The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and seller (and their attorneys) must consider the law of contracts, taxation, real estate, corporations, securities, and antitrust in many situations. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted.

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

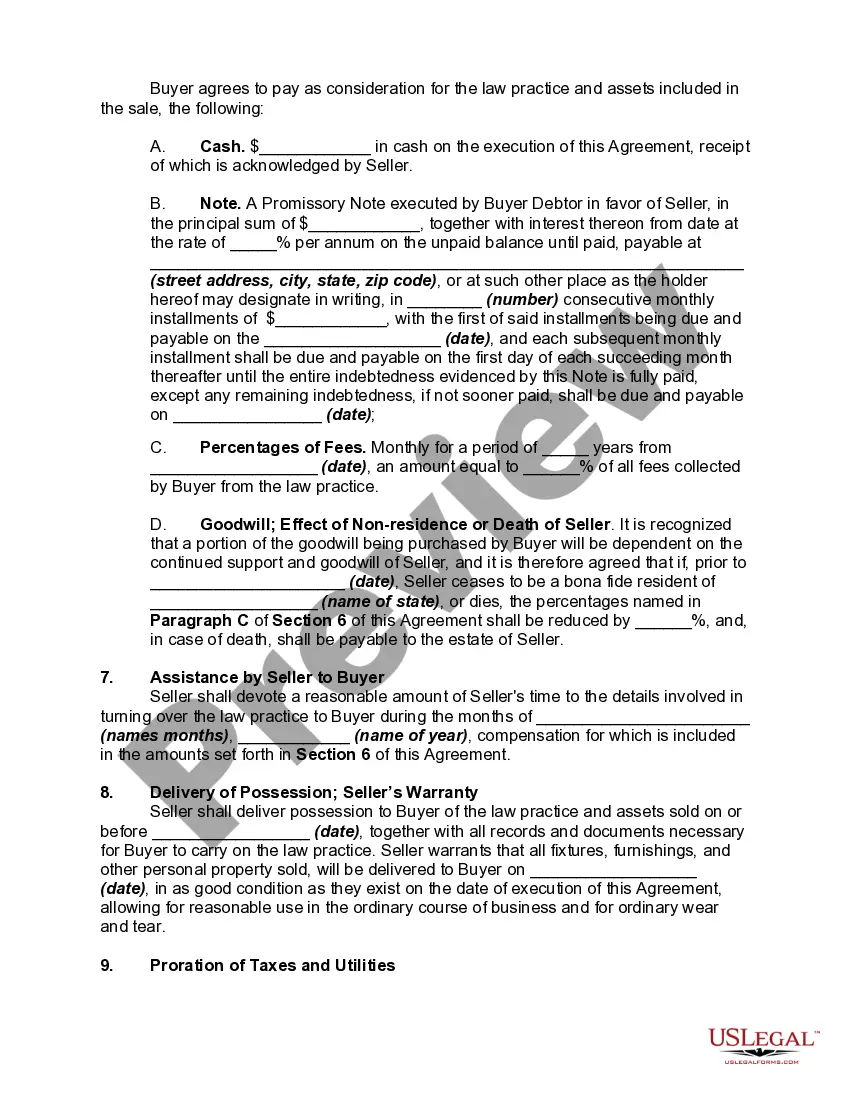

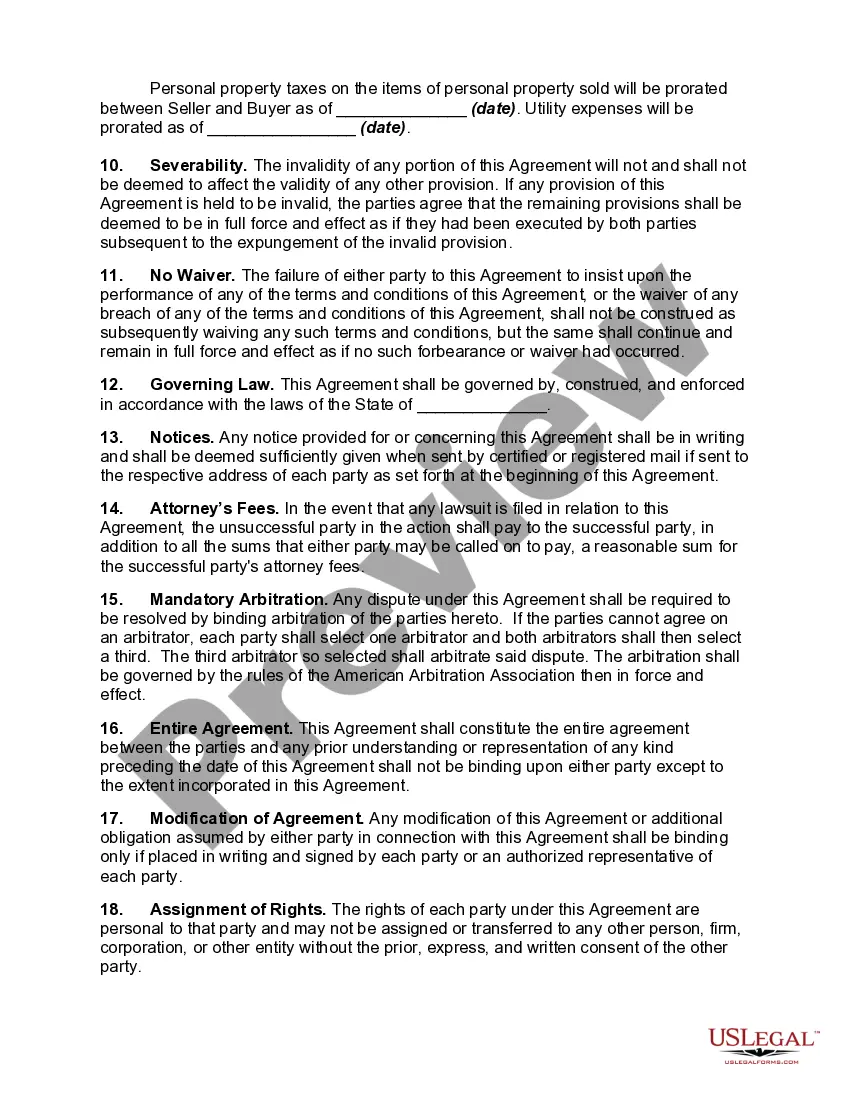

Title: Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: A Comprehensive Guide Introduction: The Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a legally binding contract that governs the sale of a legal practice owned and operated by a sole proprietor in Indiana. This detailed description aims to shed light on the various aspects of this agreement, including its provisions, benefits, and different types. Keywords: Indiana, Agreement for Sale, Sole Proprietorship Law Practice, Restrictive Covenant. 1. Key Provisions of the Agreement: — Purchase Price: The agreement outlines the price at which the sole proprietorship law practice will be sold. — Transfer of Assets and Liabilities: It specifies the assets and liabilities that will be transferred to the buyer upon the completion of the sale. — Scope of Transfer: Defines the extent of the law practice being sold, including client files, ongoing cases, intellectual property, and any related materials. — Payment Terms: Outlines the payment structure, such as down payment, installments, or lump sum, along with any applicable interest rates. — Confidentiality and Non-Disclosure: Imposes obligations on both parties to maintain the confidentiality of sensitive business information. — Non-Compete and Restrictive Covenant: Establishes a duration during which the seller is restricted from engaging in a similar business in the same geographical area. 2. Benefits of the Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: — Seamless Transition: The agreement provides a structured framework for the smooth transfer of ownership, ensuring minimal disruption to clients and ongoing cases. — Protection of Goodwill: Through the inclusion of a restrictive covenant, the seller safeguards the value of their practice while preventing unfair competition. — Compliance with Legal Requirements: By adhering to the Indiana Agreement for Sale, both the buyer and seller safeguard themselves from legal issues that may arise from an improperly executed sale. — Financial Security: The agreement offers financial security for the seller, as they can receive fair compensation for their business built over the years. 3. Types of Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: — Standard Agreement for Sale: This is the most common type, encompassing all the essential provisions mentioned earlier. — Customizability: The agreement can be tailored to suit the unique circumstances and needs of both the buyer and seller. Various supplementary clauses can be added to address specific requirements. Conclusion: The Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a crucial legal framework that enables the smooth transfer of ownership and protection of goodwill in the legal industry. By comprehending its provisions and benefits, sole proprietors can navigate the process of selling their law practices with confidence, ensuring a fair and secure transaction. Keywords: Indiana, Agreement for Sale, Sole Proprietorship, Law Practice, Restrictive Covenant.Title: Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: A Comprehensive Guide Introduction: The Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a legally binding contract that governs the sale of a legal practice owned and operated by a sole proprietor in Indiana. This detailed description aims to shed light on the various aspects of this agreement, including its provisions, benefits, and different types. Keywords: Indiana, Agreement for Sale, Sole Proprietorship Law Practice, Restrictive Covenant. 1. Key Provisions of the Agreement: — Purchase Price: The agreement outlines the price at which the sole proprietorship law practice will be sold. — Transfer of Assets and Liabilities: It specifies the assets and liabilities that will be transferred to the buyer upon the completion of the sale. — Scope of Transfer: Defines the extent of the law practice being sold, including client files, ongoing cases, intellectual property, and any related materials. — Payment Terms: Outlines the payment structure, such as down payment, installments, or lump sum, along with any applicable interest rates. — Confidentiality and Non-Disclosure: Imposes obligations on both parties to maintain the confidentiality of sensitive business information. — Non-Compete and Restrictive Covenant: Establishes a duration during which the seller is restricted from engaging in a similar business in the same geographical area. 2. Benefits of the Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: — Seamless Transition: The agreement provides a structured framework for the smooth transfer of ownership, ensuring minimal disruption to clients and ongoing cases. — Protection of Goodwill: Through the inclusion of a restrictive covenant, the seller safeguards the value of their practice while preventing unfair competition. — Compliance with Legal Requirements: By adhering to the Indiana Agreement for Sale, both the buyer and seller safeguard themselves from legal issues that may arise from an improperly executed sale. — Financial Security: The agreement offers financial security for the seller, as they can receive fair compensation for their business built over the years. 3. Types of Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant: — Standard Agreement for Sale: This is the most common type, encompassing all the essential provisions mentioned earlier. — Customizability: The agreement can be tailored to suit the unique circumstances and needs of both the buyer and seller. Various supplementary clauses can be added to address specific requirements. Conclusion: The Indiana Agreement for Sale of Sole Proprietorship Law Practice with Restrictive Covenant is a crucial legal framework that enables the smooth transfer of ownership and protection of goodwill in the legal industry. By comprehending its provisions and benefits, sole proprietors can navigate the process of selling their law practices with confidence, ensuring a fair and secure transaction. Keywords: Indiana, Agreement for Sale, Sole Proprietorship, Law Practice, Restrictive Covenant.