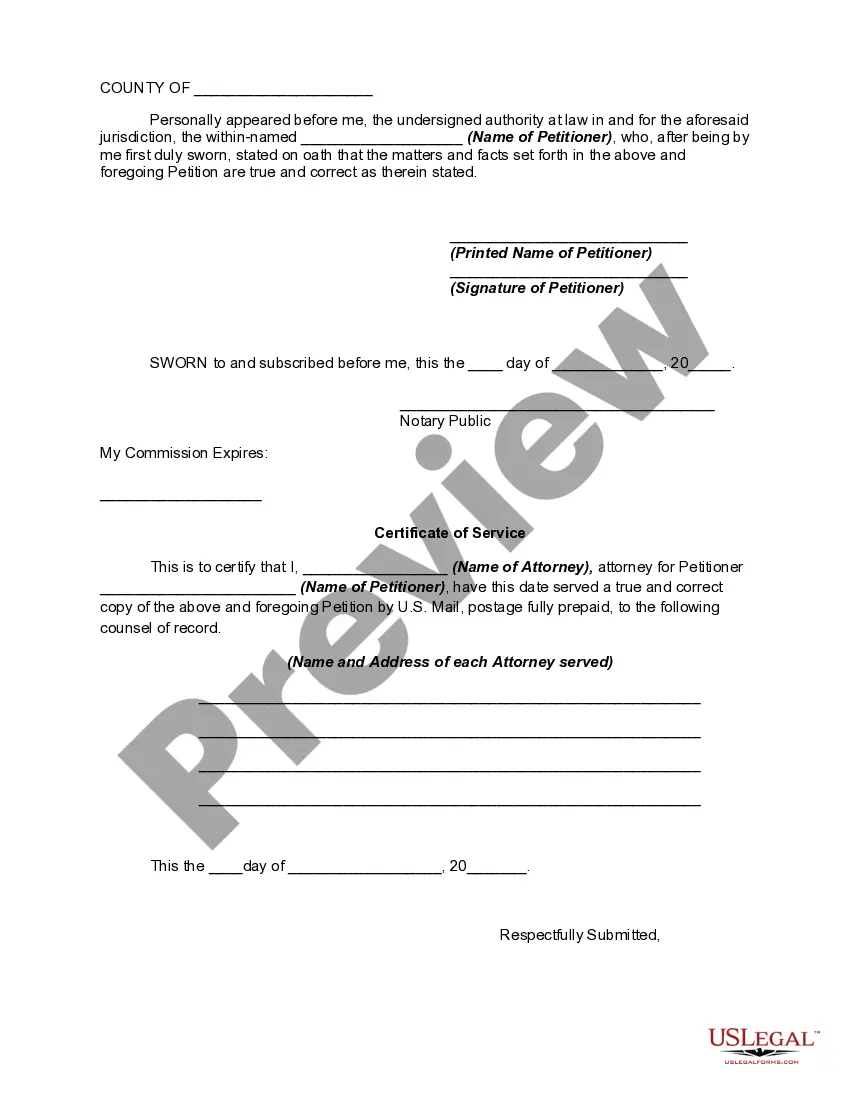

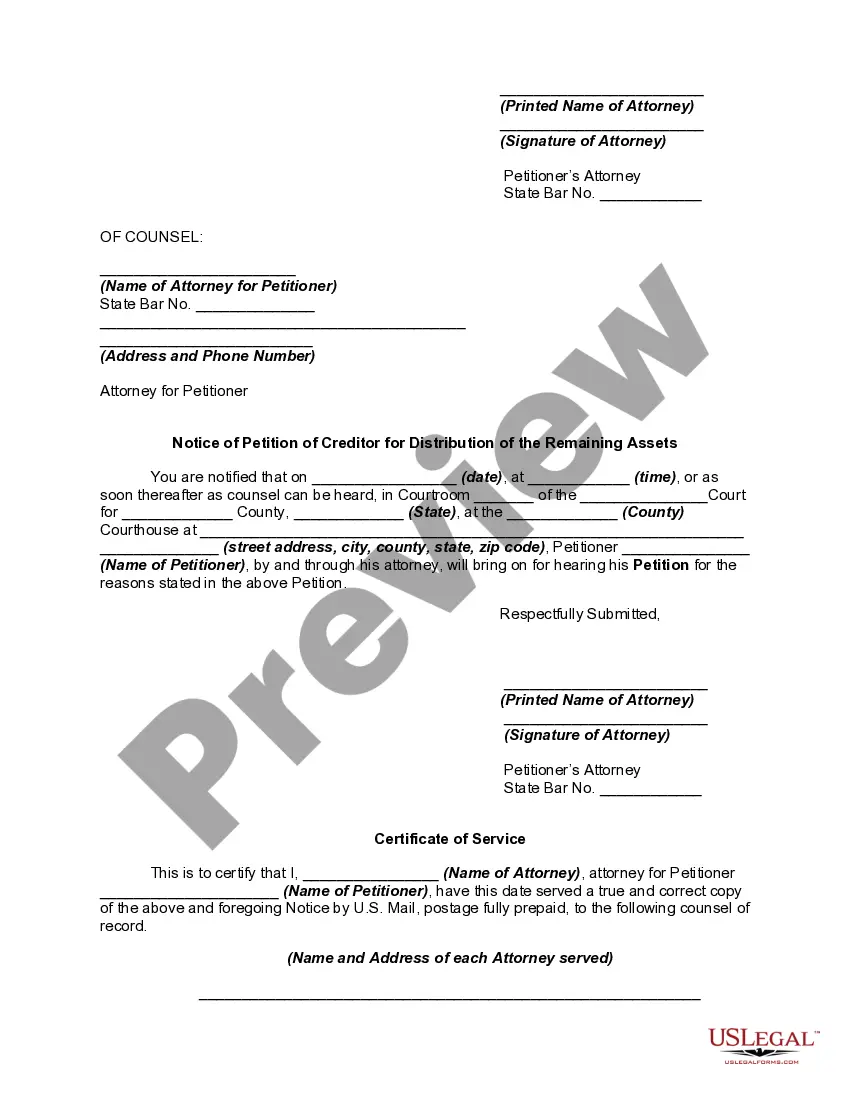

The following form is a Petition that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.

Indiana Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate

Description

How to fill out Petition Of Creditor Of An Estate Of A Decedent For Distribution Of The Remaining Assets Of The Estate?

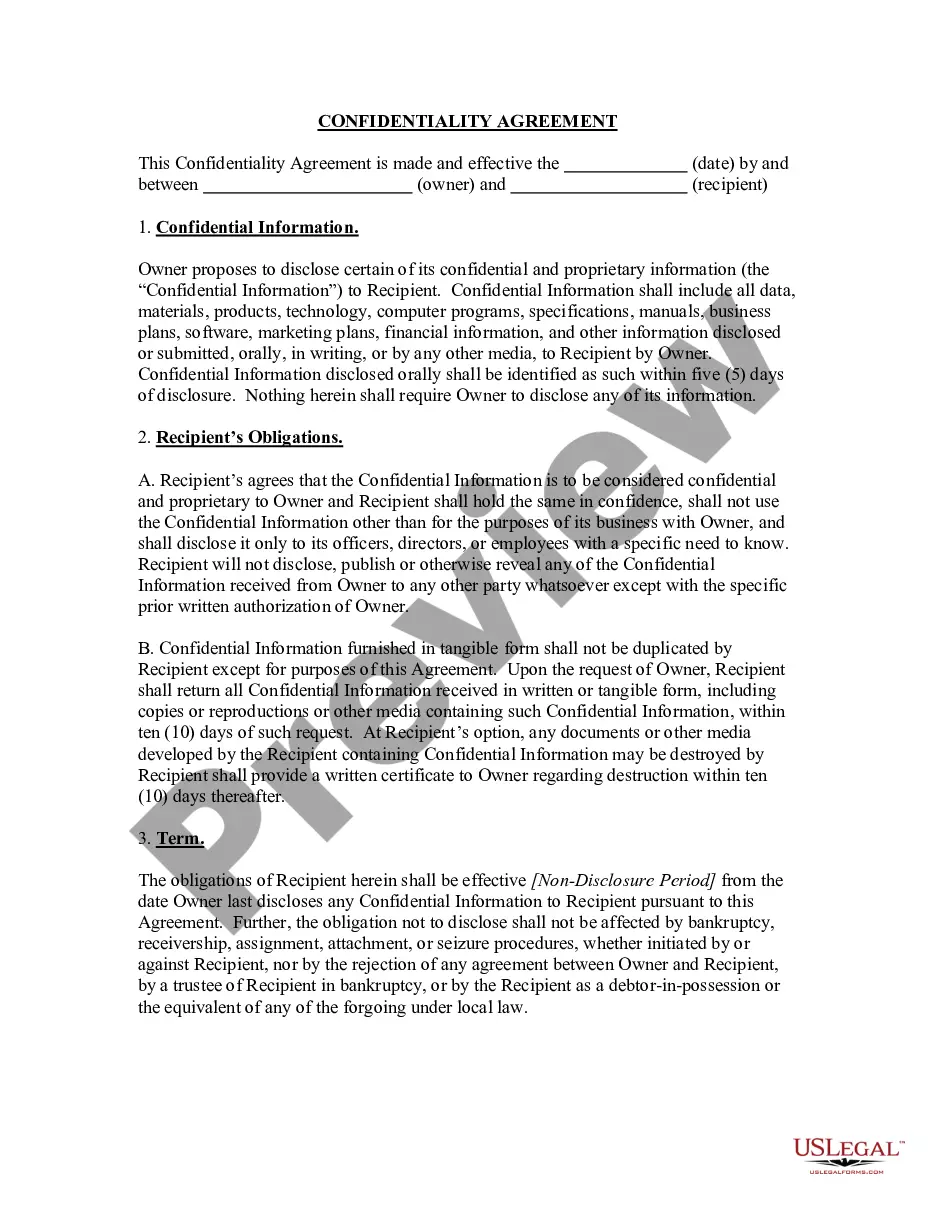

Have you been in a place in which you need files for either company or individual uses just about every day time? There are plenty of lawful file themes available on the net, but finding types you can rely on is not simple. US Legal Forms gives thousands of type themes, much like the Indiana Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate, which are published to satisfy state and federal needs.

In case you are currently familiar with US Legal Forms site and possess a merchant account, just log in. Next, you are able to obtain the Indiana Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate format.

If you do not come with an bank account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the type you require and make sure it is to the appropriate city/state.

- Make use of the Preview switch to check the shape.

- Read the outline to actually have chosen the appropriate type.

- When the type is not what you`re searching for, utilize the Research discipline to find the type that fits your needs and needs.

- Once you find the appropriate type, click on Get now.

- Select the rates plan you need, submit the desired information and facts to produce your money, and pay money for your order utilizing your PayPal or credit card.

- Decide on a handy data file formatting and obtain your version.

Get all the file themes you might have bought in the My Forms menus. You can get a more version of Indiana Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate at any time, if necessary. Just select the required type to obtain or print out the file format.

Use US Legal Forms, probably the most comprehensive variety of lawful varieties, to conserve some time and stay away from errors. The assistance gives skillfully made lawful file themes which can be used for a selection of uses. Create a merchant account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

(d) All claims barrable under subsection (a) shall be barred if not filed within nine (9) months after the death of the decedent. (e) Nothing in this section shall affect or prevent any action or proceeding to enforce any mortgage, pledge, or other lien upon property of the estate.

Can An Executor Distribute Money Before Probate? An executor should avoid distributing any cash from the estate before they fully understand the estates total worth and the total value of liabilities. It is highly advised not to distribute any assets to beneficiaries until, at the very least, probate has been granted.

What is Distribution? Once disbursement is complete, meaning all debts and final taxes are paid, a trustee can distribute the inheritance to beneficiaries. This is called distribution. It is only then that money should be paid to the benefit or care of the beneficiary.

In Indiana, smaller estates can escape the need to go through probate. If a person's estate is worth less than $50,000, it may not be necessary. Affidavits must be filed, however, swearing to this. Another way to avoid probate in Indiana is with a living revocable trust.

An order for final distribution in California probate is conclusive to the rights of heirs and devisees in a decedent's estate. The order also releases the personal representative from claims by heirs and devisees, unless, of course, there is fraud or misrepresentation present.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.

A distribution is the delivery of cash or an asset to a given heir. After resolving debts and paying any taxes due, the executor should distribute the remaining estate to the heirs in ance with the instructions in the will (or as dictated by the court).