Indiana Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Installment Promissory Note With Bank Deposit As Collateral?

If you need to detailed, obtain, or create official document templates, utilize US Legal Forms, the most extensive assortment of official forms available online. Make use of the site’s straightforward and user-friendly search to locate the documents you need.

Many templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to discover the Indiana Installment Promissory Note with Bank Deposit as Collateral within just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Indiana Installment Promissory Note with Bank Deposit as Collateral. You can also retrieve forms you have previously downloaded in the My documents section of your account.

Every official document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Indiana Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

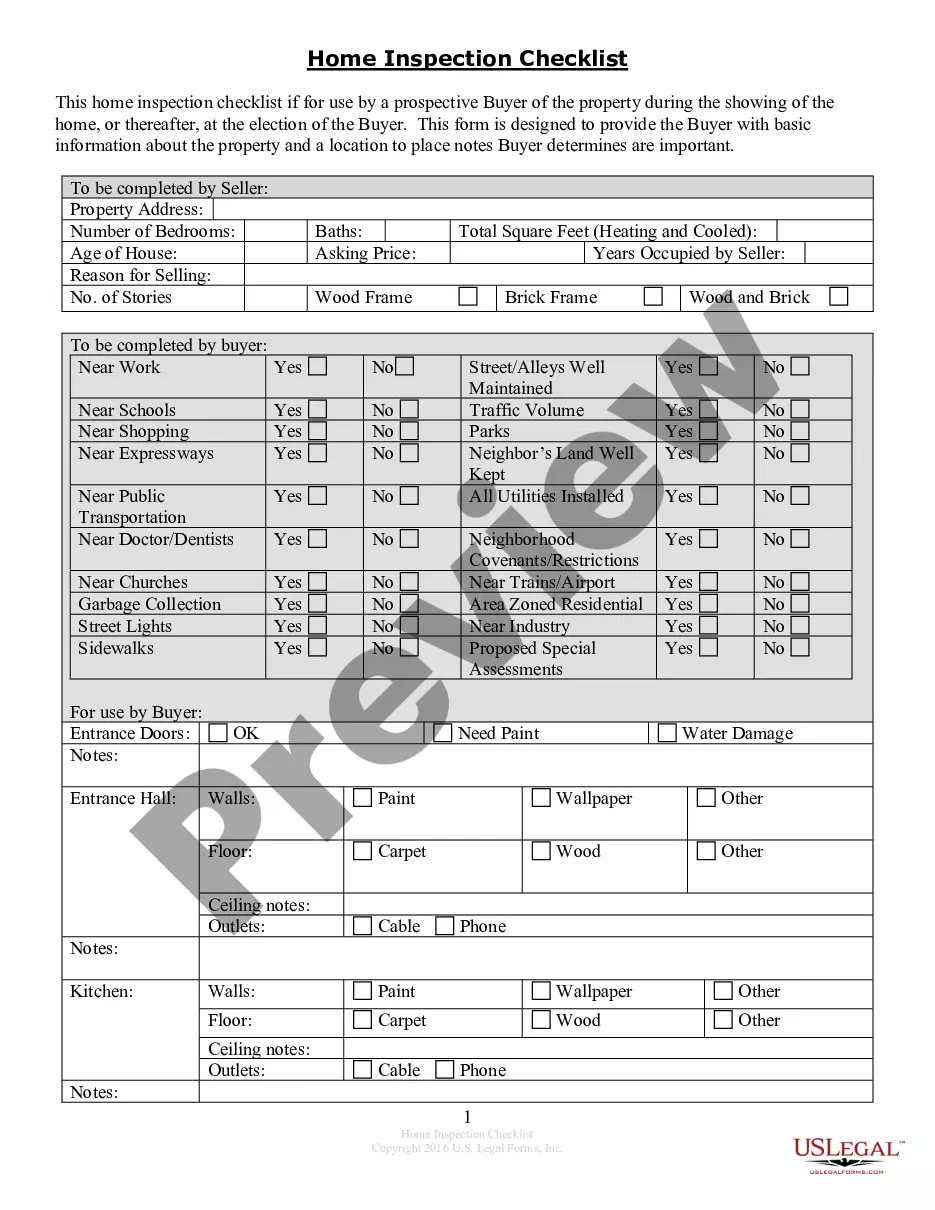

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the official form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the official form and download it to your device.

- Step 7. Complete, edit, and print or sign the Indiana Installment Promissory Note with Bank Deposit as Collateral.

Form popularity

FAQ

Promissory notes come in various forms, including secured and unsecured notes, demand notes, and installment notes. A secured promissory note, like the Indiana Installment Promissory Note with Bank Deposit as Collateral, offers security for the lender by including collateral. Understanding these different types can help borrowers choose the best option for their financial situation.

The key difference between secured and unsecured promissory notes lies in collateral. A secured promissory note, like the Indiana Installment Promissory Note with Bank Deposit as Collateral, is backed by specific assets that the lender can claim if the borrower defaults. Conversely, an unsecured promissory note does not have collateral, which can result in higher risk for lenders and potentially higher interest rates for borrowers.

In many cases, notarization is not a strict legal requirement for a secured promissory note, but it is highly recommended. Notarizing your Indiana Installment Promissory Note with Bank Deposit as Collateral adds an extra layer of authenticity and can help prevent disputes in the future. A notarized document demonstrates that both parties willingly entered into the agreement, which can be valuable if you ever need to enforce the note.

For a promissory note to be considered valid, it must outline the amount borrowed, interest rate, repayment schedule, and the signatures of the lender and borrower. Any missing details can lead to disputes in the future. When preparing an Indiana Installment Promissory Note with Bank Deposit as Collateral, it's essential to fulfill all requirements to ensure it holds up legally.

A promissory note becomes invalid when it is not completed according to state laws or lacks the necessary signatures. Moreover, if there's a misunderstanding between the parties involved regarding the terms, it can undermine the note's validity. Therefore, when drafting an Indiana Installment Promissory Note with Bank Deposit as Collateral, clarity and compliance with legal standards are crucial.

A promissory note can be voided if it lacks essential components, such as the signature of the borrower or a clear indication of the repayment terms. Additionally, if the agreement involves illegal activities, such as fraud, it is inherently invalid. If you’re looking to create a valid Indiana Installment Promissory Note with Bank Deposit as Collateral, ensure it meets all legal requirements.

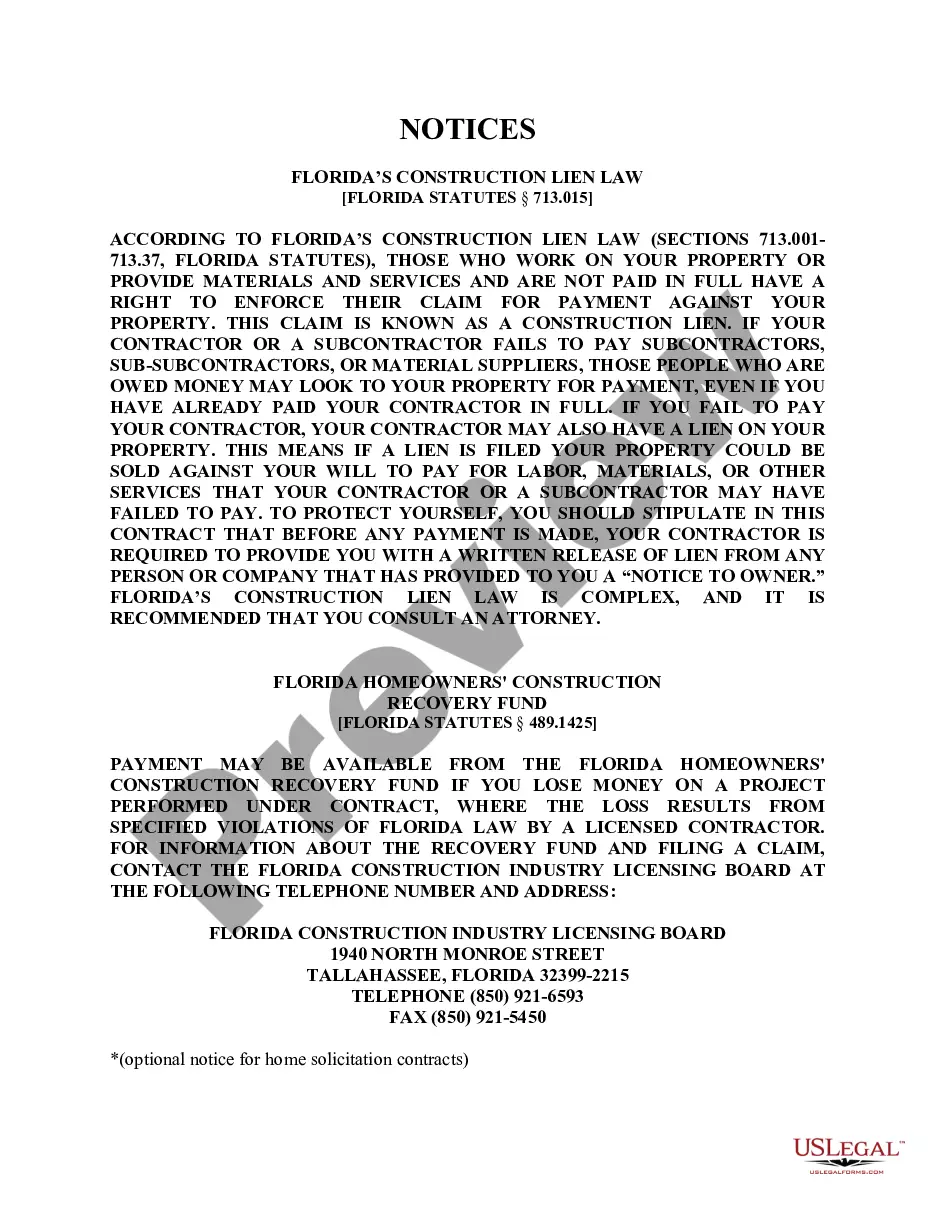

The primary legal documents for collateral include the security agreement and any relevant promissory notes. When dealing with an Indiana Installment Promissory Note with Bank Deposit as Collateral, a comprehensive security agreement is essential. Additionally, having the promissory note adequately drafted ensures that both parties understand their rights, obligations, and the handling of the collateral.

Among the various documents, the security agreement specifically connects the promissory note to the collateral. If you are looking to secure an Indiana Installment Promissory Note with Bank Deposit as Collateral, this agreement will outline the terms and conditions that protect your investment. Proper documentation is crucial to ensure clarity and legal enforceability.

A security agreement is what connects a promissory note to collateral. In the case of an Indiana Installment Promissory Note with Bank Deposit as Collateral, this agreement establishes a clear link between the note and the bank deposit held as security. This legal framework helps protect the lender's interests should the borrower default on the note.

The document that connects the promissory note to the collateral is known as a security agreement. This agreement outlines the relationship between the Indiana Installment Promissory Note with Bank Deposit as Collateral and the asset serving as collateral. It specifies the rights and responsibilities of both parties, thereby ensuring legal protection of the collateral involved.