Indiana Settlement Agreement Regarding Property Damages due to an Automobile Accident is a legal document that outlines the terms and conditions agreed upon by the parties involved in an accident-related property damage claim. This agreement is designed to provide a fair resolution to the property damage caused by the accident. Keywords: Indiana, settlement agreement, property damages, automobile accident, terms and conditions, parties involved, fair resolution, accident-related, legal document. There are different types of Indiana Settlement Agreements regarding property damages due to an automobile accident, including: 1. Mediated Settlement Agreement: This type of agreement is reached through mediation, where a neutral third party (mediator) helps the parties negotiate a fair resolution. The mediator facilitates communication and assists in finding a mutually satisfactory solution for property damage claims. 2. Court-Approved Settlement Agreement: In some cases, parties may opt to settle their property damage claim by submitting a settlement agreement to the court for approval. Once the court reviews and approves the agreement, it becomes legally binding. 3. Insurance Company Settlement Agreement: When dealing with property damage claims, it is common for individuals to negotiate with the insurance companies involved. If an agreement is reached between the parties and the insurance company, a settlement agreement outlines the terms agreed upon. 4. Uninsured/Under insured Motorist Settlement Agreement: In cases where the at-fault driver does not have insurance or carries insufficient coverage, the injured party may pursue a settlement agreement with their own insurance company. This agreement ensures compensation for property damages caused by an uninsured or under insured driver. 5. Voluntary Settlement Agreement: This type of agreement is reached through voluntary negotiation between the parties involved in an automobile accident. This agreement allows both parties to come to a fair resolution regarding property damages without involving formal legal proceedings. In conclusion, an Indiana Settlement Agreement Regarding Property Damages due to an Automobile Accident is a legal document that outlines the terms and conditions agreed upon by the parties involved in a property damage claim resulting from an automobile accident. Different types of settlement agreements exist, including mediated, court-approved, insurance company, uninsured/under insured motorist, and voluntary settlement agreements. These agreements aim to provide a fair resolution for the property damages caused by an accident, and they play a crucial role in ensuring a satisfactory outcome for all parties involved.

Indiana Settlement Agreement Regarding Property Damages due to an Automobile Accident

Description

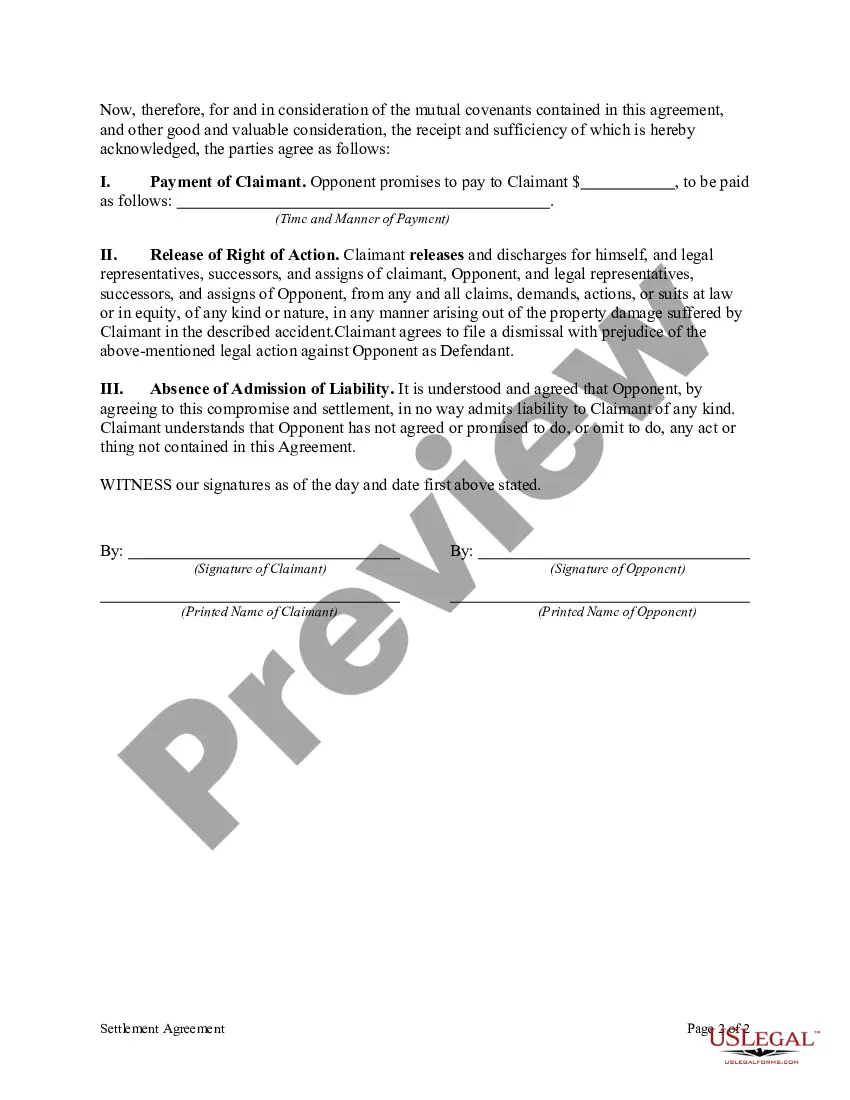

How to fill out Indiana Settlement Agreement Regarding Property Damages Due To An Automobile Accident?

Choosing the best authorized papers template can be quite a have a problem. Naturally, there are a variety of web templates available on the net, but how will you discover the authorized develop you will need? Utilize the US Legal Forms web site. The support gives a large number of web templates, including the Indiana Settlement Agreement Regarding Property Damages due to an Automobile Accident, which can be used for organization and private requires. All of the types are inspected by professionals and fulfill state and federal needs.

In case you are presently registered, log in in your profile and click the Down load switch to find the Indiana Settlement Agreement Regarding Property Damages due to an Automobile Accident. Make use of profile to search throughout the authorized types you possess purchased earlier. Visit the My Forms tab of your profile and acquire an additional duplicate of the papers you will need.

In case you are a new user of US Legal Forms, listed below are simple directions that you should stick to:

- First, make sure you have chosen the proper develop to your town/area. You are able to check out the form using the Review switch and browse the form outline to guarantee this is the best for you.

- If the develop is not going to fulfill your requirements, utilize the Seach area to get the correct develop.

- When you are certain the form is suitable, click the Acquire now switch to find the develop.

- Choose the pricing strategy you would like and enter the required details. Make your profile and buy the order with your PayPal profile or Visa or Mastercard.

- Pick the document formatting and obtain the authorized papers template in your system.

- Total, revise and print out and sign the acquired Indiana Settlement Agreement Regarding Property Damages due to an Automobile Accident.

US Legal Forms is definitely the biggest local library of authorized types for which you can find numerous papers web templates. Utilize the service to obtain appropriately-created paperwork that stick to status needs.