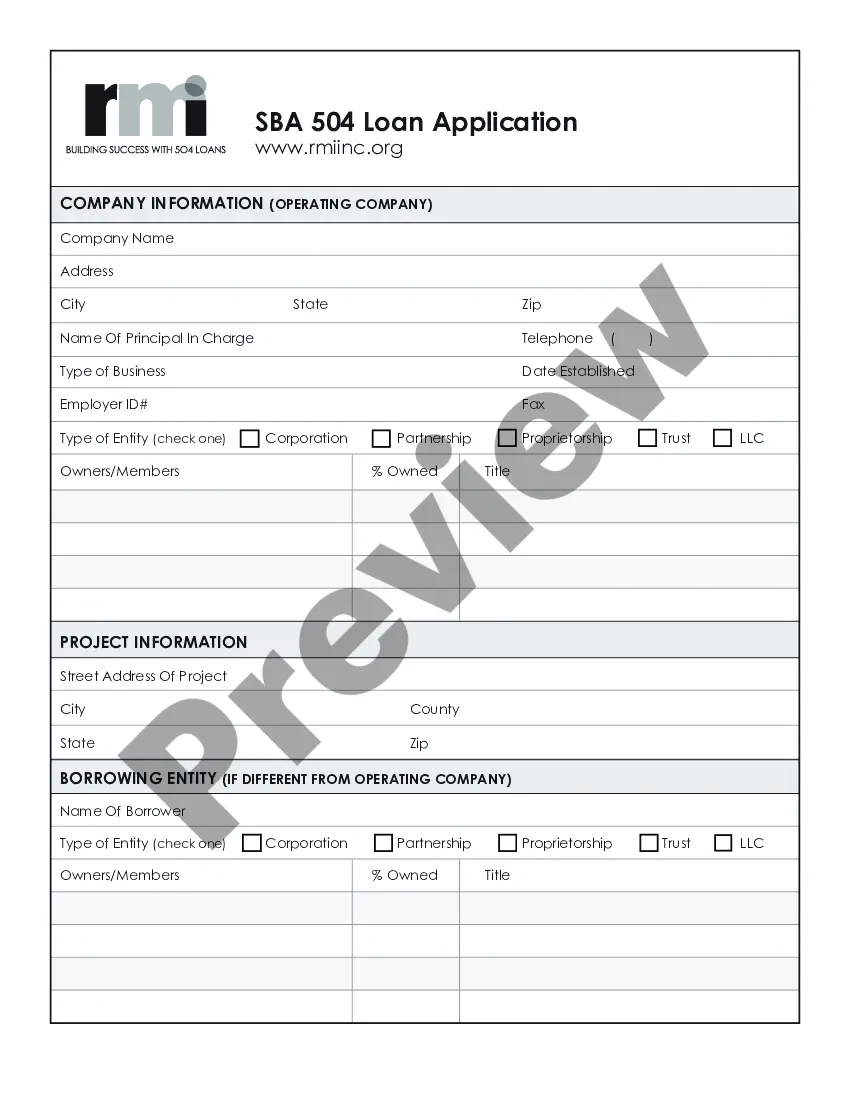

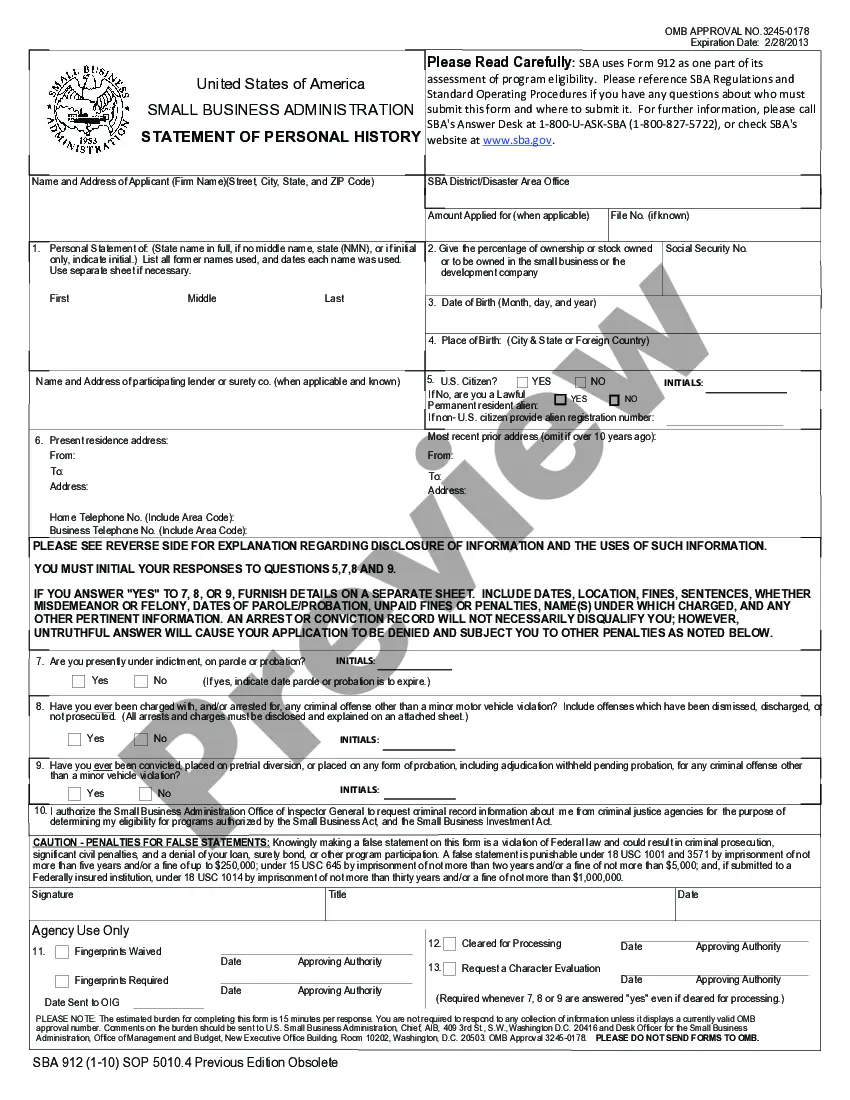

Indiana Small Business Administration Loan Application Form and Checklist

Description

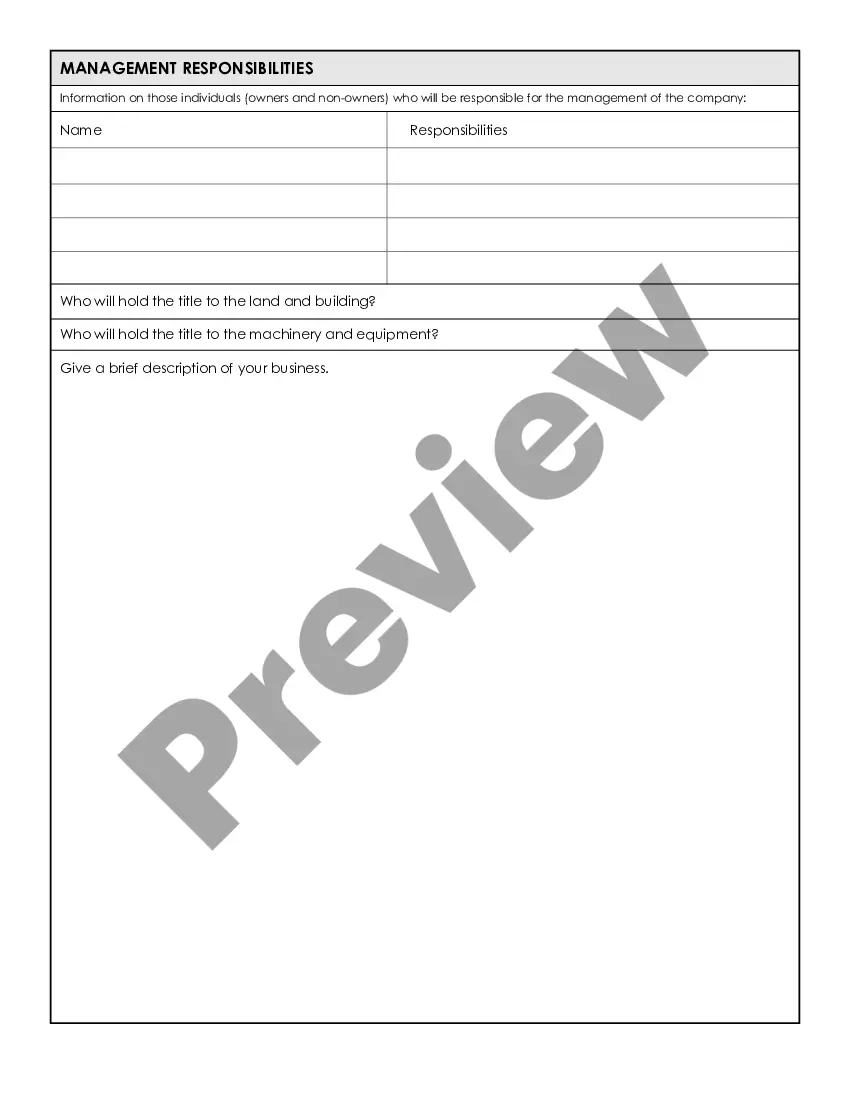

How to fill out Small Business Administration Loan Application Form And Checklist?

Are you within a position the place you require paperwork for both organization or individual reasons almost every working day? There are a variety of lawful file layouts available online, but finding types you can rely on is not simple. US Legal Forms offers a huge number of develop layouts, much like the Indiana Small Business Administration Loan Application Form and Checklist, that happen to be composed to satisfy state and federal specifications.

In case you are already familiar with US Legal Forms site and get an account, basically log in. After that, you may download the Indiana Small Business Administration Loan Application Form and Checklist web template.

If you do not come with an accounts and want to begin using US Legal Forms, follow these steps:

- Find the develop you want and make sure it is for your right city/state.

- Use the Preview button to analyze the form.

- See the explanation to ensure that you have chosen the right develop.

- In the event the develop is not what you`re looking for, make use of the Look for industry to obtain the develop that suits you and specifications.

- Whenever you find the right develop, just click Acquire now.

- Opt for the pricing strategy you desire, submit the necessary information and facts to generate your account, and buy the order using your PayPal or credit card.

- Select a practical paper formatting and download your copy.

Discover every one of the file layouts you possess bought in the My Forms menu. You can get a more copy of Indiana Small Business Administration Loan Application Form and Checklist anytime, if possible. Just click the necessary develop to download or print out the file web template.

Use US Legal Forms, by far the most extensive collection of lawful varieties, to save lots of time as well as steer clear of faults. The service offers appropriately produced lawful file layouts which you can use for a variety of reasons. Generate an account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

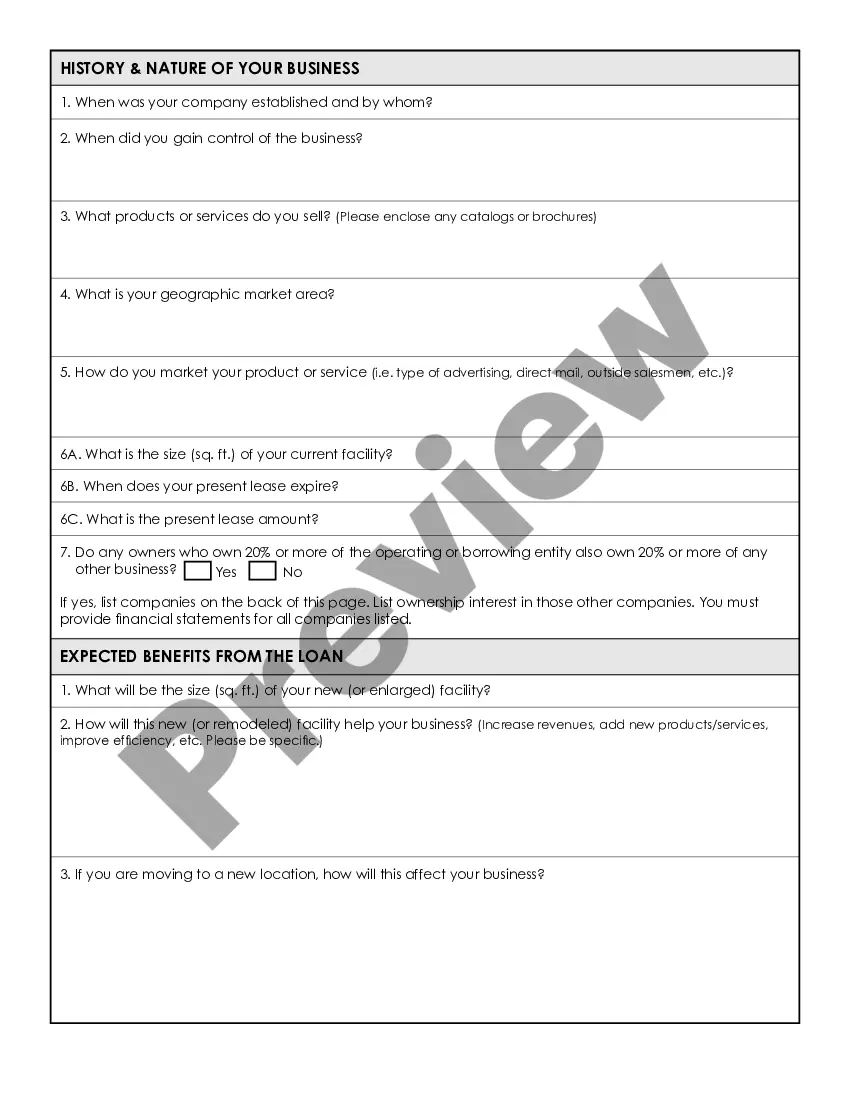

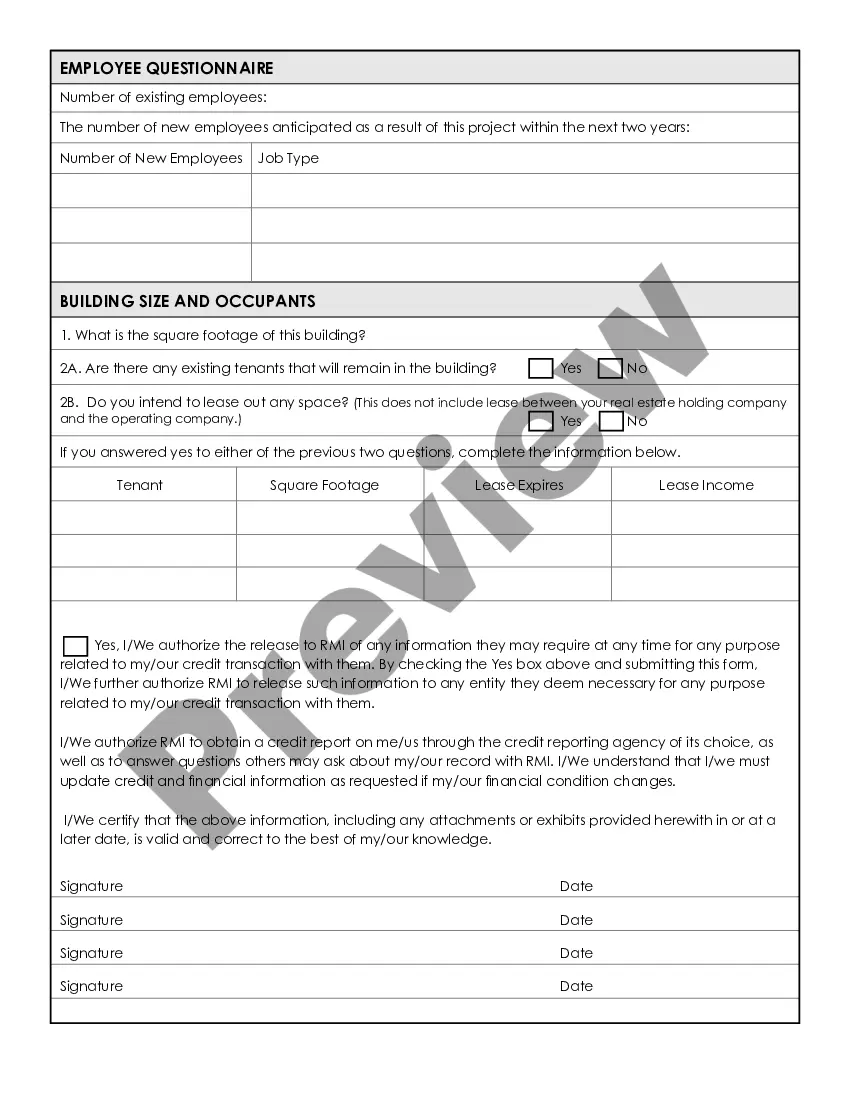

SBA Form 1919 (Borrower Information Form) SBA Form 413 (Personal Finance Statement) Current profit and loss statement, along with schedules from the prior three fiscal years. One year of projected financial statements and a detailed explanation of how your business will meet these projections.

The SBA or Your Lender Can Take Legal Action The lender can take you to court and receive a judgment against you, giving them the right to take money from your bank account.

After reviewing the financial documents prepared internally by you or your accountant, the SBA lender will look to your business income tax returns and bank statements to verify this information.

Low Doc Loans - Low doc business loans will require you to produce bank statements or merchant processing documents, but in most circumstances will not require financial statements.

Every lender, whether it's a bank or alternative lender, will require proof of identity. Bank Statements ? Lenders commonly request anywhere from the last three months to the last three years of bank statements. Bank statements present a picture of the cash inflows and outflows of your business.

Eligibility requirements Be an operating business. Operate for profit. Be located in the U.S. Be small under SBA size requirements. Not be a type of ineligible business. Not be able to obtain the desired credit on reasonable terms from non-federal, non-state, and non-local government sources.