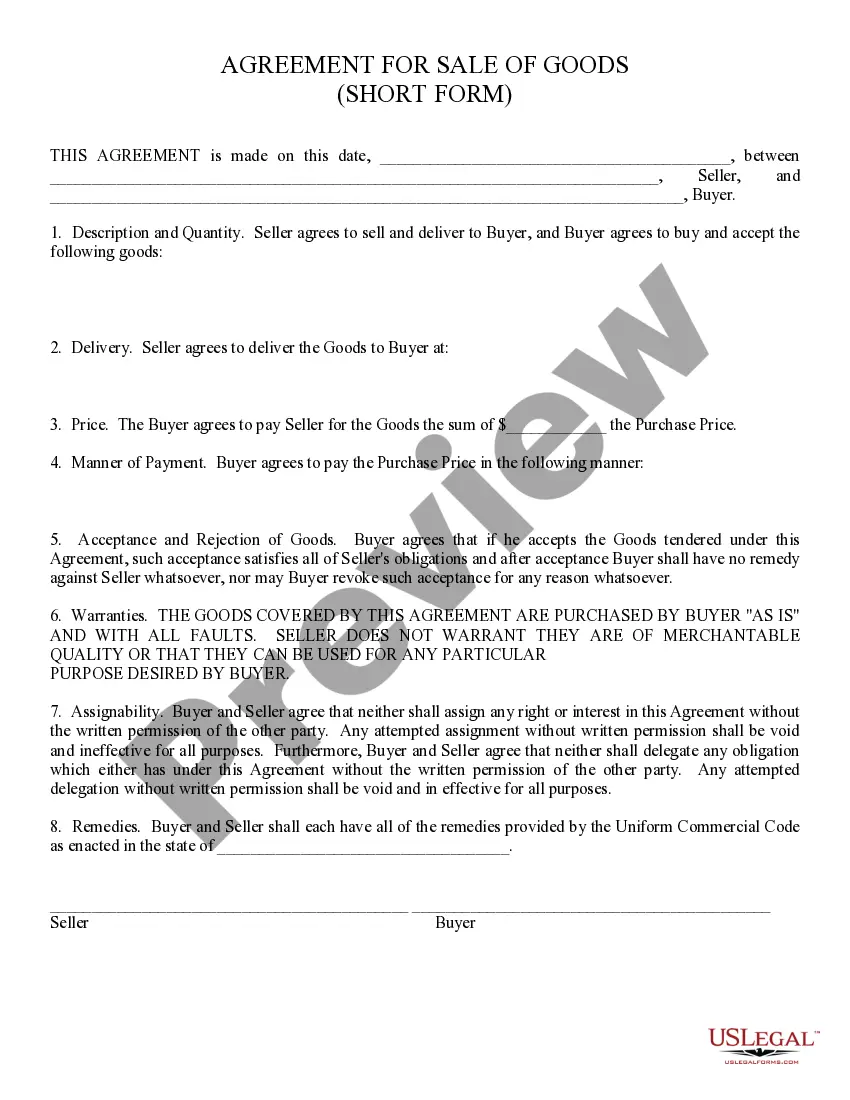

Indiana Corporate Asset Purchase Agreement is a legally binding document that outlines the terms and conditions for the purchase and sale of assets by a corporation based in the state of Indiana. This agreement is important for businesses looking to expand or restructure their operations, as it allows them to acquire or dispose of specific assets while protecting their rights and interests. The Indiana Corporate Asset Purchase Agreement typically includes various key components such as the identification of the buyer and seller, a detailed description of the assets being purchased, purchase price and payment terms, representations and warranties, covenants, indemnification provisions, and conditions precedent to closing. It is crucial to understand that there may be different types or variations of the Indiana Corporate Asset Purchase Agreement, depending on the specific circumstances and nature of the transaction. Here are a few examples: 1. Stock Purchase Agreement: This type of agreement involves the purchase of all or a majority of the corporate stocks of a target company, thereby acquiring all its assets and liabilities. 2. Asset Purchase Agreement: In this scenario, the buyer intends to purchase specific assets of the target company, such as equipment, inventory, intellectual property, contracts, or real estate. This agreement enables the buyer to acquire desired assets without assuming certain obligations or liabilities of the seller. 3. Merger Agreement: Although not strictly an asset purchase agreement, a merger agreement involves the consolidation of two or more companies into a single entity. This agreement encompasses the transfer of assets, liabilities, and stocks, leading to the combination of two previously separate corporate entities. Each type of Indiana Corporate Asset Purchase Agreement presents a unique set of considerations and requirements. Therefore, it is crucial for parties involved in such transactions to consult with legal professionals to ensure compliance with relevant laws and to protect their respective rights and interests. In conclusion, the Indiana Corporate Asset Purchase Agreement serves as a comprehensive document that facilitates the purchase and sale of assets by corporate entities based in Indiana. Whether it involves acquiring stocks, specific assets, or engaging in a merger, this agreement ensures a clear understanding between the parties involved and protects their legal rights throughout the transaction process.

Indiana Corporate Asset Purchase Agreement

Description

How to fill out Indiana Corporate Asset Purchase Agreement?

Are you currently inside a place where you will need paperwork for both company or person uses just about every time? There are a lot of lawful record web templates available on the net, but getting ones you can depend on is not effortless. US Legal Forms offers 1000s of develop web templates, like the Indiana Corporate Asset Purchase Agreement, which can be written to satisfy federal and state demands.

If you are already acquainted with US Legal Forms web site and have a merchant account, simply log in. Following that, it is possible to down load the Indiana Corporate Asset Purchase Agreement web template.

Should you not offer an profile and need to start using US Legal Forms, follow these steps:

- Get the develop you want and ensure it is to the appropriate town/area.

- Utilize the Preview option to analyze the form.

- Look at the information to ensure that you have selected the correct develop.

- If the develop is not what you are seeking, utilize the Search industry to obtain the develop that fits your needs and demands.

- Whenever you find the appropriate develop, click on Buy now.

- Select the prices plan you need, submit the specified details to make your account, and purchase an order making use of your PayPal or charge card.

- Decide on a practical file formatting and down load your duplicate.

Discover each of the record web templates you have bought in the My Forms food selection. You can aquire a further duplicate of Indiana Corporate Asset Purchase Agreement whenever, if necessary. Just click on the needed develop to down load or produce the record web template.

Use US Legal Forms, the most substantial assortment of lawful forms, to conserve time and steer clear of faults. The assistance offers skillfully manufactured lawful record web templates that can be used for a selection of uses. Generate a merchant account on US Legal Forms and start producing your life a little easier.