Indiana Proof of Residency for Credit Card

Description

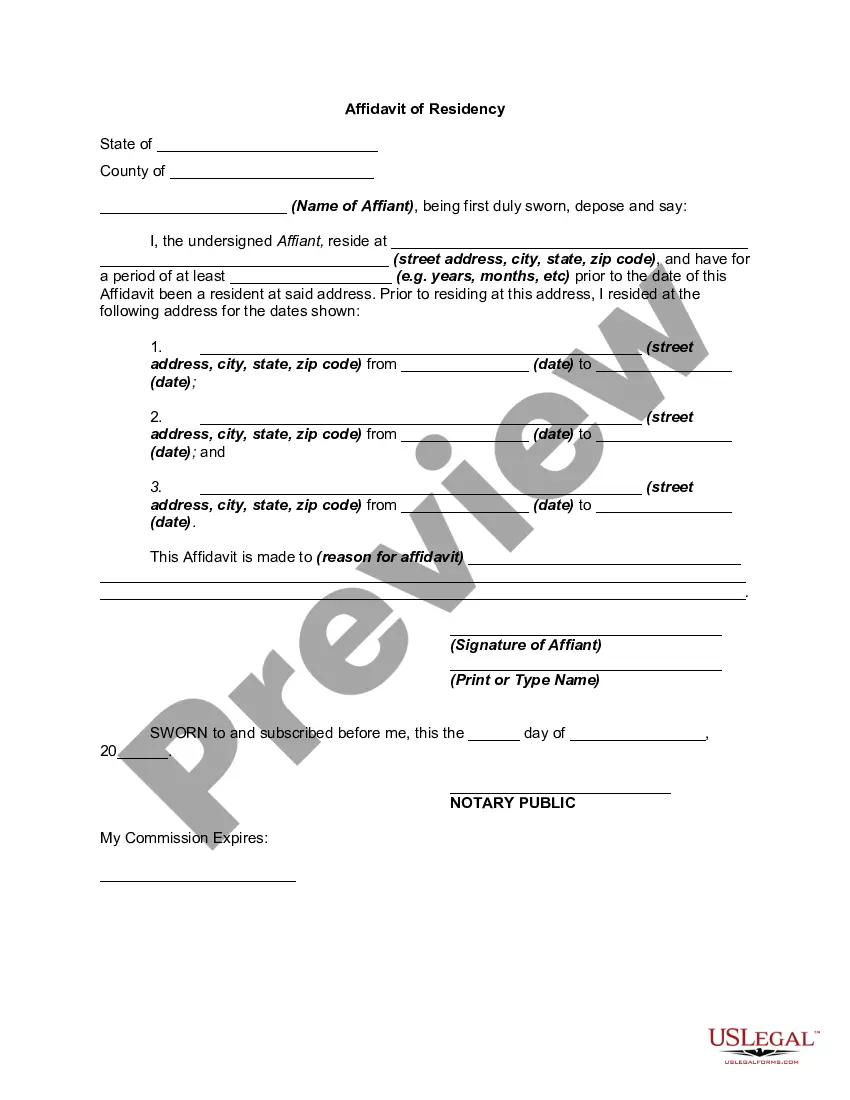

How to fill out Proof Of Residency For Credit Card?

If you need to total, down load, or produce lawful document web templates, use US Legal Forms, the biggest variety of lawful forms, that can be found on-line. Make use of the site`s basic and convenient research to discover the papers you will need. A variety of web templates for organization and individual reasons are categorized by groups and says, or search phrases. Use US Legal Forms to discover the Indiana Proof of Residency for Credit Card within a handful of click throughs.

Should you be previously a US Legal Forms buyer, log in to your account and then click the Down load key to get the Indiana Proof of Residency for Credit Card. You can even access forms you formerly delivered electronically within the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape for the proper city/land.

- Step 2. Take advantage of the Preview method to look through the form`s content material. Never forget to read through the information.

- Step 3. Should you be not happy together with the type, make use of the Look for area towards the top of the screen to discover other versions of the lawful type design.

- Step 4. When you have found the shape you will need, click on the Acquire now key. Pick the pricing program you favor and add your accreditations to sign up on an account.

- Step 5. Method the deal. You can use your charge card or PayPal account to perform the deal.

- Step 6. Select the formatting of the lawful type and down load it on your device.

- Step 7. Complete, modify and produce or sign the Indiana Proof of Residency for Credit Card.

Every single lawful document design you buy is yours permanently. You may have acces to each type you delivered electronically within your acccount. Select the My Forms segment and select a type to produce or down load again.

Contend and down load, and produce the Indiana Proof of Residency for Credit Card with US Legal Forms. There are thousands of professional and status-particular forms you can utilize for your personal organization or individual needs.

Form popularity

FAQ

Proof of insurance can be in the form of an insurance ID card or other document from your insurance company. To meet the proof of insurance requirements, your ID card or form must show the policy number, policy effective dates, covered vehicle, and policyholder name.

SR50 ? This form provides proof of current insurance to the BMV. This form must not be submitted with an effective date in the future or an expiration date in the past. The form indicates the beginning and ending dates of the current policy. An SR22 will also suffice for proof of current insurance.

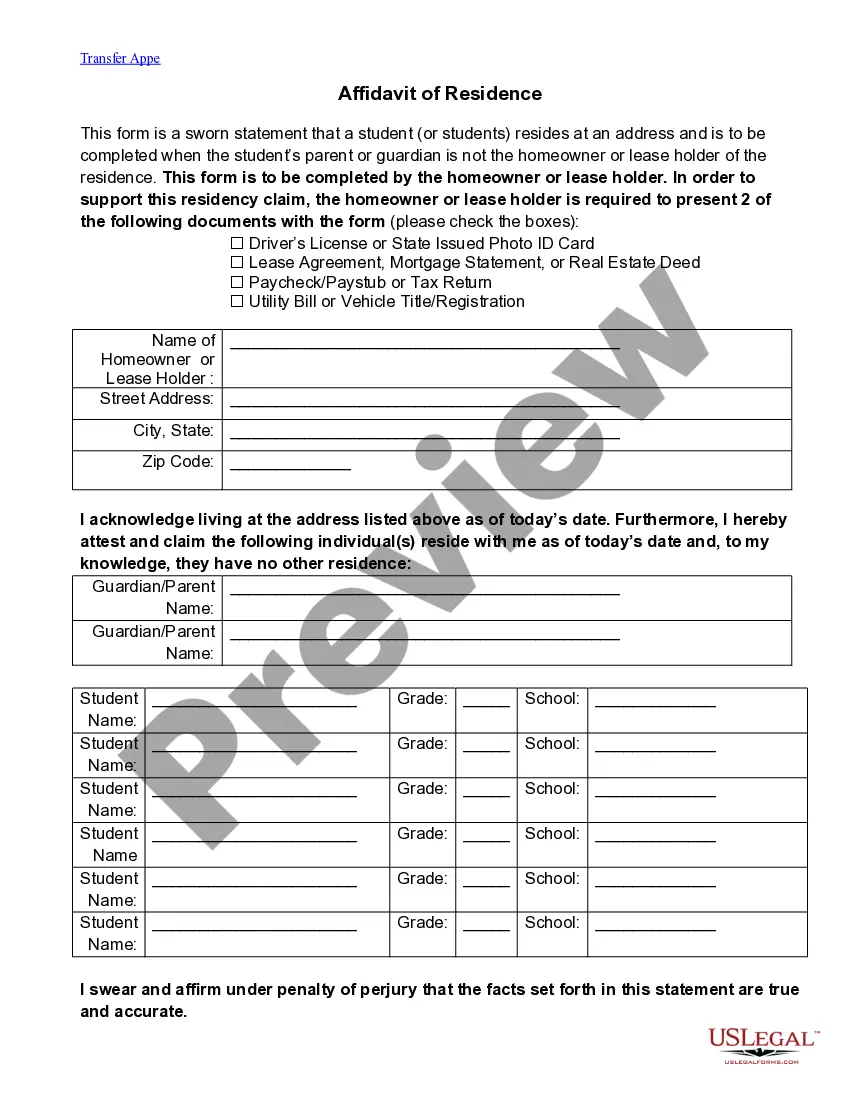

Utility company, credit card, doctor or hospital bill issued within 60 days of application. Bank Statement or bank transaction receipt, dated within 60 days of application. Pre-printed pay stub, dated within 60 days of application. within current or immediately-prior year.

The most common documents (must be printed) proving your Indiana residency include: Computer-generated bill from a utility company, credit card company, doctor, or hospital, issued within 60 days of the date you visit a BMV branch, and containing your name and address of residence.

The Bureau of Motor Vehicles (BMV) is required to verify that all motorists have the minimum liability insurance coverage in effect with respect to the vehicle operated whenever a vehicle operator is involved in: An auto accident for which the BMV receives an accident report.

Required Documentation to Obtain an ID Card One document proving your identity; and. One document proving your lawful status in the United States; and. One document proving your Social Security number; and. Two documents proving your Indiana residency.

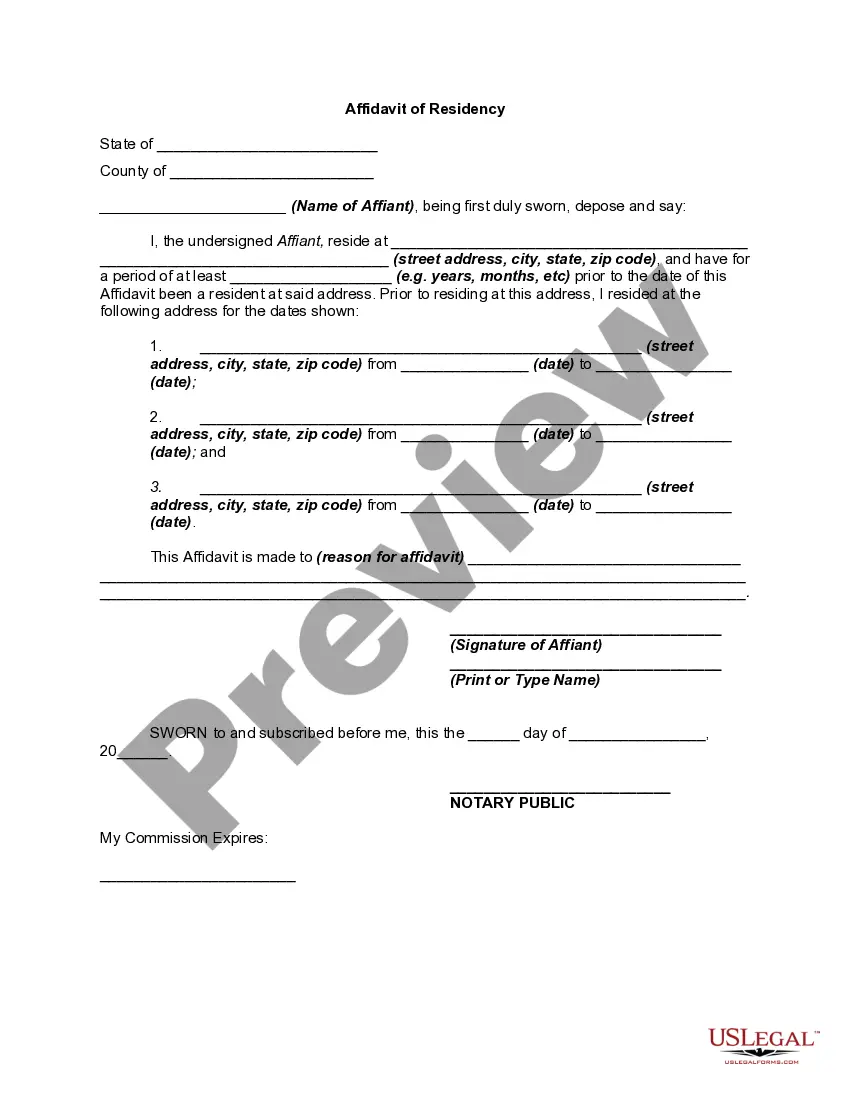

An Indiana Residency Affidavit for you must be signed at a license branch by another Indiana resident who attests that you may use his or her address of residence for record purposes. The person signing the affidavit must submit two documents proving their Indiana residency.

A document or identification card from your insurance company. A DMV authorization letter, if you are a cash depositor or are self-insured. California Proof of Insurance Certificate (SR 22) form for broad coverage or owner's policy.