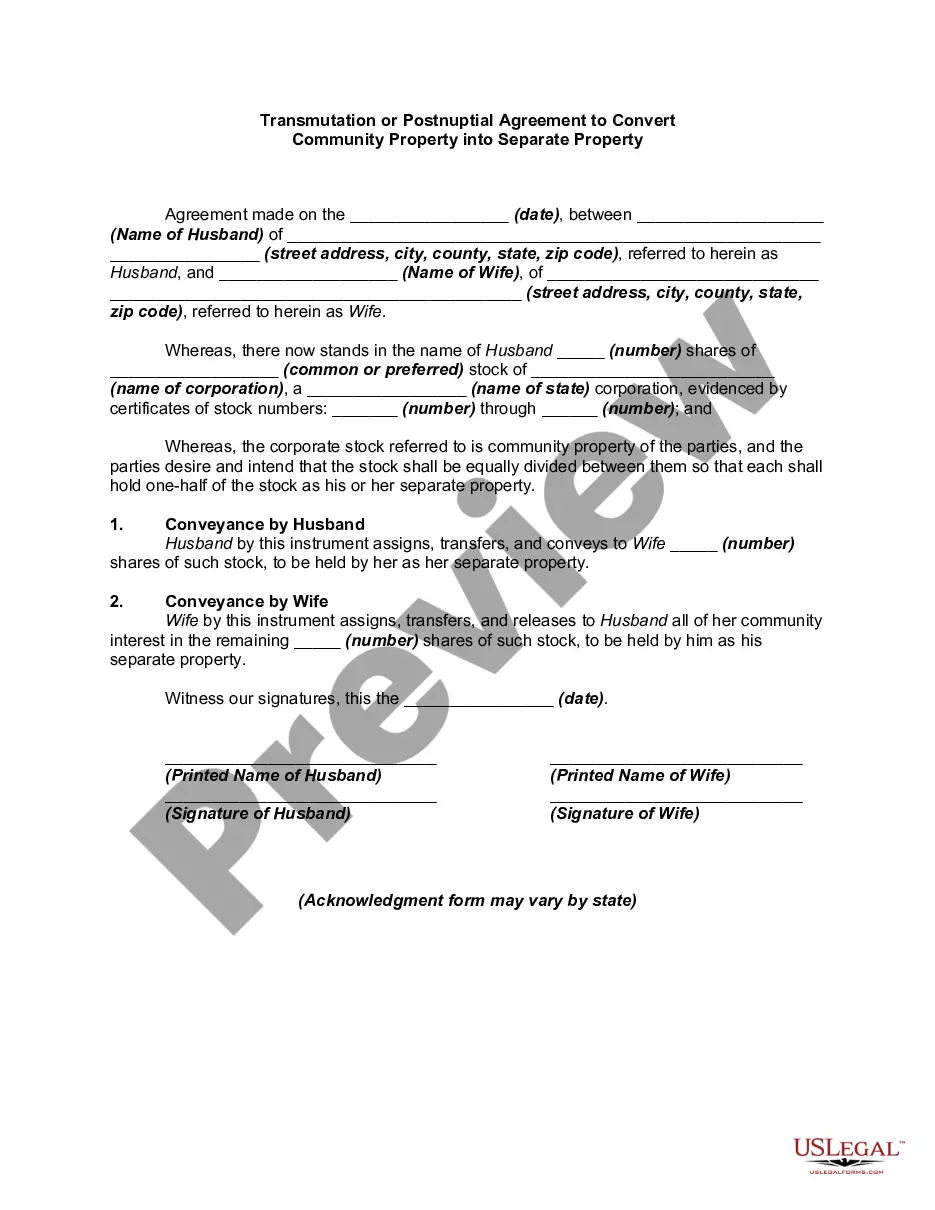

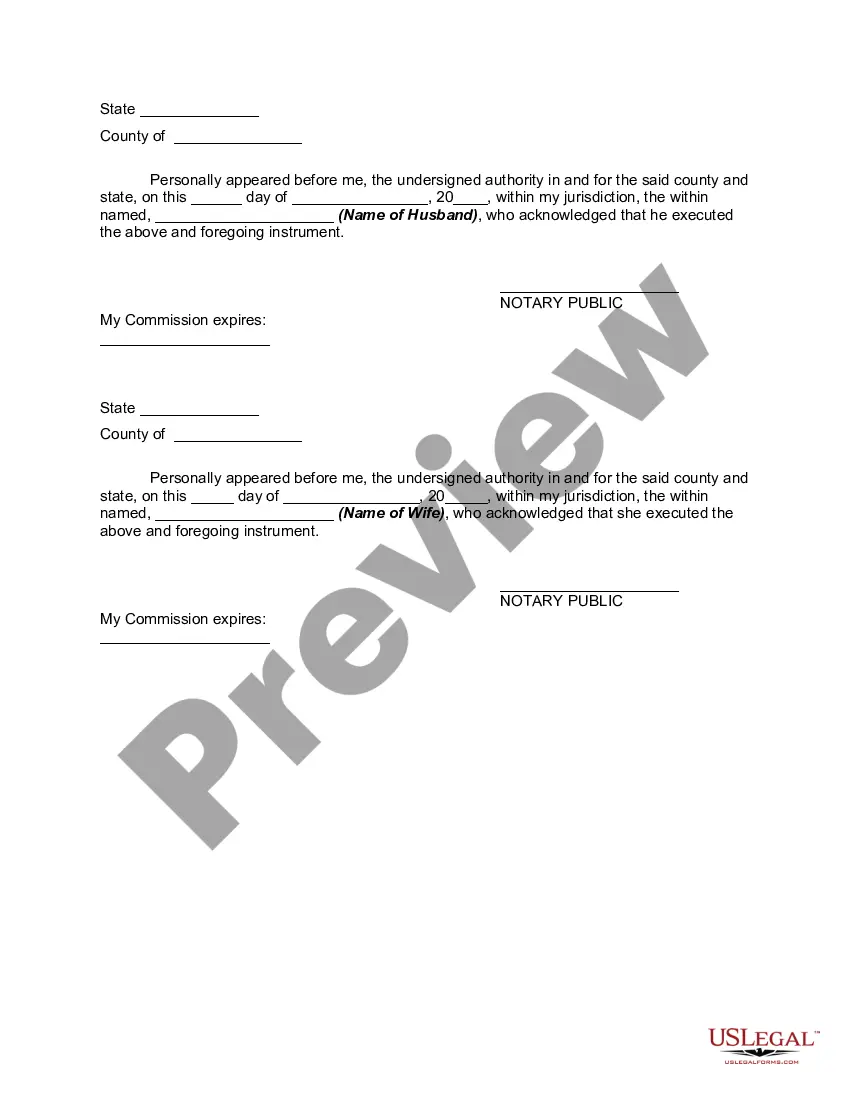

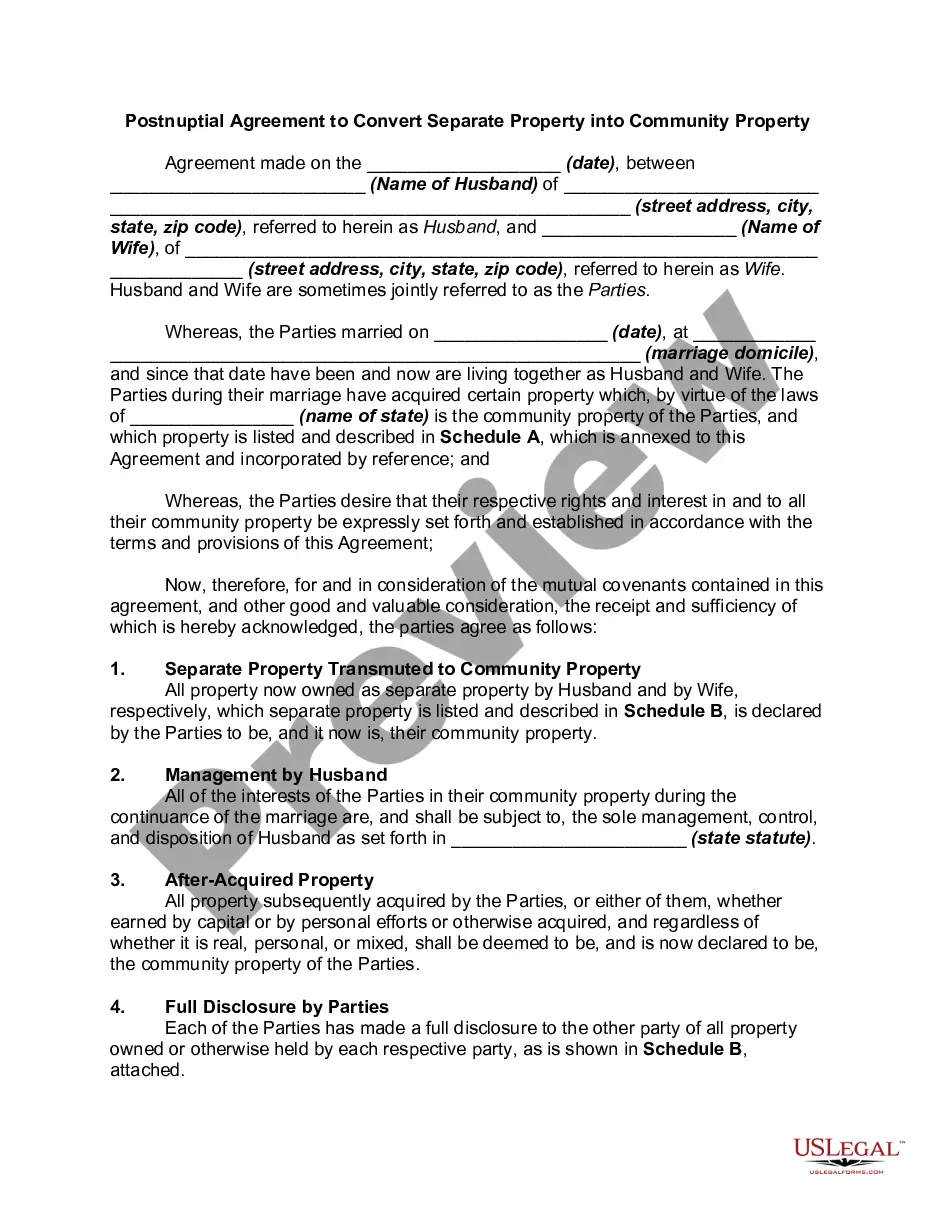

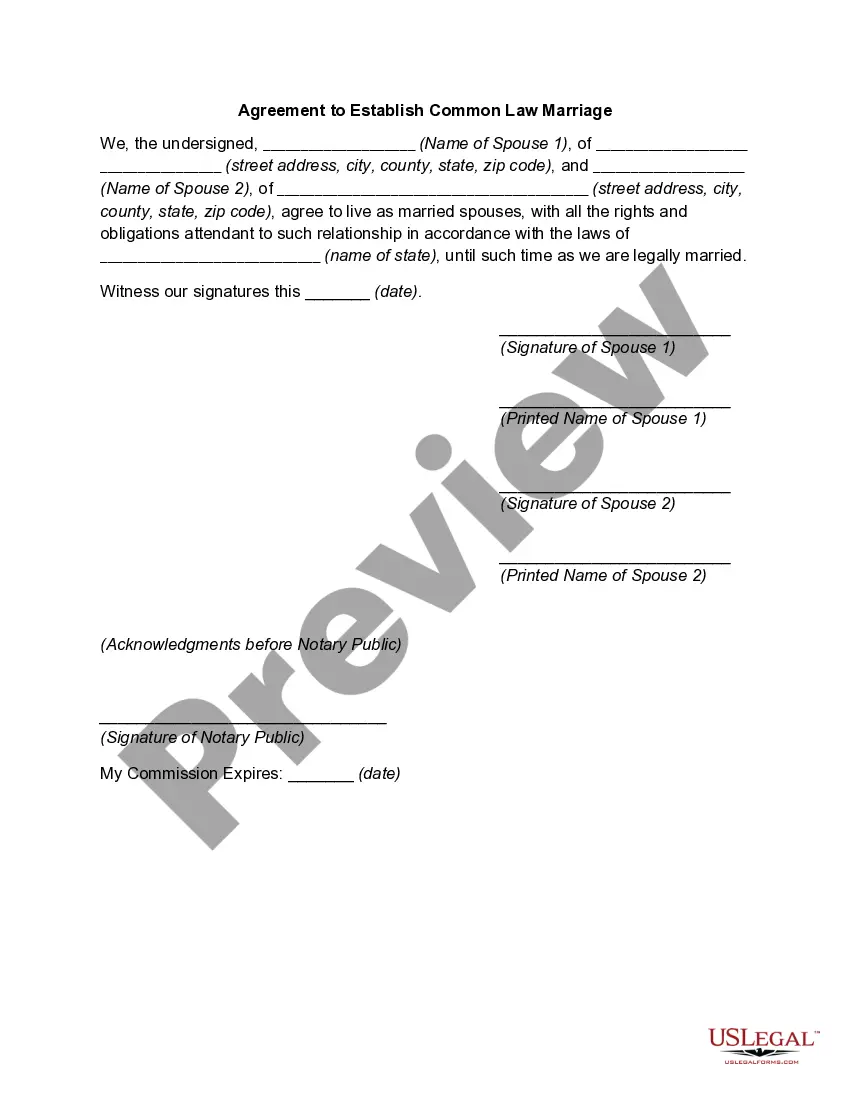

A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

If you require to accumulate, retrieve, or generate authorized document models, utilize US Legal Forms, the largest collection of legal documents, available online.

Utilize the site's straightforward and user-friendly search feature to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is yours indefinitely. You can access all the forms you downloaded in your account. Click the My documents section and select a form to print or download again.

Stay competitive by downloading and printing the Indiana Transmutation or Postnuptial Agreement for Converting Community Property into Separate Property with US Legal Forms. Thousands of professional and state-specific templates are available for your business or personal needs.

- Utilize US Legal Forms to find the Indiana Transmutation or Postnuptial Agreement for Converting Community Property into Separate Property in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Indiana Transmutation or Postnuptial Agreement for Converting Community Property into Separate Property.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

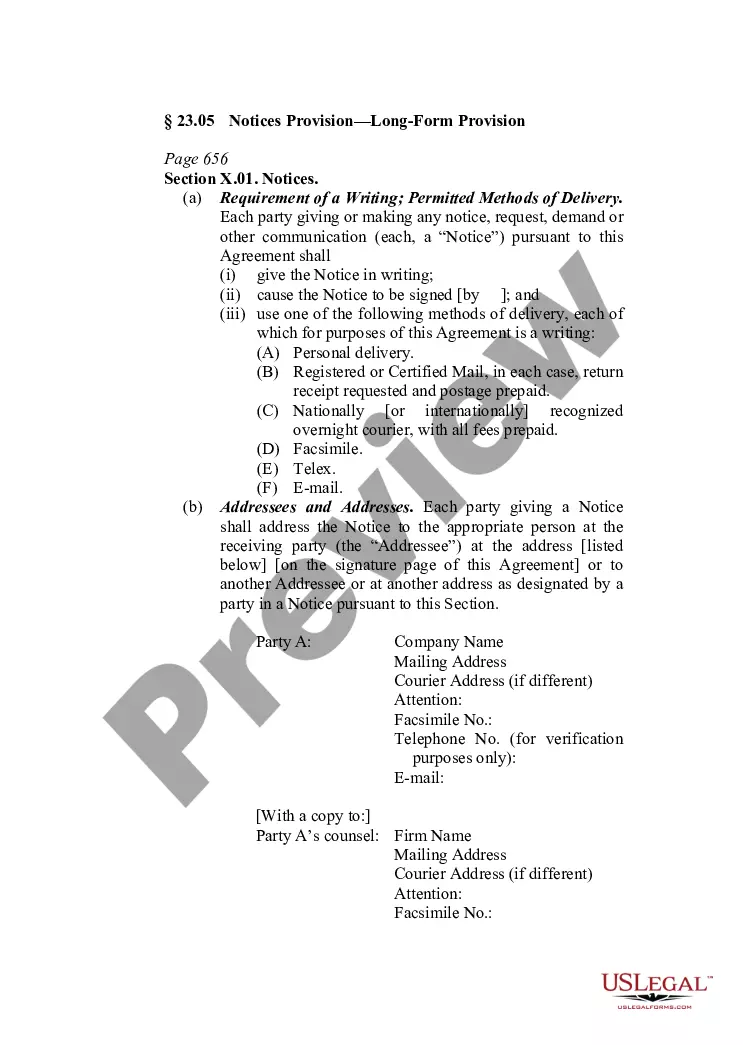

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other documents in the legal form template.

- Step 4. Once you have found the form you want, click on the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Indiana Transmutation or Postnuptial Agreement for Converting Community Property into Separate Property.

Form popularity

FAQ

In Indiana, a wife is not automatically entitled to half of everything in the event of a divorce. Instead, the court aims for an equitable division of marital property based on various factors. If couples have an agreement, such as a postnuptial agreement, it can outline specific shares of the property. Implementing an Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can directly influence how assets are divided.

The best way to divide marital assets often depends on personal circumstances, but open communication and negotiation are key. Creating a clear postnuptial agreement allows both parties to express their wishes and expectations regarding asset division. This proactive approach can avoid disputes later on. For instance, having an Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can set clear guidelines for how assets should be handled.

When a divorce occurs in Indiana, the court assesses the couple's marital property and debts to ensure a fair division. The court evaluates the contributions of each spouse and other relevant circumstances. A postnuptial agreement can simplify this process by clarifying each spouse's rights to property, ensuring both parties know what to expect. By considering an Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, couples can streamline the division process.

In Indiana, marital property is divided based on the principle of equitable distribution. This approach seeks to divide property fairly, though not necessarily equally, considering various factors such as the earning capacity of each spouse and contributions to the marriage. If you have a clear postnuptial agreement in place, it can outline how you wish to divide your community property. An Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can help define these terms.

In Indiana, there is no specific duration required to split assets when a marriage ends. Both parties have rights to marital property acquired during the marriage, regardless of how long they have been married. This means that if you have entered into a postnuptial agreement, it may affect how assets are divided. Utilizing an Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can clarify ownership.

Transmutation in marriage involves legally changing how property is classified between spouses. This shift can result in turning community property into separate property, typically achieved through a mutual agreement, like a postnuptial agreement. Such arrangements help protect individual assets and provide clarity about ownership. If you are considering transmutation in Indiana, understanding how a postnuptial agreement can benefit you is essential.

A transmutation agreement might involve spouses who decide that one wants to keep a family heirloom, such as a piece of jewelry, as separate property. They would draft a postnuptial agreement that outlines this intention and states that the jewelry will not be considered community property. Such agreements help couples avoid misunderstandings about asset ownership in the future. Utilizing an Indiana transmutation or postnuptial agreement can simplify property classification.

Transmutation in law refers to the process of changing the classification of property from community property to separate property or vice versa. In the context of marriage, this often involves a formal agreement, such as a postnuptial agreement, which explicitly states each spouse's intentions regarding their property. By using a postnuptial agreement to convert community property into separate property, couples clarify ownership and reduce potential disputes. Knowing the legal implications of Indiana transmutation can ensure proper asset management.

An example of transmutation is when a couple agrees to convert a jointly owned vacation home, which is considered community property, into separate property owned solely by one spouse. This agreement typically occurs through a written document, such as a postnuptial agreement. By clearly stating the intention, the couple protects the asset from being divided in case of divorce. Understanding how to implement Indiana transmutation can help couples safeguard their assets.

Postnuptial agreements typically cannot dictate child custody arrangements or child support obligations. Indiana law restricts such agreements from addressing matters that impact children, as their best interests must come first. However, an Indiana Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can effectively manage and delineate asset ownership and financial responsibilities during a marriage.