Indiana General Form of Agreement to Incorporate

Description

How to fill out General Form Of Agreement To Incorporate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template options that you can download or print.

By using the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the most recent versions of documents, such as the Indiana General Form of Agreement to Incorporate, in just a few minutes.

If you already have a monthly subscription, sign in and download the Indiana General Form of Agreement to Incorporate from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Each template you purchase has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you want.

Access the Indiana General Form of Agreement to Incorporate with US Legal Forms, the most extensive collection of legal template options. Utilize thousands of expert and state-specific templates that meet your business or personal needs and requirements.

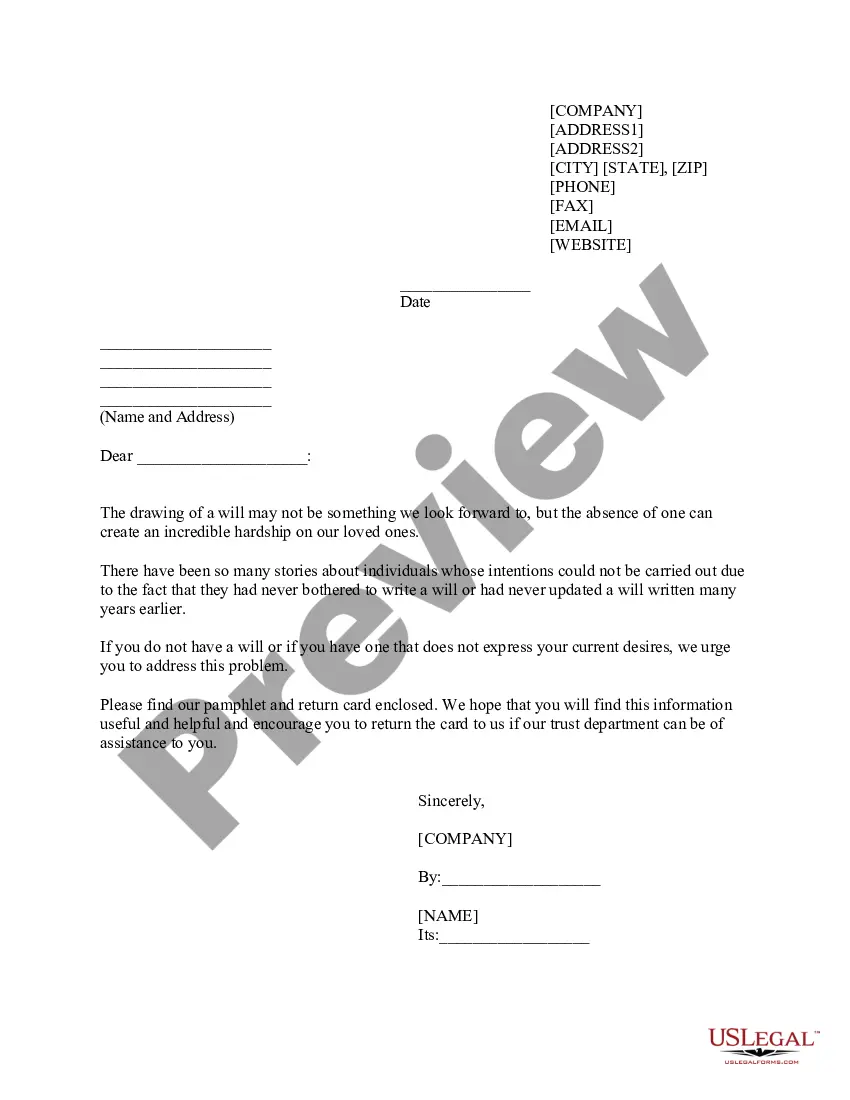

- Ensure you have selected the correct form for your city/region. Click the Preview button to review the form's contents. Check the form details to make sure you have picked the correct one.

- If the form doesn't meet your needs, use the Search field at the top of the page to find one that does.

- Once you are content with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and enter your information to register for an account.

- Complete the transaction. Utilize your credit card or PayPal account to finalize the purchase.

- Select the format and download the form onto your device.

- Make adjustments. Fill out, modify, and print and sign the downloaded Indiana General Form of Agreement to Incorporate.

Form popularity

FAQ

To incorporate a company in Indiana, you need to file the Indiana General Form of Agreement to Incorporate with the Secretary of State. This form requires essential details, such as your company name, the registered agent's information, and the purpose of your business. Once filed, you should obtain an Employer Identification Number (EIN) from the IRS to establish your business legally. By using US Legal Forms, you can easily access and complete the necessary documents, ensuring your incorporation process is smooth and efficient.

Yes, you must register your business with the Indiana Secretary of State to legally operate an LLC in the state. This registration is necessary to receive your Articles of Organization, which formally establishes your business. Utilizing the Indiana General Form of Agreement to Incorporate alongside this registration can help streamline your business setup.

Indiana does not mandate an operating agreement for LLCs, but it is beneficial for internal governance. A well-drafted operating agreement lays out the structure and rules of your business, reducing potential conflicts. The Indiana General Form of Agreement to Incorporate is a great resource to help you create this essential document.

While Indiana does not legally require an LLC to have an operating agreement, having one is highly recommended. This agreement serves as a roadmap for operations and helps protect member interests. Using the Indiana General Form of Agreement to Incorporate can simplify this process and ensure you cover all necessary details.

An LLC operating agreement is crucial for establishing clear rules and procedures for your business. It defines the roles of members and outlines how decisions are made, providing a framework for operations. Having the Indiana General Form of Agreement to Incorporate can ensure that your LLC runs smoothly and efficiently.

An LLC can technically operate without an operating agreement, but it is not advisable. Without this document, you may face uncertainties regarding management, ownership, and profit distribution. The Indiana General Form of Agreement to Incorporate helps clarify these aspects and can prevent disputes among members.

If an operating agreement is not signed in Indiana, the LLC will default to the state’s regulations, which may not align with your business intentions. This lack of clarity can lead to misunderstandings and disputes among members. To avoid these issues, consider establishing an operating agreement using the Indiana General Form of Agreement to Incorporate, which provides a clear structure for your business.

Indiana does not mandate an operating agreement for LLCs, but it strongly encourages having one. This agreement serves as an internal document that governs the management of your LLC and can prevent future disputes among members. For a comprehensive approach, reference resources like the Indiana General Form of Agreement to Incorporate.

While Indiana law does not legally require LLCs to have an operating agreement, it is highly recommended. Having an operating agreement can protect your personal assets and clarify operational procedures. To streamline this process, consider using the Indiana General Form of Agreement to Incorporate as a solid foundation.

Yes, you can write your own operating agreement for your LLC in Indiana. This document outlines how the business will operate and details the rights and responsibilities of the members. Utilizing the Indiana General Form of Agreement to Incorporate can help you ensure that all crucial points are addressed.