Title: Understanding Indiana Miller Trust Forms for Assisted Living: Types and Uses Introduction: When it comes to financing assisted living expenses for individuals who require long-term care, Indiana Miller Trust forms play a crucial role. In this article, we will explore the concept of Miller Trusts and delve into the various types and uses specifically related to assisted living. By understanding the benefits and requirements of these forms, individuals and families can make informed decisions about managing their financial affairs. Keywords: Indiana Miller Trust, assisted living, financing, long-term care, forms, benefits, requirements, financial affairs. 1. What is an Indiana Miller Trust? — An Indiana Miller Trust is a specialized trust established under Medicaid rules to help individuals qualify for long-term care assistance. — It allows individuals with excess income to redirect their funds into a trust, called a Miller Trust, to meet Medicaid eligibility criteria. 2. Types of Indiana Miller Trust Forms for Assisted Living: a) Traditional Miller Trust: — Also knowAANaaaaaaaaan a "Income-Only Trust," this type of Miller Trust is used when an individual's income exceeds the Medicaid eligibility limit. — The excess income is deposited into the trust, which then pays for the individual's assisted living expenses. b) Pooled Miller Trust: — This type of trust is managed by a nonprofit organization that combines the assets and funds of multiple individuals into a single trust. — Individuals can contribute their excess income to the pooled trust, and the trust administrator handles the disbursement of funds for their assisted living costs. c) Community Spouse Miller Trust (CST): — This trust is specifically designed for married couples when one spouse requires assisted living while the other remains at home. ThistleMT protects the income of the spouse staying at home, ensuring they can maintain their financial stability and standard of living. 3. Uses and Benefits of Indiana Miller Trust Forms for Assisted Living: a) Qualifying for Medicaid: — By redirecting excess income into a Miller Trust, individuals can meet Medicaid's income limit requirements, ensuring they can receive financial assistance for assisted living costs. b) Preserving Family Assets: — Setting up a Miller Trust can help individuals protect their personal assets from being depleted entirely on assisted living expenses. — Instead of spending down assets to qualify for Medicaid, the trust acts as a tool to allocate funds for care, preserving assets for other purposes or future generations. c) Financial Planning Flexibility: — A Miller Trust provides flexibility in managing income and assets, allowing individuals to utilize funds for various assisted living needs such as room and board, medical expenses, or personal care services. d) Peace of Mind: — With a Miller Trust in place, individuals and their families can have peace of mind knowing that financial assistance is available to cover assisted living costs, reducing stress and financial burden. Conclusion: Understanding the different types and uses of Indiana Miller Trust forms is crucial for navigating the complex world of financing assisted living. By leveraging these specialized trusts, individuals can protect their assets, qualify for Medicaid, and maintain financial stability while receiving necessary care. Consulting with professionals who specialize in elder law and estate planning can provide additional guidance in utilizing Miller Trusts effectively. Keywords: Indiana Miller Trust, assisted living, financing, long-term care, forms, benefits, requirements, financial affairs, traditional Miller Trust, pooled Miller Trust, community spouse Miller Trust, Medicaid, income limit, preserving assets, financial planning, peace of mind.

Miller Trust Indiana

Description

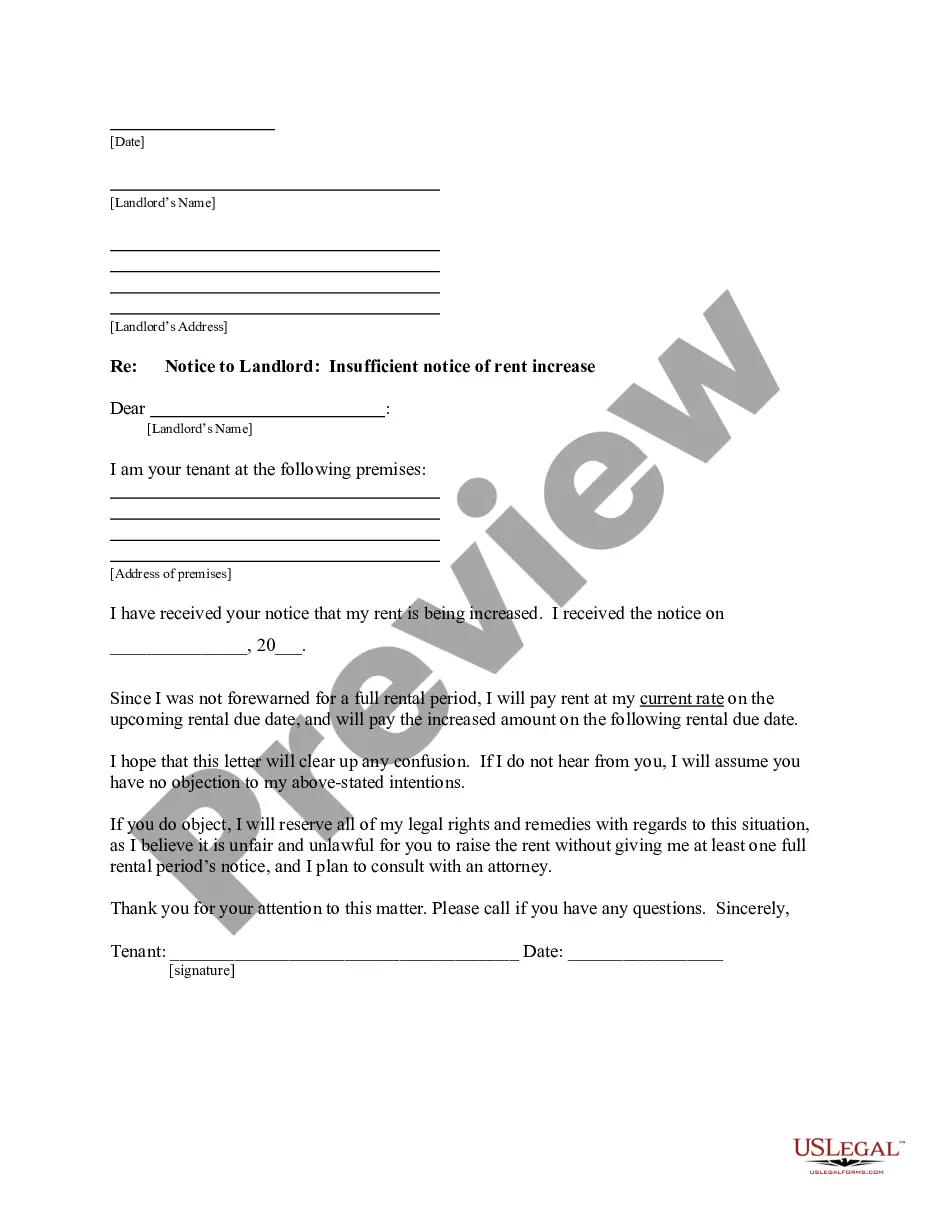

How to fill out Indiana Miller Trust Forms For Assisted Living?

If you seek to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available on the internet.

Take advantage of the site's simple and user-friendly search to locate the documents you require. Various templates for commercial and individual purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Indiana Miller Trust Forms for Assisted Living in just a few clicks.

Each legal document format you acquire is yours indefinitely. You may access every document you downloaded in your account. Click the My documents section and select a document to print or download again.

Be proactive and download, and print the Indiana Miller Trust Forms for Assisted Living with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your personal business or specific needs.

- If you are already a US Legal Forms client, Log In to your account and select the Download button to retrieve the Indiana Miller Trust Forms for Assisted Living.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate area/state.

- Step 2. Use the Review option to examine the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Download the format of the legal document and save it to your device.

- Step 7. Complete, edit, and print or sign the Indiana Miller Trust Forms for Assisted Living.

Form popularity

FAQ

Setting up a Miller's trust in Indiana involves a few straightforward steps. First, you will need to consult with an attorney who specializes in elder law or Medicaid planning to ensure you understand the requirements. After that, you can complete the necessary Indiana Miller Trust Forms for Assisted Living, which dictate how funds are managed to meet Medicaid's eligibility criteria. This trust can help protect your assets while allowing you to benefit from essential services.

If you cannot afford assisted living, several options may be available to you. You could explore financial assistance programs, including Medicaid, which may cover some costs. Additionally, using Indiana Miller Trust Forms for Assisted Living can help manage your assets and potentially qualify you for more aid. Reaching out to local resources can provide guidance on finding the right support for your situation.

Yes, Medicaid can cover assisted living costs in Indiana, though specific requirements must be met. Typically, you must qualify for Medicaid based on income and asset limits. One way to manage asset limits is by using Indiana Miller Trust Forms for Assisted Living, which can allow you to allocate your resources effectively while still receiving necessary support. This option can be crucial for individuals seeking affordability in care.

In Indiana, eligibility for assisted living typically includes adults who need help with daily activities but do not require full nursing care. This often encompasses seniors and individuals with disabilities. To qualify, you may need to demonstrate a functional need for assistance, along with meeting financial criteria. Utilizing Indiana Miller Trust Forms for Assisted Living can help streamline the process of applying for assistance under Medicaid.

You do not necessarily need a lawyer to set up a Miller trust, especially if you utilize Indiana Miller Trust Forms for Assisted Living. The forms provide comprehensive instructions to help you complete the setup. However, having legal guidance can help clarify any uncertainties and ensure compliance with state laws. If you choose to go it alone, double-check all details for accuracy.

A Miller trust in Texas operates similarly to those in Indiana, designed to help individuals qualify for Medicaid. It allows you to bypass income limits for eligibility by transferring excess income into the trust. The trust then pays for your long-term care needs. For the required Indiana Miller Trust Forms for Assisted Living, consult a reliable resource to ensure the correct documents.

To establish a Miller trust, start by obtaining the necessary Indiana Miller Trust Forms for Assisted Living. You will need to gather financial information to determine your eligibility. Once completed, submit the forms to the appropriate state agency. Ensure that the trust meets all legal requirements to effectively manage your assets.

Interesting Questions

More info

Resources Workforce Assisted Living Team Member Resources Member Search Resources.