Indiana Assignment and Transfer of Stock

Description

How to fill out Assignment And Transfer Of Stock?

If you aim to be thorough, obtain, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s straightforward and convenient search feature to find the documents you require.

Various templates for business and specific applications are categorized by types and suggestions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to get the Indiana Assignment and Transfer of Stock with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Acquire button to obtain the Indiana Assignment and Transfer of Stock.

- You can also access forms you have previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form appropriate for your state/country.

- Step 2. Use the Review feature to check the form’s details. Remember to view the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

Form popularity

FAQ

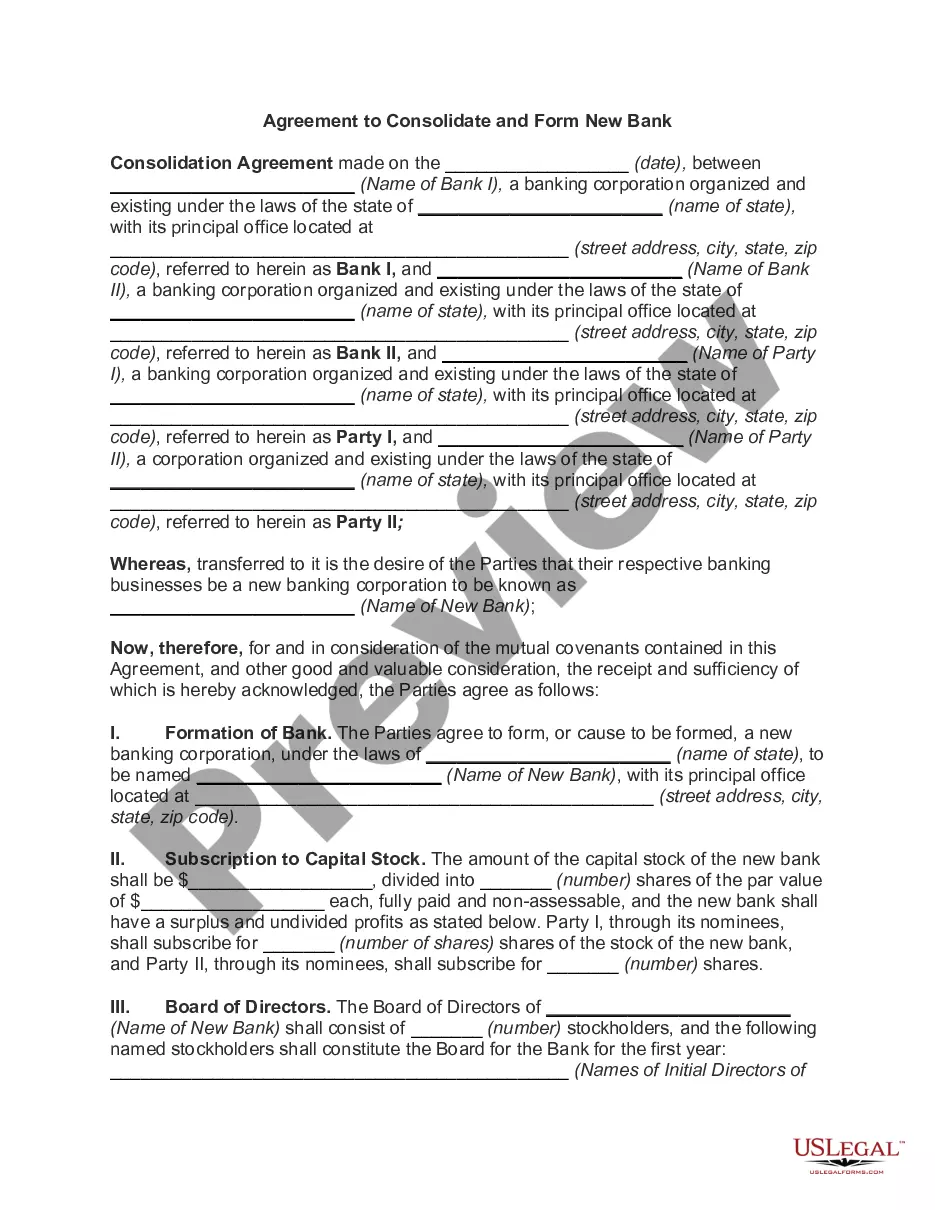

To complete a stock transfer form in Indiana, begin by obtaining the official form from your stockholder's association or corporate entity. Fill out the necessary information, including the names of both the transferor and the transferee, the number of shares being transferred, and the corporation's details. Make sure you sign the form and, if required, get the signature of a witness. Using a trusted platform like US Legal Forms can simplify this process by providing easy access to reliable stock transfer forms tailored for the Indiana Assignment and Transfer of Stock.

A stock power form for transferring shares is a specific document that allows the current owner to authorize the transfer of their shares to another party. It serves as a reliable tool in the Indiana Assignment and Transfer of Stock process by simplifying the transfer of ownership. By using this form, shareholders can ensure compliance with legal requirements while maintaining transparency in the transaction. You can find easy-to-use templates for stock power forms on platforms like US Legal Forms, making this process even more accessible.

The primary document to transfer stock is called a stock transfer form or stock assignment form. This legal document outlines the necessary details of the transfer and is key in the Indiana Assignment and Transfer of Stock procedure. It typically requires signatures from both the seller and buyer, ensuring clarity and accountability in the transaction. Using a reputable resource like US Legal Forms helps streamline this legal process.

Yes, a stock transfer form is essential when transferring shares. This form serves as proof of ownership change and is a fundamental part of the Indiana Assignment and Transfer of Stock process. Completing a stock transfer form correctly prevents potential disputes and ensures that the transfer is legally recognized. If you're unsure about the process, platforms like US Legal Forms can provide templates and guidance.

A stock power form is a legal document used to transfer ownership of shares from one party to another. It facilitates the Indiana Assignment and Transfer of Stock process by authorizing the transferor to transfer their shares to the transferee. Typically, this form includes details such as the stockholder's name, number of shares, and the recipient's information. Utilizing a stock power form ensures a smooth and legally binding transfer.

To fill out a stock power, start by entering the stockholder's name and the details of the shares being transferred. Specify the recipient's information and make sure to sign the document, as your signature validates the transaction. If necessary, consult with a legal professional or utilize services like US Legal Forms to ensure accuracy.

A stock assignment is a document that transfers ownership of shares without necessarily requiring the physical stock certificate. In the Indiana Assignment and Transfer of Stock process, this assignment indicates your intent to transfer ownership and is critical if you have lost the certificate. It can help streamline the transfer process.

The form for transfer of stock ownership in Indiana typically includes a stock transfer form or a stock power. This document is essential for legalizing the change in ownership and ensuring all parties involved have the necessary information. For efficient processing, consider using platforms like US Legal Forms, which provide easy access to templates.

Filling out a stock power form for Indiana Assignment and Transfer of Stock involves entering the owner's information, along with the details of the shares being transferred. Clearly indicate the name of the new shareholder and attach it to the original stock certificate if applicable. Remember to sign and date the form, as this authorizes the transfer officially.

A stock certificate is a physical document that represents ownership of shares in a corporation, while a stock power is a separate document that authorizes the transfer of those shares. In the context of Indiana Assignment and Transfer of Stock, the stock certificate confirms your ownership, and the stock power facilitates the transfer process. Understanding these differences helps ensure smooth transactions.