Indiana Employment Agreement with Chief Financial Officer An Indiana Employment Agreement with a Chief Financial Officer (CFO) is a legally binding contract that outlines the terms and conditions of employment between a company and its CFO. This agreement sets forth the rights, responsibilities, and obligations of both parties involved, ensuring clarity and protection for all parties. The Indiana Employment Agreement with a Chief Financial Officer typically includes the following key elements: 1. Parties involved: Clearly identifies the company and the CFO being hired. 2. Position and duties: Outlines the CFO's responsibilities, authority, and reporting structure within the organization. This includes overseeing financial operations, managing budgets, financial planning, analyzing financial data, and providing strategic recommendations. 3. Compensation and benefits: Details the CFO's salary, bonus structure, benefits package, and any potential additional incentives or bonuses based on performance metrics. 4. Term of employment: Specifies the commencement date of employment and whether it is an at-will agreement (which allows either party to terminate the employment at any time) or for a specific term (with a defined start and end date). 5. Termination clause: Outlines the conditions under which either party may terminate the CFO's employment, including provisions for resignation, termination for cause, termination without cause, or termination due to disability or death. 6. Confidentiality and non-disclosure: Includes provisions to protect the company's confidential information, trade secrets, and intellectual property during and after employment. This may also include non-compete and non-solicitation clauses to prevent the CFO from working for a competitor or soliciting company clients and employees. 7. Intellectual property: Specifies that any inventions, developments, or discoveries made by the CFO during their employment belong to the company. 8. Non-disparagement: Parties agree not to make any derogatory or negative statements about each other. 9. Governing law: Indicates that the agreement is governed by the laws of the state of Indiana. Types of Indiana Employment Agreement with Chief Financial Officer: 1. At-will employment agreement: This type of agreement does not have a specific duration and allows either party to terminate the employment relationship at any time, for any reason, or without any reason, as long as it is not discriminatory or in violation of applicable laws. 2. Fixed-term employment agreement: A fixed-term agreement specifies a definite period of employment, typically with a specific start and end date. 3. Temporary or interim employment agreement: This type of agreement is used when hiring a CFO on a temporary basis, such as during a leave of absence or transition period. In conclusion, an Indiana Employment Agreement with a Chief Financial Officer is a critical document that establishes the terms and conditions of employment between a company and its CFO. It ensures a clear understanding of each party's rights and obligations while providing legal protection.

Indiana Employment Agreement with Chief Financial Officer

Description

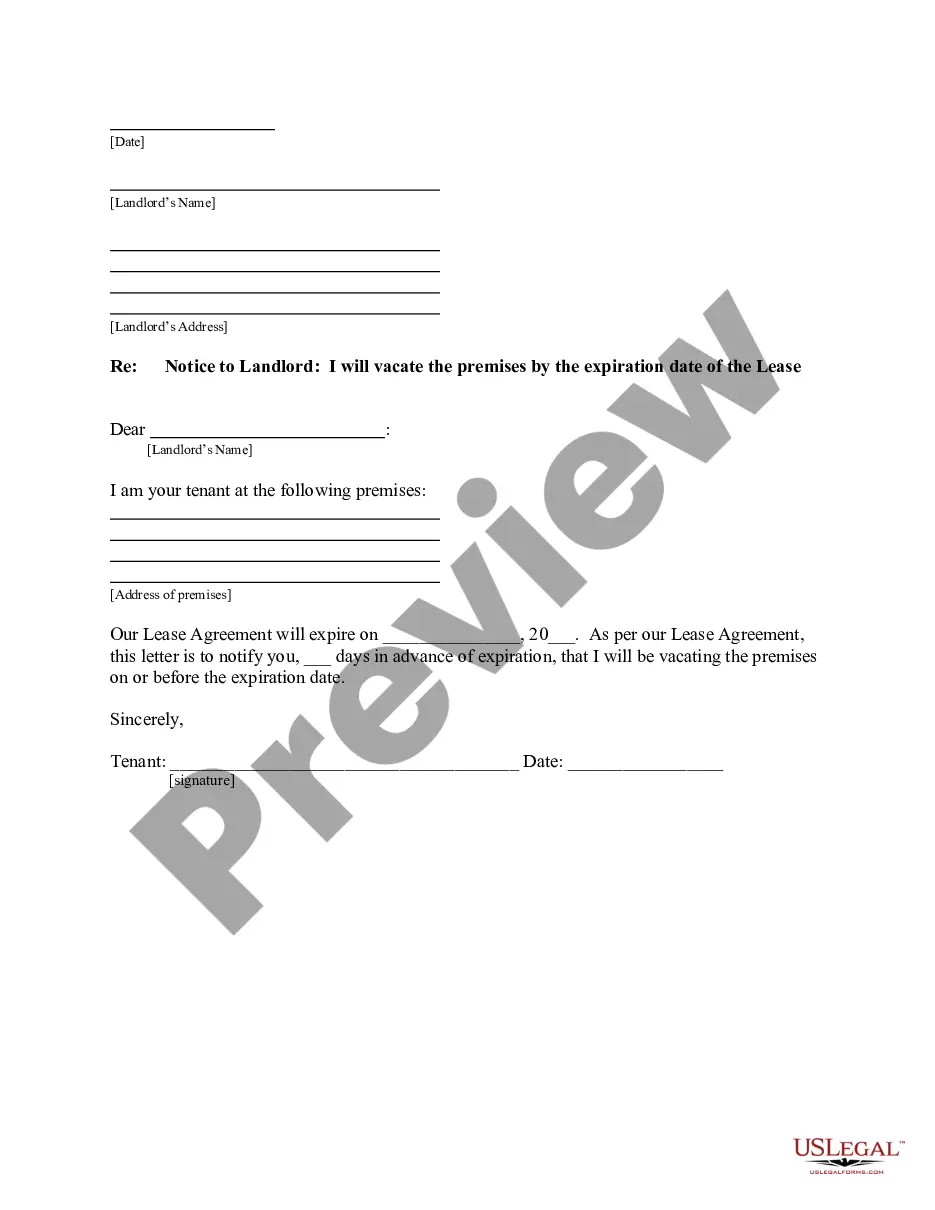

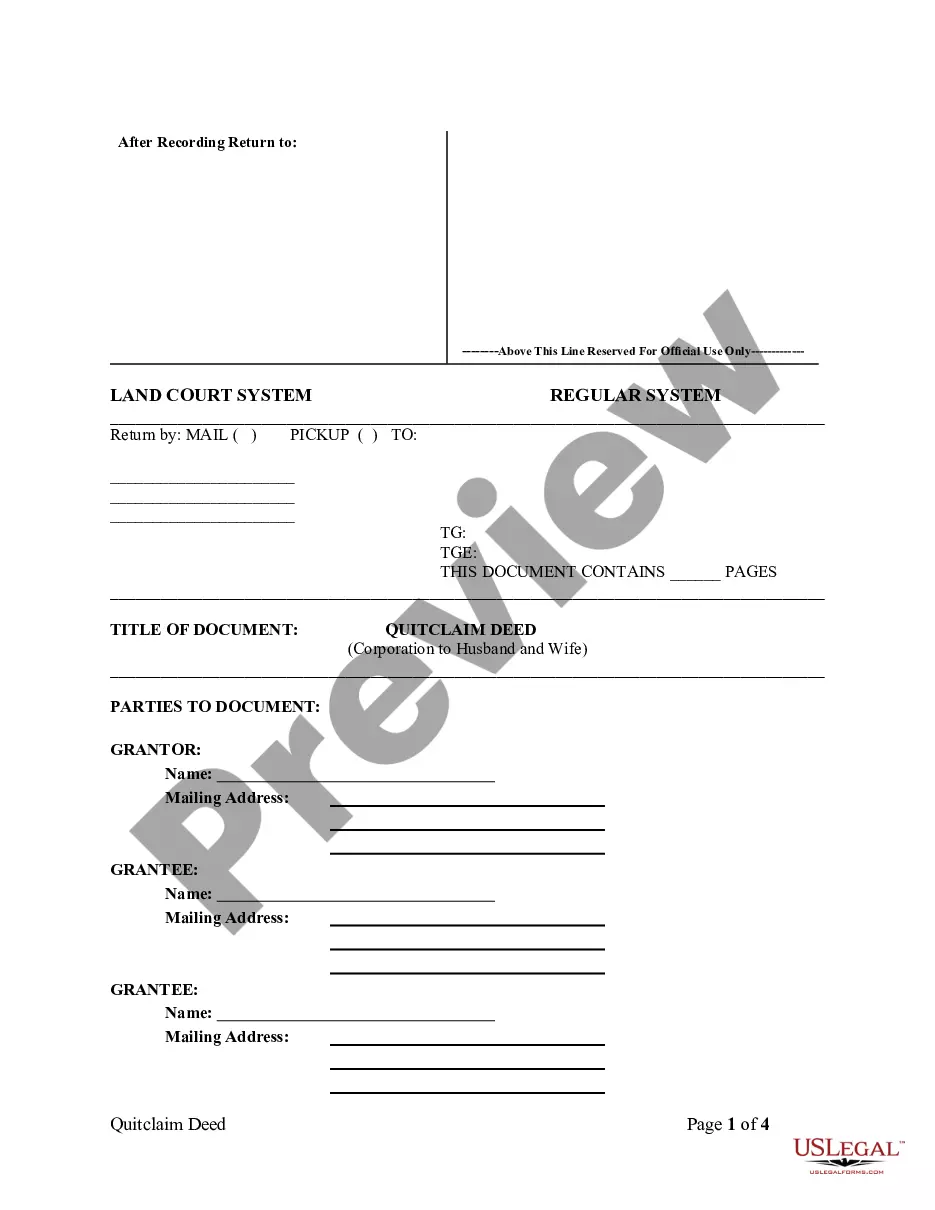

How to fill out Indiana Employment Agreement With Chief Financial Officer?

If you require to complete, obtain, or print legal document templates, use US Legal Forms, the largest selection of legal forms available online.

Utilize the site’s simple and user-friendly search to locate the documents you need. A variety of templates for business and personal use are organized by categories and states, or key terms.

Use US Legal Forms to access the Indiana Employment Agreement with Chief Financial Officer in just a few clicks.

Every legal document template you receive is yours forever. You have access to every form you obtained in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Indiana Employment Agreement with Chief Financial Officer using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to retrieve the Indiana Employment Agreement with Chief Financial Officer.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s contents. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to discover other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred payment plan and enter your details to sign up for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Indiana Employment Agreement with Chief Financial Officer.

Form popularity

FAQ

To form a legally binding Indiana Employment Agreement with Chief Financial Officer, four key components are necessary: offer, acceptance, consideration, and competency. The offer outlines the employment terms proposed by the employer. Acceptance confirms that the CFO agrees to those terms. Consideration involves the exchange of value, while competency ensures all parties have the legal capacity to enter into the agreement. Ensuring these components are met strengthens the contract's validity.

The three essential elements of a legally binding Indiana Employment Agreement with Chief Financial Officer are mutual consent, legality, and consideration. Mutual consent occurs when both parties agree on the terms, reflecting their shared intent. Legality ensures the contract's purpose aligns with applicable laws. Consideration reflects the value exchanged, which is crucial for enforceability.

The three factors of an Indiana Employment Agreement with Chief Financial Officer include offer, acceptance, and consideration. The offer presents the employment terms from the employer, while acceptance shows the CFO agrees to these terms. Consideration refers to the value exchanged, which could be salary and benefits for the work performed. These factors create a sturdy framework for a valid contract.

For an Indiana Employment Agreement with Chief Financial Officer to be legally binding, it requires competency, mutual consent, and a lawful purpose. Competency means both parties must have the legal capacity to enter the agreement. Mutual consent is evident when both parties agree to the terms without coercion. Lastly, the contract's purpose must not violate any laws.

An Indiana Employment Agreement with Chief Financial Officer must clearly outline the offer, acceptance, and consideration. First, the offer must detail the job responsibilities and expected compensation. Next, the acceptance needs a signature from both parties, indicating mutual agreement. Finally, consideration ensures that both sides receive something of value, which solidifies the contract's legality.

To create an employment agreement, start by outlining the job title, responsibilities, and expectations. Incorporate compensation details, benefits, and termination conditions. Using an Indiana Employment Agreement with Chief Financial Officer as a template can streamline this process, ensuring you cover all essential elements. Legal platforms like uslegalforms can provide tools and templates to help you draft an effective agreement.

While it depends on company policy and state laws, many employers provide contracts to ensure clear terms of employment. If you hold a significant position, such as CFO, an Indiana Employment Agreement with Chief Financial Officer is advisable for outlining duties and compensation. Contracts foster transparency and protect the rights of employees. It’s always best to discuss contract terms with your employer.

The office of the Chief Financial Officer (CFO) manages a company's financial planning, risk management, and record-keeping. In addition, the CFO oversees financial reporting and ensures compliance with regulations. An Indiana Employment Agreement with Chief Financial Officer should detail these responsibilities and the expectations for performance. This clarity is crucial for organizational financial health.

Yes, a contract is essential for a CEO. An Indiana Employment Agreement with Chief Financial Officer lays down the rules of engagement and serves as protection for the CEO and the company. By having a formal agreement, both parties are clear about goals, expectations, and compensation. This clarity facilitates a smoother working relationship and reduces potential conflicts.

It is highly recommended for a CEO to have an employment contract. An Indiana Employment Agreement with Chief Financial Officer provides legal security and outlines expectations, compensation, and performance metrics. This documentation also serves as a reference point in case of disputes or disagreements. Consequently, contracts create an environment of transparency and trust.

More info

LANG, Chief Financial Officer Segment First National Bank of Florida 1275 Park Avenue Tampa, Florida 33630 Executive Officer and Director of Segment is Chief Financial Officer of Segment and a Director of the Segment and the parent company. The Executive Officer is the senior executive of the Parent Company. He is responsible for the management of the operations and financials of Segment and the Parent Company, as well as serving as the responsible head of the Segment and the Parent Company. He also manages the investments of the Segment and the Parent Company. 2 ROBERT P. LANG, Executive Director First National Bank of Florida 1275 Park Avenue Tampa, Florida 33630 Manager of Segment is Chief Financial Officer of Segment. President and Chief Executive Officer of the Segment. His primary responsibilities are to oversee and develop the business strategy and operations of Segment, as well as the day-to-day activities of the Parent. 3 JEAN M.