Title: Understanding Indiana Miller Trust Forms for Assisted Living: Types and Uses Introduction: When it comes to financing assisted living expenses for individuals who require long-term care, Indiana Miller Trust forms play a crucial role. In this article, we will explore the concept of Miller Trusts and delve into the various types and uses specifically related to assisted living. By understanding the benefits and requirements of these forms, individuals and families can make informed decisions about managing their financial affairs. Keywords: Indiana Miller Trust, assisted living, financing, long-term care, forms, benefits, requirements, financial affairs. 1. What is an Indiana Miller Trust? — An Indiana Miller Trust is a specialized trust established under Medicaid rules to help individuals qualify for long-term care assistance. — It allows individuals with excess income to redirect their funds into a trust, called a Miller Trust, to meet Medicaid eligibility criteria. 2. Types of Indiana Miller Trust Forms for Assisted Living: a) Traditional Miller Trust: — Also knowAANaaaaaaaaan a "Income-Only Trust," this type of Miller Trust is used when an individual's income exceeds the Medicaid eligibility limit. — The excess income is deposited into the trust, which then pays for the individual's assisted living expenses. b) Pooled Miller Trust: — This type of trust is managed by a nonprofit organization that combines the assets and funds of multiple individuals into a single trust. — Individuals can contribute their excess income to the pooled trust, and the trust administrator handles the disbursement of funds for their assisted living costs. c) Community Spouse Miller Trust (CST): — This trust is specifically designed for married couples when one spouse requires assisted living while the other remains at home. ThistleMT protects the income of the spouse staying at home, ensuring they can maintain their financial stability and standard of living. 3. Uses and Benefits of Indiana Miller Trust Forms for Assisted Living: a) Qualifying for Medicaid: — By redirecting excess income into a Miller Trust, individuals can meet Medicaid's income limit requirements, ensuring they can receive financial assistance for assisted living costs. b) Preserving Family Assets: — Setting up a Miller Trust can help individuals protect their personal assets from being depleted entirely on assisted living expenses. — Instead of spending down assets to qualify for Medicaid, the trust acts as a tool to allocate funds for care, preserving assets for other purposes or future generations. c) Financial Planning Flexibility: — A Miller Trust provides flexibility in managing income and assets, allowing individuals to utilize funds for various assisted living needs such as room and board, medical expenses, or personal care services. d) Peace of Mind: — With a Miller Trust in place, individuals and their families can have peace of mind knowing that financial assistance is available to cover assisted living costs, reducing stress and financial burden. Conclusion: Understanding the different types and uses of Indiana Miller Trust forms is crucial for navigating the complex world of financing assisted living. By leveraging these specialized trusts, individuals can protect their assets, qualify for Medicaid, and maintain financial stability while receiving necessary care. Consulting with professionals who specialize in elder law and estate planning can provide additional guidance in utilizing Miller Trusts effectively. Keywords: Indiana Miller Trust, assisted living, financing, long-term care, forms, benefits, requirements, financial affairs, traditional Miller Trust, pooled Miller Trust, community spouse Miller Trust, Medicaid, income limit, preserving assets, financial planning, peace of mind.

Indiana Miller Trust Forms for Assisted Living

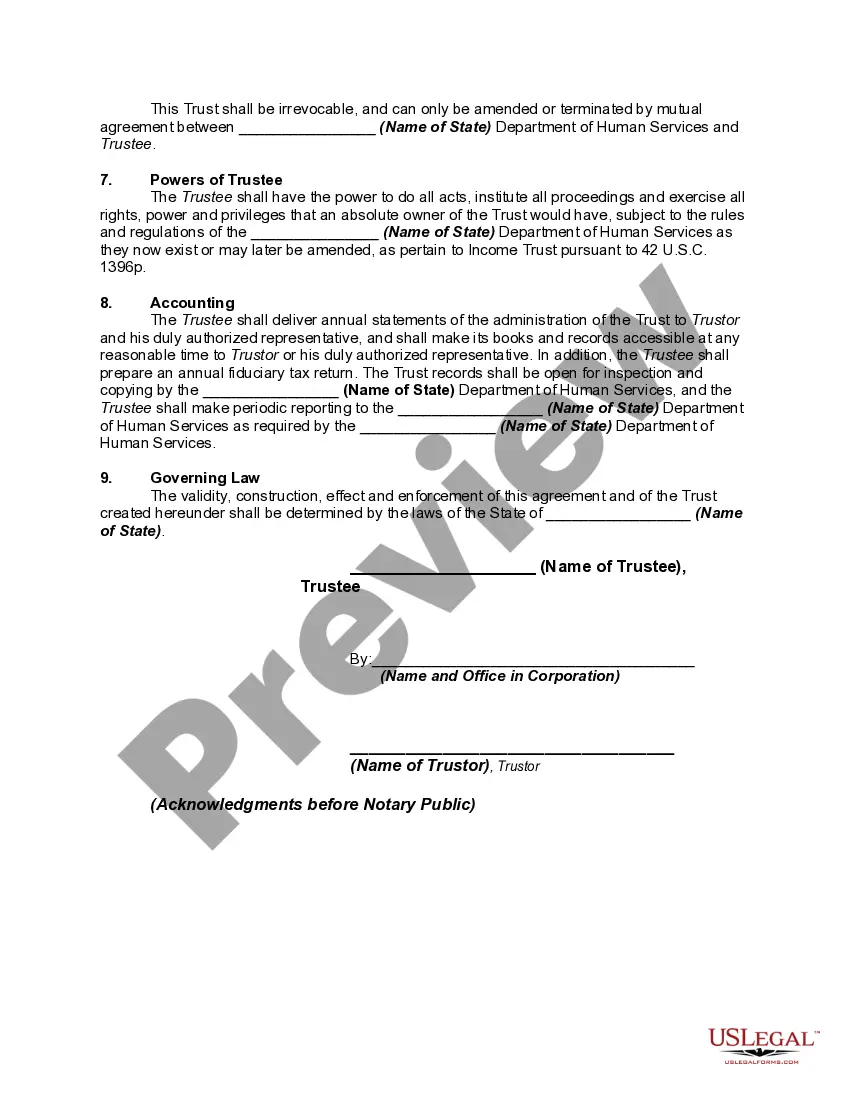

Description

How to fill out Indiana Miller Trust Forms For Assisted Living?

If you want to full, obtain, or printing legitimate papers templates, use US Legal Forms, the greatest collection of legitimate types, that can be found on the web. Take advantage of the site`s basic and hassle-free search to find the paperwork you need. Numerous templates for business and specific uses are categorized by types and states, or search phrases. Use US Legal Forms to find the Indiana Miller Trust Forms for Assisted Living in a few clicks.

If you are previously a US Legal Forms customer, log in in your bank account and click the Download option to find the Indiana Miller Trust Forms for Assisted Living. Also you can gain access to types you previously downloaded from the My Forms tab of your bank account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the correct area/country.

- Step 2. Use the Review solution to look over the form`s content. Do not overlook to read the explanation.

- Step 3. If you are not satisfied with the develop, utilize the Look for field at the top of the display to discover other variations of the legitimate develop format.

- Step 4. Once you have located the shape you need, go through the Get now option. Opt for the costs prepare you choose and add your references to register to have an bank account.

- Step 5. Procedure the transaction. You can use your credit card or PayPal bank account to complete the transaction.

- Step 6. Find the format of the legitimate develop and obtain it on your own device.

- Step 7. Full, edit and printing or sign the Indiana Miller Trust Forms for Assisted Living.

Each legitimate papers format you get is yours permanently. You may have acces to each develop you downloaded in your acccount. Click the My Forms section and select a develop to printing or obtain yet again.

Be competitive and obtain, and printing the Indiana Miller Trust Forms for Assisted Living with US Legal Forms. There are millions of skilled and status-certain types you can use for your personal business or specific demands.