US Legal Forms - one of several largest libraries of authorized forms in the USA - delivers an array of authorized file templates you can obtain or printing. While using web site, you can get a huge number of forms for company and specific uses, sorted by types, says, or keywords and phrases.You can find the latest models of forms much like the Indiana Articles of Incorporation of Homeowners Association within minutes.

If you already have a registration, log in and obtain Indiana Articles of Incorporation of Homeowners Association through the US Legal Forms library. The Obtain key will show up on every develop you see. You have accessibility to all formerly delivered electronically forms inside the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, here are easy instructions to help you get started:

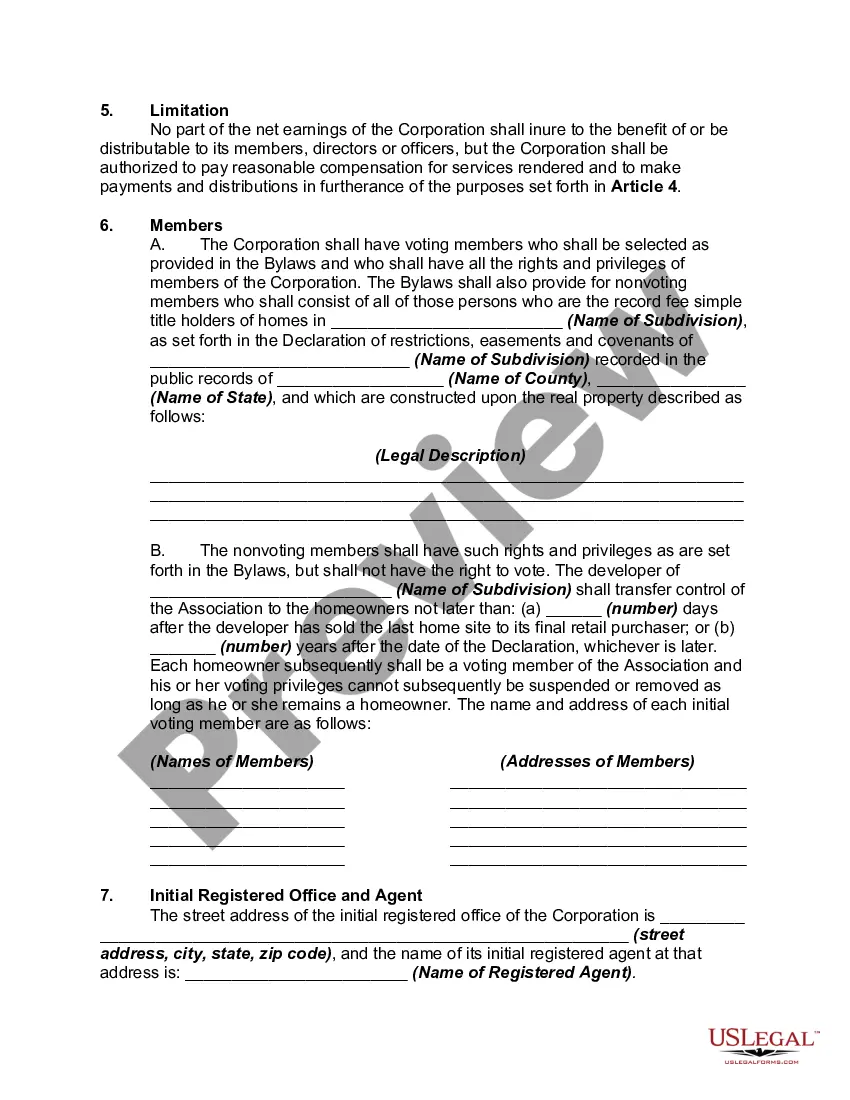

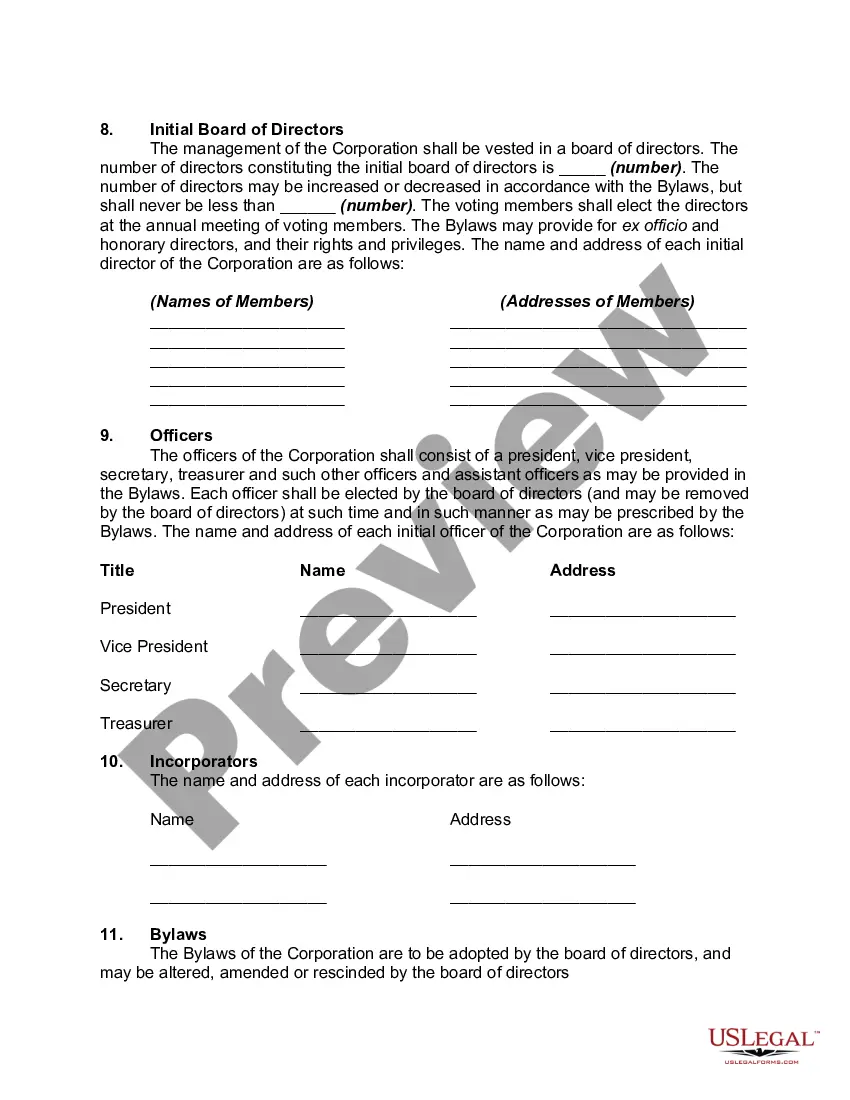

- Make sure you have picked the best develop to your city/area. Click on the Review key to examine the form`s content material. Look at the develop description to ensure that you have chosen the right develop.

- When the develop doesn`t fit your specifications, use the Search discipline on top of the screen to find the one that does.

- In case you are content with the form, validate your option by clicking the Buy now key. Then, pick the rates program you like and offer your references to register to have an bank account.

- Approach the transaction. Make use of charge card or PayPal bank account to finish the transaction.

- Select the formatting and obtain the form on the gadget.

- Make changes. Fill out, edit and printing and sign the delivered electronically Indiana Articles of Incorporation of Homeowners Association.

Every single design you added to your bank account does not have an expiration time and is your own for a long time. So, in order to obtain or printing an additional version, just go to the My Forms portion and click around the develop you require.

Obtain access to the Indiana Articles of Incorporation of Homeowners Association with US Legal Forms, by far the most considerable library of authorized file templates. Use a huge number of expert and state-distinct templates that fulfill your company or specific requires and specifications.