Indiana Indemnification of Buyer and Seller of Business: A Comprehensive Guide In the state of Indiana, the indemnification of buyer and seller of a business is a crucial component of any business acquisition or sale agreement. This provision aims to protect both parties involved in the transaction by shifting certain potential liabilities and risks from the buyer to the seller. Keywords: Indiana, indemnification, buyer, seller, business, agreement, liabilities, risks, transaction When it comes to Indiana indemnification laws, there are two main types that can apply to buyers and sellers of a business: 1. General Indemnification: This type of indemnification is commonly included in most business purchase agreements in Indiana. It provides the buyer with protection against any undisclosed, unknown, or latent liabilities, as well as unforeseen risks that may arise after the completion of the sale. The seller agrees to indemnify the buyer for any losses or damages resulting from such liabilities, ensuring a certain level of financial security for the buyer. 2. Specific Indemnification: In some cases, there may be specific risks or liabilities that the buyer and seller want to address separately from the general indemnification provision. Specific indemnification clauses can be negotiated and included in the agreement to cover unique circumstances related to the business being sold. This can include protecting the buyer against pending litigation, tax obligations, environmental issues, or other potential liabilities that are specific to the industry or nature of the business. It is important to note that the scope and limitations of indemnification provisions can vary depending on the specifics of the transaction. Buyers are encouraged to conduct thorough due diligence and seek legal advice to ensure that all known and potential risks are adequately addressed in the indemnification clause. The Indiana courts generally uphold indemnification provisions, but it is crucial for both parties to carefully negotiate and draft the clause to avoid any ambiguity or potential disputes in the future. Key elements that should be included in the indemnification provision are: 1. Definitions: Clearly define the terms used in the indemnification provision to avoid any confusion or misinterpretation. 2. Scope of Indemnification: Specify the types of liabilities and risks that the seller agrees to indemnify the buyer against. This should include a detailed description of the potential liabilities, such as legal claims, taxes, environmental issues, or contractual obligations. 3. Limitations: Establish any limitations on the indemnification, such as monetary caps, time limits for claims, or conditions that must be met for the buyer to be eligible for indemnification. 4. Notice and Process: Outline the procedure to be followed by the buyer in notifying the seller of a potential claim and the process for resolving disputes related to the indemnification provision. Indemnification is a vital aspect of any business purchase or sale agreement in Indiana, ensuring that both parties are protected from unforeseen liabilities and risks. By understanding the different types of indemnification clauses and including comprehensive provisions in the agreement, buyers and sellers can facilitate a smoother transaction and minimize future disputes. Overall, when engaging in a business transaction in Indiana, it is essential for both buyers and sellers to seek professional legal advice to draft and negotiate a comprehensive indemnification provision that best suits their specific needs and protects their respective interests.

Indiana Indemnification of Buyer and Seller of Business

Description

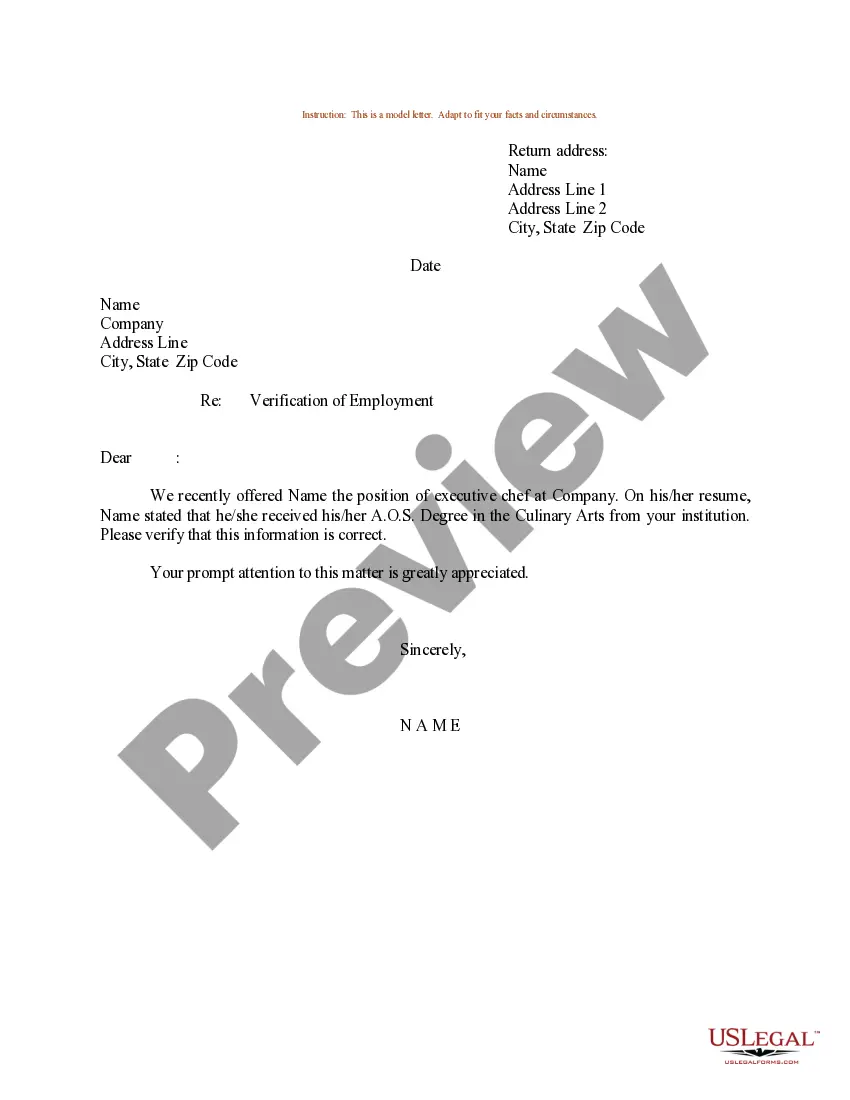

How to fill out Indemnification Of Buyer And Seller Of Business?

Selecting the appropriate valid document template can be quite a challenge.

Certainly, there are numerous templates accessible on the web, but how can you locate the correct form that you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Indiana Indemnification of Buyer and Seller of Business, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, utilize the Search box to find the correct form. Once you are confident that the form is suitable, click the Acquire now option to obtain the form. Choose the payment plan you require and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, edit, print, and sign the acquired Indiana Indemnification of Buyer and Seller of Business. US Legal Forms is the largest repository of legal forms where you can access a variety of document templates. Use the service to download appropriately designed papers that meet state requirements.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download option to access the Indiana Indemnification of Buyer and Seller of Business.

- Use your account to browse through the legal forms you have purchased previously.

- Navigate to the My documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your area/state. You can review the form using the Review option and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Common law indemnification in Indiana allows a party to recover damages from another party that is primarily responsible for the loss or claim. This principle applies where the indemnified party is not at fault, effectively shifting liability to the party that caused the damage. Understanding the nuances of common law indemnification is crucial for anyone engaging in business transactions. US Legal Forms can provide insights and templates to help navigate these legal waters.

Indemnification clauses can hold up in court, provided they are clear, reasonable, and comply with state laws. Courts generally enforce these clauses unless they are deemed unfair or violate public policy. In Indiana, like in other states, properly drafted indemnification terms can stand the test of legal scrutiny. For the best results, consider referencing resources from US Legal Forms to ensure your drafting meets legal standards.

In simple terms, an indemnity clause is an agreement between parties about who will cover certain costs if problems arise. It ensures that if one party faces a claim or loss, the other party will take care of it, helping to avoid financial strain. This clause is particularly essential in business transactions, like those involving the Indiana Indemnification of Buyer and Seller of Business. US Legal Forms offers accessible templates to help create an effective indemnity clause.

The indemnification clause for the sale of a business outlines the obligations of the buyer and the seller regarding future claims or losses. This clause acts as a safeguard, stipulating who will cover expenses related to potential legal issues or liabilities. A well-crafted indemnification clause can prevent conflicts after the sale, providing peace of mind for both parties. Exploring US Legal Forms can help you find templates and examples for this important document.

The indemnity clause for the seller in Indiana refers to the legal provision that protects the seller from future claims arising from the sale of their business. This clause ensures that the buyer assumes responsibility for any liabilities that may arise after the sale. By specifying the terms of indemnification, both parties can clarify their responsibilities, reducing the risk of disputes. To better understand and draft this clause, consider using resources from US Legal Forms.

To fill out a letter of indemnity, start with the date and the names of the parties involved. Clearly state the intent and scope of indemnification, particularly regarding transactions related to the Indiana Indemnification of Buyer and Seller of Business. Ensure the letter is signed by authorized representatives to validate it, helping protect all parties involved in the transaction.

Filling out an indemnity bond is similar to completing any legal document, requiring careful attention to detail. You need to include the principal, surety, and obligee's details while specifying the bond amount and purpose, especially within the scope of the Indiana Indemnification of Buyer and Seller of Business. Make sure to read each section thoroughly to comply with any specific legal requirements.

A seller's indemnity clause typically states that the seller agrees to compensate the buyer for losses incurred due to certain claims or liabilities. In the context of the Indiana Indemnification of Buyer and Seller of Business, this clause helps protect the buyer from risks associated with the transaction. Reviewing sample clauses can provide a clearer understanding, and US Legal Forms offers various examples for reference.

Filling out an indemnity agreement requires detailing each party's information and the specific situations under which indemnification applies. With regards to Indiana Indemnification of Buyer and Seller of Business, clarity in terms and conditions is vital. Consider consulting legal resources for guidance, or explore platforms like US Legal Forms for templates that can simplify the process.

To fill an indemnity form, start by entering the names and contact details of the buyer and seller involved in the business. Next, include relevant business details and specific indemnification terms, which are crucial in the context of Indiana Indemnification of Buyer and Seller of Business. Double-check the form for accuracy before submitting it, ensuring all sections are complete.

More info

The Judicial Branch of the Federal Government, the Federal Courts (Supreme Court and the Courts of Appeals) are the two principal instruments through which the nation's government rules. The Judicial Branch of the Federal Government is responsible for the formation and execution of the laws in all aspects of its various functions, including the courts and their administrations, and the courts themselves. In the United States, the Federal Courts constitute all court-related matters. The judicial system is governed primarily by rules of court that are established by statute. Most matters are heard by one of thirty-four federal judges on a rotating basis, known as circuit courts, who issue opinions to decide all matters, whether criminal, civil or administrative. There are twelve different kinds of courts, in part because each country defines and classifies its own system. Judges generally work for the state or local government, but can also work for private firms.