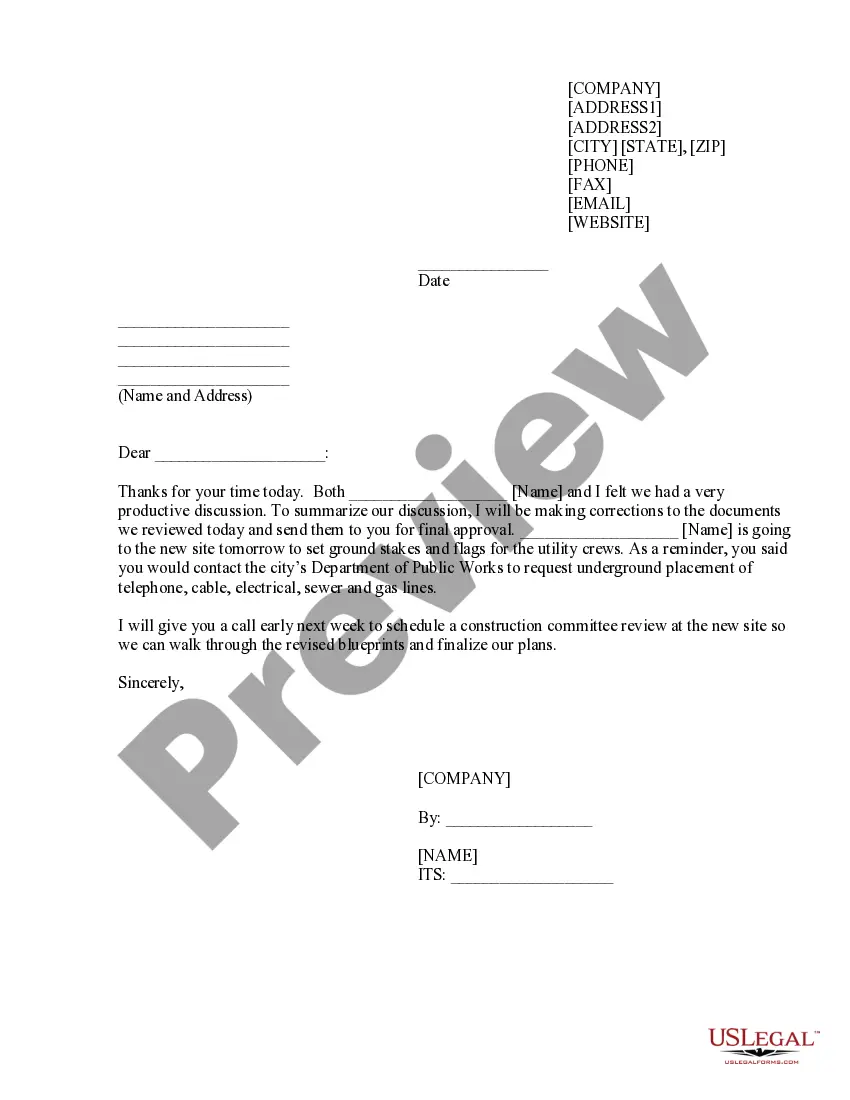

How to fill out Placement Contract Between Virtual Staffing Agency And Virtual Employee?

Are you presently in a location where you occasionally need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of templates, such as the Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee, which can be filled out to comply with state and federal regulations.

Once you find the correct document, click Get Now.

Select the pricing plan you want, enter the required information to create your account, and process your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Next, you can download the Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the right document.

- If the document isn't what you're looking for, use the Search box to locate the template that meets your needs.

Form popularity

FAQ

Gig workers are typically considered independent contractors. This classification allows gig workers to take on various short-term projects with different employers. An Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can help outline the expectations and responsibilities of gig workers, ensuring that both sides understand their commitments. This clarity can lead to smoother working relationships and fewer misunderstandings.

Virtual assistants are usually regarded as independent contractors. This distinction allows them greater flexibility in their work arrangements and how they manage their projects. The Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee provides a thorough framework outlining the terms of engagement for both parties, making it a vital tool for defining the relationship. It's essential to clarify the terms to avoid confusion.

Yes, starting a staffing agency in Indiana generally requires a business license. Additionally, you must comply with local and state regulations. Utilizing an Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can guide your hiring practices and help maintain compliance. Consider researching the specific requirements for your business model to ensure you meet all legal obligations.

Virtual assistants are commonly categorized as independent contractors rather than employees. This classification grants them autonomy over their work and the ability to serve multiple clients simultaneously. An Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can establish the terms of this relationship, protecting both the staffing agency and the virtual employee. It is important to clarify these roles to avoid potential legal issues.

Yes, many virtual assistants work as freelancers. This setup allows them the flexibility to choose their clients and manage their own schedules. The Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can formalize these freelance arrangements, ensuring both parties are clear on expectations. Freelancing can be rewarding for those who enjoy independent work.

Yes, virtual assistants typically receive a 1099 form if they are classified as independent contractors. This means they are responsible for reporting their income and paying any taxes owed. Using an Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can help clarify financial responsibilities. Always consult a tax professional for tailored advice.

Yes, a virtual assistant can serve as a contractor if you establish a working relationship that allows them to operate independently. They should have control over how they complete their tasks, without direct oversight. Clearly defining the terms in an Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee will help formalize this arrangement, ensuring both parties understand their rights and responsibilities.

To procure a contract for your staffing agency, you can either draft one from scratch or utilize pre-existing templates tailored to your needs. Platforms like uslegalforms provide customizable templates that can simplify the process. Look for agreements that focus on the Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee, as this ensures compliance with local laws and practices in Indiana.

Whether a virtual assistant counts as an employee depends on your working relationship. If you dictate their tasks, provide direction, and set their working hours, they likely qualify as an employee. However, if they operate independently and manage their own workspace, they may be classified as an independent contractor. Utilizing an Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can help clarify this classification.

Remote workers may fall into either category of employees or independent contractors, depending on their work arrangements. Employees usually work under direct supervision with set hours, while independent contractors perform tasks on their terms. The classification affects taxation, benefits, and legal obligations. Therefore, understanding the nuances can be crucial, and an Indiana Placement Contract between Virtual Staffing Agency and Virtual Employee can help define these roles clearly.