Title: Indiana Contract with Independent Contractor to Photograph Works of Art for Book — Self-Employed Description: An Indiana Contract with Independent Contractor to Photograph Works of Art for Book is a legally binding agreement between a self-employed photographer and a client seeking to document and capture images of various works of art or artistic creations for the purpose of creating a book. This contract outlines the specific terms and conditions under which the independent contractor will provide their photography services. Keywords: Indiana contract, independent contractor, photographs, works of art, book, self-employed, legally binding, terms and conditions, photography services. Different types of Indiana Contracts with Independent Contractor to Photograph Works of Art for Book — Self-Employed may include: 1. Limited Usage Agreement: This contract type limits the usage rights of the photographs to a specific purpose, such as for the creation of a book. It outlines the number of photographs to be taken, the delivery timeline, and any additional provisions related to exclusivity, copyright, or licensing arrangements. 2. Exclusive Commission Agreement: An exclusive commission agreement grants the client exclusive rights to use the photographs for a specified period. This type of contract ensures that the photographer cannot sell or license the images to other parties during the agreed-upon time frame. 3. Time-Based Engagement Contract: A time-based engagement contract outlines the duration of the photographer's services, which can vary from a few weeks to months or even longer. It may include provisions for regular meetings, progress reports, and compensation arrangements based on an hourly, daily, or weekly rate. 4. Work-for-Hire Agreement: A work-for-hire agreement states that the client retains full ownership of the photographs, and the photographer acts as an employee rather than an independent contractor. This type of contract may provide for a fixed payment or salary in exchange for the transfer of copyright and ownership rights. 5. Non-Disclosure Agreement: A non-disclosure agreement (NDA) ensures the confidentiality of the project and any sensitive information shared between the client and photographer. It restricts the independent contractor from disclosing any details about the book, its content, or the artistic works involved to third parties. Note: It is essential to consult with a legal professional or attorney specializing in contract law to ensure accuracy and compliance with specific state laws when drafting or executing any contract.

Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed

Description

How to fill out Indiana Contract With Independent Contractor To Photograph Works Of Art For Book - Self-Employed?

US Legal Forms - one of several largest libraries of legal varieties in the States - delivers a variety of legal file templates you are able to acquire or print out. While using web site, you can get a large number of varieties for business and individual reasons, categorized by categories, claims, or keywords and phrases.You can get the most recent models of varieties just like the Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed within minutes.

If you currently have a subscription, log in and acquire Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed through the US Legal Forms local library. The Obtain option can look on each form you view. You gain access to all earlier downloaded varieties inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms for the first time, allow me to share basic instructions to help you get started:

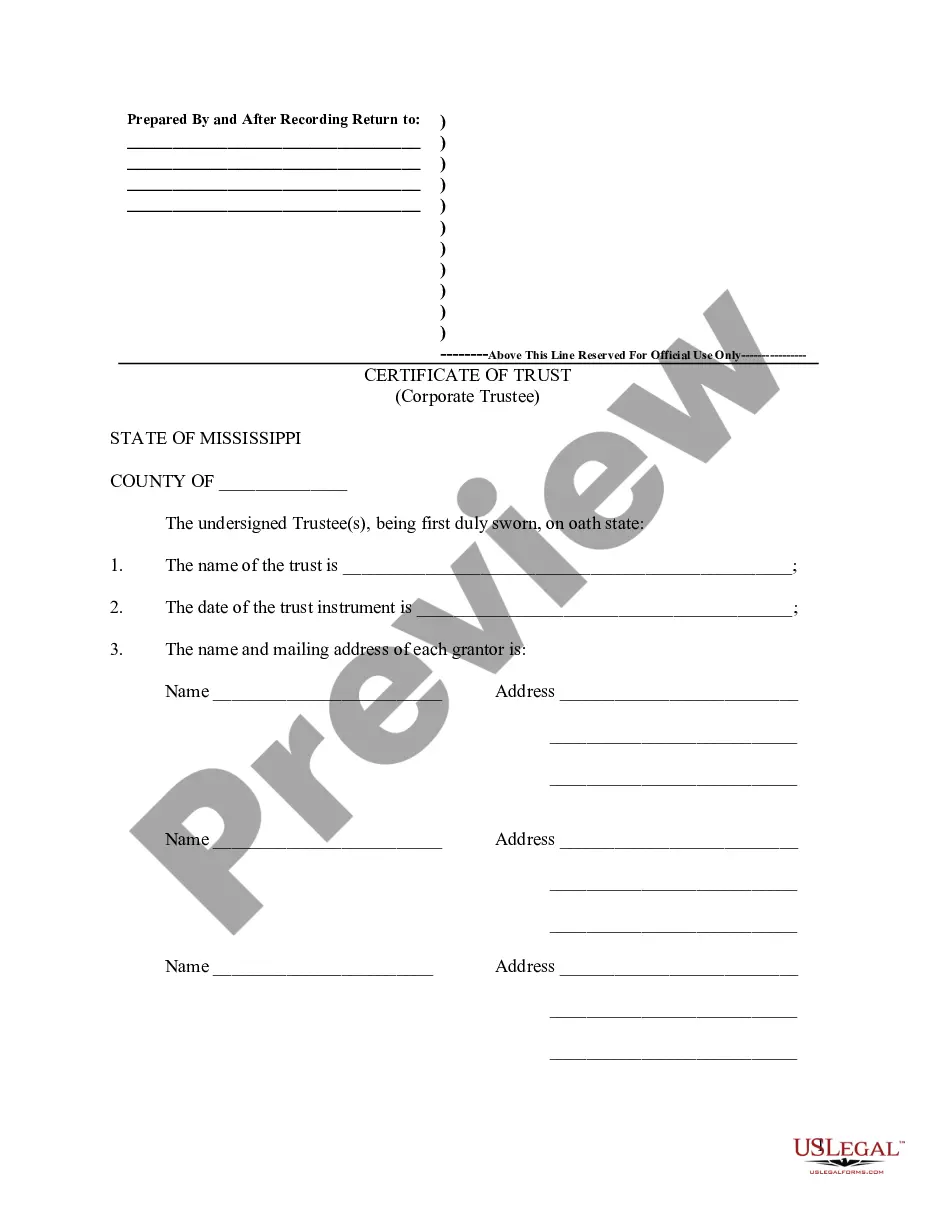

- Be sure to have picked the proper form for your personal area/county. Click on the Review option to analyze the form`s content material. See the form explanation to actually have chosen the right form.

- If the form doesn`t satisfy your requirements, take advantage of the Lookup industry at the top of the display to get the one which does.

- Should you be happy with the form, affirm your option by visiting the Purchase now option. Then, opt for the pricing plan you want and provide your credentials to sign up to have an accounts.

- Approach the transaction. Use your bank card or PayPal accounts to perform the transaction.

- Find the format and acquire the form on the system.

- Make modifications. Fill out, modify and print out and indication the downloaded Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed.

Each and every template you added to your bank account does not have an expiry time and is yours permanently. So, if you wish to acquire or print out an additional duplicate, just visit the My Forms portion and click about the form you need.

Get access to the Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed with US Legal Forms, the most considerable local library of legal file templates. Use a large number of professional and state-certain templates that meet up with your small business or individual requires and requirements.

Form popularity

FAQ

The IRS and other agencies often use the 'common law test' to identify whether someone qualifies as an independent contractor. This test evaluates the level of control a business has over the worker and the degree of independence displayed, similar to relationships outlined in an Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed. Understanding this test can help you navigate contractor classification effectively.

To verify employment for an independent contractor, you can review contracts, invoices, and payment records. You should also ask for references or testimonials from previous clients, which can confirm the nature of the work. If you use a platform like USLegalForms, you can find templates for contracts like the Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, making the verification process more accessible.

You can prove you are an independent contractor by providing documents like your contracts, invoices, and 1099 forms. An Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed can serve as a primary piece of evidence. Additionally, maintaining a portfolio of your work can further establish your services and client relationships.

The IRS uses several factors to determine whether someone is an independent contractor, focusing on the level of control and independence in the working relationship. Key elements include the ability to set your schedule, the provision of your tools, and the nature of your contractual agreements, such as the Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed. Understanding these criteria can help you meet the IRS definitions.

You qualify as a 1099 employee if you receive payment for services but do not have taxes withheld from your income. Being classified as an independent contractor, like in an Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, means you control how and when you work. Generally, you provide services without the employer controlling the manner in which those services are performed.

To establish yourself as an independent contractor, start by choosing a business name and registering it if needed. Next, create a detailed service agreement, like an Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed, to clarify your responsibilities. Finally, obtain any necessary licenses and permits to operate legally.

To prove income as a 1099 employee, you can provide your bank statements, 1099 forms, and invoices for your services. You should maintain detailed records of your work, including contracts such as the Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed. By showing these documents, you can effectively demonstrate your income and work history.

Yes, if you hire a photographer as an independent contractor, you typically provide them with a 1099 form for tax purposes. This form reports the payments made to them during the year. Keeping clear financial records is essential, especially when you have an Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed in place, to ensure compliance with IRS regulations.

To write an independent contractor agreement, begin by detailing the services to be provided, payment terms, and timelines. It's important to clarify the relationship and responsibilities of both parties. You can simplify the drafting process using accessible templates available on UsLegalForms, particularly for an Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed.

Writing a photo contract involves specifying the terms of the services provided, including fees, rights, and timelines. Be sure to include both parties' names and define the scope of work clearly. Utilizing templates from platforms like UsLegalForms can help streamline this process, especially for an Indiana Contract with Independent Contractor to Photograph Works of Art for Book - Self-Employed.